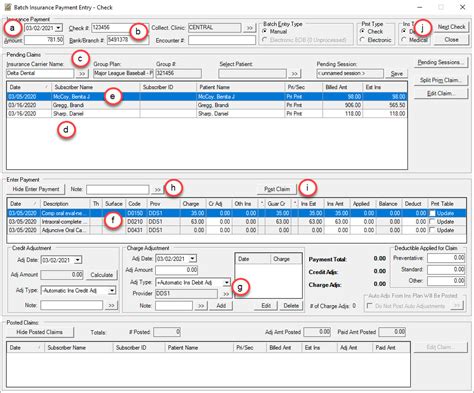

Insurance Payments

In the complex world of insurance, understanding the intricacies of insurance payments is crucial for both policyholders and insurers. This article delves into the multifaceted nature of insurance payments, exploring the various factors, processes, and implications involved. From premium calculations to claim settlements, we'll uncover the key aspects that shape the financial landscape of the insurance industry.

The Anatomy of Insurance Payments

Insurance payments, at their core, represent a mutually beneficial agreement between an insurance company and a policyholder. This agreement, often referred to as an insurance policy, outlines the terms and conditions under which financial protection is provided. The payment structure is designed to ensure that policyholders receive the necessary coverage while insurers maintain financial stability.

Premium Calculations: A Balancing Act

One of the fundamental aspects of insurance payments is the determination of insurance premiums. Insurance companies employ sophisticated actuarial science to calculate premiums. This process involves assessing various factors, including the policyholder’s age, health status, occupation, and the specific risks associated with the coverage type.

For instance, consider health insurance premiums. These are typically influenced by factors such as the policyholder's age, pre-existing medical conditions, and the level of coverage desired. Older individuals, who are statistically more likely to require medical care, often face higher premiums. Similarly, individuals with a history of chronic illnesses may be charged a higher rate to account for the increased likelihood of claims.

| Factor | Impact on Premium |

|---|---|

| Age | Higher premiums for older individuals |

| Health Status | Pre-existing conditions can increase rates |

| Occupation | High-risk occupations may lead to higher costs |

Additionally, the type of coverage plays a significant role. For instance, comprehensive car insurance, which offers a broader range of protections, will generally cost more than basic liability coverage. Similarly, homeowners' insurance premiums can vary based on the location's risk factors, such as susceptibility to natural disasters.

Claim Settlements: Navigating the Process

When an insured event occurs, policyholders initiate the claim process. This involves submitting documentation to support their claim, such as medical records for health insurance claims or property damage assessments for homeowners’ insurance. The insurance company then evaluates the claim, considering factors like the policy terms, coverage limits, and the specific circumstances of the event.

For example, in the case of a car accident, the insurance company would assess the extent of the damage, determine liability, and calculate the payout based on the policy's coverage. This process can be intricate, especially when dealing with complex scenarios or disputes over liability.

The Impact of Deductibles and Co-pays

Insurance policies often include deductibles and co-pays, which are crucial elements in the payment structure. A deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. This acts as a deterrent for minor claims and helps keep premiums lower.

Consider the example of homeowners' insurance with a $1,000 deductible. If a policyholder experiences a minor roof leak causing $500 in damages, they would be responsible for paying the full amount as it falls below the deductible. However, for a more significant event, like a fire causing $20,000 in damages, the insurance company would cover the remainder after the deductible is met.

Similarly, co-pays are fixed amounts paid by the policyholder at the time of service, typically for healthcare services. These co-pays contribute to the overall cost-sharing arrangement between the insurer and the insured.

Payment Methods and Frequency

Insurance payments can be structured in various ways, depending on the type of insurance and the policyholder’s preferences. Common payment methods include monthly installments, quarterly payments, or even annual premiums. Some insurers offer flexible payment plans to accommodate different financial situations.

For instance, life insurance policies often provide the option of paying premiums annually, which can result in slight discounts due to the reduced administrative costs for the insurer. On the other hand, monthly payments provide a more manageable approach for policyholders with varying income streams.

The Financial Implications

Insurance payments have far-reaching financial implications for both insurers and policyholders. For insurers, the financial health of the company is paramount. They must ensure that premiums collected are sufficient to cover claims, administrative costs, and provide a reasonable profit margin. This delicate balance is crucial for the long-term viability of the insurance provider.

Policyholders, on the other hand, face the challenge of managing their financial resources to meet insurance obligations. The cost of insurance can be a significant expense, especially for those with multiple policies or high-risk occupations. However, the peace of mind and financial protection provided by insurance can be invaluable in times of need.

The Role of Reinsurance

Insurers often employ reinsurance as a risk management strategy. Reinsurance involves transferring a portion of the risk and, consequently, a portion of the premiums to another insurance company. This practice helps spread the financial burden across multiple entities, reducing the impact of large-scale claims on a single insurer.

For instance, an insurance company specializing in natural disaster coverage may reinsure a significant portion of its policies to mitigate the financial risk associated with catastrophic events. This allows the primary insurer to maintain financial stability while still offering comprehensive coverage to policyholders.

Performance Analysis and Rating

Insurance companies are closely scrutinized by regulatory bodies and rating agencies to ensure financial solvency and ethical practices. Performance analysis involves evaluating the insurer’s ability to meet its financial obligations, including paying claims promptly and maintaining adequate reserves.

Rating agencies assign ratings to insurance companies based on their financial strength and stability. These ratings are crucial for policyholders, as they provide an indication of the insurer's reliability and ability to honor its commitments. A highly rated insurer is generally considered more financially secure and less likely to face liquidity issues.

The Future of Insurance Payments

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. The future of insurance payments is likely to be shaped by several key trends and innovations.

Digital Transformation

The digital age has ushered in a new era of convenience and efficiency for insurance payments. Online platforms and mobile applications now enable policyholders to manage their policies, pay premiums, and file claims with just a few clicks. This digital transformation enhances the customer experience and reduces administrative burdens for insurers.

Additionally, the use of big data analytics allows insurers to make more accurate predictions and assess risks more efficiently. By analyzing vast datasets, insurers can identify patterns and trends, leading to more precise premium calculations and improved claim settlement processes.

Pay-As-You-Go Models

Traditional insurance models, with their fixed premiums, may soon give way to more flexible pay-as-you-go or usage-based models. These innovative approaches are particularly relevant in the automotive and health insurance sectors.

For example, telematics-based car insurance policies use sensors to track driving behavior and adjust premiums accordingly. Safe drivers may benefit from lower premiums, while those with riskier driving habits pay more. This model encourages safer driving practices and provides a more personalized insurance experience.

Blockchain and Smart Contracts

The integration of blockchain technology and smart contracts has the potential to revolutionize insurance payments. Blockchain offers a secure and transparent ledger system, enhancing the efficiency and security of transactions. Smart contracts, self-executing contracts with predefined rules, can automate various processes, including claim settlements.

Imagine a scenario where a property insurance claim is automatically triggered and settled using smart contracts. Upon detection of a covered event, such as a natural disaster, the smart contract could initiate the claim process, verify the validity of the claim, and disburse the payout without human intervention. This streamlined process could significantly reduce claim processing times and minimize the risk of fraud.

Insurtech Collaborations

The rise of Insurtech startups and their collaborations with traditional insurers is another notable trend. These collaborations bring together the agility and innovation of startups with the established expertise of insurance providers. Insurtech companies often leverage technology to offer unique insurance products and streamline processes, benefiting both insurers and policyholders.

For instance, an Insurtech startup may develop a health monitoring app that integrates with insurance policies. This app could track users' health data, encourage healthy behaviors, and provide real-time insights to both policyholders and insurers. Such innovations can lead to better risk management and more personalized insurance experiences.

Conclusion

Insurance payments are a complex yet vital aspect of the insurance industry. From premium calculations to claim settlements, each step involves careful consideration of various factors. As the industry evolves, the future of insurance payments looks promising, with digital transformation, innovative models, and technological advancements poised to enhance the customer experience and streamline processes.

How often should I review my insurance policies and payments?

+It’s recommended to review your insurance policies annually or whenever your personal circumstances change significantly. Life events such as marriage, buying a new home, or starting a business can impact your insurance needs. Regular reviews ensure that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.

What happens if I miss an insurance premium payment?

+Missing an insurance premium payment can have serious consequences. Most insurers offer a grace period, typically around 30 days, during which you can still make the payment without facing immediate cancellation. However, if the payment is not made within this grace period, your policy may be canceled, leaving you without coverage. It’s crucial to stay on top of your payments to avoid any lapses in coverage.

Can I negotiate my insurance premiums?

+While insurance premiums are typically set based on actuarial calculations, there may be room for negotiation in certain cases. Some insurers offer discounts for bundling multiple policies or for maintaining a long-term relationship with the company. Additionally, if you believe your premiums are unfairly high based on your personal circumstances, you can consider shopping around for alternative quotes or discussing your concerns with your insurer.