Auto Insurance Best Prices

Securing the best auto insurance prices is a crucial aspect of financial planning, offering protection and peace of mind for vehicle owners. This comprehensive guide will delve into the world of auto insurance, exploring the key factors that influence pricing, and providing expert strategies to help you find the most competitive rates tailored to your specific needs.

Understanding Auto Insurance: An Overview

Auto insurance is a contract between you and an insurance provider, designed to financially protect you against potential losses and liabilities arising from owning and operating a motor vehicle. These losses can range from vehicle damage to bodily injuries and property damage caused by accidents, theft, or natural disasters.

The cost of auto insurance varies significantly, influenced by a multitude of factors, including your personal driving history, the make and model of your vehicle, your location, and the specific coverage types you choose. Understanding these variables is the first step toward obtaining the best possible insurance rates.

Factors Affecting Auto Insurance Prices

Multiple factors play a role in determining the cost of your auto insurance policy. By understanding these elements, you can make informed decisions to potentially reduce your insurance premiums.

1. Personal Information and Driving History

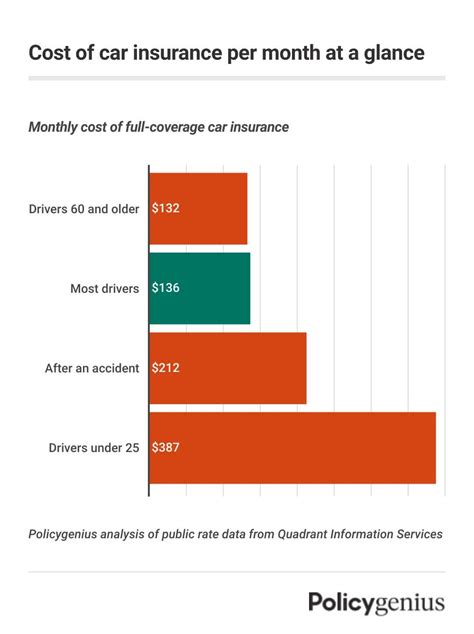

Your age, gender, and marital status can impact your insurance rates. Generally, younger drivers, especially males, are considered higher risk due to their propensity for more frequent and severe accidents. However, this risk profile can change with age and driving experience.

Your driving record is a critical factor. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents or traffic violations may result in higher rates. Some insurance companies offer discounts for safe driving, further incentivizing responsible behavior behind the wheel.

2. Vehicle Factors

The type of vehicle you drive significantly influences your insurance costs. Factors such as the make, model, and year of your vehicle, as well as its safety and anti-theft features, can impact your insurance rates. Sports cars and luxury vehicles, for instance, often have higher insurance premiums due to their higher repair costs and increased likelihood of theft.

The primary use of your vehicle also matters. If you primarily use your car for commuting to work, your insurance rates may be higher compared to someone who only uses their vehicle occasionally for pleasure driving.

3. Location and Usage

Where you live and how you use your vehicle are additional factors that insurance companies consider when determining your rates. Urban areas typically have higher insurance rates due to increased traffic congestion and the higher likelihood of accidents and theft.

The annual mileage you drive is also a factor. The more you drive, the higher the risk of being involved in an accident, which can lead to increased insurance premiums. Conversely, if you drive infrequently, you may qualify for low-mileage discounts.

4. Coverage Types and Limits

The types of coverage you choose and the limits you set for each coverage type directly affect your insurance premiums. Comprehensive and collision coverage, which protect against damage to your vehicle from accidents, theft, or natural disasters, can be costly but provide essential protection.

Liability coverage, which covers damages you cause to others, is legally required in most states. The higher the liability limits you choose, the more protection you have, but also the higher your premiums will be.

5. Discounts and Bundling

Insurance companies often offer discounts to incentivize safe driving and loyalty. These discounts can include safe driver discounts, multi-policy discounts (for bundling multiple insurance types with the same provider), and multi-car discounts (for insuring multiple vehicles with the same company). Taking advantage of these discounts can significantly reduce your insurance costs.

Strategies to Find the Best Auto Insurance Prices

With a deeper understanding of the factors that influence auto insurance prices, you can now employ strategic approaches to find the best deals.

1. Shop Around and Compare Quotes

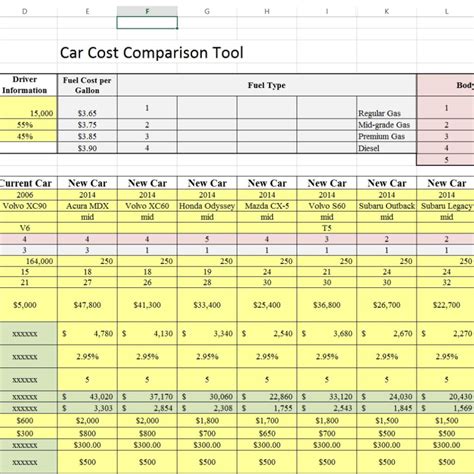

The auto insurance market is highly competitive, and prices can vary significantly between providers. Shopping around and obtaining multiple quotes is essential to ensure you’re getting the best deal. Online comparison tools can be a convenient way to quickly assess a range of insurance providers and their offerings.

2. Tailor Your Coverage

Consider your specific needs and tailor your coverage accordingly. If you drive an older vehicle that’s paid off, you may not need collision or comprehensive coverage, as the cost of these coverages may exceed the value of your vehicle. By carefully selecting the coverage types and limits that align with your needs, you can potentially reduce your insurance premiums.

3. Maintain a Good Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid traffic violations and accidents to maintain a positive driving history. Many insurance companies offer safe driver discounts, further rewarding responsible driving behavior.

4. Explore Discounts and Bundling Options

Take advantage of any available discounts and consider bundling your insurance policies. Many insurance companies offer discounts for policyholders who bundle their auto insurance with other types of insurance, such as homeowners or renters insurance. Additionally, some providers offer discounts for specific professions, military service, or educational achievements.

5. Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. While a higher deductible means you’ll pay more if you need to make a claim, it can significantly reduce your monthly insurance premiums.

6. Stay Informed About Your Credit Score

Your credit score can impact your insurance rates. Many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. Maintaining a good credit score can help you qualify for lower insurance premiums. Conversely, a poor credit score may result in higher insurance rates.

Performance Analysis: Real-World Examples

Let’s explore some real-world scenarios to illustrate the impact of these strategies on auto insurance prices.

Scenario 1: New Driver

Sarah, a 22-year-old recent college graduate, is shopping for her first auto insurance policy. She has a clean driving record and plans to drive her 2018 Toyota Corolla primarily for commuting to her new job. By shopping around and comparing quotes from various insurance providers, Sarah finds that she can get a comprehensive policy with liability limits of 100,000/300,000 for around 1,200 annually. By taking advantage of safe driver and multi-policy discounts (as she also has a renters insurance policy with the same provider), she's able to reduce her annual premium to 1,000.

Scenario 2: Experienced Driver with an Older Vehicle

John, a 45-year-old with a pristine driving record, is the sole owner of a 2005 Honda Civic. He uses his car sparingly for pleasure driving and has no need for collision or comprehensive coverage, given the age and value of his vehicle. By opting for liability-only coverage with relatively high liability limits (500,000), John is able to secure an annual premium of just 400. This strategy showcases the importance of tailoring coverage to your specific needs to minimize costs.

Scenario 3: Family with Multiple Vehicles

The Smith family has two vehicles: a 2015 Ford Explorer and a 2019 Toyota RAV4. Both vehicles are primarily driven by the parents, with occasional use by their teenage son. By bundling their auto insurance policies with their homeowners insurance and taking advantage of multi-car and good student discounts (their son maintains a 3.5 GPA), the Smith family is able to secure a comprehensive insurance policy for both vehicles with liability limits of 250,000/500,000 for a total annual premium of $2,400. This example highlights the benefits of bundling and exploring all available discounts.

Evidence-Based Future Implications

The auto insurance market is continually evolving, with new technologies and changing consumer behaviors impacting the industry. Here are some key future implications to consider:

- Telematics and Usage-Based Insurance: Telematics devices and smartphone apps that track driving behavior are becoming increasingly popular. These technologies can provide real-time data on driving habits, allowing insurance companies to offer more personalized and dynamic pricing. Drivers with safer driving habits may benefit from lower premiums, while those with riskier habits may see their rates increase.

- Autonomous Vehicles: The widespread adoption of autonomous vehicles is expected to revolutionize the auto insurance industry. With fewer accidents caused by human error, insurance rates could potentially decrease. However, the transition period as autonomous vehicles are integrated into the market may introduce new challenges and risks, potentially impacting insurance rates.

- Online Comparison Tools: The rise of online insurance comparison platforms has already had a significant impact on the industry, empowering consumers to quickly and easily compare insurance providers and their offerings. This trend is likely to continue, further driving competition and potentially leading to more transparent and competitive pricing.

How often should I review my auto insurance policy to ensure I’m getting the best rates?

+It’s a good practice to review your auto insurance policy annually or whenever you experience a significant life change (e.g., moving to a new location, purchasing a new vehicle, or getting married). Regular reviews ensure you’re aware of any changes in your insurance needs and can take advantage of new discounts or offers.

What are some common mistakes to avoid when shopping for auto insurance?

+Some common mistakes include not comparing enough quotes, failing to explore all available discounts, and not understanding the coverage limits and exclusions in your policy. It’s crucial to thoroughly research and understand your options before making a decision.

Can my credit score really impact my auto insurance rates?

+Yes, many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. While the impact of your credit score on insurance rates can vary by state and provider, maintaining a good credit score is generally beneficial for securing lower insurance premiums.

What’s the best way to save money on auto insurance without sacrificing coverage?

+The key is to tailor your coverage to your specific needs and explore all available discounts. Opting for higher deductibles can reduce your premiums, but make sure you have the financial capacity to cover the deductible if needed. Additionally, consider bundling your auto insurance with other policies to take advantage of multi-policy discounts.