Metlife Auto Insurance Quote

Are you in the market for reliable and comprehensive auto insurance coverage? Look no further than MetLife, a trusted name in the insurance industry with a long-standing reputation for excellence. In this in-depth guide, we will explore the world of MetLife Auto Insurance Quotes, delving into the benefits, coverage options, and the steps involved in obtaining a personalized quote that suits your specific needs.

The Benefits of Choosing MetLife Auto Insurance

MetLife Auto Insurance offers a range of advantages that set it apart from other insurance providers. Here’s a glimpse into why MetLife is a top choice for many vehicle owners:

Comprehensive Coverage Options

MetLife understands that every driver has unique needs when it comes to auto insurance. That’s why they provide a wide array of coverage options to ensure you receive the protection that aligns perfectly with your circumstances. Whether you’re seeking liability coverage, collision protection, comprehensive insurance, or additional add-ons like rental car coverage or roadside assistance, MetLife has got you covered.

One of the standout features of MetLife's coverage is their uninsured/underinsured motorist coverage. This protection ensures you're financially safeguarded in the event of an accident with a driver who lacks sufficient insurance coverage. MetLife's comprehensive approach to coverage gives you peace of mind, knowing that you're prepared for a wide range of unforeseen circumstances.

Customizable Plans for Your Needs

MetLife recognizes that one-size-fits-all insurance policies aren’t effective. That’s why they offer highly customizable plans tailored to your specific requirements. Whether you’re a young driver just starting out, a seasoned motorist, or someone with a unique vehicle, MetLife can craft a policy that fits your needs and budget. Their flexible approach ensures you receive the coverage you deserve without paying for unnecessary extras.

Excellent Customer Service and Support

MetLife prides itself on its exceptional customer service. Their dedicated team of professionals is readily available to assist you with any queries or concerns you may have throughout the insurance process. From providing guidance on selecting the right coverage to offering prompt assistance in the event of a claim, MetLife ensures you receive the support you need, when you need it.

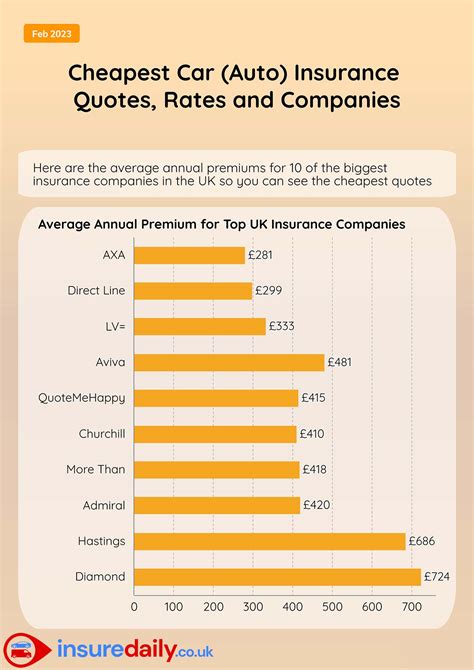

Competitive Pricing and Discounts

When it comes to auto insurance, cost is a significant consideration. MetLife understands this and strives to offer competitive pricing for their comprehensive coverage. Additionally, they provide a range of discounts to make their policies even more affordable. These discounts may include multi-policy discounts (for bundling your auto insurance with other MetLife policies), good student discounts, safe driver discounts, and more. By taking advantage of these discounts, you can further reduce your insurance costs without compromising on quality coverage.

The MetLife Auto Insurance Quote Process

Obtaining a MetLife Auto Insurance Quote is a straightforward and efficient process. Here’s a step-by-step guide to help you navigate the journey:

Step 1: Gather Essential Information

Before initiating the quote process, it’s beneficial to have certain information readily available. This includes details about your vehicle, such as the make, model, year, and vehicle identification number (VIN). Additionally, having information about your driving history, including any accidents or violations, will streamline the process. If you’re currently insured with another provider, gathering details about your existing policy can also be advantageous.

Step 2: Choose Your Coverage Options

MetLife offers a comprehensive range of coverage options to choose from. Take the time to carefully review these options and select the ones that best suit your needs. Consider factors such as your vehicle’s value, your driving habits, and any specific requirements you may have. By selecting the right coverage, you can ensure you’re adequately protected without overspending on unnecessary add-ons.

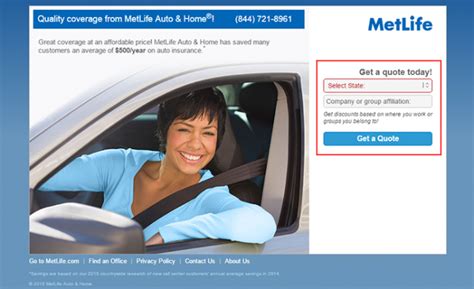

Step 3: Complete the Online Quote Form

MetLife provides a user-friendly online quote form that can be completed in a matter of minutes. Simply navigate to their official website and locate the “Get a Quote” section. Here, you’ll be guided through a series of questions aimed at gathering the necessary information to generate an accurate quote. Ensure you provide accurate and detailed responses to ensure the quote reflects your actual needs.

Step 4: Review and Compare Quotes

Once you’ve submitted the online form, MetLife’s system will generate a personalized quote based on the information you’ve provided. Take the time to review the quote carefully, paying attention to the coverage limits, deductibles, and any additional features included. Compare the quote with other insurance providers to ensure you’re getting the best value for your money. MetLife’s competitive pricing and comprehensive coverage make them a strong contender in the auto insurance market.

Step 5: Contact MetLife for Further Assistance

If you have any questions or require further clarification about your quote, don’t hesitate to reach out to MetLife’s customer service team. Their knowledgeable representatives are available to provide guidance and address any concerns you may have. Whether you need additional information about coverage options or want to discuss potential discounts, MetLife’s team is dedicated to ensuring you receive the support you need to make an informed decision.

Understanding Your MetLife Auto Insurance Quote

Once you’ve obtained your MetLife Auto Insurance Quote, it’s important to understand the key components that make up your policy. Here’s a breakdown of some essential aspects to consider:

Policy Limits and Deductibles

Your MetLife auto insurance policy will have specified policy limits, which represent the maximum amount your insurance provider will pay out for covered damages or losses. These limits are typically set for liability coverage, collision coverage, and comprehensive coverage. It’s crucial to choose limits that provide adequate protection without being excessive. Additionally, your policy will have deductibles, which are the amounts you’ll need to pay out of pocket before your insurance coverage kicks in. Selecting the right deductible level can help you balance coverage and affordability.

| Coverage Type | Policy Limit | Deductible |

|---|---|---|

| Liability Coverage | $100,000 per person / $300,000 per accident | $500 |

| Collision Coverage | $15,000 | $1,000 |

| Comprehensive Coverage | $5,000 | $500 |

Additional Coverages and Add-ons

In addition to the standard coverage options, MetLife offers a range of additional coverages and add-ons to enhance your policy. These may include rental car reimbursement, roadside assistance, gap coverage, or customized equipment coverage. Depending on your specific needs and preferences, you can tailor your policy to include these add-ons, ensuring you have the comprehensive protection you desire.

Discounts and Savings Opportunities

MetLife recognizes the importance of providing affordable insurance options, which is why they offer a variety of discounts to their policyholders. These discounts can significantly reduce your insurance premiums and make coverage more accessible. Some common discounts provided by MetLife include multi-policy discounts (for bundling multiple insurance policies), safe driver discounts (for maintaining a clean driving record), good student discounts (for eligible students), and loyalty discounts (for long-term customers). By taking advantage of these discounts, you can further optimize your insurance costs.

The Importance of Regularly Reviewing Your Auto Insurance Policy

Auto insurance is an essential aspect of vehicle ownership, and it’s crucial to regularly review and assess your policy to ensure it continues to meet your needs. Here’s why staying proactive with your auto insurance is beneficial:

Changing Circumstances

Life is full of changes, and these changes can impact your auto insurance needs. Whether you’ve purchased a new vehicle, moved to a different state, or experienced a significant life event like marriage or the birth of a child, it’s essential to review your policy to ensure it aligns with your current circumstances. Updating your policy to reflect these changes ensures you maintain adequate coverage and avoid any potential gaps in protection.

Staying Up-to-Date with Coverage

Auto insurance policies and coverage options evolve over time. By regularly reviewing your policy, you can stay informed about any updates or enhancements MetLife may offer. This allows you to take advantage of new coverage options or discounts that can further optimize your insurance experience. Staying up-to-date ensures you have access to the latest and most comprehensive coverage available.

Identifying Cost-Saving Opportunities

As your circumstances change, so too may your eligibility for certain discounts or coverage adjustments. By reviewing your policy, you can identify opportunities to save on your insurance premiums. Whether it’s qualifying for a new discount, adjusting your deductible, or removing unnecessary coverage, taking advantage of these cost-saving measures can help you manage your insurance expenses effectively.

FAQs

What factors influence my MetLife Auto Insurance Quote?

+Several factors can influence your MetLife Auto Insurance Quote, including your driving record, the make and model of your vehicle, your location, and the coverage options you choose. Additionally, your age, gender, and marital status may also play a role in determining your premium.

Can I customize my MetLife Auto Insurance policy further?

+Absolutely! MetLife understands that every driver has unique needs. You can customize your policy by adding or removing coverage options, adjusting your deductibles, or opting for specialized add-ons like rental car reimbursement or roadside assistance. This flexibility allows you to create a policy that perfectly suits your requirements.

How can I get the best value for my MetLife Auto Insurance policy?

+To get the best value for your MetLife Auto Insurance policy, consider the following tips: review your coverage options to ensure you’re not overinsured or underinsured, take advantage of any applicable discounts (such as multi-policy discounts or safe driver discounts), and regularly compare quotes from multiple insurance providers to ensure you’re getting a competitive rate.

What should I do if I’m involved in an accident while insured with MetLife Auto Insurance?

+If you’re involved in an accident, it’s important to remain calm and follow these steps: first, ensure the safety of yourself and others involved, then call the police to report the accident. Collect the necessary information from the other driver(s), including their insurance details. Take photos of the accident scene and any damage to your vehicle. Finally, contact MetLife’s customer service team to report the accident and initiate the claims process.

How can I contact MetLife’s customer service team for assistance?

+MetLife provides multiple channels for you to reach their customer service team. You can call their toll-free number, which is typically available 24⁄7, or visit their official website to access their online help center. Additionally, you may have the option to send an email or use live chat support, depending on your preference.

In conclusion, MetLife Auto Insurance Quotes offer a comprehensive and customizable approach to protecting your vehicle and ensuring your peace of mind. By understanding the benefits, coverage options, and quote process, you can make an informed decision about your auto insurance needs. Remember to regularly review your policy to stay up-to-date and take advantage of any cost-saving opportunities. With MetLife’s dedication to customer service and competitive pricing, you can trust that your auto insurance needs are in good hands.