Medicare Gap Insurance Coverage

Medicare Gap Insurance, also known as Medicare Supplement Insurance (Medigap), is a crucial aspect of healthcare coverage for individuals enrolled in Medicare. This type of insurance plan fills the "gaps" left by Original Medicare, ensuring that policyholders have comprehensive coverage for their medical needs. As healthcare costs continue to rise, understanding the intricacies of Medicare Gap Insurance becomes increasingly important for those seeking financial protection and peace of mind.

Understanding Medicare Gap Insurance

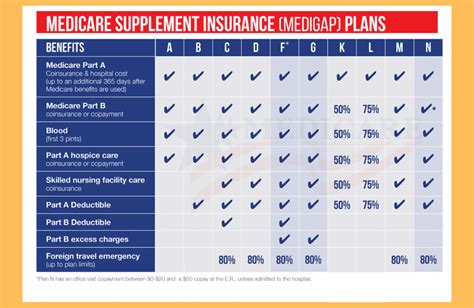

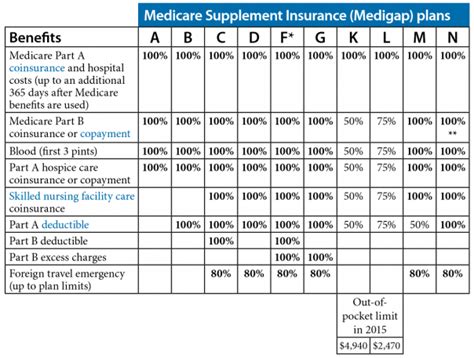

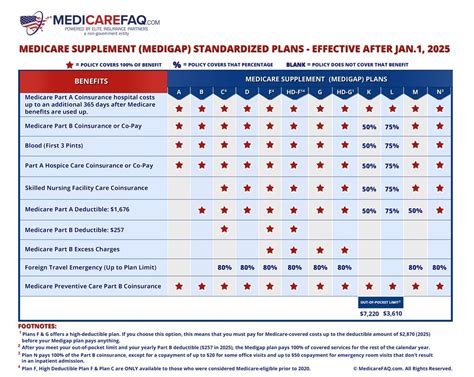

Medicare Gap Insurance is designed to cover the costs that Original Medicare, Part A and Part B, do not fully cover. These gaps can include deductibles, copayments, and coinsurance, which can accumulate quickly and become a significant financial burden for individuals. Medigap policies are standardized by the Centers for Medicare & Medicaid Services (CMS), ensuring that policyholders receive consistent coverage regardless of the insurance company they choose.

One of the key advantages of Medicare Gap Insurance is that it offers flexibility. Policyholders can select a plan that best suits their healthcare needs and budget. There are currently ten standardized Medigap plans (labeled A through N, excluding F and G), each with its own set of benefits and coverage levels. Plans C and F, for instance, provide more comprehensive coverage but will be discontinued for new enrollees starting in 2020. However, existing policyholders can continue their coverage.

Key Features of Medicare Gap Insurance Plans

-

Plan A: This basic plan covers some costs associated with hospital stays and doctor visits. It is a good option for those who are generally healthy and have few medical expenses.

-

Plan F: Offering the most comprehensive coverage, Plan F includes all the gaps in Original Medicare. It is ideal for individuals who want maximum protection and have higher healthcare needs.

-

Plan G: Similar to Plan F, Plan G covers all gaps except for the Part B deductible. It provides excellent coverage at a slightly lower cost.

-

Plan N: A cost-effective option, Plan N covers most gaps but has certain cost-sharing provisions. Policyholders may pay a small amount for office visits and other services.

It's important to note that Medigap policies can only be used with Original Medicare, not with Medicare Advantage plans. Additionally, each Medigap policy must be sold separately from any other health insurance policy, ensuring that policyholders receive dedicated and focused coverage for their Medicare-related expenses.

Enrolling in Medicare Gap Insurance

Enrollment in Medicare Gap Insurance is subject to certain rules and timelines. The Medicare Open Enrollment Period, which typically runs from January 1 to March 31 each year, offers a window of opportunity for individuals to enroll in Medigap without undergoing a medical underwriting process. This means that insurance companies cannot deny coverage or charge higher premiums based on an individual’s health status during this period.

However, if an individual misses this enrollment window, they may still be able to sign up for Medigap at other times, but they might face additional challenges. Guaranteed Issue Rights allow individuals to enroll in a Medigap policy without a health exam or being subject to medical underwriting. These rights typically arise when an individual loses their current Medigap coverage due to certain events, such as moving out of their insurance company's service area or joining a Medicare Advantage plan. In such cases, they have a limited time frame to enroll in a new Medigap plan without being denied coverage or charged higher premiums.

Medicare Gap Insurance and Pre-Existing Conditions

Medicare Gap Insurance is particularly beneficial for individuals with pre-existing health conditions. During the Medicare Open Enrollment Period, insurance companies cannot deny coverage or charge higher premiums based on these conditions. This ensures that individuals can obtain the necessary healthcare coverage without facing financial discrimination due to their health status.

| Medicare Gap Insurance Enrollment Timeline | Description |

|---|---|

| Medicare Open Enrollment Period | A designated period each year when individuals can enroll in Medigap without medical underwriting. |

| Guaranteed Issue Rights | Enables enrollment in Medigap without health exams during specific events like losing current coverage. |

Cost and Coverage of Medicare Gap Insurance

The cost of Medicare Gap Insurance varies depending on several factors, including the chosen plan, the insurance company, and the policyholder’s age and location. Generally, premiums are higher for more comprehensive plans and for individuals in certain health conditions. However, the benefits of having Medigap coverage often outweigh the costs, as it provides financial security and reduces out-of-pocket expenses.

The coverage provided by Medicare Gap Insurance is extensive. It includes services like hospital stays, skilled nursing facility care, home health care, and physician services. Some plans also offer additional benefits such as coverage for foreign travel emergencies and even preventive care services. These added benefits can significantly enhance the overall healthcare experience for policyholders.

Choosing the Right Medicare Gap Insurance Plan

Selecting the appropriate Medicare Gap Insurance plan requires careful consideration. Individuals should evaluate their current and future healthcare needs, as well as their budget. Consulting with a licensed insurance agent or a Medicare counselor can provide valuable guidance in choosing the best plan. It’s important to review the plan’s coverage details, including what is covered, any exclusions or limitations, and the specific costs associated with the plan.

Policyholders should also be aware of the Medicare Part B deductible, which is not covered by all Medigap plans. Plans that cover this deductible often come with higher premiums. Understanding the potential costs associated with different plans can help individuals make informed decisions about their healthcare coverage.

Medicare Gap Insurance and Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C, are an alternative to Original Medicare and Medigap. These plans are offered by private insurance companies and typically include additional benefits, such as prescription drug coverage and vision care. However, it’s important to note that individuals cannot have both a Medigap policy and a Medicare Advantage Plan at the same time.

While Medicare Advantage Plans may seem appealing due to their extra benefits, they often come with restrictions on healthcare providers and services. In contrast, Medigap plans offer more flexibility and coverage for a wider range of healthcare services. The choice between these options depends on an individual's specific needs and preferences.

Comparing Medicare Gap Insurance and Medicare Advantage Plans

| Comparison | Medicare Gap Insurance | Medicare Advantage Plans |

|---|---|---|

| Flexibility | Offers flexibility in choosing healthcare providers and services. | May have restrictions on providers and services. |

| Coverage | Comprehensive coverage for Original Medicare gaps. | May include additional benefits like prescription drugs. |

| Provider Network | No provider network restrictions. | May require use of specific provider networks. |

| Out-of-Pocket Costs | Depends on the chosen plan and individual circumstances. | Varies, but may have lower out-of-pocket costs due to bundled services. |

Future of Medicare Gap Insurance

The landscape of Medicare Gap Insurance is continually evolving to meet the changing needs of policyholders. With the ongoing debate over healthcare reform, the future of Medigap remains uncertain. However, the current standardization of Medigap plans ensures that policyholders receive consistent coverage, regardless of any future changes.

As healthcare costs continue to rise, the demand for Medicare Gap Insurance is expected to increase. Policyholders can stay informed about potential changes by regularly reviewing their Medigap coverage and staying in touch with their insurance providers. By staying proactive, individuals can ensure that they have the necessary coverage to protect their financial well-being and access to quality healthcare.

Conclusion

Medicare Gap Insurance is a vital component of healthcare coverage for individuals enrolled in Original Medicare. By filling the gaps in Medicare coverage, Medigap plans provide financial protection and peace of mind. With a variety of plan options available, policyholders can tailor their coverage to their specific needs and budget. As the healthcare landscape evolves, staying informed and proactive is key to ensuring comprehensive and affordable healthcare coverage.

Can I have both a Medicare Gap Insurance plan and a Medicare Advantage Plan at the same time?

+No, you cannot have both a Medicare Gap Insurance plan (Medigap) and a Medicare Advantage Plan simultaneously. Medigap plans are designed to supplement Original Medicare, while Medicare Advantage Plans replace Original Medicare. Having both types of coverage is not allowed.

What happens if I miss the Medicare Open Enrollment Period for Medicare Gap Insurance?

+If you miss the Medicare Open Enrollment Period, you may still be able to enroll in a Medicare Gap Insurance plan, but you might face certain challenges. Insurance companies may deny coverage or charge higher premiums based on your health status. However, you may have Guaranteed Issue Rights during specific events, allowing you to enroll without medical underwriting.

Are there any age restrictions for enrolling in Medicare Gap Insurance?

+No, there are no age restrictions for enrolling in Medicare Gap Insurance. As long as you are enrolled in Original Medicare, you can purchase a Medigap plan regardless of your age. However, premiums may vary based on age, with younger individuals often paying lower premiums.

What is the difference between Medicare Part A and Part B deductibles, and how do they relate to Medicare Gap Insurance?

+Medicare Part A covers hospital stays, while Part B covers outpatient services. Both parts have deductibles that must be met before coverage begins. Medicare Gap Insurance plans may cover these deductibles, depending on the specific plan you choose. Some plans cover both Part A and Part B deductibles, while others cover only one or none at all.