Medical Insurance High Deductible

Understanding the intricacies of medical insurance, especially when it comes to high-deductible plans, is crucial for anyone seeking to navigate the healthcare system effectively. In this comprehensive guide, we will delve into the world of high-deductible medical insurance, exploring its features, benefits, and potential drawbacks. By the end of this article, you will have a clear understanding of how these plans work and whether they align with your healthcare needs.

What is a High-Deductible Medical Insurance Plan?

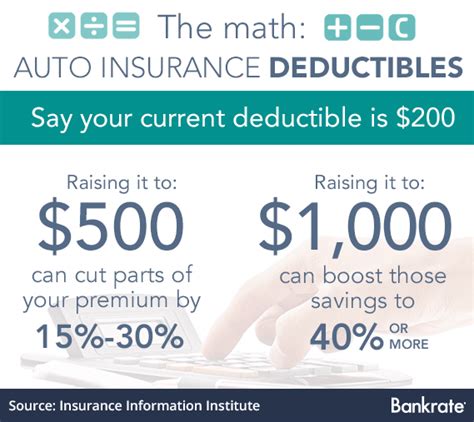

A high-deductible medical insurance plan is a type of health coverage that requires individuals or families to pay a substantial amount out of pocket before the insurance provider starts covering the costs. This deductible, typically higher than in traditional plans, acts as a threshold that policyholders must meet before their insurance kicks in.

For instance, consider a hypothetical high-deductible plan with an annual deductible of $5,000. This means that you, as the policyholder, are responsible for paying the first $5,000 of your medical expenses in a given year before your insurance company starts contributing. While this may seem like a significant sum, there are several advantages and considerations to keep in mind.

Key Features of High-Deductible Plans

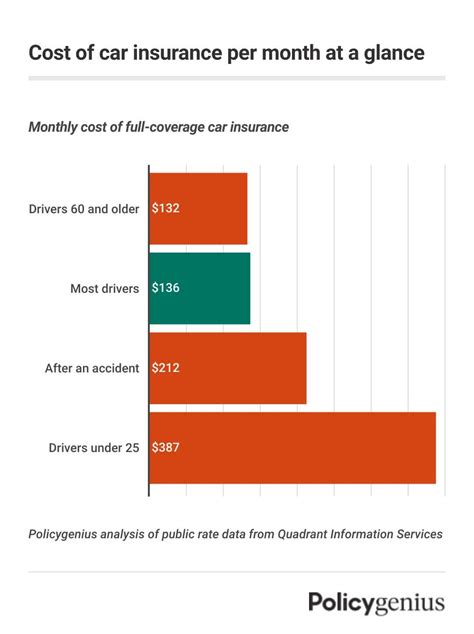

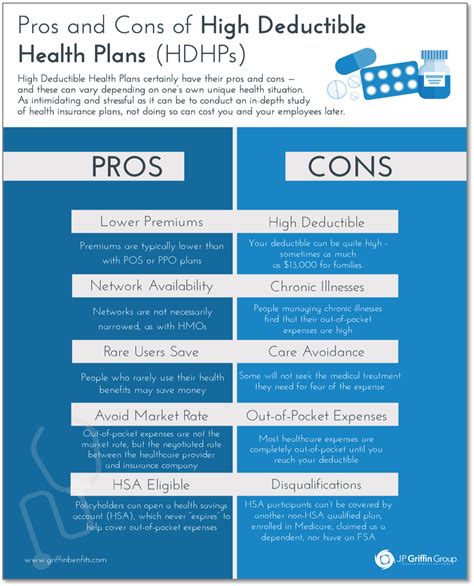

- Lower Premiums: One of the primary attractions of high-deductible plans is the potential for lower monthly premiums. Insurance companies often offer reduced rates for these plans, making them more affordable for those on a tight budget.

- Health Savings Accounts (HSAs): High-deductible plans often come with the option to open a Health Savings Account. HSAs allow you to save pre-tax dollars specifically for medical expenses, providing a tax-efficient way to manage healthcare costs.

- Focus on Preventive Care: These plans often emphasize preventive healthcare services, such as annual check-ups, vaccinations, and screenings, which are typically covered at no cost to the policyholder.

- Out-of-Pocket Maximum: While the deductible is high, high-deductible plans usually have a defined out-of-pocket maximum. This means that once you’ve paid a certain amount, typically the deductible plus a specified copay or coinsurance, the insurance company covers the rest of your expenses for the year.

| Plan Type | Average Deductible |

|---|---|

| High-Deductible Health Plan (HDHP) | $2,000 - $5,000 (Individual) |

| Traditional Health Insurance | $500 - $2,000 (Individual) |

Benefits of High-Deductible Medical Insurance

High-deductible plans offer a range of advantages, making them a popular choice for certain individuals and families. Let’s explore some of the key benefits:

1. Cost Savings for Healthy Individuals

If you are generally healthy and have few medical needs, a high-deductible plan can be an excellent way to save money. The lower premiums can significantly reduce your overall healthcare expenses, especially if you rarely incur major medical costs.

2. Tax Benefits with HSAs

Health Savings Accounts, often paired with high-deductible plans, provide tax advantages. Contributions to HSAs are tax-deductible, and the funds grow tax-free. Additionally, withdrawals for qualified medical expenses are tax-free, making it an efficient way to manage healthcare costs.

3. Emphasis on Preventive Care

Many high-deductible plans prioritize preventive care, ensuring that policyholders receive essential health screenings and check-ups at no additional cost. This proactive approach to healthcare can help identify potential issues early on, leading to better health outcomes.

4. Control Over Healthcare Choices

With a high-deductible plan, you have more control over your healthcare decisions. You can choose providers and treatments that align with your preferences and budget, as the out-of-pocket expenses are often more manageable.

Potential Drawbacks and Considerations

While high-deductible plans offer several benefits, they may not be suitable for everyone. It’s essential to consider the following potential drawbacks:

1. Higher Out-of-Pocket Costs for Major Illnesses

If you or a family member experience a serious illness or injury, the high deductible can result in substantial out-of-pocket expenses before insurance coverage kicks in. This can be a significant financial burden, especially for those with limited savings.

2. Limited Coverage for Certain Services

High-deductible plans may have restrictions on certain services or treatments. Always review the plan’s coverage details to ensure that your specific healthcare needs are adequately addressed.

3. Administrative Complexity

Managing a high-deductible plan, especially with an HSA, can be more complex than traditional insurance. It requires careful tracking of expenses and understanding of tax regulations.

Real-World Example: John’s Experience

Let’s consider a real-life scenario to illustrate the impact of a high-deductible plan. John, a 35-year-old professional, opted for a high-deductible health plan with a $4,000 annual deductible. Here’s how his experience played out:

- Year 1: John remained healthy, only visiting his primary care physician for an annual check-up, which was covered at no cost. He paid a low monthly premium and contributed to his HSA, saving for future medical expenses.

- Year 2: Unfortunately, John was diagnosed with a chronic condition, requiring frequent doctor visits and prescription medications. He quickly met his deductible and started receiving coverage for these expenses. The out-of-pocket maximum ensured that his costs remained manageable.

- Year 3: John's condition stabilized, and he only needed occasional visits to the doctor and refills for his medications. His out-of-pocket expenses were significantly lower than in Year 2, and he continued to save in his HSA for future needs.

John's experience highlights the importance of assessing your healthcare needs and financial situation when choosing a high-deductible plan. While it can provide cost savings in certain circumstances, it's crucial to understand the potential risks and benefits.

Comparing High-Deductible Plans with Traditional Insurance

To better understand the differences, let’s compare key aspects of high-deductible plans and traditional health insurance:

| Category | High-Deductible Plan | Traditional Insurance |

|---|---|---|

| Monthly Premiums | Lower | Higher |

| Annual Deductible | $2,000 - $5,000 (Individual) | $500 - $2,000 (Individual) |

| Out-of-Pocket Maximum | Defined and often higher | Defined and generally lower |

| Health Savings Account | Available | Not typically offered |

| Preventive Care Coverage | Typically included | Varies by plan |

| Suitability | Healthy individuals, budget-conscious | Individuals with higher medical needs |

Making the Right Choice for Your Healthcare

Choosing the right medical insurance plan is a critical decision that impacts your financial well-being and access to healthcare. High-deductible plans offer unique advantages, but they may not be suitable for everyone. Here are some key considerations to guide your decision-making process:

1. Assess Your Healthcare Needs

Evaluate your current and potential future healthcare requirements. If you have a history of chronic conditions or anticipate major medical expenses, a high-deductible plan might not provide sufficient coverage. Traditional insurance with lower deductibles and broader coverage may be a better fit.

2. Financial Planning

Consider your financial situation and ability to manage high out-of-pocket costs. If you have a stable income and can afford to set aside funds for unexpected medical expenses, a high-deductible plan can be a cost-effective option. However, if your finances are tight, a plan with a lower deductible might provide more financial security.

3. Understand the Plan’s Details

Read the fine print! Ensure you comprehend the plan’s coverage, exclusions, and any potential limitations. Pay attention to the network of providers, prescription drug coverage, and any additional benefits or perks the plan offers.

4. Seek Professional Advice

Consulting with a financial advisor or insurance broker can provide valuable insights tailored to your specific circumstances. They can help you navigate the complexities of different plans and make an informed decision.

5. Regularly Review and Update

Healthcare needs and insurance plans can evolve over time. Regularly assess your plan’s suitability and make adjustments as necessary. Life events like marriage, having children, or changing jobs can significantly impact your healthcare requirements.

What is the difference between a deductible and an out-of-pocket maximum in high-deductible plans?

+A deductible is the amount you pay before your insurance coverage begins. Once you meet the deductible, your insurance starts contributing to your medical expenses. The out-of-pocket maximum, on the other hand, is the most you'll pay in a year for covered services. This includes your deductible, copays, and coinsurance. Once you reach this limit, your insurance covers 100% of the costs for the rest of the year.

Are high-deductible plans suitable for families with children?

+High-deductible plans can be a viable option for families, especially if they have access to a Health Savings Account (HSA). HSAs allow families to save pre-tax dollars for medical expenses, which can be beneficial for managing the costs of children's healthcare needs. However, it's crucial to carefully assess the family's healthcare needs and financial situation before choosing a high-deductible plan.

Can I switch from a high-deductible plan to a traditional plan mid-year?

+Switching health insurance plans mid-year is generally possible but may be subject to specific rules and conditions. It often depends on the type of plan you're currently enrolled in and the availability of open enrollment periods or qualifying life events. Check with your insurance provider or an insurance broker to understand the options and requirements for switching plans.

In conclusion, high-deductible medical insurance plans offer a unique blend of cost savings and control over healthcare decisions. However, they require careful consideration of your healthcare needs and financial circumstances. By understanding the features, benefits, and potential drawbacks, you can make an informed choice that aligns with your individual or family’s healthcare goals.