Minimum Coverage Car Insurance

In today's world, car insurance is an essential aspect of vehicle ownership, offering financial protection and peace of mind to drivers. However, not all insurance policies are created equal, and understanding the different coverage options is crucial for making informed decisions. This article will delve into the concept of Minimum Coverage Car Insurance, exploring its intricacies, benefits, and considerations to help you navigate the world of automotive insurance effectively.

Understanding Minimum Coverage Car Insurance

Minimum Coverage Car Insurance, often referred to as the legal minimum or liability-only insurance, is a basic form of automotive coverage mandated by law in many regions. It serves as a fundamental safety net, ensuring that drivers can meet their legal obligations in the event of an accident or other vehicular incidents. This type of insurance is designed to protect individuals financially when they are at fault for causing damage to others or their property.

The primary purpose of minimum coverage is to provide a basic level of protection against liability claims, covering the costs associated with injuries, property damage, and legal fees resulting from an accident. It acts as a legal requirement, ensuring that drivers can meet their financial responsibilities without facing devastating financial consequences.

Key Components of Minimum Coverage

Minimum coverage car insurance typically consists of two main components:

- Bodily Injury Liability: This coverage protects the insured driver against claims for injuries or fatalities caused to others in an accident. It covers medical expenses, lost wages, and pain and suffering associated with the incident.

- Property Damage Liability: Property damage liability coverage pays for repairs or replacements of others’ property, including vehicles, structures, and personal belongings, damaged in an accident caused by the insured driver.

While minimum coverage provides a basic level of protection, it is important to note that it may not cover all potential costs associated with an accident. It primarily focuses on liability, ensuring that the insured driver can meet their legal obligations. Other aspects of vehicle ownership, such as damage to the insured vehicle or injuries to the driver and passengers, may not be covered under this type of insurance.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering for injured parties. |

| Property Damage Liability | Pays for repairs or replacements of others' property damaged in an accident. |

Benefits of Minimum Coverage Car Insurance

Minimum coverage car insurance serves several important purposes, providing benefits to both drivers and society as a whole.

Legal Compliance

One of the primary advantages of minimum coverage is its ability to help drivers stay compliant with the law. Many regions mandate that vehicle owners carry a minimum level of insurance to ensure financial responsibility in the event of an accident. By opting for minimum coverage, drivers can meet these legal requirements, avoiding potential penalties and ensuring their driving privileges remain intact.

Financial Protection

Minimum coverage provides a vital financial safety net, protecting drivers from the potentially devastating costs associated with causing an accident. It ensures that the insured driver can meet their liability obligations, covering medical bills, property damage repairs, and legal fees resulting from an accident. This protection is especially crucial for individuals who may not have the financial means to cover such expenses out of pocket.

Affordability

Minimum coverage car insurance is often more affordable than comprehensive insurance policies. It provides a cost-effective solution for individuals on a budget, offering basic protection without breaking the bank. This affordability makes insurance more accessible to a wider range of drivers, ensuring that more people can meet their legal obligations and protect themselves financially.

Peace of Mind

Despite its limitations, minimum coverage can provide a certain level of peace of mind. Knowing that you have insurance to cover your legal responsibilities in the event of an accident can reduce stress and anxiety. It offers a basic level of protection, allowing drivers to focus on their daily lives without constant worry about potential financial burdens.

| Benefit | Description |

|---|---|

| Legal Compliance | Helps drivers stay compliant with legal insurance requirements. |

| Financial Protection | Protects drivers from the financial consequences of causing an accident. |

| Affordability | Offers cost-effective insurance coverage for budget-conscious individuals. |

| Peace of Mind | Provides a basic level of protection, reducing anxiety about financial liabilities. |

Considerations and Limitations

While minimum coverage car insurance offers several benefits, it is important to understand its limitations and consider additional coverage options to ensure comprehensive protection.

Limited Coverage

As the name suggests, minimum coverage provides a basic level of protection, covering only the legal minimum requirements. It may not offer sufficient coverage for all potential costs associated with an accident. For instance, it typically does not cover damage to the insured vehicle or injuries to the driver and passengers, leaving these expenses to be covered out of pocket.

Potential Financial Risk

While minimum coverage protects against liability claims, it does not provide comprehensive protection. In the event of a severe accident, the costs associated with injuries, property damage, and legal fees can far exceed the coverage limits of a minimum policy. This can leave the insured driver vulnerable to financial strain and potential bankruptcy.

Lack of Additional Benefits

Minimum coverage car insurance often lacks the additional benefits and perks offered by more comprehensive policies. These may include rental car coverage, roadside assistance, and coverage for personal belongings in the vehicle. These added benefits can provide significant convenience and protection in various situations.

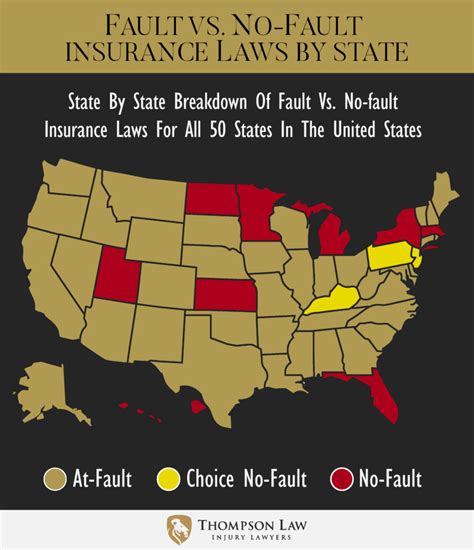

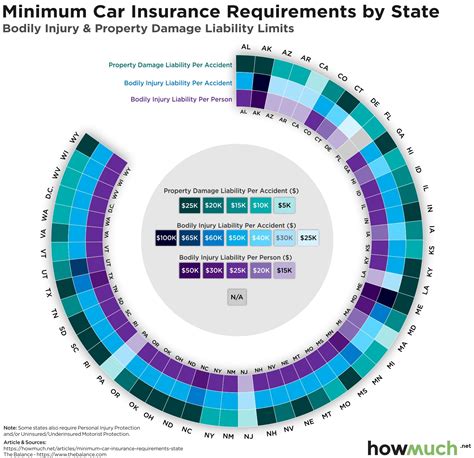

State-Specific Requirements

It’s important to note that minimum coverage requirements vary by state or region. Some areas may have higher or lower minimum limits, and certain states may have additional coverage requirements, such as uninsured motorist coverage or personal injury protection. Understanding the specific requirements of your state is crucial when selecting an insurance policy.

| Consideration | Description |

|---|---|

| Limited Coverage | Minimum coverage may not provide sufficient protection for all potential costs. |

| Financial Risk | Inadequate coverage limits can leave drivers vulnerable to financial strain. |

| Lack of Benefits | Minimum coverage may not include additional benefits offered by comprehensive policies. |

| State-Specific Requirements | Minimum coverage limits and requirements vary by state, so understanding local laws is essential. |

When to Consider Minimum Coverage

Minimum coverage car insurance can be a suitable option for certain individuals and situations. Here are some factors to consider when deciding whether minimum coverage is the right choice for you:

Budget Constraints

If you are on a tight budget and need to prioritize your spending, minimum coverage can be a cost-effective solution. It provides the legal minimum protection, ensuring you remain compliant with the law, without straining your finances.

Low-Risk Drivers

For individuals with a clean driving record and a history of safe driving, minimum coverage may be sufficient. If you are a cautious driver and have a low risk of being involved in an accident, minimum coverage can offer adequate protection while keeping costs low.

Temporary Arrangements

In certain situations, such as borrowing a vehicle temporarily or using a rental car, minimum coverage can be a practical option. It provides the necessary protection for the short term, ensuring you meet legal requirements without the need for a comprehensive policy.

Secondary Vehicles

If you own multiple vehicles, you may consider minimum coverage for secondary or less frequently used vehicles. This can help reduce overall insurance costs while still ensuring that all your vehicles are legally insured.

| Consideration | Description |

|---|---|

| Budget Constraints | Minimum coverage is cost-effective, making it suitable for budget-conscious individuals. |

| Low-Risk Drivers | Safe drivers with a clean record may find minimum coverage sufficient for their needs. |

| Temporary Arrangements | Practical for short-term vehicle usage, such as rentals or temporary borrowings. |

| Secondary Vehicles | Ideal for reducing insurance costs on less frequently used vehicles. |

Comparing Minimum Coverage with Comprehensive Insurance

When considering insurance options, it is essential to understand the differences between minimum coverage and comprehensive insurance. While minimum coverage provides a basic level of protection, comprehensive insurance offers a more extensive range of benefits.

Comprehensive Insurance

Comprehensive car insurance, also known as full coverage, provides a higher level of protection than minimum coverage. It typically includes liability coverage, as well as additional benefits such as collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. These added layers of protection ensure that the insured driver is covered for a wider range of situations, including accidents, vandalism, theft, and natural disasters.

Key Differences

- Scope of Coverage: Comprehensive insurance offers a broader scope of protection, covering a wider range of incidents and providing additional benefits.

- Cost: Comprehensive insurance is generally more expensive than minimum coverage, as it offers a higher level of protection.

- Financial Security: With comprehensive insurance, drivers have greater financial security, as they are covered for a wider range of costs associated with an accident or other incidents.

- Convenience: Comprehensive policies often include added conveniences, such as rental car coverage and roadside assistance, providing added peace of mind.

| Comparison | Minimum Coverage | Comprehensive Insurance |

|---|---|---|

| Coverage Scope | Basic liability coverage | Broad range of coverages, including liability, collision, comprehensive, and more |

| Cost | Affordable | Higher premium |

| Financial Security | Limited protection | Comprehensive protection |

| Convenience | Basic protection | Additional benefits and conveniences |

Tailoring Your Insurance Coverage

Every driver’s needs and circumstances are unique, making it essential to tailor your insurance coverage to suit your specific requirements. Here are some tips to help you customize your insurance policy:

Assess Your Needs

Evaluate your driving habits, the value of your vehicle, and your financial situation. Consider factors such as the likelihood of accidents, the cost of repairs, and your ability to handle unexpected expenses. This assessment will help you determine the level of coverage that best aligns with your needs.

Shop Around

Compare quotes from different insurance providers to find the best coverage and rates. Many insurance companies offer online tools or agents who can help you customize your policy and provide quotes based on your specific requirements.

Consider Additional Coverage

Evaluate the benefits of adding optional coverages, such as collision, comprehensive, rental car coverage, or roadside assistance. These additional coverages can provide greater peace of mind and protection in various situations.

Understand Deductibles

Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it also means you’ll pay more out of pocket in the event of a claim. Assess your financial situation and comfort level to determine the right deductible for you.

Review Regularly

Insurance needs can change over time. Review your policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and aligned with your current needs.

| Customization Tip | Description |

|---|---|

| Assess Your Needs | Evaluate driving habits, vehicle value, and financial situation to determine coverage needs. |

| Shop Around | Compare quotes from multiple insurers to find the best coverage and rates. |

| Consider Additional Coverage | Evaluate the benefits of adding optional coverages for greater protection. |

| Understand Deductibles | Choose a deductible that aligns with your financial comfort level and coverage needs. |

| Review Regularly | Periodically review your policy to ensure it remains adequate for your changing circumstances. |

The Future of Minimum Coverage Car Insurance

As the automotive industry evolves, so too does the landscape of car insurance. The future of minimum coverage car insurance is likely to be shaped by several key factors and trends.

Technological Advances

Advancements in automotive technology, such as autonomous driving features and advanced safety systems, may impact the need for minimum coverage. These technologies could potentially reduce the frequency and severity of accidents, leading to a reevaluation of minimum coverage requirements.

Changing Regulatory Environment

State and regional regulations regarding minimum coverage requirements are subject to change. As safety standards and societal needs evolve, governments may adjust the legal minimums, potentially increasing or decreasing the required levels of coverage.

Data-Driven Insurance

The insurance industry is increasingly leveraging data analytics and telematics to assess risk and personalize insurance policies. This trend may lead to more tailored minimum coverage options, with premiums and coverage limits adjusted based on individual driving behavior and risk profiles.

Alternative Mobility Options

The rise of shared mobility options, such as ride-sharing and car-sharing services, may impact the demand for traditional car insurance, including minimum coverage. These alternative mobility options may offer their own insurance coverage, potentially reducing the need for individual policies.

Environmental Considerations

As environmental concerns grow, there may be a shift towards incentivizing eco-friendly vehicles and driving behaviors. This could lead to changes in insurance regulations, potentially influencing the future of minimum coverage requirements.

| Future Trend | Impact |

|---|---|

| Technological Advances | May reduce the need for minimum coverage as safety features improve. |

| Changing Regulatory Environment | State regulations may adjust minimum coverage requirements. |

| Data-Driven Insurance | Tailored minimum coverage options based on individual driving behavior. |

| Alternative Mobility Options | Shared mobility services may offer their own insurance coverage. |

| Environmental Considerations | Incentivizing eco-friendly vehicles may influence insurance regulations. |

Conclusion

Minimum Coverage Car Insurance serves as a fundamental safety net, ensuring that drivers can meet their legal obligations and protect themselves financially in the event of an accident. While it provides a basic level of protection, it is essential to understand its limitations and consider additional coverage options to ensure comprehensive protection. By tailoring your insurance policy to your specific needs and staying informed about evolving trends and regulations, you can make informed decisions to safeguard your financial well-being and navigate the complex world of automotive insurance with confidence.