Best Insurance For Travel

Traveling is an exciting adventure, but it can also come with unexpected risks and challenges. Having the right insurance coverage can provide peace of mind and ensure that your travels are protected. With numerous options available, finding the best insurance for your travel needs can be a daunting task. In this comprehensive guide, we will explore the world of travel insurance, offering expert insights and a detailed analysis to help you make an informed decision.

Understanding Travel Insurance: A Comprehensive Overview

Travel insurance is a specialized form of coverage designed to protect travelers against various unforeseen events that may occur during their journey. It offers financial protection and assistance for a range of situations, ensuring that your trip remains enjoyable and stress-free. Let’s delve into the key aspects of travel insurance to understand its importance and benefits.

Coverage Options and Benefits

Travel insurance policies typically offer a comprehensive range of coverage options, tailored to meet the diverse needs of travelers. Here are some of the key benefits that you can expect from a travel insurance plan:

- Medical Expenses: Covers emergency medical treatment, hospitalization, and even evacuation in case of an illness or injury during your trip.

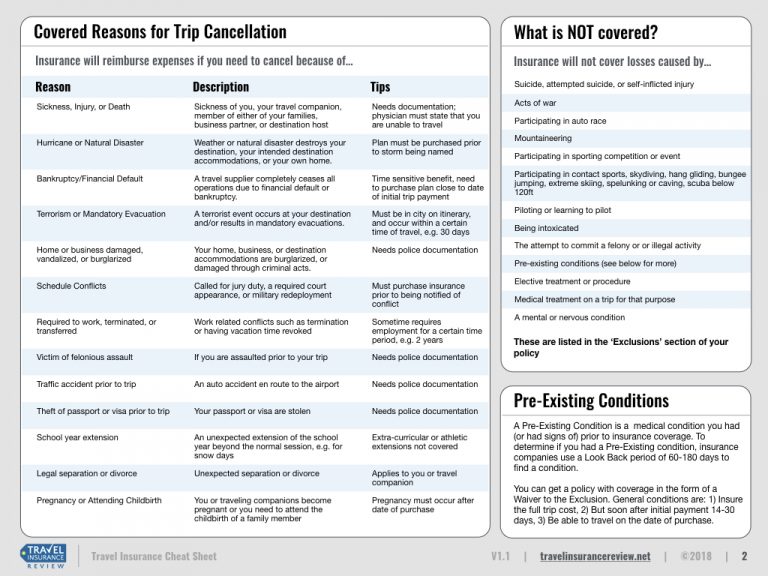

- Trip Cancellation and Interruption: Provides reimbursement for non-refundable trip costs if your travel plans are canceled or interrupted due to covered reasons such as illness, natural disasters, or travel advisories.

- Baggage and Personal Belongings: Offers compensation for lost, stolen, or damaged luggage and personal items, including valuable electronics and jewelry.

- Travel Delay: Reimburses expenses incurred due to unexpected delays in transportation, such as flight cancellations or severe weather conditions.

- Emergency Assistance: Provides 24⁄7 access to a network of medical and travel professionals who can offer assistance and guidance in case of emergencies.

- Personal Liability: Protects you against claims arising from accidents or injuries caused to others during your trip.

- Rental Car Coverage: Extends coverage to your rental car, providing protection against damage or theft.

It's important to note that the specific coverage and benefits may vary depending on the insurance provider and the policy chosen. Some policies may offer additional coverage for adventure activities, sports equipment, or even cruise vacations.

When to Consider Travel Insurance

Travel insurance is particularly beneficial in certain situations. Here are some scenarios where having travel insurance can make a significant difference:

- International Travel: When traveling abroad, especially to destinations with limited or expensive medical facilities, travel insurance provides crucial coverage for medical emergencies and evacuation.

- Adventure Travel: If your trip involves adventurous activities like hiking, skiing, or water sports, travel insurance can protect you against accidents and provide specialized coverage for sports-related injuries.

- Family Trips: When traveling with family, especially children, travel insurance offers peace of mind by covering medical emergencies, trip cancellations, and other unexpected events that may impact your family’s travel plans.

- High-Cost Trips: For expensive vacations or trips with significant non-refundable deposits, travel insurance ensures that you don’t incur financial losses in case of unforeseen circumstances.

- Travel Advisories ’: In regions with political instability, natural disasters, or health concerns, travel insurance can provide coverage if you need to cancel or interrupt your trip due to official travel advisories.

Evaluating Travel Insurance Providers: A Comparative Analysis

With a vast array of travel insurance providers in the market, choosing the right one can be challenging. Here, we present a comparative analysis of some of the top travel insurance companies, highlighting their key features and offerings.

Company A: A Leader in Travel Protection

Company A is a renowned name in the travel insurance industry, known for its comprehensive coverage and excellent customer service. Here’s a glimpse of what they offer:

- Comprehensive Coverage: Company A provides a wide range of coverage options, including medical expenses, trip cancellation, baggage loss, and emergency assistance.

- Customizable Plans: They offer flexible plans that can be tailored to your specific travel needs, allowing you to choose the coverage limits and additional benefits that suit your trip.

- 24⁄7 Assistance: With a dedicated team of travel experts, Company A offers round-the-clock assistance, ensuring prompt response and support during emergencies.

- Travel Benefits: In addition to insurance coverage, they provide exclusive travel benefits such as trip delay reimbursement, rental car insurance, and even travel concierge services.

- Online Claims Management: Their user-friendly online platform allows you to easily manage your policy, file claims, and track their progress, ensuring a seamless claims process.

Company B: Focused on Adventure Travel

Company B specializes in providing insurance coverage for adventure-seekers. If your travel plans involve thrilling activities, Company B is an excellent choice. Here’s why:

- Adventure Sports Coverage: They offer specialized coverage for a wide range of adventure sports, including skiing, hiking, scuba diving, and more. Their policies provide protection against injuries and accidents during these activities.

- Medical Evacuation: Company B’s policies include coverage for medical evacuation, ensuring that you can receive timely medical attention in remote or challenging locations.

- Gear Protection: They understand the importance of your sports equipment, so their policies cover the loss, damage, or theft of essential gear, providing peace of mind during your adventures.

- Flexible Trip Lengths: Whether you’re planning a short weekend getaway or an extended expedition, Company B offers flexible trip duration options to accommodate your travel plans.

Company C: Affordable Travel Protection

For budget-conscious travelers, Company C offers affordable travel insurance options without compromising on coverage. Here’s what sets them apart:

- Competitive Pricing: Company C is known for its affordable premiums, making travel insurance accessible to a wider range of travelers.

- Basic Coverage: While their policies may have lower coverage limits compared to other providers, they still offer essential protection for medical expenses, trip cancellations, and baggage loss.

- Optional Add-ons: If you require additional coverage, Company C allows you to customize your policy with optional add-ons, such as adventure sports coverage or rental car insurance.

- Traveler-Friendly Claims Process: They strive to make the claims process as hassle-free as possible, offering a simple and transparent procedure for filing and processing claims.

Company D: Comprehensive Coverage for Families

If you’re planning a family trip, Company D is an excellent choice, offering specialized coverage tailored to the needs of families. Here’s what they bring to the table:

- Family Plans: Company D provides family-friendly policies that cover all family members under a single plan, making it convenient and cost-effective for group travel.

- Medical Coverage for Children: Their policies include comprehensive medical coverage for children, ensuring that your little ones are protected during your travels.

- Travel Assistance for Families: They offer dedicated travel assistance services specifically designed for families, providing support and guidance in case of emergencies or unexpected situations.

- Trip Cancellation for Family Emergencies: In case of a family emergency, Company D’s policies allow for trip cancellation coverage, ensuring that you can prioritize your family’s well-being without incurring financial losses.

How to Choose the Right Travel Insurance Policy

Selecting the best travel insurance policy involves careful consideration of your travel plans and personal needs. Here are some key factors to keep in mind when making your choice:

- Destination and Activities: Assess the risks associated with your destination and planned activities. If you’re traveling to a remote or high-risk area, or engaging in adventure sports, ensure that your insurance policy provides adequate coverage.

- Trip Cost and Cancellation Risks: Consider the financial investment you’ve made in your trip. Choose a policy that offers sufficient trip cancellation and interruption coverage to protect your non-refundable expenses.

- Medical Coverage: Evaluate your health and any pre-existing conditions. Ensure that your travel insurance policy provides adequate medical coverage, including emergency treatment, hospitalization, and evacuation if necessary.

- Baggage and Personal Belongings: Assess the value of your luggage and personal items. Choose a policy that offers sufficient coverage for lost, stolen, or damaged belongings.

- Additional Benefits: Look for policies that offer extra benefits such as rental car coverage, travel delay reimbursement, or travel assistance services. These can provide added convenience and peace of mind during your travels.

- Reputation and Customer Service: Research the reputation of the insurance provider. Read reviews and seek recommendations to ensure that the company has a strong track record of providing excellent customer service and prompt claims processing.

The Future of Travel Insurance: Emerging Trends and Innovations

The travel insurance industry is constantly evolving, with new trends and innovations shaping the way policies are designed and offered. Here’s a glimpse into the future of travel insurance:

Digitalization and Convenience

Travel insurance providers are increasingly embracing digitalization to enhance the customer experience. Expect to see more user-friendly online platforms, mobile apps, and digital tools that streamline the policy purchase, management, and claims process. Real-time updates, instant policy access, and digital documentation will become the norm, making travel insurance more accessible and convenient.

Personalized Coverage

The future of travel insurance lies in personalized coverage options. Insurers are developing innovative ways to tailor policies to individual travelers’ needs. This includes dynamic pricing models, customizable coverage limits, and the ability to add or remove specific benefits based on personal preferences and travel plans. By offering personalized coverage, insurers can provide a more tailored and cost-effective solution for travelers.

Data-Driven Insights

With advancements in data analytics, travel insurance providers can leverage big data to gain valuable insights into travel patterns, risk factors, and customer behavior. This data-driven approach will enable insurers to offer more accurate pricing, better risk management, and targeted coverage options. By analyzing travel trends and consumer preferences, insurers can provide more relevant and tailored policies.

Integrated Travel Experiences

Travel insurance is evolving beyond a standalone product. Insurers are partnering with travel companies, airlines, and hospitality providers to offer integrated travel experiences. This includes seamless insurance integration within travel booking platforms, providing travelers with convenient access to insurance options during the booking process. Additionally, insurers are exploring partnerships to offer exclusive travel benefits and experiences, enhancing the overall travel journey.

Artificial Intelligence and Automation

Artificial Intelligence (AI) and automation are set to revolutionize the travel insurance industry. Insurers are utilizing AI-powered chatbots and virtual assistants to provide 24⁄7 customer support, offering instant assistance and policy information. AI algorithms can also analyze travel data to identify potential risks and suggest tailored coverage options. Automation will further streamline the claims process, reducing processing times and enhancing customer satisfaction.

Frequently Asked Questions (FAQ)

What happens if I need to make a claim during my trip?

+

If you need to make a claim during your trip, follow the procedures outlined in your insurance policy. Typically, you’ll need to contact your insurance provider’s emergency assistance number and provide them with the details of your situation. They will guide you through the necessary steps, which may include filing a claim form, providing documentation, and seeking approval for any emergency treatments or expenses.

Can I extend my travel insurance coverage while abroad?

+

In most cases, it is possible to extend your travel insurance coverage while you are abroad. Contact your insurance provider before your original policy expires to discuss your options. They can guide you through the process of extending your coverage, ensuring that you remain protected throughout your extended trip.

What if I have a pre-existing medical condition? Will I be covered by travel insurance?

+

Travel insurance policies typically cover pre-existing medical conditions, but there may be certain conditions or limitations. It’s essential to disclose any pre-existing conditions when purchasing your policy and understand the specific coverage and exclusions related to those conditions. Some policies may require additional premiums or endorsements to provide comprehensive coverage for pre-existing conditions.

Can I cancel my travel insurance policy after purchasing it?

+

Yes, you can cancel your travel insurance policy, but it’s important to review the terms and conditions of your policy. Many policies have a free-look period, allowing you to cancel within a certain timeframe and receive a full refund. After the free-look period, you may still be able to cancel, but you may incur cancellation fees or be subject to a pro-rated refund.

What should I look for when comparing travel insurance policies?

+

When comparing travel insurance policies, consider the following factors: coverage limits and exclusions, premium cost, reputation of the insurance provider, ease of claims process, and additional benefits. Assess your specific travel needs and choose a policy that provides adequate coverage for your planned activities, destination, and potential risks.

In conclusion, travel insurance is an essential component of any well-planned trip. By understanding the coverage options, evaluating top providers, and making an informed choice, you can ensure that your travels are protected and that you have the necessary support in case of unexpected events. As the travel insurance industry continues to innovate, travelers can look forward to more personalized, convenient, and integrated insurance solutions.