Why Is Whole Life Insurance Bad

Whole life insurance, also known as permanent life insurance, has long been a topic of debate in the financial and insurance sectors. While it may seem like a straightforward concept—an insurance policy that covers you for your entire life—the reality is far more complex. In this comprehensive analysis, we will delve into the reasons why whole life insurance might not be the best choice for many individuals, exploring the financial implications, limitations, and alternative options available.

Understanding Whole Life Insurance

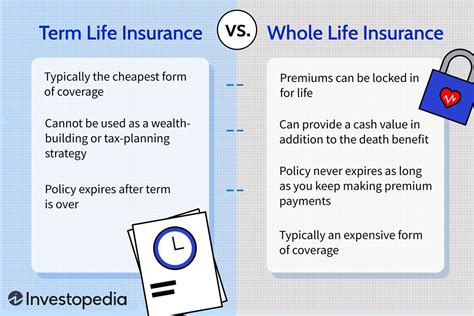

Whole life insurance is a type of permanent insurance policy that provides coverage throughout an individual’s lifetime, ensuring financial protection for beneficiaries upon the insured’s death. Unlike term life insurance, which offers coverage for a specific period, whole life insurance is designed to be a long-term investment and protection plan. It combines a death benefit with a cash value component, which grows over time and can be accessed by the policyholder.

Key Features of Whole Life Insurance

Whole life insurance policies typically include the following key features:

- Guaranteed Death Benefit: The policy guarantees a fixed death benefit to the beneficiaries upon the insured’s passing, regardless of when it occurs.

- Cash Value Accumulation: A portion of the premiums paid goes into a cash value account, which earns interest and can be borrowed against or withdrawn by the policyholder.

- Premium Stability: Premiums for whole life insurance remain level throughout the policy, providing predictability in payments.

- Dividend Potential: Some whole life policies offer dividends, which are based on the insurer’s performance and can be used to reduce premiums or increase cash value.

The Drawbacks of Whole Life Insurance

While whole life insurance may seem like a secure and stable option, there are several drawbacks and limitations that make it a less appealing choice for many individuals.

High Initial Costs

One of the most significant disadvantages of whole life insurance is the high initial cost. Premiums for whole life insurance tend to be considerably higher than those for term life insurance, especially for younger individuals. This is because whole life insurance covers you for your entire life, whereas term insurance covers you for a specific period.

| Insurance Type | Average Annual Premium (for a healthy 30-year-old) |

|---|---|

| Whole Life Insurance | $2,500 - $5,000 |

| Term Life Insurance (20-year term) | $200 - $500 |

As illustrated in the table above, the difference in premiums can be substantial, especially when considering that term life insurance can be renewed or converted into a permanent policy later in life if needed.

Limited Flexibility

Whole life insurance policies are often rigid and lack flexibility. Once a policy is in place, it is challenging to make significant changes without incurring additional costs or penalties. For instance, if an individual’s financial situation changes, they may find it difficult to adjust their coverage or premiums to suit their new circumstances.

Opportunity Cost and Investment Returns

The cash value component of whole life insurance may seem like an attractive feature, but it often comes with a significant opportunity cost. The returns on the cash value are typically lower compared to other investment options, such as stocks, bonds, or mutual funds. This means that individuals may be missing out on potentially higher returns by investing in whole life insurance.

Furthermore, the cash value is not easily accessible without incurring penalties or reducing the death benefit. Withdrawing funds from the cash value may result in reduced coverage or higher premiums, negating the benefits of having a whole life policy.

Complexity and Misunderstanding

Whole life insurance policies can be complex, with numerous provisions, riders, and fine print. This complexity often leads to misunderstandings and misconceptions among policyholders. Many individuals may not fully comprehend the intricacies of their policy, including the impact of withdrawals, loans, or changes in their financial situation.

Alternatives to Whole Life Insurance

Given the drawbacks of whole life insurance, there are several alternative options that individuals can consider to meet their insurance and financial needs:

Term Life Insurance

Term life insurance is a more affordable and flexible option for many individuals. It provides coverage for a specific period, typically ranging from 10 to 30 years. During this term, the policyholder pays a fixed premium, and their beneficiaries receive a death benefit if the insured passes away within the term. Term life insurance is ideal for those seeking coverage during their working years, when financial responsibilities are at their peak.

Universal Life Insurance

Universal life insurance offers more flexibility than whole life insurance while still providing permanent coverage. Policyholders can adjust their premiums and death benefit amounts as their financial situation changes. Universal life insurance also features a cash value component, but it offers more investment options and potentially higher returns.

Variable Life Insurance

Variable life insurance is another type of permanent insurance policy that allows policyholders to invest a portion of their premiums in a variety of investment vehicles, such as stocks and bonds. This option provides the potential for higher returns but also carries more risk compared to whole life insurance.

Conclusion: Making Informed Decisions

Whole life insurance may not be the ideal choice for everyone, as it comes with high costs, limited flexibility, and potential opportunity costs. It is essential for individuals to carefully consider their financial goals, insurance needs, and risk tolerance before committing to any insurance policy. Consulting with financial advisors and insurance experts can provide valuable insights and help individuals make informed decisions about their long-term financial and insurance strategies.

What is the primary advantage of whole life insurance over term life insurance?

+The primary advantage of whole life insurance is its longevity. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers coverage for the policyholder’s entire life. This makes it a more stable and predictable option, especially for individuals who want lifelong coverage without the need for renewal or conversion.

Can I access the cash value of my whole life insurance policy?

+Yes, you can access the cash value of your whole life insurance policy through loans or withdrawals. However, it’s important to note that withdrawing funds may reduce your death benefit or result in higher premiums. Additionally, loans against the cash value will accrue interest, which can impact the overall value of your policy.

Is whole life insurance a good investment option?

+The investment potential of whole life insurance is often a subject of debate. While the cash value component of the policy does earn interest, the returns are typically lower compared to other investment options. Whole life insurance is primarily designed for long-term financial protection rather than high investment returns.