Types Of Health Insurance Coverage

Health insurance is an essential aspect of modern healthcare systems, providing individuals and families with access to necessary medical services and financial protection. With a wide range of coverage options available, understanding the different types of health insurance is crucial for making informed decisions about your healthcare needs and ensuring adequate protection. This article aims to delve into the various types of health insurance coverage, exploring their features, benefits, and considerations to help you navigate the complex world of healthcare insurance.

Understanding Health Insurance Basics

Health insurance is a contractual agreement between an individual or a group and an insurance provider, whereby the insurer agrees to cover a portion or all of the costs associated with medical services and treatments. This coverage helps mitigate the financial burden of healthcare expenses, ensuring that individuals can access necessary care without facing significant financial hardship.

The primary goal of health insurance is to provide individuals with peace of mind, knowing that they have access to quality healthcare when needed. It also aims to promote preventive care and early detection of health issues, thereby reducing the overall healthcare costs in the long run.

Health insurance coverage can vary significantly based on the plan chosen, the provider, and the individual's specific healthcare needs. Understanding the different types of coverage available is the first step in selecting the right plan for you and your family.

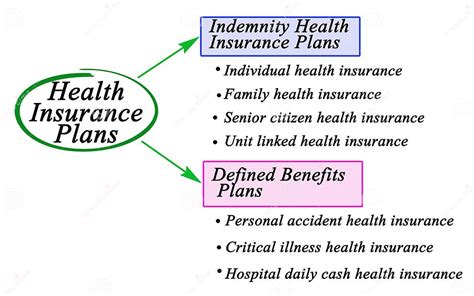

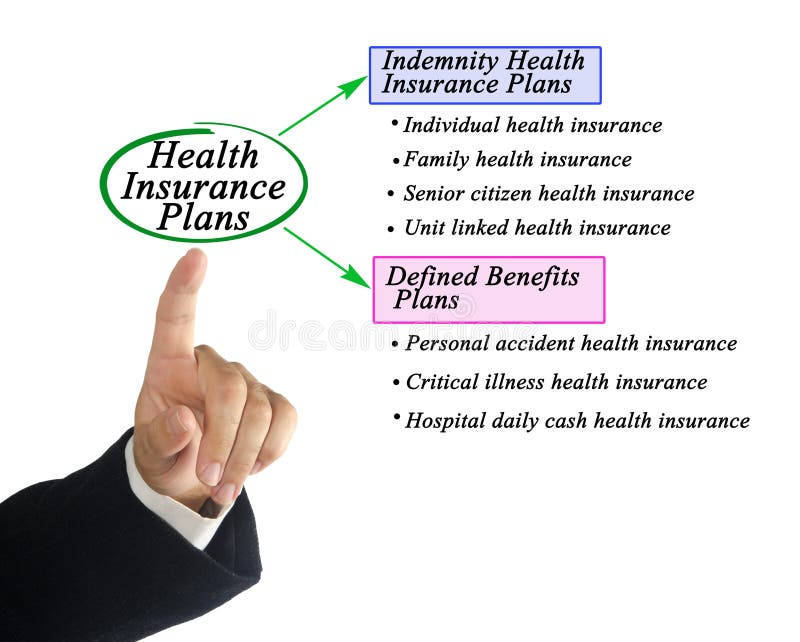

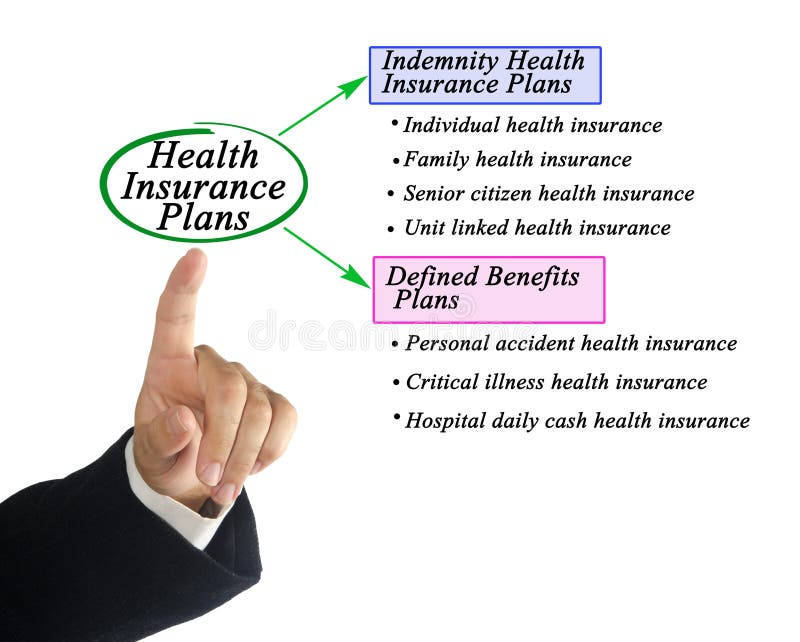

Major Types of Health Insurance Coverage

The healthcare industry offers a diverse range of insurance plans, each with its own set of features and benefits. Here, we explore some of the most common types of health insurance coverage available today.

1. Private Health Insurance

Private health insurance plans are typically purchased by individuals or families directly from insurance companies. These plans offer a wide range of coverage options, allowing policyholders to choose the level of coverage that best suits their needs and budget. Private health insurance is often more flexible and customizable compared to other types of coverage.

Key features of private health insurance include:

- Choice of Providers: Policyholders often have the freedom to choose their healthcare providers, including doctors, specialists, and hospitals, from a network of preferred providers.

- Flexible Coverage: Private insurance plans can be tailored to include specific benefits such as dental, vision, prescription drugs, and mental health services, among others.

- Cost-Sharing: Policyholders share the cost of healthcare services with the insurance provider through deductibles, copayments, and coinsurance. The amount of cost-sharing can vary based on the plan's design.

2. Employer-Sponsored Health Insurance

Many individuals obtain health insurance through their employers as part of their benefits package. Employer-sponsored health insurance plans are often more cost-effective for employees, as the employer typically covers a portion of the premium. These plans can be a significant advantage for employees, providing comprehensive coverage at a lower cost.

Key aspects of employer-sponsored health insurance include:

- Group Coverage: Employers negotiate with insurance companies to offer health insurance plans to their employees as a group. This can lead to more affordable rates due to the larger pool of participants.

- Automatic Enrollment: Employees are often automatically enrolled in the employer's chosen health insurance plan, simplifying the process of obtaining coverage.

- Defined Benefits: Employer-sponsored plans usually come with defined benefits, including coverage for medical, dental, vision, and sometimes additional services like wellness programs.

3. Public Health Insurance

Public health insurance is provided and funded by government entities and is often available to individuals who meet specific eligibility criteria. These plans aim to provide healthcare coverage to those who may not have access to private insurance or who have low to moderate incomes.

Notable public health insurance programs include:

- Medicare: A federal program in the United States that provides health insurance for individuals aged 65 and older, as well as those with certain disabilities. Medicare covers a wide range of medical services and is divided into different parts (Parts A, B, C, and D) for various healthcare needs.

- Medicaid: A joint federal and state program that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Medicaid benefits can vary by state, but it generally covers essential health services.

- CHIP (Children's Health Insurance Program): A program designed to provide low-cost health coverage to children in families who earn too much to qualify for Medicaid but cannot afford private insurance. CHIP covers a comprehensive range of services, including routine check-ups, immunizations, and dental care.

4. Short-Term Health Insurance

Short-term health insurance plans are designed to provide temporary coverage for individuals who are between jobs, waiting for long-term coverage to start, or facing other transitional periods. These plans offer limited benefits and typically have shorter durations, ranging from a few months to a year.

Key characteristics of short-term health insurance include:

- Lower Cost: Short-term plans often have lower premiums compared to long-term plans, making them an affordable option for temporary coverage.

- Limited Coverage: These plans typically cover only essential medical services and may have restrictions on pre-existing conditions or specific treatments.

- Renewal Options: Some short-term plans allow for renewal, but the duration of coverage is usually capped at a certain period (e.g., 364 days in the United States).

5. High-Deductible Health Plans (HDHPs)

High-deductible health plans are a type of private health insurance plan that has a higher deductible than traditional plans. While HDHPs may have lower premiums, they require policyholders to pay a significant portion of their healthcare costs out of pocket before the insurance coverage kicks in.

Key features of HDHPs include:

- Lower Premiums: HDHPs often have lower monthly premiums compared to traditional plans, making them a cost-effective option for those who are generally healthy and do not anticipate frequent healthcare needs.

- Health Savings Accounts (HSAs): HDHPs are often paired with Health Savings Accounts, which allow policyholders to save money on a pre-tax basis for future medical expenses. HSAs can be a tax-efficient way to manage healthcare costs.

- Cost Awareness: HDHPs encourage policyholders to be more conscious of their healthcare costs, as they have a greater financial responsibility for their healthcare expenses.

6. Catastrophic Health Insurance

Catastrophic health insurance plans are designed to provide coverage for unexpected, severe medical conditions or accidents. These plans typically have very high deductibles and offer limited benefits, but they can be a lifeline in the event of a major health crisis.

Key aspects of catastrophic health insurance include:

- Low Premiums: Catastrophic plans often have lower monthly premiums compared to other types of insurance, making them an affordable option for those who are generally healthy and want basic coverage.

- High Deductibles: These plans have very high deductibles, which means policyholders must pay a substantial amount out of pocket before the insurance coverage starts.

- Limited Benefits: Catastrophic plans usually cover only essential health benefits, such as emergency services, hospitalization, and some outpatient care. They may not cover preventive care or routine medical services.

Considerations for Choosing Health Insurance

When selecting a health insurance plan, several factors should be taken into consideration to ensure you choose the most suitable coverage for your needs.

Assessing Your Healthcare Needs

Understanding your personal and family healthcare needs is crucial. Consider factors such as:

- Chronic conditions or ongoing medical treatments.

- Frequency of doctor visits and required specialist care.

- Prescription medication needs.

- Pregnancy and maternity care requirements.

- Mental health services utilization.

Evaluating Cost and Coverage

Health insurance plans can vary significantly in terms of cost and coverage. Assess the following:

- Premiums: Monthly premiums are a significant cost component of health insurance. Evaluate plans based on their premium costs and whether they fit within your budget.

- Deductibles and Copayments: Deductibles (the amount you pay before insurance coverage begins) and copayments (fixed amounts paid for specific services) can vary widely. Consider your ability to afford these out-of-pocket expenses.

- Network of Providers: Check if your preferred healthcare providers are in-network for the plan you’re considering. Out-of-network care can be more expensive.

- Benefit Coverage: Review the specific benefits covered by each plan, including medical, dental, vision, prescription drugs, and additional services like wellness programs.

Exploring Additional Features

Beyond basic coverage, health insurance plans may offer additional features that can enhance your healthcare experience. Consider the following:

- Wellness Programs: Some plans include incentives and rewards for maintaining a healthy lifestyle, such as gym memberships or discounts on healthy food options.

- Telehealth Services: Telehealth has become increasingly popular, offering convenient access to healthcare professionals through video conferencing or phone calls.

- Prescription Drug Coverage: Ensure that any prescription medications you regularly take are covered by the plan, and understand any potential costs associated with them.

- Maternity and Pediatric Care: If you’re planning a family or have young children, look for plans that provide comprehensive maternity and pediatric care coverage.

The Future of Health Insurance

The healthcare industry is constantly evolving, and health insurance is no exception. As medical technologies advance and healthcare needs change, insurance providers are adapting to offer more comprehensive and tailored coverage.

Here are some trends and considerations for the future of health insurance:

Personalized Health Insurance

Insurance providers are increasingly moving towards personalized health insurance plans. These plans are designed to cater to the unique healthcare needs of individuals, offering flexible coverage options and tailored benefits.

For example, some insurers are developing plans that integrate genetic testing results to provide more precise coverage for potential health risks. Others are creating plans with specific focus areas, such as mental health or senior care.

Integration of Technology

Technology is playing a pivotal role in the healthcare industry, and health insurance is no exception. Insurance providers are leveraging technology to enhance customer experience and improve efficiency.

This includes the use of mobile apps for easier plan management, the implementation of artificial intelligence for streamlined claims processing, and the integration of wearable devices to incentivize healthy behaviors and offer discounts on premiums.

Focus on Preventive Care

Preventive care is gaining increased attention in the healthcare industry. Insurance providers are recognizing the importance of early detection and prevention in managing healthcare costs and improving overall health outcomes.

Many plans now offer incentives for policyholders to engage in preventive care measures, such as annual check-ups, screenings, and immunizations. By promoting preventive care, insurers aim to reduce the incidence of chronic diseases and avoid more costly treatments down the line.

Addressing Mental Health

Mental health is a growing focus in the healthcare industry, and insurance providers are responding by expanding mental health coverage in their plans.

This includes increased access to mental health professionals, coverage for a wider range of mental health treatments, and reduced stigma around seeking mental health support. By addressing mental health needs, insurers are helping to improve overall well-being and productivity.

Conclusion

Health insurance is a vital component of our healthcare system, offering protection and access to essential medical services. With a range of coverage options available, from private to public insurance, and various plan types like HDHPs and catastrophic plans, there’s a health insurance solution to fit every individual’s needs.

As you navigate the world of health insurance, consider your specific healthcare needs, evaluate the cost and coverage of different plans, and explore additional features that can enhance your healthcare experience. Stay informed about the latest trends and developments in the healthcare industry to ensure you're making the best choices for your health and financial well-being.

What is the difference between a PPO and an HMO plan?

+A Preferred Provider Organization (PPO) plan allows you to see any healthcare provider, whether in-network or out-of-network, without a referral. However, using in-network providers typically results in lower out-of-pocket costs. On the other hand, a Health Maintenance Organization (HMO) plan requires you to choose a primary care physician (PCP) within their network and generally requires referrals for specialist care. HMO plans often have lower premiums and deductibles but may have more limited provider options.

Can I switch health insurance plans during the year?

+In most cases, you can only switch health insurance plans during specific open enrollment periods or if you experience a qualifying life event, such as marriage, divorce, birth of a child, or loss of other coverage. Check with your insurance provider or employer to understand your options for switching plans.

How do I choose the right health insurance plan for my family?

+Choosing the right health insurance plan for your family involves considering several factors. Evaluate your family’s healthcare needs, including any chronic conditions or ongoing treatments. Assess the cost of premiums, deductibles, and copayments to ensure they fit within your budget. Check if your preferred providers are in-network, and review the specific benefits covered by each plan. Additionally, consider any additional features like wellness programs or telehealth services that can enhance your family’s healthcare experience.