Go To Go Car Insurance

Welcome to an in-depth exploration of Go To Go Car Insurance, a unique and innovative insurance provider in the world of automotive coverage. This article will delve into the intricacies of Go To Go's offerings, shedding light on its features, benefits, and the impact it has on the insurance landscape. With a focus on providing comprehensive and tailored coverage, Go To Go aims to revolutionize the way drivers protect their vehicles and themselves.

The Rise of Go To Go: A Disruptive Force in Car Insurance

In an industry often associated with complexity and confusion, Go To Go Car Insurance stands out as a beacon of simplicity and innovation. Founded with a mission to empower drivers and simplify the insurance process, Go To Go has quickly established itself as a trusted name in the automotive insurance sector.

The journey of Go To Go began with a simple idea: to create an insurance experience that is not only comprehensive but also incredibly accessible. By leveraging advanced technologies and a customer-centric approach, they have successfully carved a niche for themselves in a highly competitive market.

One of the key aspects that sets Go To Go apart is its commitment to transparency. Unlike traditional insurance providers, Go To Go strives to educate its customers, providing them with the knowledge and tools to make informed decisions about their coverage. This transparency extends to their pricing structure, policy terms, and claims process, ensuring that drivers always know exactly what they're getting into.

The Go To Go Advantage: A Holistic Approach to Automotive Insurance

Go To Go Car Insurance offers a range of coverage options designed to cater to the diverse needs of modern drivers. From comprehensive policies that cover a wide array of incidents to more tailored plans that focus on specific risks, Go To Go provides flexibility and customization that is often lacking in the industry.

One of the standout features of Go To Go's offering is its personalized risk assessment. Unlike traditional insurance providers that often rely on generic profiles, Go To Go takes a more nuanced approach. By analyzing a driver's unique circumstances, including their driving history, vehicle type, and usage patterns, Go To Go can offer highly tailored coverage options that truly meet the individual's needs.

Furthermore, Go To Go understands that insurance is not a one-size-fits-all proposition. That's why they offer a suite of optional add-ons that allow drivers to further customize their coverage. Whether it's enhanced roadside assistance, coverage for specific mechanical failures, or additional liability protection, Go To Go ensures that drivers can create a policy that is as unique as their driving experience.

| Coverage Type | Description |

|---|---|

| Comprehensive | Covers a wide range of incidents, including accidents, theft, and natural disasters. |

| Liability | Protects against claims arising from property damage or bodily injury caused by the policyholder. |

| Collision | Covers damage to the insured vehicle caused by a collision, regardless of fault. |

| Personal Injury Protection (PIP) | Provides coverage for medical expenses and lost wages resulting from an accident, regardless of fault. |

| Uninsured/Underinsured Motorist | Protects policyholders in the event of an accident with a driver who lacks sufficient insurance coverage. |

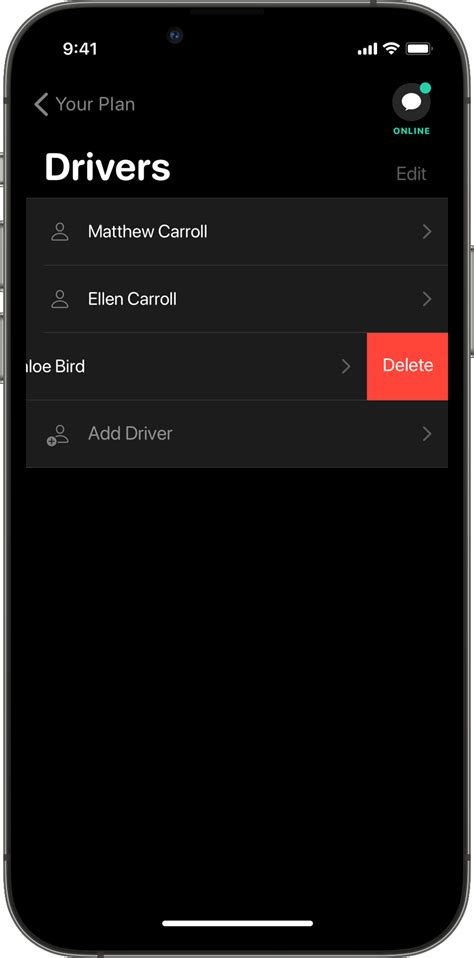

Beyond the coverage itself, Go To Go excels in the claims process. They understand that filing a claim can be a stressful and daunting experience. That's why they've streamlined the process, making it as efficient and hassle-free as possible. With a dedicated claims team and a user-friendly online platform, Go To Go ensures that their customers can navigate the claims process with ease and confidence.

Go To Go’s Impact on the Insurance Landscape

The arrival of Go To Go Car Insurance has had a significant impact on the insurance landscape, shaking up the status quo and challenging traditional providers to innovate and improve their offerings.

One of the most notable effects is the increased focus on customer education. Go To Go's emphasis on transparency and its commitment to providing resources and tools for drivers to understand their coverage has sparked a broader conversation within the industry. Other providers are now recognizing the importance of empowering customers with knowledge, leading to a more informed and engaged consumer base.

Additionally, Go To Go's success has driven a shift towards personalization in the insurance sector. By demonstrating the value of tailoring coverage to individual needs, Go To Go has inspired other companies to explore more nuanced risk assessment methods and offer a wider range of customizable options. This shift towards personalization not only enhances customer satisfaction but also improves the overall efficiency of the insurance process.

Furthermore, Go To Go's innovative use of technology has accelerated the digital transformation of the insurance industry. With its user-friendly online platform and seamless digital processes, Go To Go has set a new standard for convenience and accessibility. This has encouraged other providers to invest in digital infrastructure, leading to a more competitive and efficient market.

Go To Go’s Unique Value Proposition

Go To Go Car Insurance stands out from its competitors with a unique value proposition that is centered on three key pillars: transparency, personalization, and technological innovation.

By prioritizing transparency, Go To Go ensures that its customers are well-informed about their coverage options, policy terms, and claims process. This approach not only builds trust but also empowers drivers to make decisions that align with their specific needs and budget.

Personalization is at the heart of Go To Go's offering. Through its advanced risk assessment algorithms and a wide range of customizable add-ons, Go To Go creates tailored coverage plans that fit the unique circumstances of each driver. This level of personalization not only enhances customer satisfaction but also ensures that resources are allocated efficiently, reducing waste and improving overall efficiency.

Technological innovation is the third pillar that sets Go To Go apart. By leveraging cutting-edge technologies, Go To Go has streamlined the insurance process, making it faster, more efficient, and more accessible. From online policy management to digital claims submission, Go To Go has elevated the customer experience, setting a new benchmark for the industry.

The Future of Automotive Insurance with Go To Go

As the automotive insurance landscape continues to evolve, Go To Go Car Insurance is well-positioned to lead the way towards a more innovative and customer-centric future. With its commitment to continuous improvement and its focus on staying ahead of industry trends, Go To Go is poised to remain a disruptive force in the market.

Looking ahead, Go To Go is exploring new avenues of coverage to meet the evolving needs of drivers. This includes potential expansions into areas such as autonomous vehicle insurance and coverage for emerging technologies like electric vehicles and ride-sharing services. By staying ahead of the curve, Go To Go ensures that its customers have access to the most relevant and up-to-date coverage options.

Furthermore, Go To Go is dedicated to enhancing its technological capabilities. With ongoing investments in artificial intelligence and machine learning, Go To Go aims to further automate and streamline its processes, making insurance even more accessible and efficient. This includes potential advancements in areas such as automated claims assessment and predictive analytics, which could revolutionize the way insurance is delivered and experienced.

In conclusion, Go To Go Car Insurance has emerged as a trailblazer in the automotive insurance industry, offering a refreshing approach to a traditionally complex and confusing process. With its focus on transparency, personalization, and technological innovation, Go To Go has not only disrupted the market but has also set a new standard for what drivers can expect from their insurance provider. As the future unfolds, Go To Go is poised to continue leading the way, ensuring that drivers have access to the most innovative and customer-centric insurance solutions available.

How does Go To Go Car Insurance compare to traditional providers in terms of pricing?

+Go To Go’s pricing structure is highly competitive and often more affordable than traditional providers. Their focus on personalized risk assessment allows them to offer precise pricing based on individual circumstances, ensuring that customers pay only for the coverage they need.

What makes Go To Go’s claims process more efficient than others?

+Go To Go’s claims process is streamlined and digital-first, allowing customers to submit claims and track their progress online. Their dedicated claims team provides prompt and personalized assistance, ensuring a smooth and hassle-free experience.

Can Go To Go provide coverage for specialized vehicles, such as classic cars or off-road vehicles?

+Absolutely! Go To Go offers specialized coverage options for a wide range of vehicles, including classic cars, off-road vehicles, and even recreational vehicles. Their team of experts can assess the unique needs of these vehicles and provide tailored coverage solutions.