Insurance Authorization

In the complex world of healthcare, insurance authorization stands as a critical process, acting as a gatekeeper between patients and the medical services they require. It's a crucial step that determines whether a patient can access necessary treatments, medications, or procedures. This intricate system impacts millions of lives, yet it often remains a mysterious and daunting process for many individuals. Today, we aim to demystify insurance authorization, shedding light on its workings, importance, and potential pitfalls.

Understanding Insurance Authorization: The Fundamentals

Insurance authorization, often referred to as prior authorization or pre-authorization, is a requirement in many healthcare systems, especially those with private insurance plans. It's a process where a healthcare provider or patient seeks approval from an insurance company before a specific medical service or treatment can be administered.

This authorization process is designed to ensure that the proposed treatment or service is medically necessary, appropriate for the patient's condition, and covered by the insurance policy. It's a form of quality control and cost management, helping to prevent unnecessary or inappropriate treatments and to maintain the financial integrity of the healthcare system.

The Authorization Journey: A Step-by-Step Breakdown

The insurance authorization process typically involves several key steps, each with its own complexities and potential challenges.

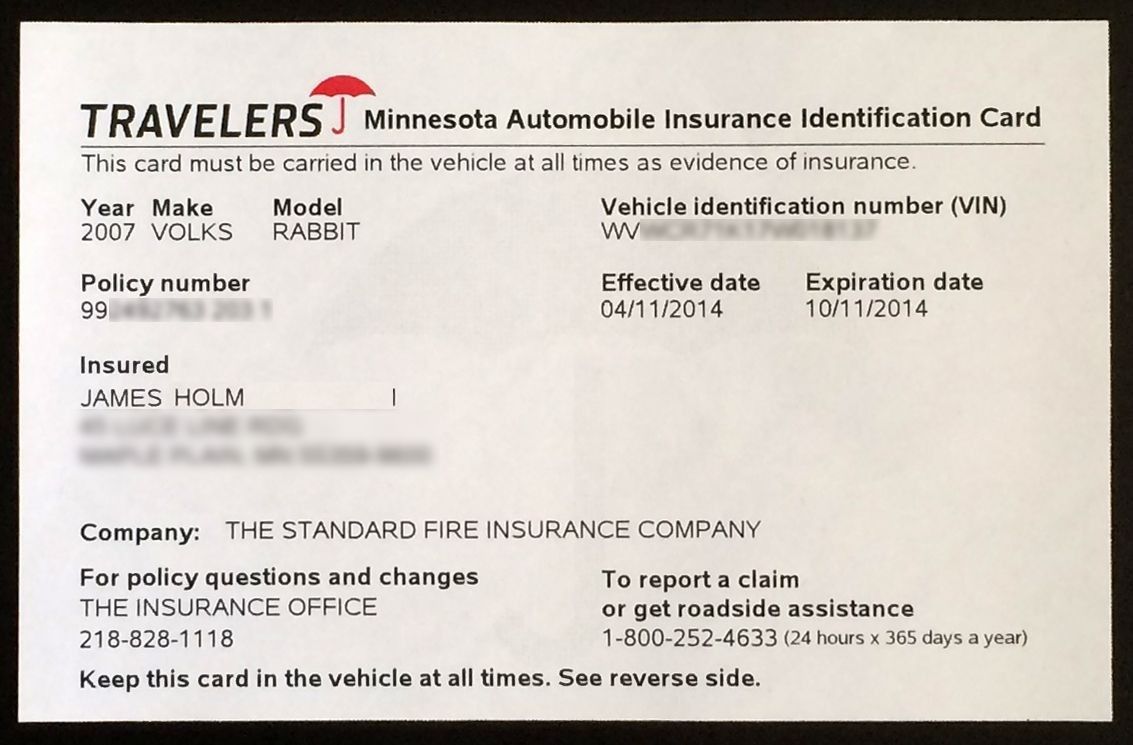

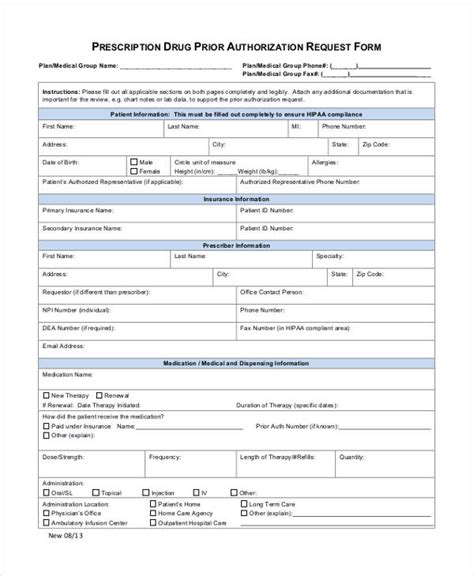

- Initiation of Authorization Request: This is often the responsibility of the healthcare provider, who must complete and submit a detailed authorization request form. The form includes information about the patient, the proposed treatment, and the medical necessity of the service.

- Review and Verification: The insurance company then reviews the request, checking for completeness and accuracy. They may seek additional information or clarifications from the provider.

- Decision Making: Based on the review, the insurance company makes a decision to either approve or deny the request. Approval means the treatment can proceed as planned, while denial indicates that the service is not covered or not deemed medically necessary.

- Appeal and Reconsideration: In cases of denial, the provider or patient has the right to appeal the decision. This involves submitting additional evidence or arguments to support the medical necessity of the treatment.

- Final Determination: After the appeal process, a final decision is made, which can either uphold the initial denial or reverse it, allowing the treatment to proceed.

| Step | Description |

|---|---|

| Request Initiation | Healthcare provider submits a detailed request. |

| Review | Insurance company checks and verifies the request. |

| Decision | Approval or denial based on medical necessity and policy coverage. |

| Appeal | Provider or patient can challenge a denial decision. |

| Final Determination | Final decision to proceed or not with the treatment. |

The Impact of Insurance Authorization

Insurance authorization plays a significant role in the healthcare landscape, impacting patients, providers, and the insurance industry itself.

- Patient Experience: For patients, insurance authorization can be a source of anxiety and confusion. Delays in authorization can lead to treatment delays, impacting health outcomes. Understanding the process and knowing their rights can empower patients to navigate this system more effectively.

- Healthcare Providers: Providers face the challenge of completing complex authorization forms accurately and efficiently. They also play a crucial role in advocating for their patients, ensuring that necessary treatments are approved.

- Insurance Companies: Insurance companies have the task of managing these authorizations, balancing the need for cost control with the provision of necessary healthcare services. They must ensure that their processes are fair, efficient, and compliant with regulatory standards.

Simplifying the Process: Strategies and Solutions

The insurance authorization process, while necessary, is often criticized for its complexity and potential for delays. However, there are strategies and solutions being implemented to streamline this process and improve its efficiency.

Digital Solutions and Automation

One of the most significant advancements in insurance authorization is the integration of digital technologies. Online platforms and mobile apps are now available, allowing providers to submit authorization requests electronically, reducing paperwork and potential errors.

Furthermore, automation technologies are being used to streamline the review process. Artificial intelligence (AI) and machine learning algorithms can analyze authorization requests, identify missing information, and even predict potential approvals or denials based on historical data.

Standardization and Education

Standardizing authorization forms and processes can greatly simplify the system. By creating clear, consistent guidelines for authorization requests, providers can complete forms more efficiently, and insurance companies can review them more effectively.

Education is also key. Providing comprehensive training and resources to healthcare providers on how to navigate the authorization process can reduce errors and improve the overall efficiency of the system.

Expedited Review Processes

Some insurance companies are implementing expedited review processes for certain types of treatments or services. These fast-track authorizations are designed for situations where time is of the essence, such as emergency treatments or life-threatening conditions.

Collaborative Approaches

Collaboration between insurance companies, healthcare providers, and patient advocacy groups can lead to more patient-centric authorization processes. By working together, these stakeholders can identify pain points and implement solutions that benefit all parties involved.

| Strategy | Description |

|---|---|

| Digital Solutions | Using online platforms and AI for faster, more efficient authorization processes. |

| Standardization | Creating uniform guidelines to simplify authorization forms and processes. |

| Education | Providing training and resources to healthcare providers to navigate the authorization process effectively. |

| Expedited Reviews | Implementing fast-track authorizations for urgent or life-threatening cases. |

| Collaborative Approaches | Working together to create patient-centric authorization processes that benefit all stakeholders. |

Future Implications and Industry Insights

Looking ahead, the insurance authorization landscape is expected to evolve further, driven by technological advancements and changing healthcare policies.

The Role of Technology

Technological advancements will continue to play a pivotal role in simplifying insurance authorization. The integration of AI, blockchain, and other innovative technologies is expected to enhance the efficiency and security of the process.

For instance, blockchain technology can provide a secure, transparent, and immutable record of authorization requests, approvals, and denials. This can reduce fraud, improve data accuracy, and streamline the overall process.

Policy Changes and Regulatory Developments

Healthcare policies and regulations are constantly evolving. Future changes may include updates to authorization requirements, coverage guidelines, and appeal processes. Staying informed about these developments is crucial for both patients and providers.

Embracing a Patient-Centric Approach

The future of insurance authorization lies in a more patient-centric model. This involves not only streamlining the process but also ensuring that patients understand their rights and have the necessary support to navigate the system effectively.

Education, clear communication, and accessible resources will be key in empowering patients to advocate for their healthcare needs and ensuring timely access to necessary treatments.

Frequently Asked Questions

What happens if my insurance authorization is denied?

+If your insurance authorization is denied, you have the right to appeal the decision. This involves providing additional evidence or arguments to support the medical necessity of the treatment. It’s important to work closely with your healthcare provider during the appeal process.

How long does the insurance authorization process typically take?

+The duration of the insurance authorization process can vary depending on several factors, including the complexity of the treatment, the insurance company’s review process, and whether there are any delays or missing information. In general, it can take anywhere from a few days to several weeks.

Can I get an expedited insurance authorization for urgent treatments?

+Yes, some insurance companies offer expedited review processes for urgent or life-threatening treatments. These fast-track authorizations are designed to ensure that patients receive timely care when time is of the essence. It’s important to discuss this option with your healthcare provider.

How can I ensure my insurance authorization request is approved?

+To increase the chances of your insurance authorization request being approved, it’s crucial to provide complete and accurate information. Work closely with your healthcare provider to ensure that the authorization request form is filled out correctly and includes all necessary supporting documentation.

What role does my healthcare provider play in the insurance authorization process?

+Healthcare providers play a critical role in the insurance authorization process. They are responsible for submitting the authorization request, providing necessary medical information, and advocating for their patients. They can also guide you through the process and help with any appeals if needed.