Get Pet Insurance

Pet ownership is a rewarding experience, bringing joy and companionship to millions of people worldwide. However, it also comes with responsibilities, including ensuring the health and well-being of our furry friends. One crucial aspect of responsible pet ownership is securing pet insurance, a vital tool to safeguard both your pet's health and your financial stability.

Understanding Pet Insurance

Pet insurance is a type of health coverage designed specifically for our four-legged companions. Similar to human health insurance, it provides financial protection against unexpected veterinary expenses. It offers a safety net, ensuring that you can provide the best possible care for your pet without the worry of excessive costs.

The concept of pet insurance has gained significant popularity over the years, especially as veterinary medicine has advanced, offering a wide range of specialized treatments and procedures. These advancements, while beneficial, can also be costly, making pet insurance an essential consideration for pet owners.

The Benefits of Pet Insurance

The advantages of pet insurance are multifaceted. Firstly, it ensures that your pet receives the highest standard of care without financial constraints. Many pet insurance policies cover a wide range of treatments, including accidents, illnesses, and even routine care such as vaccinations and check-ups.

Secondly, pet insurance provides peace of mind. Knowing that you are financially prepared for unexpected veterinary emergencies can reduce the stress associated with pet ownership. It allows you to focus on your pet's health and recovery rather than worrying about the financial implications.

Furthermore, pet insurance can be a cost-effective solution in the long run. While the premiums may seem like an additional expense, they are often far less than the potential costs of veterinary treatments, especially for older pets or those with pre-existing conditions.

Types of Pet Insurance Policies

Pet insurance policies can vary widely, and it’s essential to understand the different types available to make an informed decision.

- Accident-Only Policies: As the name suggests, these policies cover injuries or accidents but do not provide coverage for illnesses. They are often more affordable but may not offer comprehensive protection.

- Accident and Illness Policies: These policies provide coverage for both accidents and illnesses, offering a more comprehensive level of protection. They are ideal for pet owners seeking broad coverage.

- Wellness Plans: Some pet insurance companies offer wellness plans that cover routine care, such as vaccinations, dental cleaning, and preventive treatments. These plans can be a cost-effective way to manage your pet's ongoing health needs.

- Lifetime Policies: These policies provide coverage for the entire lifetime of your pet, often with a set annual limit that renews each year. They offer consistent protection and are suitable for long-term pet ownership.

- Time-Limited Policies: With a time-limited policy, coverage is provided for a specified period, typically 12 months. The benefit limit applies per condition or illness during that period.

Each type of policy has its advantages and considerations, and it's essential to choose one that aligns with your pet's needs and your financial situation.

How Pet Insurance Works

Understanding how pet insurance works is crucial to making the most of your policy. Here’s a breakdown of the process:

Policy Selection

When choosing a pet insurance policy, consider factors such as the type of coverage, the deductible (the amount you pay out of pocket before the insurance kicks in), and the annual or lifetime benefit limits. Compare policies from different providers to find the best fit for your pet.

Enrolling Your Pet

The enrollment process typically involves providing detailed information about your pet, including breed, age, and any pre-existing conditions. Some insurers may require a health examination before offering coverage.

Claim Process

When your pet receives veterinary treatment, you’ll need to pay the full amount upfront. Afterward, you can submit a claim to your insurance provider, usually online or via mail. The claim process often requires providing documentation, such as veterinary invoices and a diagnosis from the vet.

Once the claim is submitted, the insurance company will review it and reimburse you for the covered expenses, minus any applicable deductibles or co-pays.

Coverage Exclusions

It’s important to be aware of what is not covered by your pet insurance policy. Common exclusions include pre-existing conditions, elective procedures, and certain breeds with known genetic predispositions to specific illnesses. Understanding these exclusions is crucial to managing your expectations and ensuring you choose a policy that suits your pet’s needs.

Tips for Choosing the Right Pet Insurance

With numerous pet insurance providers and policies available, selecting the right one can be challenging. Here are some tips to guide your decision:

Research and Compare

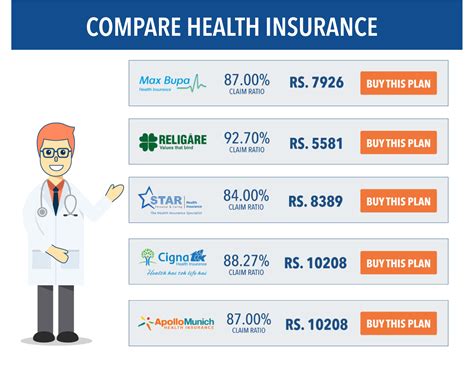

Take the time to research and compare different pet insurance providers. Look for reviews and ratings from current or past customers to gauge the quality of service and coverage. Compare policy features, including deductibles, benefit limits, and exclusions, to find the best value for your money.

Consider Your Pet’s Needs

Assess your pet’s current and potential future health needs. If your pet has a known condition or is prone to certain illnesses, ensure the policy you choose provides adequate coverage. Consider your pet’s age and breed, as some breeds are more prone to specific health issues.

Check for Discounts

Inquire about discounts or promotions offered by insurance providers. Some companies offer discounts for multiple pets, while others may have partnerships with veterinary organizations, providing additional benefits or reduced rates.

Read the Fine Print

Always read the policy documentation thoroughly. Understand the terms and conditions, including the coverage limits, deductibles, and any exclusions. This ensures you know exactly what is and isn’t covered, helping you make informed decisions about your pet’s health.

Choose a Reputable Provider

Opt for a well-established and reputable insurance provider with a track record of prompt claim processing and good customer service. Check for accreditation or certification from recognized bodies in the pet insurance industry.

The Impact of Pet Insurance on Veterinary Care

Pet insurance has had a significant impact on the veterinary industry, enabling pet owners to access a broader range of medical treatments for their animals. It has contributed to improved pet health and longevity, as owners are more likely to seek veterinary care without financial constraints.

Additionally, pet insurance has led to increased awareness and education about pet health and wellness. With the financial protection offered by insurance, pet owners are more inclined to engage in preventive care, such as regular check-ups and vaccinations, which can significantly enhance their pet's quality of life.

Real-Life Examples of Pet Insurance Claims

To illustrate the benefits of pet insurance, let’s explore some real-life examples of successful claims:

Emergency Surgery for a Dog

A Labrador Retriever named Max swallowed a toy, requiring emergency surgery to remove the obstruction. The surgery and post-operative care cost $5,000. With his accident and illness policy, Max’s owner received reimbursement for 80% of the total cost, significantly reducing the financial burden.

Treatment for a Cat’s Chronic Condition

Luna, a Persian cat, was diagnosed with chronic kidney disease. Her treatment plan included regular medications and specialized diets, totaling $1,200 per year. Luna’s wellness plan covered 70% of these costs, making her ongoing treatment more manageable for her owner.

Multiple Claims for an Older Dog

Charlie, a senior Golden Retriever, had multiple health issues, including arthritis and a heart condition. His lifetime policy covered various treatments, including medication, physical therapy, and specialized care, totaling $3,500 in a year. The policy’s annual limit renewed, ensuring continued coverage for Charlie’s ongoing health needs.

Future of Pet Insurance

The pet insurance industry is evolving, with a growing focus on digital technology and personalized coverage. Insurers are leveraging data analytics to offer more tailored policies, taking into account factors like pet age, breed, and geographic location. Additionally, there is a rising trend of integrating pet insurance with telemedicine services, providing remote veterinary consultations and advice.

Looking ahead, the future of pet insurance is promising. As veterinary medicine continues to advance and the demand for specialized care grows, pet insurance will play a pivotal role in ensuring pet owners can access the best possible treatment for their beloved companions.

Frequently Asked Questions

How much does pet insurance cost on average?

+

The cost of pet insurance can vary significantly depending on factors such as the type of coverage, the pet’s age and breed, and the insurer. On average, accident-only policies may cost around 20 to 30 per month, while accident and illness policies can range from 30 to 70 or more per month. Wellness plans typically have lower premiums, starting at around 10 to 20 per month.

Can I get pet insurance for my older pet?

+

Yes, you can get pet insurance for older pets. However, it’s important to note that the cost of insurance may be higher for older pets due to the increased risk of health issues. Some insurers may have age limits or offer specific policies tailored for senior pets.

What is not covered by most pet insurance policies?

+

Most pet insurance policies typically exclude pre-existing conditions, elective procedures, and certain breeds with known genetic predispositions to specific illnesses. It’s crucial to review the policy’s exclusions carefully to understand what is and isn’t covered.

How long does it take to process a pet insurance claim?

+

The processing time for a pet insurance claim can vary depending on the insurer and the complexity of the claim. Generally, it can take anywhere from a few days to a couple of weeks. Some insurers offer faster claim processing with online submissions and digital documentation.

Can I switch pet insurance providers if I’m not satisfied with my current coverage?

+

Yes, you can switch pet insurance providers if you’re not satisfied with your current coverage. However, it’s important to understand that pre-existing conditions may not be covered by the new insurer, and there may be waiting periods before certain conditions become eligible for coverage.