Marketplace Insurance Blue Cross Blue Shield

The healthcare landscape in the United States is a complex web of providers, plans, and policies, and one of the key players in this intricate system is Blue Cross Blue Shield (BCBS). With its wide network and diverse range of offerings, BCBS has become a trusted name in the insurance industry. In this comprehensive article, we will delve into the world of Marketplace Insurance as offered by Blue Cross Blue Shield, exploring its features, benefits, and the impact it has on individuals and families seeking affordable healthcare coverage.

The Evolution of Marketplace Insurance

The concept of Marketplace Insurance emerged as a result of the Affordable Care Act (ACA), also known as Obamacare. This groundbreaking legislation aimed to make healthcare more accessible and affordable for Americans by creating online marketplaces, or exchanges, where individuals and small businesses could shop for and compare health insurance plans. Blue Cross Blue Shield, with its extensive experience and nationwide presence, quickly became a prominent player in these marketplaces.

The ACA introduced several key features that revolutionized the insurance landscape. It mandated that insurers offer coverage regardless of pre-existing conditions, eliminated lifetime and annual limits on coverage, and provided subsidies to make insurance more affordable for low- and middle-income individuals. These reforms significantly expanded the pool of insured individuals, particularly among those who previously struggled to find affordable coverage.

Blue Cross Blue Shield: A Trusted Provider

Blue Cross Blue Shield is a unique entity in the healthcare industry, as it is not a single insurance company but rather a federation of independent, locally operated companies across the United States. This decentralized structure allows BCBS to tailor its plans and services to the specific needs of each region, making it a versatile and adaptable insurer.

With a rich history dating back to the early 20th century, BCBS has evolved to become a leading provider of health insurance, serving millions of individuals, families, and businesses. Its commitment to innovation and customer-centric approaches has solidified its reputation as a trusted partner in the journey towards better healthcare access.

Marketplace Insurance Plans: A Comprehensive Overview

Blue Cross Blue Shield offers a comprehensive range of insurance plans on the Marketplace, catering to diverse needs and budgets. These plans can be broadly categorized into four main types, each with its own set of features and coverage levels:

Bronze Plans

Bronze plans are the most affordable option in the Marketplace, offering lower monthly premiums in exchange for higher out-of-pocket costs when receiving healthcare services. These plans are ideal for individuals who prioritize lower monthly expenses and are willing to pay more out of pocket for healthcare services.

On average, Bronze plans cover approximately 60% of healthcare costs, with the remaining 40% being the responsibility of the insured individual. While this may seem like a significant out-of-pocket expense, it is important to note that these plans still provide essential health benefits, ensuring access to critical care when needed.

Silver Plans

Silver plans strike a balance between monthly premiums and out-of-pocket costs, making them a popular choice among many individuals and families. These plans typically cover around 70% of healthcare expenses, leaving the insured responsible for the remaining 30%. The balance between premiums and out-of-pocket costs makes Silver plans a versatile option for those seeking a middle ground in terms of financial commitment.

One of the key advantages of Silver plans is their eligibility for cost-sharing reductions. These reductions can significantly lower out-of-pocket costs for individuals and families with lower incomes, making healthcare more affordable and accessible.

Gold Plans

Gold plans offer a higher level of coverage, with approximately 80% of healthcare costs covered by the insurer. This means that insured individuals will have lower out-of-pocket expenses when accessing healthcare services. While the monthly premiums for Gold plans are higher compared to Bronze or Silver, they provide a more comprehensive coverage option for those who anticipate frequent or specialized healthcare needs.

Gold plans are particularly beneficial for individuals with chronic conditions or those who require ongoing medical treatments. The reduced out-of-pocket costs can make a significant difference in managing healthcare expenses over time.

Platinum Plans

Platinum plans are the most comprehensive and expensive option in the Marketplace. With these plans, Blue Cross Blue Shield covers an impressive 90% of healthcare costs, leaving only a small portion for the insured individual to pay out of pocket. The monthly premiums for Platinum plans are higher, reflecting the extensive coverage they provide.

Platinum plans are ideal for individuals and families who prioritize minimal out-of-pocket expenses and want the peace of mind that comes with extensive coverage. These plans are particularly beneficial for those with complex healthcare needs or who require specialized treatments.

The Benefits of Marketplace Insurance

Choosing Marketplace Insurance through Blue Cross Blue Shield offers a multitude of benefits, empowering individuals and families to take control of their healthcare journey. Here are some key advantages:

- Affordability: Marketplace plans, including those offered by BCBS, are designed to be affordable. The combination of subsidies and cost-sharing reductions makes healthcare coverage more accessible, especially for those with lower incomes.

- Essential Health Benefits: All Marketplace plans, regardless of metal level, must cover essential health benefits. These include services like emergency care, hospitalization, maternity care, mental health services, and more. This ensures that insured individuals have access to a wide range of critical healthcare services.

- Pre-existing Condition Coverage: One of the most significant advantages of Marketplace Insurance is the guarantee of coverage for pre-existing conditions. This means that individuals with health issues prior to enrolling in a plan cannot be denied coverage or charged higher premiums based on their health status.

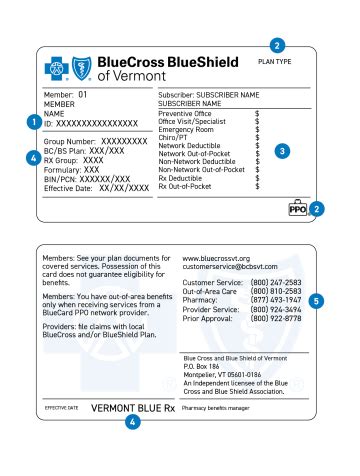

- Network of Providers: Blue Cross Blue Shield boasts an extensive network of healthcare providers, ensuring that insured individuals have access to a wide range of doctors, specialists, and facilities. This network coverage provides convenience and peace of mind, as individuals can choose from a diverse pool of healthcare professionals.

- Customer Support: BCBS is known for its exceptional customer service. From enrollment to claims processing, the company provides dedicated support to ensure a smooth and stress-free experience for its members. This level of service adds an extra layer of reassurance when navigating the complexities of healthcare insurance.

Performance Analysis: Marketplace Insurance Success Stories

The impact of Marketplace Insurance on individuals and families cannot be overstated. Here are some real-life examples of how Blue Cross Blue Shield’s Marketplace plans have made a difference:

Sarah’s Story: Affordable Peace of Mind

Sarah, a single mother of two, had struggled to find affordable healthcare coverage for her family. With limited income, she was concerned about the financial burden of unexpected medical expenses. When she discovered Marketplace Insurance, she was relieved to find that the premiums were within her budget. She chose a Silver plan, which provided a good balance between cost and coverage.

Sarah's story highlights how Marketplace Insurance can offer peace of mind to families who may have previously gone without coverage due to financial constraints. With her new plan, Sarah can access regular check-ups, vaccinations, and necessary medical treatments without worrying about unaffordable out-of-pocket costs.

John’s Journey: Specialized Treatment Access

John, a young professional with a chronic condition, faced challenges in finding insurance that would cover his specialized treatment needs. Many traditional plans excluded certain pre-existing conditions or imposed restrictive limits on coverage. However, when he explored Marketplace Insurance, he found a Platinum plan offered by Blue Cross Blue Shield that met his unique requirements.

John's story illustrates how Marketplace Insurance, particularly the more comprehensive plans like Platinum, can provide essential coverage for individuals with specific healthcare needs. With his new plan, John can focus on his treatment and well-being without the added stress of financial concerns.

Maria’s Experience: Navigating Complex Care

Maria, an elderly woman with multiple health conditions, required a plan that could accommodate her complex care needs. She was concerned about the potential costs and the challenge of finding a plan that would cover her specialized treatments. After researching her options, she enrolled in a Gold plan through the Marketplace, specifically designed for individuals with chronic conditions.

Maria's story showcases how Marketplace Insurance can be tailored to meet the unique needs of individuals with complex healthcare requirements. With her Gold plan, Maria can access the specialized care she needs without worrying about excessive out-of-pocket expenses.

Future Implications and Industry Insights

The Marketplace Insurance landscape is continuously evolving, and Blue Cross Blue Shield remains at the forefront of these developments. As the industry adapts to changing healthcare needs and policies, BCBS is committed to providing innovative solutions that meet the diverse requirements of its members.

Looking ahead, we can expect to see further enhancements in the digital experience of enrolling in Marketplace plans. Blue Cross Blue Shield is investing in streamlined online platforms and user-friendly interfaces to make the process more accessible and efficient. Additionally, as healthcare technology advances, we can anticipate the integration of digital health solutions, such as telemedicine, into Marketplace plans, offering greater convenience and accessibility to members.

Furthermore, as the Affordable Care Act continues to shape the healthcare landscape, Blue Cross Blue Shield remains dedicated to advocating for policies that promote affordable and accessible healthcare for all Americans. The company's expertise and nationwide presence position it as a key influencer in shaping the future of healthcare coverage.

Conclusion

Blue Cross Blue Shield’s Marketplace Insurance plans have revolutionized the way individuals and families access healthcare coverage. By offering a range of affordable and comprehensive options, BCBS has empowered millions to take control of their health and well-being. From Bronze to Platinum, each plan level provides a unique balance of coverage and cost, ensuring that there is an option to suit every budget and healthcare need.

As we navigate the complexities of the healthcare industry, Blue Cross Blue Shield stands as a trusted partner, guiding individuals towards better health outcomes. With its commitment to innovation, customer-centric approaches, and advocacy for affordable care, BCBS continues to lead the way in making healthcare more accessible and equitable for all.

Can I switch my Marketplace Insurance plan during the year?

+Yes, in certain circumstances, you may be eligible to switch your Marketplace plan outside of the open enrollment period. These circumstances include life events such as marriage, divorce, birth or adoption of a child, or loss of other health coverage. It’s important to review the specific guidelines and deadlines for special enrollment periods to ensure a smooth transition.

What happens if I miss the open enrollment period for Marketplace Insurance?

+If you miss the open enrollment period, you may still be able to enroll in a Marketplace plan if you qualify for a special enrollment period due to a qualifying life event. However, if you do not qualify for a special enrollment period, you may need to wait until the next open enrollment period to enroll in a new plan.

How can I determine which Marketplace Insurance plan is best for me?

+Choosing the right Marketplace plan depends on various factors, including your healthcare needs, budget, and preferences. Consider factors such as your expected healthcare expenses, the balance between premiums and out-of-pocket costs, and the network of providers available. It’s also beneficial to compare plans side by side to understand the differences in coverage and costs.