What Does Hdhp Mean In Health Insurance

In the realm of health insurance, understanding the different types of plans and their acronyms is crucial for making informed decisions about your healthcare coverage. One such plan that has gained popularity due to its cost-saving potential is the High Deductible Health Plan (HDHP). HDHPs offer a unique approach to healthcare financing, combining higher deductibles with tax-advantaged savings options. This article aims to provide an in-depth exploration of HDHPs, shedding light on their features, benefits, and considerations to help you navigate the complex world of health insurance with confidence.

Understanding High Deductible Health Plans (HDHPs)

HDHPs are a specific type of health insurance plan characterized by higher deductibles compared to traditional health plans. The deductible is the amount you must pay out of pocket for covered healthcare services before your insurance plan starts contributing. In the case of HDHPs, this deductible amount is typically set at a higher level.

The key idea behind HDHPs is to encourage individuals to become more proactive and cost-conscious consumers of healthcare services. By requiring a higher initial payment for healthcare, HDHPs incentivize individuals to make well-informed decisions about their healthcare needs and to explore cost-effective options.

Key Features of HDHPs

HDHPs typically offer the following features:

- High Deductible: The deductible, which is the amount you pay before insurance coverage kicks in, is set at a higher level than traditional health plans. This can range from a few thousand dollars to over $10,000, depending on the plan and the individual’s or family’s needs.

- Lower Premiums: In exchange for the higher deductible, HDHPs often come with lower monthly premiums compared to traditional health insurance plans. This can make HDHPs more affordable for individuals and families, especially those who prioritize saving money upfront.

- Health Savings Accounts (HSAs): HDHPs are often paired with Health Savings Accounts, which are tax-advantaged savings accounts. HSAs allow individuals to set aside pre-tax dollars to pay for qualified medical expenses. The funds in an HSA roll over year to year and can be invested, providing long-term savings potential.

- Preventive Care Coverage: HDHPs are required by law to cover certain preventive services at no cost to the policyholder, even before the deductible is met. These services include annual check-ups, immunizations, and certain screenings, ensuring that individuals can access essential healthcare services without additional financial burden.

Benefits of HDHPs

HDHPs offer a range of advantages for those seeking cost-effective healthcare coverage:

- Cost Savings: The most significant benefit of HDHPs is the potential for substantial cost savings. With lower premiums and the ability to save pre-tax dollars in an HSA, individuals can build a financial cushion for future healthcare expenses.

- Tax Benefits: HSAs offer triple tax advantages: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. This makes HDHPs an attractive option for those looking to maximize their tax savings.

- Flexibility: HDHPs provide flexibility in healthcare decision-making. Policyholders have the freedom to choose their healthcare providers and services, making it easier to find cost-effective options that align with their specific needs.

- Long-Term Financial Planning: The ability to save in an HSA and the potential for investment growth makes HDHPs a strategic choice for long-term financial planning. Policyholders can build a substantial healthcare savings fund over time, providing financial security for unexpected medical expenses.

Considerations and Potential Drawbacks

While HDHPs offer numerous benefits, there are some considerations to keep in mind:

- Higher Out-of-Pocket Costs: The higher deductibles of HDHPs mean that individuals may face significant out-of-pocket expenses before insurance coverage begins. This can be a challenge for those with immediate or frequent healthcare needs.

- Limited Network Coverage: HDHPs may have narrower provider networks compared to traditional plans. This means that policyholders may need to carefully select their healthcare providers to ensure they are covered under the plan.

- Understanding HSAs: While HSAs offer significant advantages, they also come with certain rules and restrictions. Policyholders need to understand the eligibility criteria, contribution limits, and qualified medical expense guidelines to maximize the benefits of their HSA.

Comparing HDHPs with Other Health Insurance Plans

To fully grasp the value of HDHPs, it’s essential to compare them with other common health insurance plan types.

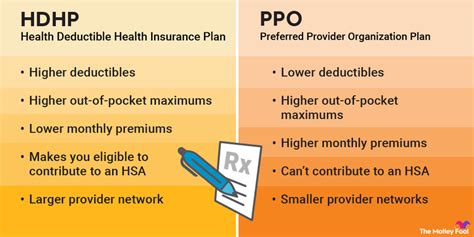

HDHPs vs. PPOs

PPOs, or Preferred Provider Organizations, are a popular type of health insurance plan that offers more flexibility in choosing healthcare providers. Unlike HDHPs, PPOs typically have lower deductibles and out-of-pocket costs. However, PPOs often come with higher monthly premiums.

HDHPs, on the other hand, provide a cost-effective alternative with lower premiums and the potential for significant savings through HSAs. While HDHPs may have narrower provider networks, policyholders can still access a wide range of healthcare services and providers, especially when utilizing in-network options.

HDHPs vs. HMOs

HMOs, or Health Maintenance Organizations, are known for their focus on preventive care and coordinated healthcare services. HDHPs share this emphasis on preventive care, ensuring that essential services are covered at no additional cost.

However, HDHPs offer more flexibility compared to HMOs, which often require policyholders to choose a primary care physician and obtain referrals for specialist visits. HDHPs allow individuals to choose their providers without the need for referrals, providing greater control over their healthcare decisions.

HDHPs vs. POS Plans

POS, or Point of Service plans, combine elements of both PPOs and HMOs. Like HDHPs, POS plans offer flexibility in provider choice and coverage for preventive services. However, POS plans typically have higher premiums and out-of-pocket costs compared to HDHPs.

HDHPs provide a more cost-conscious option, especially for individuals who prioritize saving money upfront and are comfortable with the higher deductible structure.

Real-World Examples of HDHP Success Stories

To illustrate the impact of HDHPs, let’s explore some real-world success stories:

- John’s Story: John, a young professional, opted for an HDHP with an HSA. He was able to save a substantial amount in his HSA over the years, taking advantage of the tax benefits. When he faced a major medical expense, he had a significant financial cushion to cover the costs without incurring debt.

- Sarah’s Story: Sarah, a mother of two, chose an HDHP to save on premiums. She prioritized preventive care for her family, taking advantage of the no-cost coverage for annual check-ups and immunizations. By staying on top of their healthcare needs, Sarah and her family were able to maintain their health while managing their finances effectively.

- Michael’s Story: Michael, a small business owner, offered his employees an HDHP option. The plan’s lower premiums and HSA benefits were well-received, providing employees with a cost-effective healthcare solution. Michael’s company also benefited from the tax advantages associated with HDHPs, making it a win-win situation for both the business and its employees.

Performance Analysis and Industry Trends

HDHPs have gained popularity in recent years, and their market share continues to grow. According to a KFF survey, the percentage of workers enrolled in HDHPs increased from 16% in 2008 to 40% in 2021. This growth can be attributed to the cost-saving potential and tax advantages offered by HDHPs.

Moreover, the flexibility and control that HDHPs provide align with the changing landscape of healthcare. As individuals become more engaged in their healthcare decisions and seek cost-effective solutions, HDHPs offer a compelling alternative to traditional health insurance plans.

Industry Insights and Expert Perspectives

Future Implications and Evolving Trends

As the healthcare industry continues to evolve, HDHPs are expected to play a significant role in shaping the future of health insurance. Here are some key trends and considerations for the future:

Enhanced Digital Tools

The integration of digital technologies is transforming the healthcare landscape. HDHPs are likely to leverage these advancements, providing policyholders with access to online tools for cost estimation, provider comparisons, and personalized healthcare plans. These digital enhancements will further empower individuals to make informed healthcare decisions.

Expanded Coverage Options

HDHPs may evolve to offer more comprehensive coverage options, addressing the concerns of individuals with higher healthcare needs. This could include expanded preventive care benefits, enhanced mental health coverage, and improved support for chronic condition management.

Focus on Consumer Engagement

HDHPs are likely to continue emphasizing consumer engagement and education. Insurance providers may offer incentives and rewards for individuals who actively manage their healthcare, encouraging preventive care, wellness programs, and informed decision-making.

Regulatory Changes

The regulatory environment surrounding HDHPs and HSAs is subject to change. Policyholders and industry professionals should stay informed about potential updates to contribution limits, eligibility criteria, and tax advantages associated with HDHPs and HSAs.

Conclusion

High Deductible Health Plans (HDHPs) offer a unique and cost-effective approach to healthcare coverage. By understanding the features, benefits, and considerations of HDHPs, individuals can make informed choices that align with their healthcare needs and financial goals. As the healthcare industry evolves, HDHPs are poised to play a pivotal role in shaping the future of health insurance, empowering individuals to take control of their healthcare journey.

FAQ

Can I use my HSA funds for non-medical expenses?

+No, HSA funds are intended for qualified medical expenses only. Withdrawals for non-medical purposes may be subject to penalties and taxes.

What happens if I don’t use all the funds in my HSA by the end of the year?

+Unlike flexible spending accounts (FSAs), HSA funds roll over from year to year. You can continue to save and grow your HSA funds over time, providing long-term financial security for healthcare expenses.

Are HDHPs suitable for individuals with chronic health conditions?

+HDHPs can be a viable option for individuals with chronic conditions, especially if they are proactive in managing their healthcare needs. However, it’s important to carefully review the plan’s coverage and consider the potential out-of-pocket expenses. Consulting with a healthcare professional and insurance advisor can help determine the best plan for your specific circumstances.