Geico Insurance Code

The GEICO insurance code, a unique identifier in the world of auto insurance, plays a pivotal role in the insurance industry. This alphanumeric code holds significant value, impacting various aspects of the insurance process, from policy creation to claims management. In this comprehensive guide, we delve into the intricacies of the GEICO insurance code, exploring its history, purpose, and the vital role it plays in safeguarding drivers and their vehicles.

The Evolution of GEICO Insurance Codes

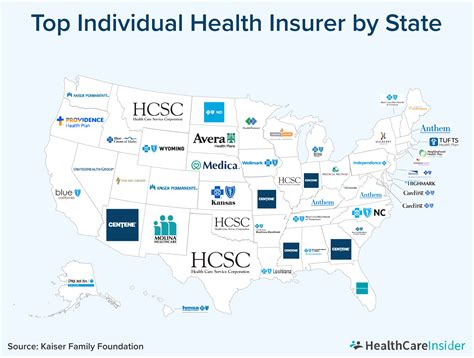

GEICO, an acronym for Government Employees Insurance Company, has a rich history dating back to 1936. Founded by Leo and Lillian Goodwin, GEICO initially catered to government employees, offering affordable insurance options. Over the decades, GEICO expanded its reach, becoming one of the largest auto insurance providers in the United States. This expansion brought about the need for a standardized and efficient system to manage policies, leading to the development of the GEICO insurance code.

The insurance code system, introduced in the late 20th century, revolutionized GEICO's operations. It provided a streamlined approach to policy management, allowing for quick identification and retrieval of policy details. Each code, a unique combination of letters and numbers, became a digital fingerprint for every policyholder, containing crucial information about the insured vehicle, driver details, and policy specifics.

Understanding the GEICO Insurance Code Structure

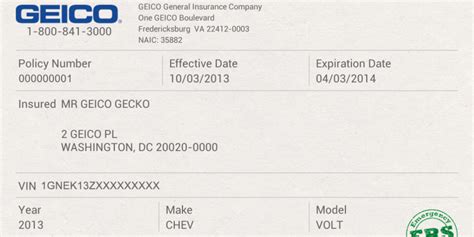

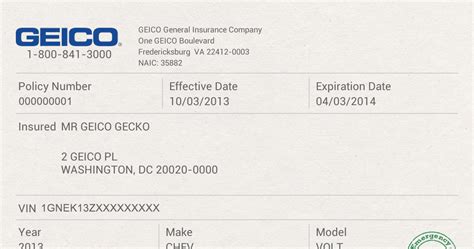

A GEICO insurance code typically consists of a combination of letters and numbers, arranged in a specific format. While the exact structure may vary based on policy type and other factors, the code generally adheres to a standardized format. For instance, a sample code could be ABC1234567890, where ABC represents a unique identifier for the policyholder, and the subsequent numbers provide additional details about the policy.

The code's structure is designed to offer a high level of specificity. Each character within the code carries meaning, allowing GEICO's systems to quickly interpret and process the information. This level of detail ensures efficient policy management, claim processing, and overall customer service.

| Code Component | Description |

|---|---|

| Letters (e.g., ABC) | Unique identifier for the policyholder. |

| Numbers (e.g., 1234567890) | Contains policy details, vehicle information, and more. |

The Role of Insurance Codes in Policy Management

Insurance codes are at the heart of GEICO’s policy management system. When a customer purchases an insurance policy, a unique code is generated and associated with their policy. This code serves as a reference point for all future interactions, whether it’s policy updates, renewals, or claims.

For instance, when a policyholder contacts GEICO's customer service, the representative can quickly locate their policy using the insurance code. This enables a swift resolution to any queries or issues, ensuring a high level of customer satisfaction.

Policy Updates and Renewals

As policy details change over time, the insurance code remains a constant reference. Whether it’s an update to vehicle specifications, a change in driver information, or a policy renewal, the code ensures that all relevant details are easily accessible. This streamlined approach saves time and reduces administrative burdens, benefiting both GEICO and its policyholders.

Claims Management

In the event of an accident or incident, the insurance code becomes a critical tool for claims management. It allows GEICO’s claims adjusters to quickly access the necessary policy information, speeding up the claims process. The code’s specificity ensures that the correct policy and coverage details are considered, leading to more accurate and efficient claims settlements.

The Impact of Technology on Insurance Codes

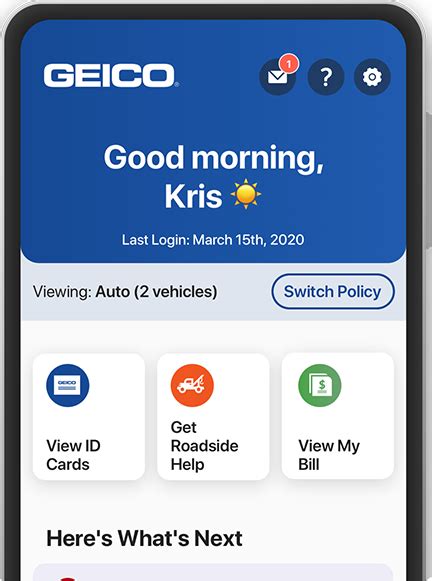

The digital revolution has transformed the insurance industry, and GEICO has embraced these advancements to enhance its services. The introduction of online platforms and mobile apps has made insurance codes even more accessible and convenient.

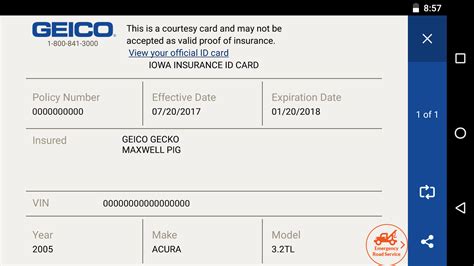

Policyholders can now easily access their insurance codes and policy details through secure online portals. This digital accessibility empowers customers to manage their policies independently, reducing the need for frequent customer service interactions. Additionally, GEICO's mobile app allows policyholders to have their insurance code and policy information readily available, facilitating quick and efficient claims processes.

Data Security and Privacy

With the increased digital presence, GEICO has invested significantly in data security and privacy measures. The insurance codes are encrypted and stored in secure databases, ensuring that policyholder information remains confidential. Advanced security protocols protect against unauthorized access, safeguarding customer data and maintaining trust.

Future Implications and Innovations

As technology continues to advance, GEICO is exploring new ways to enhance its insurance code system. Artificial Intelligence (AI) and Machine Learning (ML) are being leveraged to further optimize policy management and claims processes. These technologies can analyze vast amounts of data, including insurance codes, to identify patterns and trends, leading to more efficient and accurate decision-making.

Furthermore, GEICO is exploring blockchain technology to enhance data security and transparency. Blockchain's distributed ledger system can provide an immutable record of policy transactions, ensuring data integrity and reducing the risk of fraud. This innovative approach could revolutionize the insurance industry, setting new standards for data management and security.

How can I find my GEICO insurance code?

+Your GEICO insurance code is typically found on your insurance card. It's a unique combination of letters and numbers and is also available through your online account or the GEICO mobile app.

What happens if my insurance code is lost or forgotten?

+If you misplace your insurance code, you can easily retrieve it by logging into your GEICO online account or by contacting GEICO's customer service. They can provide you with your code and any other policy-related information.

Can my insurance code be used to access my personal information?

+No, your insurance code is not a direct access point to your personal information. It is a unique identifier for your policy and is used primarily for internal GEICO processes. Your personal information is securely stored and protected, and GEICO takes data privacy seriously.

In conclusion, the GEICO insurance code is a powerful tool that underpins the company’s efficient and customer-centric approach to auto insurance. From policy management to claims settlements, the code ensures a seamless and secure experience for policyholders. As GEICO continues to innovate and embrace technological advancements, the insurance code system is set to become even more robust and integral to the company’s success.