Company Medical Insurance

Company medical insurance, often referred to as group health insurance, is a vital component of employee benefits packages offered by organizations worldwide. In today's highly competitive job market, businesses recognize the importance of providing comprehensive healthcare coverage to attract and retain talented individuals. This article delves into the intricacies of company medical insurance, exploring its various aspects, benefits, and implications for both employers and employees.

Understanding Company Medical Insurance

Company medical insurance plans are designed to provide employees and their eligible dependents with access to a range of healthcare services, from routine check-ups and preventative care to specialized treatments and hospital stays. These plans are typically offered by employers as a means of promoting employee well-being and offering a valuable incentive to join and remain with the organization.

The concept of company medical insurance has evolved significantly over the years, adapting to changing healthcare landscapes and the diverse needs of modern workforces. In many countries, group health insurance is an essential part of social security systems, ensuring that employees have access to affordable and comprehensive healthcare. Additionally, these plans often include provisions for dental, vision, and mental health services, recognizing the holistic nature of employee wellness.

Key Features of Company Medical Insurance Plans

Company medical insurance plans can vary greatly in their coverage and benefits, but there are several key features that are commonly included:

- Pre-existing Condition Coverage: Many plans now offer coverage for pre-existing conditions, ensuring that employees can access necessary treatments without being penalized for previous health issues.

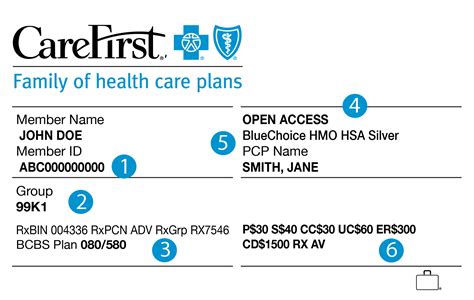

- Network of Healthcare Providers: Insurers often have partnerships with healthcare providers, offering employees a network of doctors, hospitals, and specialists to choose from. This network can impact the cost and availability of services.

- Flexible Plan Options: Employers may provide a range of plan options, allowing employees to choose the level of coverage that best suits their needs and budgets. These options can include different deductibles, co-pays, and coverage limits.

- Wellness Programs: To promote preventative care and healthy lifestyles, many companies offer wellness programs as part of their medical insurance plans. These programs may include discounts on gym memberships, incentives for healthy habits, and access to health coaching services.

- Dental and Vision Coverage: Beyond basic medical coverage, company insurance plans often extend to include dental and vision care, recognizing the importance of oral and eye health.

The Benefits of Company Medical Insurance

Company medical insurance offers a multitude of advantages to both employers and employees. For employers, providing comprehensive healthcare coverage can:

- Attract Top Talent: In a competitive job market, offering attractive employee benefits like medical insurance can make a company more appealing to potential hires.

- Reduce Absenteeism: By providing access to healthcare services, employees are more likely to stay healthy and productive, leading to reduced absenteeism and improved overall workforce performance.

- Enhance Employee Morale: A sense of security and well-being can boost employee morale and satisfaction, leading to increased engagement and loyalty.

- Manage Healthcare Costs: Group health insurance plans often offer economies of scale, allowing employers to negotiate better rates and manage healthcare costs more effectively.

For employees, company medical insurance provides a range of benefits, including:

- Access to Quality Healthcare: Employees gain access to a network of healthcare providers, ensuring they can receive the necessary medical care when needed.

- Financial Protection: Medical insurance protects employees from the potentially high costs of healthcare, especially for unexpected illnesses or accidents.

- Peace of Mind: Knowing that they and their families are covered by a comprehensive medical plan can provide employees with a sense of security and peace of mind.

- Wellness Incentives: Many companies use medical insurance plans to promote employee wellness, offering incentives and resources to encourage healthy lifestyles.

Real-World Examples of Successful Company Medical Insurance Programs

Several prominent companies have implemented innovative and successful medical insurance programs that have had a positive impact on their workforce. For instance:

| Company | Medical Insurance Program Highlights |

|---|---|

| Google offers a comprehensive healthcare package to its employees, including coverage for mental health services and fertility treatments. The company also provides access to on-site medical clinics and wellness programs to encourage preventative care. | |

| Salesforce | Salesforce's medical insurance plans include robust coverage for employees and their families, with a focus on preventative care and wellness. The company also offers unique benefits like coverage for acupuncture and chiropractic care. |

| Apple | Apple provides a range of medical insurance options to its employees, allowing them to choose the plan that best suits their needs. The company also offers incentives for healthy behaviors and provides access to on-site medical services. |

These companies demonstrate the potential for company medical insurance to go beyond basic healthcare coverage, offering innovative benefits and programs that enhance employee well-being and satisfaction.

The Future of Company Medical Insurance

As healthcare landscapes continue to evolve, so too will the nature of company medical insurance. Several key trends and developments are shaping the future of this critical employee benefit:

- Telehealth and Virtual Care: With the increasing popularity of telehealth services, company medical insurance plans are likely to expand their coverage to include virtual healthcare options, making it more convenient for employees to access medical advice and treatments.

- Personalized Medicine: Advances in healthcare technology and genomics are paving the way for more personalized treatment approaches. Company medical insurance plans may begin to offer coverage for genetic testing and precision medicine, ensuring employees receive the most effective treatments for their unique needs.

- Mental Health Focus: Recognizing the importance of mental health, companies are increasingly incorporating mental health services into their medical insurance plans. This trend is expected to continue, with a focus on providing comprehensive coverage for conditions like depression, anxiety, and stress-related disorders.

- Employee Empowerment: Companies are shifting towards a more employee-centric approach, offering greater flexibility and choice in medical insurance plans. This may include allowing employees to customize their plans based on their individual needs and preferences.

- Data-Driven Decision Making: With the advent of big data and analytics, companies are leveraging data to make more informed decisions about their medical insurance offerings. This approach can lead to more efficient and cost-effective plans that better meet the needs of the workforce.

FAQs

What are the key differences between individual and company medical insurance plans?

+

Company medical insurance plans often offer more comprehensive coverage and better rates due to economies of scale. They may also include additional benefits like wellness programs and access to a network of healthcare providers. Individual plans, on the other hand, offer more flexibility and can be tailored to an individual’s specific needs, but they may be more expensive and have limited coverage options.

How do companies choose the right medical insurance provider for their employees?

+

Companies consider various factors when selecting a medical insurance provider, including the provider’s reputation, the range of coverage options offered, the quality of their healthcare network, and the cost of premiums. They may also assess the provider’s claims handling process and their approach to customer service.

Are there any tax benefits associated with company medical insurance plans?

+

Yes, in many countries, company medical insurance plans offer tax advantages to both employers and employees. Employers can often deduct the cost of premiums as a business expense, while employees may receive their insurance coverage tax-free. It’s important to consult with a tax professional to understand the specific tax implications in your region.

In conclusion, company medical insurance is a critical component of modern employee benefits packages, offering a range of advantages to both employers and employees. As healthcare landscapes continue to evolve, so too will the nature of company medical insurance, with a focus on innovation, employee empowerment, and data-driven decision making. By staying informed about the latest trends and developments, companies can ensure they are offering competitive and comprehensive medical insurance plans that meet the needs of their workforce.