How Much Will Insurance Cost

Understanding the cost of insurance is a crucial aspect of financial planning and risk management. Insurance premiums can vary significantly based on a multitude of factors, making it essential to delve into the specifics to get an accurate estimate. In this comprehensive guide, we will explore the various elements that influence insurance costs, providing you with the knowledge to make informed decisions about your insurance coverage.

The Complexities of Insurance Premiums

Insurance premiums are the amounts you pay to maintain your insurance policy. These costs are not arbitrary; they are calculated based on a meticulous assessment of risk factors. The insurance industry employs sophisticated actuarial science to determine the likelihood of various events occurring and the potential costs associated with them. This process ensures that insurance providers can offer coverage while remaining financially sustainable.

The cost of insurance is influenced by a multitude of factors, each contributing to the overall risk profile of the policyholder. These factors can be broadly categorized into personal, property, and external variables. Let's delve into each of these categories to gain a deeper understanding.

Personal Factors Affecting Insurance Costs

Your personal characteristics and behaviors play a significant role in determining your insurance premiums. Here are some key personal factors that insurance companies consider:

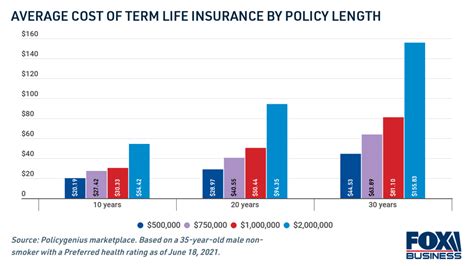

- Age: Age is a critical factor in insurance calculations. Younger individuals often pay higher premiums due to their perceived higher risk of engaging in risky behaviors and making insurance claims. As you age, your premiums may decrease as you are statistically less likely to be involved in accidents or require extensive medical care.

- Health Status: Your overall health can impact the cost of health insurance and life insurance. Pre-existing medical conditions or a history of chronic illnesses may result in higher premiums or even policy exclusions. Conversely, leading a healthy lifestyle and maintaining good health can lead to more affordable insurance options.

- Occupation: Your occupation can influence your insurance costs. High-risk occupations, such as those involving heavy machinery or extreme sports, may result in higher premiums due to the increased likelihood of accidents or injuries. On the other hand, occupations with low risk factors can lead to more affordable insurance rates.

- Driving Record: For auto insurance, your driving history is a significant factor. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or moving violations may result in higher insurance costs or even policy cancellations.

- Credit Score: Surprisingly, your credit score can impact your insurance premiums. Many insurance companies use credit-based insurance scores to assess the risk of insuring you. A higher credit score may indicate better financial responsibility, leading to lower insurance costs.

Property-Related Factors and Insurance Costs

The type and location of your property are important considerations when calculating insurance premiums. Here’s how these factors can impact your insurance costs:

- Property Type: Different types of properties carry varying levels of risk. For example, a detached single-family home may be considered less risky than a high-rise apartment building, leading to lower insurance premiums for homeowners.

- Location: The location of your property plays a significant role in insurance costs. Areas prone to natural disasters, such as hurricanes or earthquakes, may have higher insurance premiums to account for the increased risk. Similarly, high-crime areas may also result in higher premiums for homeowners or renters.

- Construction and Materials: The construction and materials used in your property can impact insurance costs. Properties built with fire-resistant materials or reinforced structures may qualify for lower insurance rates due to their reduced risk of damage.

- Security Measures: Implementing security measures like burglar alarms, surveillance cameras, or reinforced doors and windows can reduce the risk of theft or vandalism. As a result, insurance companies may offer lower premiums to policyholders who take proactive steps to secure their properties.

External Factors and Their Impact on Insurance Costs

Beyond personal and property-related factors, external variables can also influence insurance costs. These factors are often beyond your control but can significantly impact your insurance premiums:

- Economic Conditions: Economic factors, such as inflation and interest rates, can affect insurance costs. During periods of high inflation, insurance companies may adjust their premiums to maintain profitability. Similarly, changes in interest rates can impact the cost of financing insurance policies.

- Regulatory Changes: Government regulations and industry standards can influence insurance costs. For example, changes in healthcare regulations or environmental laws may prompt insurance companies to adjust their policies and premiums to remain compliant.

- Catastrophic Events: Natural disasters, such as hurricanes, floods, or wildfires, can have a significant impact on insurance costs. Areas prone to these events may experience higher insurance premiums to account for the increased risk and potential for widespread damage.

- Insurance Company Competition: The level of competition among insurance providers can affect the cost of insurance. In highly competitive markets, insurance companies may offer lower premiums to attract customers. Conversely, in less competitive markets, insurance costs may be higher.

Understanding Insurance Premiums: A Case Study

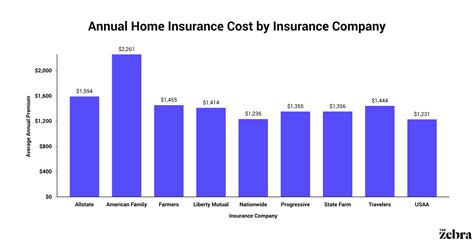

To illustrate the complexity of insurance premium calculations, let’s consider a hypothetical case study of a homeowner’s insurance policy.

| Factor | Description | Impact on Premium |

|---|---|---|

| Age of Homeowner | The homeowner is a 35-year-old professional with a stable income. | Moderate impact: Younger homeowners may pay slightly higher premiums due to their perceived higher risk. |

| Health Status | The homeowner has no pre-existing medical conditions and maintains a healthy lifestyle. | Positive impact: Good health leads to lower health insurance premiums and may also impact life insurance costs. |

| Occupation | The homeowner works as a software engineer, a relatively low-risk occupation. | Positive impact: Lower-risk occupations often result in more affordable insurance rates. |

| Driving Record | The homeowner has a clean driving record with no accidents or violations. | Positive impact: A clean driving record can lead to lower auto insurance premiums. |

| Credit Score | The homeowner has an excellent credit score of 800. | Positive impact: A high credit score can result in lower insurance costs across various policies. |

| Property Type | The homeowner lives in a single-family detached home. | Positive impact: Single-family homes are generally considered less risky than multi-family dwellings. |

| Location | The home is located in a suburban area with low crime rates and minimal natural disaster risks. | Positive impact: Lower crime rates and minimal natural disaster risks result in more affordable insurance premiums. |

| Construction and Materials | The home is constructed with fire-resistant materials and has reinforced structures. | Positive impact: Fire-resistant materials and reinforced construction can lead to lower insurance rates. |

| Security Measures | The homeowner has installed a burglar alarm and surveillance cameras. | Positive impact: Security measures can reduce the risk of theft and vandalism, leading to lower insurance costs. |

| Economic Conditions | The current economic climate is stable, with low inflation and interest rates. | Positive impact: Stable economic conditions can result in more affordable insurance premiums. |

| Regulatory Changes | There have been no recent significant regulatory changes affecting insurance policies. | Neutral impact: In the absence of major regulatory changes, insurance costs remain relatively stable. |

| Catastrophic Events | The area has a low risk of natural disasters, with no recent catastrophic events. | Positive impact: Minimal risk of natural disasters results in more affordable insurance premiums. |

In this case study, the homeowner's insurance policy is influenced by a combination of positive and neutral factors. The homeowner's personal characteristics, such as age, health, and occupation, along with the property's location and security measures, contribute to a lower-risk profile. As a result, the insurance premiums for this policy are likely to be more affordable.

Optimizing Your Insurance Costs: Tips and Strategies

While you cannot control all the factors that influence insurance costs, there are strategies you can employ to optimize your insurance expenses. Here are some tips to consider:

- Shop Around: Compare insurance quotes from multiple providers. Insurance costs can vary significantly between companies, so shopping around can help you find the most competitive rates.

- Bundle Your Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. Bundling can lead to substantial savings on your overall insurance costs.

- Increase Deductibles: Opting for higher deductibles can reduce your insurance premiums. However, it's essential to ensure that you can afford the increased out-of-pocket expenses in the event of a claim.

- Maintain a Good Credit Score: As mentioned earlier, your credit score can impact your insurance costs. Maintaining a good credit score can lead to more affordable insurance rates across various policies.

- Implement Security Measures: Enhancing the security of your property can reduce the risk of theft or damage. Installing security systems, reinforcing doors and windows, and maintaining a secure environment can lead to lower insurance premiums.

- Review Your Policies Regularly: Insurance costs and coverage needs can change over time. Regularly review your policies to ensure they align with your current circumstances and consider adjusting them as necessary.

- Consider Alternative Insurance Options: Explore different types of insurance policies and coverage options. Some insurance companies offer specialized policies or discounts for specific groups, such as seniors or members of certain professional organizations.

The Future of Insurance Costs: Trends and Predictions

The insurance industry is constantly evolving, and several trends and predictions can provide insights into the future of insurance costs. Here are some key factors to consider:

Technological Advancements

The integration of technology into the insurance industry is expected to continue. Insurtech innovations, such as telematics and digital claims processing, can lead to more efficient and accurate risk assessments. As a result, insurance companies may be able to offer more tailored and affordable policies.

Changing Risk Profiles

As society evolves, so do risk profiles. Factors such as climate change, increasing natural disasters, and changing demographic trends can impact insurance costs. Insurance companies will need to adapt their policies and premiums to address these evolving risks.

Regulatory Changes

Government regulations and industry standards play a significant role in insurance costs. Any changes in healthcare, environmental, or insurance-specific regulations can impact insurance policies and premiums. Staying informed about regulatory developments is crucial for understanding potential changes in insurance costs.

Market Competition

The level of competition among insurance providers can influence insurance costs. As the insurance market becomes more competitive, insurance companies may be incentivized to offer more affordable policies to attract customers. Monitoring market trends and comparing insurance options can help you take advantage of competitive pricing.

Conclusion: Navigating the World of Insurance Costs

Understanding the factors that influence insurance costs is the first step towards making informed decisions about your insurance coverage. By considering your personal circumstances, property characteristics, and external factors, you can estimate your insurance premiums more accurately. Remember, insurance is a vital tool for managing financial risks, and optimizing your insurance costs can lead to significant savings.

Stay informed about the latest trends and predictions in the insurance industry, and regularly review your insurance policies to ensure they align with your changing needs and circumstances. With the right knowledge and strategies, you can navigate the complex world of insurance costs and make informed choices that protect your financial well-being.

How often should I review my insurance policies?

+It is recommended to review your insurance policies annually or whenever there is a significant change in your personal or property circumstances. Regular reviews ensure that your coverage remains adequate and that you are not overpaying for unnecessary coverage.

Can I negotiate my insurance premiums?

+While insurance premiums are typically based on standardized calculations, you can still negotiate with insurance providers. Highlighting your low-risk profile, good credit score, or loyalty to the company can sometimes lead to lower premiums or additional discounts.

What is the difference between a deductible and a premium?

+A deductible is the amount you pay out of pocket before your insurance coverage kicks in. In contrast, a premium is the regular payment you make to maintain your insurance policy. Increasing your deductible can lower your premiums, but it also means you will have to pay more out of pocket if you need to make a claim.

Are there any government programs that can help reduce insurance costs?

+Some governments offer programs to assist individuals with insurance costs, especially for essential coverage like health insurance. These programs may provide subsidies or tax credits to make insurance more affordable. It’s worth exploring these options to see if you qualify.