Monthly Car Insurance

Welcome to a comprehensive exploration of monthly car insurance, a financial commitment that every vehicle owner must navigate. This article delves into the intricacies of this essential coverage, offering an in-depth analysis to guide your understanding and decision-making process.

Understanding Monthly Car Insurance: The Fundamentals

Monthly car insurance is a type of auto insurance policy that is billed and paid for on a monthly basis. It provides coverage for various aspects related to your vehicle and driving, ensuring financial protection in the event of accidents, theft, or other unforeseen circumstances. This regular payment structure allows for easier budgeting and management of insurance costs.

The concept of monthly insurance is particularly beneficial for those who prefer a consistent, manageable expense rather than a large, one-time payment. It offers flexibility and control over your insurance costs, making it an appealing option for many vehicle owners.

Key Components of Monthly Car Insurance

Monthly car insurance typically encompasses several critical components, each serving a unique purpose in safeguarding your vehicle and covering potential liabilities.

Liability Coverage

Liability coverage is a cornerstone of any car insurance policy. It protects you financially if you’re found at fault in an accident, covering the costs of injuries and damages to others. This coverage is mandatory in most states and is designed to safeguard your financial well-being in the event of a serious accident.

Liability insurance is typically divided into two main categories: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and lost wages for individuals injured in an accident, while property damage liability covers repairs or replacements for damaged property, such as other vehicles or structures.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional add-ons to your policy, providing broader protection for your vehicle. Collision coverage kicks in when your car is damaged in an accident, whether it’s a collision with another vehicle or an object like a tree or a fence. This coverage pays for repairs or the replacement of your vehicle, up to its actual cash value at the time of the accident.

Comprehensive coverage, on the other hand, protects against damages caused by non-collision events. This includes incidents like theft, vandalism, natural disasters, or damage caused by animals. Comprehensive coverage ensures that you're not left financially responsible for these unexpected events, providing peace of mind and financial security.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage are vital components of car insurance, ensuring that medical expenses resulting from an accident are covered. PIP, often referred to as “no-fault” insurance, covers a wide range of medical expenses, including doctor visits, hospital stays, and rehabilitation costs, regardless of who is at fault in the accident.

Medical Payments coverage, also known as MedPay, is similar to PIP but typically has lower limits and may not cover as many types of expenses. However, it can still be a valuable addition to your policy, providing quick and easy access to funds for medical bills after an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage protects you in situations where the at-fault driver does not have enough insurance to cover the costs of the accident. This coverage is particularly important, as it ensures that you’re not left with the financial burden of an accident caused by an uninsured or underinsured driver. It covers medical expenses, lost wages, and other related costs, providing an essential safety net.

Factors Influencing Monthly Car Insurance Costs

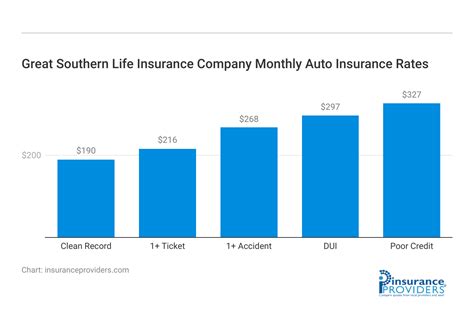

The cost of your monthly car insurance premium is influenced by a multitude of factors, each playing a role in determining the level of risk associated with your driving profile and vehicle. Understanding these factors can help you make informed decisions about your coverage and potentially lower your insurance costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can significantly impact your insurance rates. High-performance sports cars, for instance, are generally more expensive to insure due to their higher risk of accidents and greater potential for severe damage. Similarly, if you use your vehicle for business purposes or commute long distances, your insurance rates may be higher.

Driver’s Age and Experience

Your age and driving experience are key factors in determining your insurance rates. Younger drivers, particularly those under 25, are often considered higher risk and therefore pay higher premiums. Conversely, experienced drivers with a clean driving record can enjoy lower insurance rates, as they are statistically less likely to be involved in accidents.

Location and Driving Environment

Where you live and the environment in which you drive can also affect your insurance costs. Urban areas often have higher insurance rates due to increased traffic congestion, higher accident rates, and a greater risk of theft and vandalism. Additionally, factors like weather conditions and the prevalence of natural disasters in your area can influence your insurance rates.

Credit Score and Payment History

Your credit score and payment history are surprisingly influential in determining your insurance rates. Many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. A higher credit score can indicate responsible financial behavior, leading to lower insurance rates. Conversely, a lower credit score may result in higher premiums.

Driving Record

Your driving record is a critical factor in determining your insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums. However, if you have a history of accidents or moving violations, your insurance rates will likely be higher, as you’re considered a higher risk driver.

Maximizing Cost-Effectiveness in Monthly Car Insurance

While monthly car insurance is a necessary expense, there are strategies you can employ to ensure you’re getting the best value for your money. By understanding these tactics and implementing them, you can potentially reduce your insurance costs without compromising on essential coverage.

Compare Quotes from Multiple Insurers

One of the most effective ways to find the best deal on monthly car insurance is to compare quotes from multiple insurers. Insurance rates can vary significantly between companies, so getting quotes from at least three to five providers can help you identify the most cost-effective option for your needs.

Online comparison tools and insurance brokerages can streamline this process, allowing you to quickly and easily gather quotes from a variety of insurers. By taking the time to compare, you can ensure you're not overpaying for your insurance coverage.

Choose the Right Coverage Levels

While it’s essential to have adequate coverage to protect yourself financially, overinsuring your vehicle can lead to unnecessary expenses. Evaluate your specific needs and choose coverage levels that provide sufficient protection without being excessive. For example, if you drive an older vehicle with low resale value, you may not need comprehensive or collision coverage.

Conversely, if you have a newer, more expensive vehicle, these coverages are likely essential to protect your investment. By tailoring your coverage to your specific needs, you can strike a balance between adequate protection and cost-effectiveness.

Explore Discounts and Savings Opportunities

Many insurance companies offer a variety of discounts and savings opportunities to their policyholders. These can include discounts for safe driving, bundling multiple policies (such as auto and home insurance), loyalty discounts for long-term customers, and even discounts for certain professions or membership affiliations.

By inquiring about these discounts and taking advantage of the ones that apply to you, you can potentially lower your insurance costs significantly. It's always worth asking your insurer about available discounts and ensuring you're taking full advantage of any applicable savings.

Maintain a Clean Driving Record

A clean driving record is not only beneficial for your safety but also for your wallet. Insurance companies reward safe drivers with lower premiums, so maintaining a spotless driving record can lead to substantial savings on your monthly insurance costs. Avoid traffic violations and be cautious on the road to keep your record clean and your insurance rates low.

Consider Higher Deductibles

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower monthly premiums. This strategy works best for individuals who have sufficient savings to cover the higher deductible in the event of an accident or claim. By opting for a higher deductible, you essentially agree to bear more of the financial burden in exchange for lower insurance costs.

The Future of Monthly Car Insurance: Trends and Innovations

The world of car insurance is continually evolving, driven by technological advancements and changing consumer needs. Here, we explore some of the trends and innovations shaping the future of monthly car insurance, offering a glimpse into what policyholders can expect in the years to come.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance (UBI) are gaining traction in the insurance industry, offering a more personalized and data-driven approach to car insurance. With telematics, insurers can collect real-time data on driving behavior, including speed, acceleration, braking, and mileage. This data is then used to assess the risk profile of the driver and set insurance rates accordingly.

UBI policies reward safe drivers with lower premiums, as their driving behavior is continuously monitored and assessed. This technology not only encourages safer driving habits but also provides a more accurate and fair assessment of insurance rates, benefiting both insurers and policyholders.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming various industries, and the insurance sector is no exception. These technologies are being used to streamline processes, improve accuracy, and enhance customer experiences. AI-powered chatbots, for instance, can provide instant support to policyholders, answering common questions and guiding them through the claims process.

Additionally, AI and machine learning are being employed to analyze vast amounts of data, identifying patterns and trends that can inform insurance underwriting and pricing. This technology can help insurers make more accurate risk assessments and offer more tailored insurance products, benefiting both insurers and policyholders.

Digital Transformation and Online Platforms

The digital transformation of the insurance industry is well underway, with many insurers embracing online platforms and digital tools to enhance their services. Online quote comparisons, digital policy management, and mobile apps for policyholders are becoming increasingly common, offering convenience and efficiency to customers.

These digital platforms not only streamline the insurance process but also provide a more transparent and accessible experience for policyholders. They allow for real-time updates, easy policy adjustments, and seamless claims management, all from the comfort of one's home or on the go.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is set to have a significant impact on the insurance industry. Electric vehicles, with their advanced safety features and reduced maintenance needs, are generally considered safer than traditional vehicles, leading to potential insurance discounts for owners. Autonomous vehicles, while still in their early stages, have the potential to revolutionize road safety, further reducing the need for extensive insurance coverage.

Conclusion: Navigating the World of Monthly Car Insurance

Monthly car insurance is a critical aspect of vehicle ownership, providing financial protection and peace of mind for drivers. By understanding the fundamentals of car insurance, the factors influencing costs, and the strategies for maximizing cost-effectiveness, you can make informed decisions about your coverage and ensure you’re getting the best value for your money.

As the insurance industry continues to evolve, embracing technological advancements and adapting to changing consumer needs, the future of monthly car insurance looks bright. With innovations like telematics, AI, and digital platforms, the insurance experience is becoming more personalized, efficient, and accessible. As a policyholder, staying informed about these trends and innovations can help you make the most of your insurance coverage and navigate the world of monthly car insurance with confidence.

How often should I review my car insurance policy?

+It’s generally recommended to review your car insurance policy annually or whenever your life circumstances change significantly. This ensures that your coverage remains adequate and cost-effective. Life events such as moving to a new location, getting married, or purchasing a new vehicle can impact your insurance needs and rates.

What factors can I control to lower my insurance rates?

+You can control several factors to potentially lower your insurance rates. These include maintaining a clean driving record, choosing a vehicle with good safety ratings, and considering higher deductibles. Additionally, practicing safe driving habits and avoiding traffic violations can also help keep your insurance rates in check.

How do insurance companies determine my credit-based insurance score?

+Insurance companies use credit-based insurance scores to assess the risk of insuring a driver. These scores are based on factors such as your credit history, payment history, and the length of your credit history. A higher credit score generally indicates responsible financial behavior, leading to lower insurance rates.