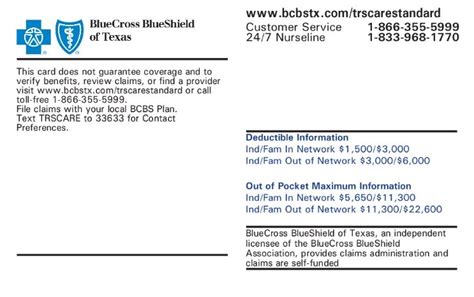

Blue Cross Blue Shield Private Insurance

The Blue Cross Blue Shield Association (BCBSA) is a national federation of 36 independent, community-based and locally operated Blue Cross and Blue Shield companies. These companies, often referred to as Blue Plans, offer a wide range of health insurance options to individuals, families, and businesses across the United States. With a rich history spanning over eight decades, BCBSA has become a trusted name in the healthcare industry, providing coverage to millions of Americans.

Understanding Blue Cross Blue Shield Private Insurance

Blue Cross Blue Shield’s private insurance plans cater to individuals and families seeking comprehensive healthcare coverage. These plans are designed to offer flexibility and customization, allowing policyholders to choose the level of coverage that best suits their needs and budget. With a network of over 1 million healthcare professionals and more than 50,000 participating hospitals, Blue Cross Blue Shield private insurance provides access to a vast healthcare ecosystem.

The private insurance plans offered by Blue Cross Blue Shield come in various forms, including:

- Individual Plans: Tailored to meet the needs of single individuals, these plans offer personalized coverage options.

- Family Plans: Designed to cover entire families, providing comprehensive healthcare benefits for all members.

- Short-Term Plans: Ideal for temporary coverage needs, offering flexibility for those in transition or between jobs.

- Medicare Supplement Plans: Complementing original Medicare, these plans help fill coverage gaps and reduce out-of-pocket expenses.

- Dental and Vision Plans: Offering additional coverage for dental and vision care, ensuring comprehensive oral and eye health.

Key Features and Benefits

Blue Cross Blue Shield private insurance plans offer a range of features and benefits that make them an attractive option for individuals and families:

- Customizable Coverage: Policyholders can choose from a variety of coverage levels, deductibles, and out-of-pocket maximums to find the right balance between affordability and benefits.

- Wide Network Access: With an extensive network of healthcare providers, policyholders can easily find in-network doctors and facilities, reducing out-of-pocket costs.

- Preventive Care Coverage: Many plans offer coverage for preventive services, such as annual check-ups, immunizations, and screenings, encouraging proactive health management.

- Prescription Drug Benefits: Most plans include prescription drug coverage, helping policyholders manage the cost of essential medications.

- Wellness Programs: Blue Cross Blue Shield often provides access to wellness programs and resources, promoting healthy lifestyles and offering discounts on fitness-related activities.

- Digital Tools and Resources: Policyholders can take advantage of online platforms and mobile apps for managing their healthcare, including finding providers, tracking claims, and accessing educational materials.

| Plan Type | Key Benefits |

|---|---|

| Individual Plans | Customizable coverage, access to specialty care, prescription drug benefits |

| Family Plans | Comprehensive coverage for all family members, wellness incentives, vision and dental options |

| Short-Term Plans | Affordable temporary coverage, flexible terms, no pre-existing condition exclusions |

| Medicare Supplement Plans | Gap coverage for Medicare beneficiaries, no referral requirements, access to out-of-network providers |

Comparative Analysis

When compared to other private insurance providers, Blue Cross Blue Shield stands out for its extensive network and commitment to community-based care. The federation’s local focus ensures that each Blue Plan understands the unique healthcare needs of its region, offering tailored solutions.

Additionally, Blue Cross Blue Shield's private insurance plans often provide more comprehensive coverage options, including access to a wider range of specialists and facilities. This can be particularly beneficial for individuals with complex or chronic health conditions who require specialized care.

Performance and Industry Standing

Blue Cross Blue Shield private insurance plans have consistently demonstrated strong performance in the market, earning recognition for their comprehensive coverage and member satisfaction. The federation’s focus on community-based care and its commitment to innovation have contributed to its success and reputation.

According to recent surveys, Blue Cross Blue Shield private insurance plans have received high marks for customer satisfaction, with policyholders reporting positive experiences with claim processing, provider networks, and overall value for money. The plans' emphasis on preventive care and wellness initiatives has also been well-received, encouraging members to take a proactive approach to their health.

Financial Strength and Stability

The financial stability of Blue Cross Blue Shield is a key factor in its success and reputation. As a non-profit organization, the federation’s focus is on providing high-quality healthcare coverage, rather than maximizing profits. This approach has allowed Blue Cross Blue Shield to maintain a strong financial position, ensuring the long-term sustainability of its plans and the ability to adapt to changing healthcare landscapes.

Blue Cross Blue Shield's financial strength is reflected in its excellent ratings from independent agencies. For example, Standard & Poor's has assigned the federation an A+ (Superior) rating, indicating its strong capacity to meet financial commitments. Similarly, A.M. Best has awarded Blue Cross Blue Shield an A (Excellent) rating, highlighting its excellent financial strength and stability.

Market Presence and Growth

Blue Cross Blue Shield’s market presence is extensive, with its network of Blue Plans covering all 50 states, Washington, D.C., and Puerto Rico. This widespread reach allows the federation to cater to a diverse range of healthcare needs and preferences across the country.

Despite facing competition from other private insurance providers, Blue Cross Blue Shield has maintained a strong market position. Its focus on innovation, member satisfaction, and community engagement has allowed it to grow and adapt to the evolving healthcare landscape. The federation's commitment to digital transformation and its investment in technology have further enhanced its market presence, making it easier for policyholders to access and manage their healthcare coverage.

Future Implications and Trends

As the healthcare industry continues to evolve, Blue Cross Blue Shield is well-positioned to navigate the changing landscape and meet the evolving needs of its policyholders. The federation’s commitment to innovation and its focus on digital transformation will play a crucial role in its future success.

Embracing Digital Health

Blue Cross Blue Shield recognizes the potential of digital health solutions to enhance the member experience and improve overall healthcare outcomes. The federation is actively investing in and partnering with digital health companies to develop innovative tools and platforms that can streamline healthcare processes, improve access to care, and empower policyholders to take control of their health.

One notable initiative is the Blue365 program, which offers policyholders exclusive discounts and deals on a range of health and wellness products and services. This program not only encourages healthy lifestyles but also provides an additional layer of support and value to policyholders.

Focus on Value-Based Care

Blue Cross Blue Shield is shifting its focus towards value-based care models, which emphasize quality outcomes and patient satisfaction over volume-based metrics. By incentivizing providers to deliver high-quality, cost-effective care, the federation aims to improve overall healthcare outcomes and reduce unnecessary healthcare spending.

This shift towards value-based care is expected to have a significant impact on the healthcare industry, as it encourages providers to adopt more patient-centric approaches and collaborate more closely with payers and other stakeholders to improve the patient experience.

Expanding Access to Care

Blue Cross Blue Shield is committed to expanding access to healthcare, particularly in underserved communities. The federation is actively working to improve healthcare infrastructure and increase the availability of healthcare services in these areas. By partnering with local healthcare providers and organizations, Blue Cross Blue Shield aims to bridge the healthcare gap and ensure that all individuals have access to the care they need.

How can I find the right Blue Cross Blue Shield private insurance plan for my needs?

+To find the right plan, consider your healthcare needs, budget, and preferences. Review the different plan options available in your area and compare coverage levels, deductibles, and out-of-pocket maximums. You can also reach out to a licensed insurance agent or directly contact your local Blue Plan for personalized assistance in choosing the best plan for your circumstances.

What sets Blue Cross Blue Shield private insurance plans apart from other providers?

+Blue Cross Blue Shield stands out for its extensive network of healthcare providers, community-based approach, and commitment to innovation. The federation’s local focus ensures that each Blue Plan understands the unique healthcare needs of its region, offering tailored solutions. Additionally, Blue Cross Blue Shield often provides more comprehensive coverage options, including access to a wider range of specialists and facilities.

Are there any discounts or incentives available with Blue Cross Blue Shield private insurance plans?

+Yes, Blue Cross Blue Shield offers various discounts and incentives to policyholders. These can include wellness incentives for maintaining a healthy lifestyle, loyalty discounts for long-term members, and access to exclusive deals through programs like Blue365. It’s important to check with your local Blue Plan to learn about the specific discounts and incentives available in your area.

How can I switch to a Blue Cross Blue Shield private insurance plan if I’m currently with another provider?

+Switching to a Blue Cross Blue Shield private insurance plan is straightforward. You can start by comparing the available plans in your area and identifying the one that best suits your needs. Once you’ve made your choice, you can apply for the plan either directly through the Blue Cross Blue Shield website or by contacting a licensed insurance agent. They will guide you through the enrollment process and help you understand any transition-related details.