Health Insurance Provider

In the complex world of healthcare, understanding your options for coverage is essential. This comprehensive guide will delve into the world of health insurance providers, exploring their vital role in ensuring access to quality healthcare services. From the fundamentals of health insurance to the diverse range of providers and their unique offerings, we will uncover the key aspects that impact your healthcare journey.

Health insurance is a critical component of modern healthcare systems, providing financial protection and access to essential medical services. With the right coverage, individuals and families can navigate the healthcare landscape with confidence, knowing that their well-being is a top priority. This article aims to demystify the world of health insurance providers, shedding light on their operations, benefits, and the factors to consider when choosing the right provider for your needs.

Understanding Health Insurance Providers

Health insurance providers, often referred to as carriers, are organizations that offer a range of health insurance plans to individuals, families, and groups. These plans serve as a financial safety net, covering a wide array of medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care services.

The primary goal of health insurance providers is to make healthcare more accessible and affordable. By pooling resources from a large number of policyholders, carriers can negotiate rates with healthcare providers and manage the overall cost of care. This system ensures that individuals can access necessary medical services without facing unaffordable out-of-pocket expenses.

Key Functions of Health Insurance Providers

- Plan Design and Development: Health insurance providers create a variety of plan options to cater to different needs and budgets. These plans may include different networks of providers, coverage limits, and cost-sharing structures.

- Risk Assessment and Underwriting: Carriers assess the health risks of potential policyholders to determine premiums. This process involves evaluating medical histories and demographic factors to ensure the financial sustainability of the plan.

- Claims Processing: When policyholders receive medical services, they submit claims to their insurance provider. The carrier then processes these claims, verifying eligibility and coverage, and reimbursing healthcare providers accordingly.

- Network Management: Many health insurance providers maintain networks of preferred healthcare providers, offering discounted rates to policyholders. Managing these networks is a crucial aspect of controlling costs and ensuring quality care.

- Member Services: Insurance providers offer a range of support services to policyholders, including assistance with plan enrollment, claim submissions, and answering questions about coverage and benefits.

Types of Health Insurance Providers

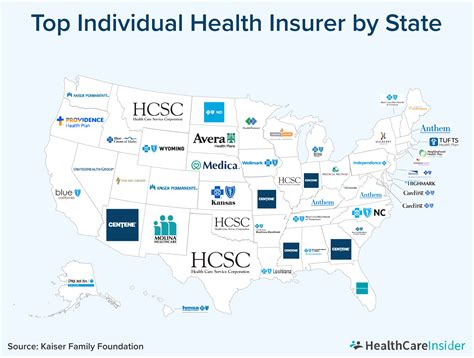

The health insurance landscape is diverse, with various types of providers offering different approaches to coverage. Understanding these distinctions is essential when choosing the right provider for your needs.

Commercial Health Insurance Companies

These are private, for-profit organizations that offer a wide range of health insurance plans to individuals, families, and employers. Commercial insurers often have extensive networks of providers and may offer plans through both the individual and group markets. They are known for their competitive pricing and innovative plan designs.

Examples of commercial health insurance companies include:

- UnitedHealthcare: One of the largest health insurance providers in the United States, offering a comprehensive range of plans, including PPOs, HMOs, and Medicare Advantage plans.

- Blue Cross Blue Shield: A well-known and trusted name in health insurance, offering plans across the country with a focus on local and regional coverage.

- Cigna: Known for its global reach and innovative digital health initiatives, Cigna provides health insurance plans in multiple countries.

Non-Profit Health Insurance Providers

Unlike commercial insurers, non-profit health insurance providers operate with a mission-driven focus rather than a profit motive. They often have a more community-oriented approach and may prioritize access to care for underserved populations. Non-profit providers may also reinvest their profits into improving healthcare services and community health initiatives.

Notable non-profit health insurance providers include:

- Kaiser Permanente: A leading integrated healthcare system in the United States, offering both health insurance and direct healthcare services through its network of hospitals and clinics.

- HealthPartners: Based in the Upper Midwest, HealthPartners is a consumer-governed, non-profit health insurer and care delivery system, known for its focus on patient-centered care.

- Harvard Pilgrim Health Care: A non-profit organization serving members in New England, offering a range of health insurance plans and emphasizing preventive care and wellness.

Government-Sponsored Health Insurance Programs

Government-sponsored health insurance programs are a crucial component of the healthcare system, providing coverage to specific populations based on eligibility criteria. These programs are typically funded and administered by federal, state, or local governments.

- Medicare: A federal program providing health insurance coverage to individuals aged 65 and older, as well as certain younger people with disabilities. Medicare is divided into several parts, including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage).

- Medicaid: A joint federal and state program that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Medicaid coverage and eligibility criteria vary from state to state.

- Children's Health Insurance Program (CHIP): CHIP provides low-cost health coverage to children in families that earn too much to qualify for Medicaid but cannot afford private coverage. CHIP is administered by individual states, which set their own guidelines for eligibility and benefits.

Factors to Consider When Choosing a Health Insurance Provider

Selecting the right health insurance provider is a crucial decision that can significantly impact your healthcare experience. Here are some key factors to consider when evaluating your options:

Network of Providers

The network of healthcare providers associated with a health insurance plan is a critical consideration. Ensure that your preferred doctors, specialists, and hospitals are included in the plan’s network to avoid out-of-network charges or the hassle of finding new providers.

Plan Benefits and Coverage

Review the specific benefits and coverage details of each plan. Consider factors such as deductibles, copayments, coinsurance, and out-of-pocket maximums. Understand what services are covered and any exclusions or limitations. Look for plans that align with your anticipated healthcare needs and budget.

Premium Costs

Premiums are the regular payments you make to maintain your health insurance coverage. Evaluate the premium costs in relation to your budget and the level of coverage provided. Keep in mind that lower premiums may come with higher out-of-pocket expenses, so strike a balance that suits your financial situation.

Provider Reputation and Service Quality

Research the reputation and service quality of the health insurance provider. Look for reviews and ratings from current and past policyholders to gauge their satisfaction with the carrier’s customer service, claim processing, and overall experience. A provider with a strong reputation for excellent service can provide added peace of mind.

Digital Tools and Resources

In today’s digital age, many health insurance providers offer online portals, mobile apps, and other digital tools to enhance the member experience. These tools can provide convenient access to your policy information, claims history, and other valuable resources. Consider the availability and usability of these digital offerings when choosing a provider.

Future Trends in Health Insurance

The health insurance industry is continually evolving to meet the changing needs of consumers and the healthcare system. Here are some key trends shaping the future of health insurance:

Value-Based Care Models

Value-based care models are gaining traction as a way to improve patient outcomes and reduce costs. These models incentivize healthcare providers to deliver high-quality, cost-effective care by linking a portion of their reimbursement to patient health outcomes. This shift is expected to drive more efficient and coordinated care, benefiting both patients and insurers.

Telehealth and Digital Health Solutions

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is likely to continue. Health insurance providers are increasingly covering telehealth visits, recognizing the convenience and accessibility they offer. Additionally, digital health solutions, such as mobile health apps and remote monitoring devices, are becoming more integrated into healthcare plans.

Consumer-Driven Health Plans

Consumer-driven health plans (CDHPs) are gaining popularity as a way to give individuals more control over their healthcare choices. These plans typically have higher deductibles, but they are often paired with health savings accounts (HSAs) or health reimbursement arrangements (HRAs) that allow individuals to save and spend pre-tax dollars on qualified medical expenses. CDHPs can be an attractive option for those who prefer more flexibility and control over their healthcare spending.

Focus on Preventive Care

Health insurance providers are increasingly recognizing the importance of preventive care in maintaining overall health and reducing long-term healthcare costs. Many plans now offer incentives and reduced cost-sharing for preventive services, such as annual check-ups, immunizations, and screenings. This trend is expected to continue as insurers seek to promote healthier lifestyles and reduce the incidence of chronic diseases.

Integration of Mental Health and Substance Use Disorder Coverage

There is a growing recognition of the importance of addressing mental health and substance use disorders as integral components of overall healthcare. Health insurance providers are increasingly offering expanded coverage for mental health services and substance use disorder treatment, often with reduced cost-sharing and improved access to specialized care.

Conclusion

Navigating the world of health insurance providers can be a complex task, but understanding your options is essential for making informed decisions about your healthcare coverage. By considering factors such as provider networks, plan benefits, and cost, you can find a health insurance plan that aligns with your needs and budget. Remember, your health insurance provider is a partner in your healthcare journey, and choosing the right one can make a significant difference in your overall well-being.

Frequently Asked Questions

How do I choose the right health insurance plan for my needs?

+Selecting the right health insurance plan involves evaluating your healthcare needs, budget, and the providers you prefer. Consider factors like network coverage, plan benefits, and cost. Review the plan’s coverage for your anticipated medical services, and ensure it aligns with your financial situation. It’s also beneficial to research the provider’s reputation and service quality to ensure a positive experience.

What are the key differences between commercial and non-profit health insurance providers?

+Commercial health insurance providers are for-profit organizations focused on offering a range of plans to individuals, families, and employers. They often prioritize competitive pricing and innovative plan designs. Non-profit providers, on the other hand, operate with a mission-driven approach, prioritizing access to care for underserved populations and reinvesting profits into community health initiatives. Non-profits may have a more localized focus and a reputation for patient-centered care.

How can I compare health insurance plans to find the best value?

+Comparing health insurance plans involves evaluating key factors such as network coverage, plan benefits, and cost. Look for plans that align with your healthcare needs and budget. Compare deductibles, copayments, and out-of-pocket maximums to understand the financial implications. Research the provider’s reputation and member satisfaction to ensure a positive experience. Additionally, consider the availability of digital tools and resources that can enhance your overall healthcare journey.

What is the role of government-sponsored health insurance programs like Medicare and Medicaid?

+Government-sponsored health insurance programs, such as Medicare and Medicaid, play a crucial role in providing coverage to specific populations based on eligibility criteria. Medicare caters to individuals aged 65 and older, as well as those with certain disabilities, offering hospital insurance, medical insurance, and prescription drug coverage. Medicaid, on the other hand, provides health coverage to eligible low-income individuals and families, with eligibility and benefits varying by state. These programs ensure access to healthcare for vulnerable populations.