Medicare Insurance Near Me

Medicare insurance is a crucial aspect of healthcare coverage for individuals aged 65 and above, as well as those with certain disabilities or medical conditions. Understanding the various options available and navigating the system can be challenging, but finding the right Medicare plan near you is an essential step toward securing comprehensive healthcare. In this comprehensive guide, we will delve into the world of Medicare insurance, exploring the different types, coverage options, and steps to locate and secure the best plan tailored to your specific needs.

Understanding Medicare Insurance

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, although those under 65 with specific disabilities or medical conditions may also qualify. The program is divided into different parts, each covering a range of healthcare services and expenses.

Parts of Medicare

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services.

- Part B (Medical Insurance): Covers doctor visits, outpatient care, medical supplies, and preventive services.

- Part C (Medicare Advantage): An alternative to Original Medicare (Parts A and B), offered by private insurance companies approved by Medicare. These plans typically include Part A, Part B, and often additional coverage like prescription drugs and vision care.

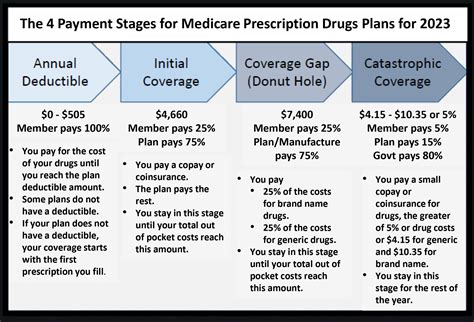

- Part D (Prescription Drug Coverage): Helps cover the cost of prescription medications and is available as a standalone plan or as part of a Medicare Advantage plan.

Determining Eligibility

To be eligible for Medicare, you must meet certain criteria. Generally, you need to be a U.S. citizen or permanent legal resident for at least five years and meet the age or disability requirements. If you’re already receiving Social Security or Railroad Retirement Board benefits, you’ll automatically be enrolled in Medicare Part A and Part B when you turn 65.

Finding Medicare Insurance Near You

When it comes to finding Medicare insurance options near your location, several factors come into play. These include understanding your specific healthcare needs, researching available plans, and considering cost and coverage.

Assessing Your Healthcare Needs

Before choosing a Medicare plan, take time to evaluate your current and potential future healthcare needs. Consider factors such as:

- Your overall health and any pre-existing conditions.

- The medications you regularly take and their costs.

- The types of healthcare services you frequently utilize (e.g., specialist visits, home healthcare, etc.).

- Your preference for in-network providers and facilities.

- Any travel plans and whether you need coverage while away from home.

Researching Available Plans

Medicare plans can vary widely in terms of coverage, cost, and provider networks. Researching the options available in your area is crucial. Here are some steps to guide your research:

- Check Medicare.gov: This official government website provides comprehensive information on Medicare plans, including coverage details, costs, and provider networks. You can use the “Plan Finder” tool to search for plans in your area.

- Contact Local Insurance Agencies: Reach out to reputable insurance agencies in your region. They can provide insights into the plans offered by various providers and help you compare options.

- Attend Medicare Open Enrollment Events: Many communities host events during Medicare’s open enrollment period, providing opportunities to learn about different plans and ask questions.

- Read Reviews and Testimonials: Online reviews and testimonials from current or past plan members can offer valuable insights into the quality of coverage and customer service.

Considering Cost and Coverage

Medicare plans come with various costs, including premiums, deductibles, copayments, and coinsurance. It’s essential to balance the cost with the coverage you need. Here are some cost-related factors to consider:

- Premium: The amount you pay monthly to maintain your coverage. Some plans have higher premiums but lower out-of-pocket costs, while others may have lower premiums but higher out-of-pocket expenses.

- Deductible: The amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles can mean lower premiums, but you’ll pay more when you need care.

- Copayment: A fixed amount you pay for a covered healthcare service. This amount is typically set by the plan and can vary depending on the service.

- Coinsurance: A percentage of the cost of a covered healthcare service that you must pay. For instance, a plan with 20% coinsurance means you pay 20% of the service cost, and the plan covers the remaining 80%.

Enrolling in Medicare Insurance

Once you’ve identified the Medicare plan that best suits your needs, it’s time to enroll. The enrollment process can vary depending on the type of plan you choose. Here’s a general overview:

Original Medicare Enrollment

Original Medicare, consisting of Parts A and B, has specific enrollment periods:

- Initial Enrollment Period: This period begins three months before your 65th birthday month and ends three months after your birthday month. Enrolling during this time ensures you won’t face late enrollment penalties.

- General Enrollment Period: If you miss the initial enrollment period, you can enroll during the general enrollment period, which runs from January 1 to March 31 each year. However, you may face late enrollment penalties.

Medicare Advantage and Part D Enrollment

Medicare Advantage plans and Part D prescription drug plans have more flexible enrollment periods:

- Initial Enrollment Period: Similar to Original Medicare, this period runs for seven months, beginning three months before your 65th birthday month and ending three months after.

- Annual Enrollment Period: This period runs from October 15 to December 7 each year. During this time, you can switch Medicare Advantage or Part D plans, or enroll in a plan for the first time.

- Special Enrollment Periods: Certain life events, such as moving or losing other health coverage, may qualify you for a special enrollment period outside the standard periods. These periods are typically shorter and have specific eligibility criteria.

Preparing for Enrollment

To ensure a smooth enrollment process, gather the necessary documentation and have the following information ready:

- Your Social Security number or a record of your Social Security benefits.

- Your Medicare number (found on your Medicare card or enrollment notice).

- Information about any other health insurance coverage you currently have.

- A list of your prescription medications and their costs.

- Any relevant medical records or test results.

Maximizing Your Medicare Benefits

Once enrolled in a Medicare plan, it’s essential to understand how to make the most of your coverage. Here are some tips to optimize your Medicare benefits:

Review Your Plan Annually

Medicare plans can change from year to year in terms of coverage, costs, and provider networks. Review your plan annually during the open enrollment period to ensure it still meets your needs. If your healthcare needs have changed, consider switching to a different plan that better suits your current situation.

Understand Your Coverage

Familiarize yourself with your plan’s coverage details, including what’s covered, any limitations or exclusions, and your out-of-pocket costs. This knowledge can help you make informed decisions about your healthcare and avoid unexpected expenses.

Utilize Preventive Services

Medicare covers various preventive services, such as annual wellness visits, screenings, and immunizations, often with no out-of-pocket costs. Taking advantage of these services can help you stay healthy and catch potential health issues early on.

Choose In-Network Providers

If you have a Medicare Advantage plan, using in-network providers can save you money and ensure smoother claims processing. Check your plan’s provider directory to find doctors, hospitals, and other healthcare professionals who accept your insurance.

Manage Your Medications

If you have a Part D prescription drug plan, make sure to review your medication list annually and update it as needed. This ensures you have coverage for the medications you require and can help you avoid gaps in coverage or high out-of-pocket costs.

Navigating Medicare’s Complexities

Medicare can be a complex system to navigate, especially for those new to the program. Here are some additional resources and tips to help you along the way:

Medicare Counseling Services

Medicare offers counseling services through the State Health Insurance Assistance Program (SHIP). These services provide free, unbiased counseling to help you understand your Medicare options and rights. You can find SHIP counseling in your state by visiting https://www.medicare.gov/contact-ship or calling 1-800-MEDICARE (1-800-633-4227).

Medicare Appeals and Grievances

If you have a dispute with your Medicare plan or provider, you have the right to file an appeal or grievance. Medicare has a process in place to handle these situations, and you can find detailed information on the Medicare.gov website.

Stay Informed

Medicare rules and guidelines can change over time. Stay informed by regularly checking the Medicare.gov website, signing up for Medicare emails, and following reputable healthcare news sources.

Seek Professional Advice

If you’re unsure about your Medicare options or have complex healthcare needs, consider consulting with a qualified insurance agent or financial advisor who specializes in Medicare. They can provide personalized guidance based on your specific circumstances.

Frequently Asked Questions

Can I have both Medicare and private insurance?

+Yes, it’s possible to have both Medicare and private insurance. However, the order in which these coverages are applied can impact your out-of-pocket costs. It’s important to understand how coordination of benefits works between Medicare and private insurance to maximize your coverage.

What happens if I miss the Initial Enrollment Period for Original Medicare?

+If you miss the Initial Enrollment Period, you can still enroll during the General Enrollment Period, but you may face a late enrollment penalty. The penalty is typically a permanent increase in your Part B premium of 10% for each 12-month period you were eligible for Medicare but didn’t enroll.

Are there any low-income assistance programs for Medicare costs?

+Yes, there are programs like Medicare Savings Programs and the Extra Help program that can help with Medicare costs for individuals with limited income and resources. These programs can assist with premiums, deductibles, and prescription drug costs. You can learn more about these programs on the Medicare.gov website or by contacting your state Medicaid office.

How often can I switch Medicare Advantage plans?

+You can switch Medicare Advantage plans during the Annual Enrollment Period, which runs from October 15 to December 7 each year. Additionally, you may have the opportunity to switch plans during a Special Enrollment Period if you move or experience a change in circumstances.

Finding the right Medicare insurance plan near you is a crucial step toward ensuring comprehensive healthcare coverage as you age. By understanding your needs, researching available plans, and considering cost and coverage, you can make an informed decision. Remember to review your plan annually, utilize preventive services, and stay informed about any changes to Medicare rules and guidelines. With the right plan and a thorough understanding of your coverage, you can navigate the healthcare system with confidence.