The Best Health Insurance

Choosing the right health insurance is a crucial decision that can significantly impact your well-being and financial security. With numerous options available, it's essential to navigate the complex landscape of healthcare coverage to find the best plan tailored to your unique needs. This comprehensive guide will delve into the world of health insurance, offering expert insights and practical advice to help you make an informed choice.

Understanding Health Insurance: A Foundation for Your Choice

Health insurance is a contract between you and an insurance company, where you pay a premium in exchange for coverage of your medical expenses. It serves as a financial safety net, ensuring that you can access necessary healthcare services without incurring overwhelming costs. Understanding the basics of health insurance is the first step toward making an informed decision.

Key Concepts to Grasp

- Premiums: The amount you pay regularly (usually monthly) to maintain your health insurance coverage.

- Deductibles: The amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often mean lower premiums.

- Copayments (Copays): A fixed amount you pay for a covered healthcare service, usually at the time of service.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage (e.g., you pay 20%, and your insurance covers the remaining 80%).

- Out-of-Pocket Maximum: The most you will pay for covered services in a year. Once you reach this limit, your insurance covers 100% of eligible expenses.

- In-Network vs. Out-of-Network: In-network providers have a contract with your insurance company, often offering discounted rates. Out-of-network providers do not, and their services may cost more.

- Coverage Limits: The maximum amount your insurance will pay for specific services or treatments.

- Pre-Existing Conditions: Health issues you had before enrolling in the insurance plan. Many plans now cover pre-existing conditions due to the Affordable Care Act (ACA) but it's important to understand how they are handled.

Evaluating Your Options: A Deep Dive into Health Insurance Plans

The market offers a wide range of health insurance plans, each with its own features and benefits. Here's a closer look at some common types of plans and their unique characteristics.

Health Maintenance Organization (HMO)

HMOs are known for their cost-effectiveness and comprehensive coverage. With an HMO, you choose a primary care physician (PCP) who coordinates all your healthcare needs. Referrals are typically required to see specialists, and you must use in-network providers to receive the full benefits. HMO plans often have lower premiums and deductibles but may have more limitations on your choice of providers.

Preferred Provider Organization (PPO)

PPOs offer more flexibility than HMOs. You can visit any healthcare provider, in or out of network, without a referral. However, using in-network providers typically results in lower costs. PPO plans often have higher premiums but provide more freedom in choosing your healthcare team. They are a good option for those who value convenience and flexibility.

Exclusive Provider Organization (EPO)

EPO plans are similar to PPOs in that you can see any healthcare provider without a referral. However, EPOs do not cover out-of-network care, except in emergencies. This means you must use in-network providers to receive any coverage. EPO plans can be a good middle ground, offering more flexibility than HMOs while maintaining cost-effectiveness.

Point of Service (POS) Plans

POS plans combine elements of HMOs and PPOs. You choose a PCP and receive comprehensive coverage when using in-network providers. However, you can also visit out-of-network providers, though at a higher cost. POS plans offer a balance between cost and flexibility, making them a popular choice for those who want some freedom in their healthcare decisions.

High Deductible Health Plans (HDHP)

HDHPs are designed to be paired with a Health Savings Account (HSA). These plans have higher deductibles, but you can contribute pre-tax dollars to your HSA to cover qualified medical expenses. HDHPs are a good option for those who are generally healthy and want to save for future medical needs. The HSA provides tax benefits and can be a valuable long-term savings tool.

Navigating the Application Process: A Step-by-Step Guide

Applying for health insurance can be a complex process, but breaking it down into steps can make it more manageable. Here's a simplified guide to help you navigate the application journey.

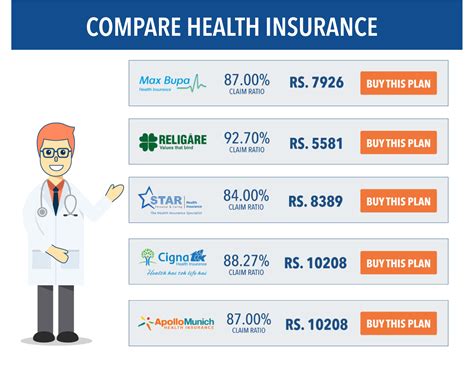

Step 1: Research and Compare Plans

Start by understanding your healthcare needs and preferences. Consider factors like your health status, the frequency of doctor visits, and any specific treatments or medications you require. Research different plans and compare their features, including premiums, deductibles, and provider networks. Online tools and resources can provide valuable information to aid your decision-making process.

Step 2: Gather Necessary Documents

Before applying, gather all the required documents. This typically includes proof of identity (e.g., driver's license or passport), income verification (pay stubs, tax returns), and any relevant medical records. Having these documents ready will streamline the application process and prevent delays.

Step 3: Choose Your Plan

Based on your research and needs assessment, select the plan that best fits your circumstances. Consider not only the financial aspects but also the coverage limits, provider networks, and any additional benefits offered by the plan.

Step 4: Complete the Application

Fill out the application form accurately and completely. Provide all the required information, including personal details, income, and any applicable discounts or subsidies. Be sure to review the application for errors before submitting it.

Step 5: Review and Accept the Offer

Once your application is processed, you will receive an offer from the insurance company. Carefully review the details of the plan, including the summary of benefits and coverage. If you are satisfied with the offer, accept it and pay the initial premium to activate your coverage.

Maximizing Your Benefits: Tips for Optimal Health Insurance Usage

Now that you have your health insurance, it's essential to use it effectively to get the most out of your coverage. Here are some strategies to help you maximize your benefits.

Stay Informed About Your Plan

Familiarize yourself with the details of your insurance plan. Know your coverage limits, deductibles, and any exclusions or limitations. Stay up-to-date with any changes to your plan or the healthcare system that may impact your coverage.

Choose In-Network Providers

Whenever possible, use in-network providers to take advantage of the discounted rates negotiated by your insurance company. This can significantly reduce your out-of-pocket costs.

Understand Preauthorization and Referrals

Some plans require preauthorization for certain services or treatments. Familiarize yourself with the process and ensure you or your provider follows the necessary steps to avoid any delays or denials of coverage. Similarly, understand the referral process for seeing specialists, especially if you have an HMO plan.

Use Preventive Care Services

Many insurance plans offer free or low-cost preventive care services, such as annual check-ups, vaccinations, and screenings. Take advantage of these services to maintain your health and catch potential issues early. Preventive care can save you money in the long run by avoiding more costly treatments down the line.

Consider Telehealth Options

Telehealth services have become increasingly popular, especially in recent years. These services allow you to consult with healthcare providers remotely, often at a lower cost. Check if your insurance plan covers telehealth visits and take advantage of this convenient and cost-effective option when appropriate.

FAQ: Frequently Asked Questions about Health Insurance

What happens if I need emergency care out of network?

+Most health insurance plans cover emergency care, even if it’s out of network. However, you may be responsible for a higher out-of-pocket cost. It’s important to understand your plan’s emergency coverage and any potential limits or exclusions.

Can I switch health insurance plans during the year?

+In most cases, you can only switch plans during the annual Open Enrollment Period or if you experience a Qualifying Life Event (e.g., marriage, birth of a child, loss of other coverage). Check with your insurance provider or the healthcare marketplace for specific rules and exceptions.

How do I know if my prescription drugs are covered by my insurance plan?

+Check your plan’s formulary, which is a list of prescription drugs covered by your insurance. If your medication is not on the formulary, you may need to pay out of pocket or consider an alternative drug. You can also contact your insurance provider to discuss options and potential solutions.

What is the difference between individual and family health insurance plans?

+Individual plans are designed for one person, while family plans cover multiple family members under one policy. Family plans often have higher premiums but provide comprehensive coverage for all family members. Consider your household’s needs and choose the plan that best fits your circumstances.