Cincinnati Life Insurance Company

Cincinnati Life Insurance Company is a well-established insurance provider with a rich history and a solid reputation in the financial services industry. Founded in 1901, this Ohio-based company has weathered the test of time and emerged as a trusted name in the realm of life insurance. With a century-long journey, Cincinnati Life has evolved and adapted to the ever-changing landscape of financial protection, catering to the diverse needs of its clients.

The company's journey began with a vision to provide reliable financial security to individuals and families. Over the years, it has expanded its reach, offering a comprehensive range of insurance products and services. Cincinnati Life's expertise lies in crafting tailored solutions that cater to various life stages and financial goals.

One of the key strengths of Cincinnati Life is its commitment to customer satisfaction. The company prides itself on building long-lasting relationships with its policyholders, ensuring they receive the support and guidance they need throughout their financial journey. With a dedicated team of professionals, Cincinnati Life strives to make insurance accessible and understandable, empowering individuals to make informed decisions about their financial future.

Comprehensive Insurance Portfolio

Cincinnati Life Insurance Company offers an extensive array of insurance products to meet the diverse needs of its clientele. From traditional life insurance policies to more specialized coverage, the company aims to provide financial protection for every stage of life.

Life Insurance Policies

The cornerstone of Cincinnati Life’s portfolio is its life insurance offerings. The company provides a range of term life insurance plans, offering flexible coverage options to suit varying budgets and protection needs. These policies ensure financial security for a specified term, providing peace of mind to policyholders and their families.

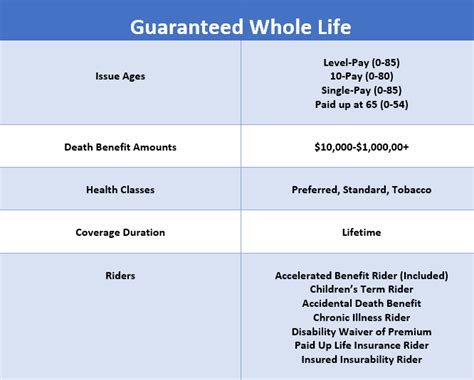

In addition to term life insurance, Cincinnati Life also offers permanent life insurance policies, such as whole life and universal life insurance. These policies provide lifelong coverage, accumulating cash value over time, which can be used for various financial goals, including retirement planning or funding educational expenses.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Affordable, flexible coverage with specified term lengths. Ideal for short-term financial protection needs. |

| Whole Life Insurance | Permanent coverage with guaranteed death benefits and cash value accumulation. Provides lifelong financial security. |

| Universal Life Insurance | Flexible permanent coverage with adjustable death benefits and cash value. Offers versatility for changing financial goals. |

Annuities and Retirement Planning

Cincinnati Life recognizes the importance of retirement planning and offers a range of annuity products to help individuals secure their financial future. Annuities provide a steady stream of income during retirement, ensuring a comfortable lifestyle post-work.

The company's annuity portfolio includes fixed annuities, which offer guaranteed interest rates and predictable income, and variable annuities, which provide the potential for higher returns through investment in various funds. Cincinnati Life also offers indexed annuities, which combine the stability of fixed annuities with the growth potential of variable annuities.

| Annuity Type | Key Features |

|---|---|

| Fixed Annuities | Guaranteed interest rates and predictable income payments. Ideal for conservative investors seeking stability. |

| Variable Annuities | Investment-linked annuities with the potential for higher returns. Offers flexibility for changing market conditions. |

| Indexed Annuities | Combines fixed and variable annuity features, providing stability with growth potential. Offers a balance between risk and reward. |

Additional Insurance Products

Beyond life insurance and annuities, Cincinnati Life offers a variety of supplementary insurance products to enhance financial protection. These include:

- Disability Income Insurance: Provides income protection in the event of a disability, ensuring financial stability during times of physical or mental incapacity.

- Long-Term Care Insurance: Covers the costs of long-term care, including nursing home stays or home health care, offering peace of mind for the future.

- Critical Illness Insurance: Provides a lump-sum payment upon the diagnosis of a specified critical illness, helping cover medical expenses and other financial burdens.

- Accidental Death and Dismemberment Insurance: Offers additional coverage in the event of accidental death or dismemberment, providing financial support for beneficiaries.

Customer Service and Support

Cincinnati Life places a strong emphasis on customer service, ensuring that policyholders receive the guidance and support they need throughout their insurance journey. The company’s dedicated team of professionals is readily available to assist with policy selection, claim processes, and any queries or concerns that may arise.

Cincinnati Life offers a range of resources to empower its customers, including online tools for policy management and claim submission. The company's website provides comprehensive information on its products and services, making it easier for individuals to understand their insurance options and make informed decisions.

Additionally, Cincinnati Life hosts educational workshops and webinars to enhance financial literacy among its clientele. These initiatives aim to demystify insurance and empower individuals to take control of their financial future. The company's commitment to customer education reflects its long-term vision of fostering financial security and stability.

Financial Strength and Stability

Cincinnati Life Insurance Company boasts a strong financial foundation, which is essential for the long-term security of its policyholders. The company’s financial stability is reflected in its high ratings from reputable rating agencies, such as A.M. Best and Standard & Poor’s.

A.M. Best, a leading insurance rating agency, has assigned Cincinnati Life a Superior rating (A+), indicating its excellent financial strength and ability to meet its ongoing obligations. This rating is a testament to the company's prudent financial management and its commitment to ensuring the long-term security of its policyholders.

Standard & Poor's, another renowned rating agency, has awarded Cincinnati Life an A rating, signifying its strong financial capacity and stable outlook. This rating highlights the company's ability to withstand economic fluctuations and maintain its financial commitments.

| Rating Agency | Rating | Significance |

|---|---|---|

| A.M. Best | A+ (Superior) | Reflects excellent financial strength and creditworthiness. |

| Standard & Poor's | A | Indicates strong financial capacity and stable financial performance. |

These high ratings underscore Cincinnati Life's financial stability and its ability to weather market volatility. Policyholders can have confidence in the company's ability to honor its commitments, ensuring their financial protection remains secure.

Community Engagement and Philanthropy

Beyond its financial services, Cincinnati Life Insurance Company actively engages with its local communities and embraces a culture of giving back. The company believes in using its resources to make a positive impact, fostering a sense of social responsibility and community development.

Community Partnerships

Cincinnati Life collaborates with various community organizations and initiatives, supporting causes that align with its values and the needs of its local communities. The company understands that its success is intrinsically linked to the well-being of the communities it serves.

Through strategic partnerships, Cincinnati Life contributes to initiatives focused on education, healthcare, and economic development. These partnerships aim to create a positive ripple effect, enhancing the lives of individuals and families in the communities where the company operates.

Philanthropic Initiatives

Cincinnati Life’s philanthropic efforts extend beyond financial contributions. The company encourages its employees to actively participate in volunteer programs and community outreach initiatives. This employee engagement fosters a culture of empathy and social consciousness, enriching the lives of both employees and the communities they serve.

Cincinnati Life's philanthropic endeavors are not limited to financial donations. The company also provides in-kind support, offering its expertise and resources to help community organizations achieve their goals. This holistic approach to giving back reflects the company's commitment to making a meaningful and lasting impact.

Industry Recognition and Awards

Cincinnati Life Insurance Company’s dedication to excellence and customer satisfaction has not gone unnoticed. The company has received numerous accolades and industry recognition, solidifying its position as a leader in the insurance sector.

Industry Awards

Cincinnati Life has been honored with prestigious awards, including the Best in Class award for its exceptional customer service. This recognition highlights the company’s commitment to providing top-notch support and guidance to its policyholders.

The company has also been recognized for its innovative approaches to insurance, earning accolades for its cutting-edge technology and digital solutions. Cincinnati Life's focus on technological advancements has enhanced its operational efficiency and improved the overall customer experience.

Community Impact Awards

Beyond industry accolades, Cincinnati Life has received recognition for its community engagement and philanthropic efforts. The company’s dedication to giving back has been acknowledged through various community impact awards, celebrating its commitment to making a positive difference in the lives of others.

These awards are a testament to Cincinnati Life's holistic approach to business, where financial success is intertwined with social responsibility and community development. The company's achievements in both insurance excellence and community engagement have solidified its reputation as a trusted and responsible corporate citizen.

The Future of Cincinnati Life

As Cincinnati Life Insurance Company enters its second century of operation, it continues to evolve and adapt to the changing landscape of the insurance industry. The company’s commitment to innovation and customer-centricity positions it well for the future.

With a focus on technological advancements, Cincinnati Life is poised to enhance its digital capabilities, offering policyholders a seamless and user-friendly experience. The company's embrace of digital transformation ensures it remains competitive and accessible to a wider audience.

Furthermore, Cincinnati Life's dedication to financial education and community engagement will continue to play a pivotal role in its future success. By empowering individuals with financial knowledge and supporting community initiatives, the company strengthens its relationships with its clientele and the communities it serves.

As Cincinnati Life looks ahead, its rich history and strong foundation serve as a testament to its resilience and ability to thrive. The company's commitment to providing reliable financial protection and support positions it well to meet the evolving needs of its policyholders for generations to come.

What sets Cincinnati Life Insurance Company apart from its competitors?

+

Cincinnati Life’s commitment to customer satisfaction and its comprehensive insurance portfolio set it apart. The company’s focus on building long-lasting relationships and providing tailored solutions for various life stages is a key differentiator. Additionally, its strong financial ratings and community engagement initiatives contribute to its unique position in the market.

How does Cincinnati Life ensure the financial security of its policyholders?

+

Cincinnati Life’s financial stability is reflected in its high ratings from reputable agencies like A.M. Best and Standard & Poor’s. These ratings indicate the company’s ability to meet its obligations and withstand economic fluctuations. Additionally, the company’s comprehensive insurance portfolio, including life insurance, annuities, and supplementary products, provides a range of options to protect policyholders’ financial interests.

What resources does Cincinnati Life offer for policyholders?

+

Cincinnati Life provides a range of resources to support its policyholders. These include online tools for policy management and claim submission, ensuring convenience and efficiency. The company also hosts educational workshops and webinars to enhance financial literacy, empowering individuals to make informed decisions about their insurance needs.