Car Insurances Near Me

When it comes to finding the right car insurance, it's essential to explore your options and understand the coverage available in your area. Car insurance is a vital aspect of vehicle ownership, providing financial protection and peace of mind on the road. In this comprehensive guide, we will delve into the world of car insurance, offering expert insights and practical advice to help you navigate the process of finding the best coverage near you.

Understanding Car Insurance: A Comprehensive Overview

Car insurance is a contract between you, the policyholder, and the insurance company. It provides financial protection against various risks and liabilities associated with owning and operating a vehicle. The primary purpose of car insurance is to safeguard you and your assets in the event of accidents, theft, or other unforeseen circumstances.

There are several key components to consider when understanding car insurance:

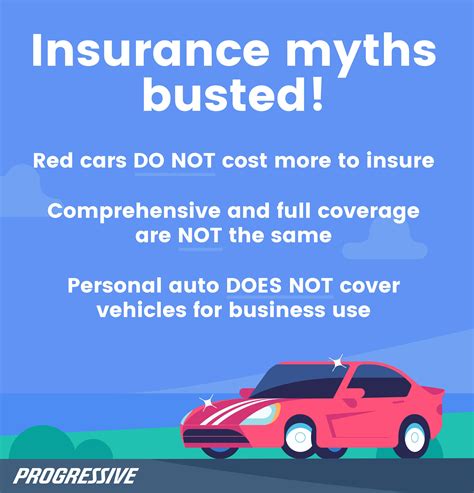

- Liability Coverage: This is the most fundamental aspect of car insurance. It covers the costs of injuries or damages you cause to others in an accident. Liability coverage typically includes bodily injury liability and property damage liability.

- Comprehensive Coverage: This type of coverage protects your vehicle against non-collision incidents, such as theft, vandalism, natural disasters, or collisions with animals. It provides financial assistance to repair or replace your vehicle in such situations.

- Collision Coverage: Collision coverage comes into play when your vehicle is involved in a collision with another vehicle or object. It covers the repair or replacement costs of your car, regardless of who is at fault.

- Medical Payments or Personal Injury Protection (PIP): This coverage pays for the medical expenses of you and your passengers, regardless of fault, in the event of an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you're involved in an accident with a driver who has little or no insurance. It ensures you receive compensation for your losses.

- Additional Coverages: Depending on your needs and preferences, you may opt for additional coverages like rental car reimbursement, roadside assistance, or custom parts and equipment coverage.

Exploring Car Insurance Options Near You

Finding car insurance that suits your needs and budget can be a daunting task, especially with the multitude of options available. Here’s a step-by-step guide to help you explore and narrow down your choices:

1. Research Local Insurance Providers

Start by identifying the car insurance companies operating in your area. You can do this by searching online or asking for recommendations from friends, family, or local automotive businesses. Compile a list of reputable insurers to begin your exploration.

2. Compare Coverage and Pricing

Once you have a list of potential insurers, it’s time to compare their offerings. Visit their websites or contact their customer service representatives to gather information on the types of coverage they provide, their policy limits, and the associated costs. Consider factors like deductibles, premium payments, and any discounts or incentives they offer.

| Insurance Provider | Coverage Options | Premium Range |

|---|---|---|

| Acme Auto Insurance | Liability, Comprehensive, Collision, Medical Payments | $120 - $180/month |

| SuperShield Insurance | Full Coverage (Liability, Comprehensive, Collision), PIP | $150 - $220/month |

| Insure-All | Customizable Coverage Plans, Rental Reimbursement | $135 - $200/month |

| Reliable Insurance Co. | Basic Liability, Comprehensive, Roadside Assistance | $110 - $160/month |

Note: The table above is a simplified example. In reality, insurance pricing can vary significantly based on factors like your driving history, vehicle type, and location.

3. Evaluate Customer Service and Reputation

While coverage and pricing are crucial, it’s equally important to assess the insurer’s customer service and overall reputation. Read online reviews, check ratings on trusted websites, and consider the insurer’s financial stability. A reputable insurer with excellent customer service can make a significant difference in your insurance experience.

4. Consider Your Specific Needs

Everyone’s insurance needs are unique. Consider your driving habits, the value of your vehicle, and any specific concerns you may have. For instance, if you frequently travel long distances, you might benefit from comprehensive coverage with a low deductible. Alternatively, if you have an older vehicle, liability-only coverage might be sufficient.

5. Shop Around and Negotiate

Don’t settle for the first quote you receive. Shop around and compare multiple offers. Many insurers are willing to negotiate prices or provide additional discounts if you bundle multiple policies (e.g., car and home insurance) or maintain a good driving record.

6. Understand Policy Exclusions and Limitations

Read the fine print of your insurance policy to understand any exclusions or limitations. For instance, some policies may have specific restrictions on coverage for high-performance vehicles or off-road driving. Ensure you’re aware of these details to avoid any surprises.

Optimizing Your Car Insurance Experience

Once you’ve found the right car insurance policy, there are additional steps you can take to optimize your coverage and ensure a positive experience:

1. Maintain a Clean Driving Record

Insurance companies reward safe drivers with lower premiums. Strive to maintain a clean driving record by avoiding accidents and traffic violations. A consistent history of safe driving can lead to significant savings over time.

2. Explore Discounts and Incentives

Many insurers offer a variety of discounts, such as multi-policy discounts, good student discounts, safe driver discounts, or loyalty rewards. Ask your insurer about these opportunities and ensure you’re taking advantage of any applicable discounts.

3. Consider Higher Deductibles

Increasing your deductible (the amount you pay out of pocket before your insurance kicks in) can significantly reduce your premium costs. However, it’s essential to choose a deductible that aligns with your financial capabilities and comfort level.

4. Review and Update Your Policy Regularly

Your insurance needs may change over time. Regularly review your policy to ensure it still meets your requirements. Life events like buying a new car, getting married, or moving to a new location can impact your insurance needs. Stay proactive and update your policy accordingly.

5. Utilize Digital Tools and Resources

Many insurance companies offer digital tools and resources to enhance your insurance experience. These can include mobile apps for policy management, digital claims submission, and online educational materials. Embrace these tools to stay informed and streamline your insurance processes.

FAQs

How much does car insurance typically cost?

+

Car insurance costs can vary significantly based on factors like your age, driving record, location, and the type of coverage you choose. On average, you can expect to pay anywhere from 50 to 250 per month for a basic liability policy, while full coverage policies can range from 100 to 500 or more per month. It’s crucial to compare quotes from multiple insurers to find the best rate for your specific situation.

What factors influence car insurance rates?

+

Several factors influence car insurance rates, including your age, gender, driving history, the make and model of your vehicle, the coverage you choose, and your location. Insurance companies also consider statistical data on accident rates and claim frequencies in your area. It’s essential to provide accurate information when obtaining quotes to ensure you receive an appropriate rate.

Can I get car insurance if I have a poor driving record?

+

Yes, you can still obtain car insurance even with a poor driving record. However, it may be more challenging and costly. Insurance companies often charge higher premiums for drivers with accidents, traffic violations, or DUI convictions. It’s advisable to shop around and compare quotes from insurers who specialize in high-risk drivers to find the most affordable coverage.

How often should I review and update my car insurance policy?

+

It’s a good practice to review your car insurance policy annually or whenever your life circumstances change. This ensures your coverage remains adequate and aligned with your needs. Significant life events like buying a new car, getting married, or moving to a different location may impact your insurance requirements. Regular reviews help you stay informed and make necessary adjustments.

What should I do if I’m involved in an accident and need to file a claim?

+

If you’re involved in an accident, the first step is to ensure your safety and the safety of others involved. Exchange contact and insurance information with the other parties and take photos of the accident scene. Contact your insurance company as soon as possible to report the incident and begin the claims process. Cooperate fully with your insurer and provide all necessary documentation to facilitate a smooth claims resolution.

Finding the right car insurance near you is a process that requires careful consideration and research. By understanding the different types of coverage, comparing options, and optimizing your policy, you can ensure you’re adequately protected on the road. Remember, a well-informed decision can lead to significant savings and peace of mind.