What Is The Limit Of Fdic Insurance

The Federal Deposit Insurance Corporation (FDIC) is a US government agency that provides deposit insurance to protect bank customers in the event of a bank failure. FDIC insurance covers a significant portion of a customer's deposits, ensuring their funds are secure and accessible even if their bank experiences financial distress. While this insurance provides a safety net for depositors, it is important to understand the limits and scope of this coverage to effectively manage one's finances.

Understanding FDIC Insurance and Its Purpose

FDIC insurance is a critical component of the US banking system, offering peace of mind to depositors by safeguarding their funds. Established in 1933 during the Great Depression, the FDIC was created to restore trust in the banking system and prevent bank runs. It has since played a vital role in maintaining financial stability by insuring deposits and promoting confidence in the nation’s banking institutions.

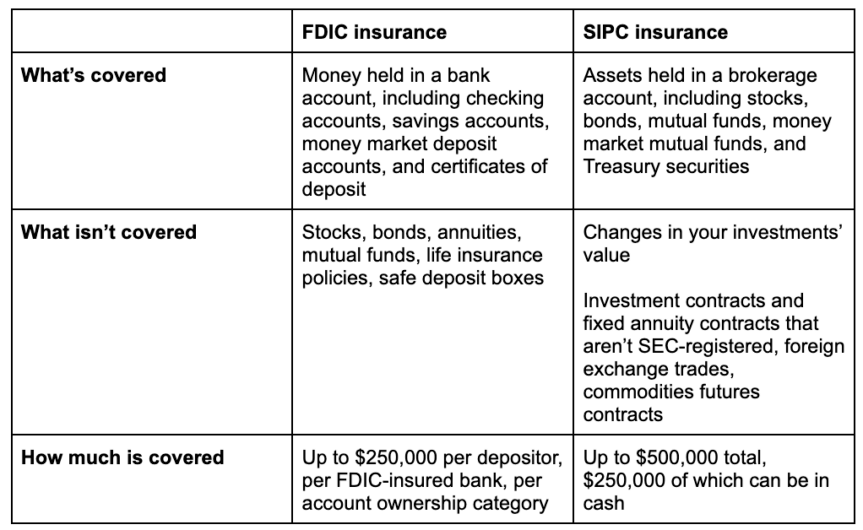

FDIC insurance covers various types of deposit accounts, including checking, savings, money market deposit accounts (MMDAs), and certificates of deposit (CDs). It is important to note that FDIC insurance does not cover investments like stocks, bonds, mutual funds, life insurance policies, or municipal securities. The insurance is provided to each depositor at an FDIC-insured bank, ensuring that individual account holders are protected even if the bank has multiple customers.

How FDIC Insurance Works

FDIC insurance operates on a per-depositor basis, meaning it covers each depositor’s accounts separately, up to the insurance limit. For example, if an individual has multiple accounts at the same bank, such as a checking and savings account, each account is insured separately. This means that the depositor’s total coverage is not limited to one account but rather extends to all eligible accounts held at the insured bank.

The FDIC insures deposits primarily through its Deposit Insurance Fund (DIF), which is funded by premiums paid by member banks. The DIF is used to resolve failed banks and ensure that depositors' funds are protected. The FDIC also has the authority to borrow from the US Treasury if necessary to cover any potential losses.

| Deposit Account Type | FDIC Insurance Limit |

|---|---|

| Single Accounts | $250,000 |

| Joint Accounts | $250,000 per co-owner |

| Self-Directed Retirement Accounts (IRAs) | $250,000 |

| Certain Trust Accounts | $250,000 per beneficiary |

| Business Accounts | $250,000 per ownership category |

The Limits of FDIC Insurance: A Comprehensive Overview

While FDIC insurance provides a robust safety net for depositors, it is essential to understand the limits of this coverage to ensure the security of one’s finances. The FDIC sets specific limits on the amount of insurance provided per depositor, which are subject to change over time.

Standard Insurance Coverage Limits

The FDIC currently provides standard insurance coverage of 250,000</strong> per depositor, per insured bank, for each account ownership category. This means that if an individual has multiple accounts at the same bank, each account is insured up to this limit. For example, if someone has a checking account and a savings account at the same bank, both accounts are insured separately up to 250,000.

It is important to note that this coverage limit applies to each ownership category. For instance, if an individual has a single account, a joint account with a spouse, and a trust account for their children, each account ownership category is insured separately up to $250,000. This allows depositors to maximize their FDIC insurance coverage by strategically organizing their accounts.

Coverage for Different Account Types

FDIC insurance covers a wide range of deposit accounts, each with its own unique characteristics and insurance limits. Understanding these differences is crucial for effectively managing one’s finances and maximizing FDIC insurance coverage.

- Single Accounts: These are accounts owned by a single individual. FDIC insurance provides coverage of up to $250,000 per account.

- Joint Accounts: Accounts owned by two or more individuals are considered joint accounts. Each co-owner is insured separately up to $250,000. For example, if a husband and wife have a joint checking account, both are insured for their share of the account balance, up to a combined total of $500,000.

- Self-Directed Retirement Accounts (IRAs): Individual Retirement Accounts (IRAs) are insured by the FDIC up to $250,000 per depositor. This coverage applies to traditional IRAs, Roth IRAs, and certain other retirement accounts.

- Certain Trust Accounts: FDIC insurance covers trust accounts for beneficiaries up to $250,000 per beneficiary. This coverage applies to revocable and irrevocable trusts, as well as certain other trust arrangements.

- Business Accounts: Business accounts, including corporate accounts, partnerships, and sole proprietorships, are insured up to $250,000 per ownership category. This means that each business entity is insured separately, allowing for multiple accounts to be insured within the same bank.

Maximizing FDIC Insurance Coverage

Understanding the limits of FDIC insurance is crucial for effectively managing one’s finances and ensuring the security of deposits. Here are some strategies to maximize FDIC insurance coverage:

- Utilize Multiple Banks: By spreading deposits across multiple FDIC-insured banks, individuals can maximize their coverage. Each bank provides separate insurance coverage, allowing depositors to exceed the standard insurance limit by having accounts at different institutions.

- Explore Different Account Ownership Categories: Depositors can take advantage of different account ownership categories to increase their FDIC insurance coverage. For example, a couple can have separate single accounts at the same bank, each insured for $250,000, and also hold a joint account, insured for an additional $250,000.

- Consider Business Accounts: Business owners can utilize business accounts to maximize FDIC insurance coverage. Each business entity is insured separately, allowing for multiple accounts to be insured within the same bank.

- Review Account Balances Regularly: It is important to regularly monitor account balances to ensure they do not exceed the FDIC insurance limit. By keeping balances within the insured limit, depositors can have peace of mind knowing their funds are fully protected.

FDIC Insurance and Bank Failures: A Case Study

Understanding how FDIC insurance works in practice can provide valuable insights into its effectiveness and limitations. Let’s examine a hypothetical case study involving a bank failure to illustrate how FDIC insurance protects depositors.

Scenario: Bank ABC’s Failure

Imagine a regional bank, Bank ABC, facing financial difficulties and ultimately declaring bankruptcy. In this scenario, the FDIC steps in to resolve the failed bank and ensure the protection of depositors’ funds.

The FDIC's primary objective is to transfer the insured deposits to another healthy bank, known as a "bridge bank." This process ensures that depositors can continue to access their funds without interruption. In cases where a bridge bank is not available, the FDIC may establish a temporary bank to facilitate the transfer of insured deposits.

During this process, the FDIC carefully evaluates the bank's records to identify insured deposits and ensure that they are properly transferred to the new bank. Depositors with accounts exceeding the FDIC insurance limit may face potential losses on the amount that exceeds the insured limit. However, the FDIC works diligently to minimize these losses and protect depositors' interests.

The Role of FDIC Insurance in Bank Failures

FDIC insurance plays a crucial role in maintaining financial stability and protecting depositors during bank failures. By promptly resolving failed banks and transferring insured deposits to healthy institutions, the FDIC ensures that depositors can continue to access their funds without significant disruptions.

The FDIC's expertise and resources allow for a swift and efficient resolution process, minimizing the impact on depositors. While some depositors with accounts exceeding the insurance limit may experience losses, the FDIC's commitment to protecting depositors' interests helps mitigate these risks and provides a safety net for the majority of depositors.

The Future of FDIC Insurance: Potential Changes and Considerations

While FDIC insurance has provided a robust safety net for depositors, it is important to consider potential changes and evolving considerations that may impact its coverage and limits in the future.

Potential Increases in Insurance Limits

The FDIC has the authority to adjust insurance limits based on economic conditions and the needs of depositors. In times of economic uncertainty or financial crises, the FDIC may temporarily increase insurance limits to provide additional protection for depositors. For example, during the 2008 financial crisis, the FDIC temporarily raised the insurance limit to $250,000, providing depositors with enhanced coverage during a challenging economic period.

While the FDIC has not made any recent changes to the insurance limit, it is important for depositors to stay informed about potential adjustments. The FDIC regularly monitors the financial landscape and may consider increasing insurance limits to address emerging risks or changing market conditions.

Considerations for High-Value Depositors

For depositors with high-value accounts, exceeding the FDIC insurance limit, it is crucial to explore alternative strategies to ensure the security of their funds. Here are some considerations for high-value depositors:

- Diversification: Spread deposits across multiple FDIC-insured banks to maximize coverage. By utilizing different institutions, depositors can ensure that their funds are fully insured.

- Securities and Investments: Explore investment options beyond FDIC-insured deposits. Securities, such as stocks and bonds, offer the potential for higher returns but also carry higher risks. It is essential to carefully assess the risks and benefits of different investment strategies.

- Asset Protection: Consider asset protection strategies, such as establishing a trust or utilizing business entities, to shield assets from potential liabilities and maximize FDIC insurance coverage.

The Importance of Staying Informed

In the dynamic world of finance, staying informed about changes in FDIC insurance limits and coverage is crucial. The FDIC regularly communicates updates and announcements through its website and various communication channels. By staying informed, depositors can make informed decisions about their finances and ensure that their deposits are adequately protected.

Additionally, depositors should familiarize themselves with the FDIC's deposit insurance rules and regulations. Understanding the specifics of insurance coverage, such as ownership categories and account types, allows individuals to strategically manage their accounts and maximize FDIC insurance benefits.

Can FDIC insurance cover all my financial assets, including investments and real estate?

+FDIC insurance is specifically designed to cover deposit accounts, such as checking, savings, and CD accounts. It does not cover investments like stocks, bonds, or mutual funds, nor does it cover real estate. It is important to diversify your financial portfolio and consider other forms of protection for assets beyond deposit accounts.

What happens if my bank fails, and I have deposits exceeding the FDIC insurance limit?

+In the event of a bank failure, the FDIC steps in to resolve the situation and protect insured deposits. While deposits exceeding the insurance limit may be at risk, the FDIC works diligently to minimize losses and protect depositors’ interests. It is important to review your account balances regularly and consider strategies to maximize FDIC insurance coverage.

Are there any special considerations for joint accounts regarding FDIC insurance limits?

+Yes, joint accounts have separate insurance coverage for each co-owner. For example, if a husband and wife have a joint checking account, each spouse is insured for their share of the account balance, up to a combined total of $500,000. It is important to understand the ownership structure of joint accounts to ensure proper insurance coverage.