Local Car Insurance Companies Near Me

When it comes to finding local car insurance providers, the options can vary greatly depending on your geographical location. Each state, and often each city, has its own unique insurance landscape. Understanding the local market and the specific needs of drivers in your area is crucial for making informed insurance decisions. This article aims to delve into the world of local car insurance companies, offering an in-depth analysis of the factors that influence your choices and the potential benefits of opting for a local provider.

Understanding the Local Car Insurance Market

The car insurance market is diverse, with a range of options available to drivers. While national insurance companies offer coverage across the country, local insurance providers tend to focus on specific regions or even individual cities. This localized approach allows them to tailor their policies and services to the unique needs and risks of drivers in their specific area.

For instance, consider the city of Chicago, Illinois. With its bustling city life and dense population, car insurance needs can be quite different from those in a rural area. Local insurance companies in Chicago may offer specialized coverage for urban driving, including options for parking damage or coverage for specific road hazards unique to the city. They may also provide more personalized service, with agents who are familiar with the local roads and driving conditions.

The Benefits of Choosing a Local Provider

Opting for a local car insurance company can bring several advantages, including:

- Personalized Service: Local insurance agents often provide a more tailored and personalized experience. They can offer advice based on your specific circumstances and the local driving environment.

- Community Knowledge: Local providers understand the unique challenges and benefits of driving in your area. This knowledge can lead to more accurate risk assessments and potentially lower premiums.

- Faster Claims Processing: In the event of an accident, a local insurer may be able to process your claim more quickly. They often have a better understanding of local repair shops and can facilitate faster repairs.

- Support for Local Businesses: Choosing a local insurance company supports the growth of small businesses in your community. This can lead to a more vibrant local economy.

Let's take a closer look at how these benefits play out in different scenarios.

Case Study: Local Insurance in Action

Imagine you’re a resident of Los Angeles, California, and you’re in the market for car insurance. You have the option of choosing a national insurer or exploring the local market. Here’s how a local insurer might benefit you:

| Factor | Local Insurer |

|---|---|

| Premium Cost | Local insurers may offer competitive rates, especially for drivers with a clean record. They often provide discounts for local loyalty and good driving habits. |

| Claim Processing | In the event of an accident, a local insurer can quickly assess the damage and facilitate repairs. They often have partnerships with local body shops, ensuring faster turnaround times. |

| Community Involvement | Many local insurers actively participate in community events and charities. Choosing them can support local initiatives and foster a sense of community. |

Finding the Right Local Car Insurance Company

Identifying the right local car insurance company involves a bit of research and consideration. Here are some steps to guide you through the process:

- Define Your Needs: Start by assessing your specific insurance needs. Consider factors like the type of car you drive, your driving record, and any unique circumstances (e.g., teenage drivers in the household or frequent long-distance travel).

- Research Local Providers: Look up local insurance companies in your area. You can start with online searches or ask for recommendations from friends and family.

- Compare Quotes: Request quotes from several local providers. Compare the coverage offered, the premiums, and any additional benefits or discounts.

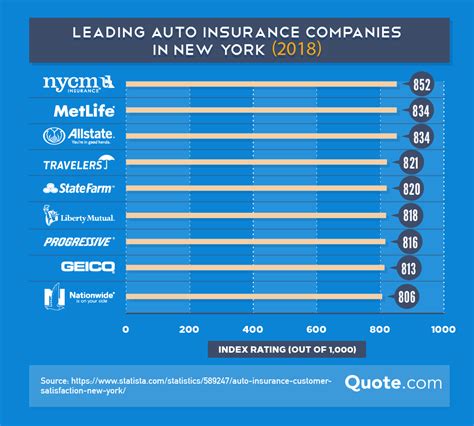

- Check Reviews and Ratings: Research the reputation of each provider. Online reviews and ratings can give you an idea of their customer service and claim handling.

- Consider Agent Availability: If you prefer face-to-face interactions, choose an insurer with easily accessible agents or offices in your area.

Expert Tip: Shop Around

It’s crucial to shop around and compare multiple local insurance providers. Each company has its own unique offerings and pricing structures. By comparing quotes, you can find the best coverage at the most competitive price.

Local vs. National Insurers: A Comparative Analysis

While local insurers offer many benefits, it’s also essential to consider the advantages of national insurers. Here’s a side-by-side comparison:

| Factor | Local Insurer | National Insurer |

|---|---|---|

| Personalized Service | Excellent | Good |

| Community Knowledge | Strong | Limited |

| Claim Processing Speed | Fast | Varies |

| Discounts and Benefits | Local-specific | Nationwide |

| Availability | Regional | Nationwide |

The Bottom Line

Choosing a local car insurance company can offer a range of benefits, from personalized service to a stronger connection with your community. However, it’s essential to weigh these advantages against the potential benefits of a national insurer, such as broader availability and nationwide discounts.

Ultimately, the decision should be based on your unique circumstances and preferences. By conducting thorough research and comparing multiple options, you can find the car insurance provider that best suits your needs and offers the most value.

How do local insurance rates compare to national insurers?

+Local insurance rates can vary widely depending on the provider and your specific circumstances. While some local insurers may offer competitive rates, others may have higher premiums. It’s essential to compare quotes from multiple providers to find the best deal.

Can I bundle my car insurance with other policies from a local insurer?

+Many local insurers offer the option to bundle your car insurance with other policies, such as homeowners or renters insurance. Bundling can often lead to significant discounts and simplified billing.

What if I move to a different city or state? Can I keep my local insurance policy?

+If you move to a different city or state, your local insurance policy may no longer be valid or provide adequate coverage. It’s important to inform your insurer about the move and discuss your options. In many cases, you’ll need to switch to a new insurer that operates in your new location.