Marketplace For Health Insurance

Exploring the Marketplace for Health Insurance: Navigating Options and Benefits

In today's dynamic healthcare landscape, understanding the intricacies of health insurance is paramount. The introduction of online marketplaces has revolutionized the way individuals and families access and compare health plans, empowering them to make informed decisions about their healthcare coverage. This article delves into the concept of the health insurance marketplace, shedding light on its workings, benefits, and the critical role it plays in ensuring accessible and affordable healthcare.

The Evolution of Health Insurance Marketplaces

The journey towards a streamlined and accessible health insurance system began with the Affordable Care Act (ACA), enacted in 2010. This landmark legislation aimed to address the challenges of unaffordable and inadequate healthcare coverage faced by millions of Americans. A key component of the ACA was the establishment of health insurance marketplaces, also known as exchanges, which have since become pivotal platforms for individuals to compare and purchase health plans.

The initial rollout of these marketplaces faced some challenges, but over the years, they have evolved significantly, becoming more user-friendly and efficient. Today, these platforms are vital tools, offering a transparent and organized way for individuals to navigate the complex world of health insurance.

How Health Insurance Marketplaces Work

At its core, a health insurance marketplace serves as a centralized platform where individuals, families, and small businesses can shop for and compare health insurance plans. These marketplaces are typically operated by state governments or, in some cases, the federal government. They offer a wide range of qualified health plans (QHPs) from various insurance carriers, providing a diverse selection to cater to different needs and preferences.

The enrollment process on these marketplaces is straightforward. Individuals can create an account, input their personal details, and browse through the available plans. The platform provides detailed information about each plan, including coverage details, provider networks, and costs. This transparency allows users to make well-informed choices based on their specific healthcare needs and financial considerations.

Key Features of Health Insurance Marketplaces

- Plan Comparison Tools: Marketplaces offer advanced search and comparison features, allowing users to filter plans based on various criteria such as cost, coverage, and provider networks. This ensures that individuals can find plans that align with their unique requirements.

- Income-Based Premium Subsidies: One of the significant advantages of health insurance marketplaces is the availability of income-based premium subsidies. Eligible individuals can receive financial assistance, making healthcare coverage more affordable. The platform calculates these subsidies based on income and family size, providing an accurate estimate during the enrollment process.

- Special Enrollment Periods: Beyond the annual open enrollment period, health insurance marketplaces offer special enrollment periods for qualifying life events such as marriage, birth or adoption of a child, or loss of other health coverage. This flexibility ensures that individuals can access coverage when they need it most.

Benefits of Utilizing Health Insurance Marketplaces

The implementation of health insurance marketplaces has brought about a multitude of benefits for consumers, insurers, and the healthcare system as a whole. Here’s a deeper look at these advantages:

Enhanced Consumer Empowerment

Health insurance marketplaces have transformed the way individuals interact with the healthcare system. By providing a user-friendly platform, these marketplaces empower consumers to take an active role in their healthcare decisions. Users can easily compare plans, understand their coverage options, and make choices that best suit their needs. This shift towards informed decision-making has led to increased consumer satisfaction and control over their healthcare journey.

Increased Access to Affordable Coverage

One of the primary goals of the ACA was to expand access to affordable healthcare. Health insurance marketplaces play a crucial role in achieving this objective. Through the availability of income-based premium subsidies, many individuals and families can now afford comprehensive health coverage. These marketplaces ensure that those with lower incomes are not excluded from accessing quality healthcare, fostering a more equitable healthcare system.

Improved Plan Transparency and Comparison

Prior to the implementation of health insurance marketplaces, individuals often faced challenges when comparing health plans. Plans were often sold directly by insurance companies, making it difficult to compare features and costs across providers. Marketplaces have addressed this issue by centralizing plan information and providing detailed comparisons. This transparency ensures that consumers can make informed choices, leading to better overall satisfaction with their health coverage.

Efficient Enrollment and Renewal Processes

The online nature of health insurance marketplaces has streamlined the enrollment and renewal processes. Users can complete these tasks from the comfort of their homes, eliminating the need for physical paperwork and lengthy in-person interactions. This efficiency not only saves time but also reduces administrative burdens for both consumers and insurance providers.

Support for Small Businesses

Health insurance marketplaces also cater to small businesses, providing them with a platform to offer health coverage to their employees. This support is particularly beneficial for small businesses that may have limited resources and expertise in navigating the complex world of health insurance. Marketplaces offer a simplified process for small businesses to compare and select plans, ensuring they can provide valuable benefits to their workforce.

Performance and Impact Analysis

The success of health insurance marketplaces can be gauged through various metrics and impact assessments. According to recent data from the Centers for Medicare & Medicaid Services (CMS), the number of individuals enrolled in health insurance plans through marketplaces has steadily increased over the years. This trend suggests that marketplaces are effectively reaching and serving their target populations.

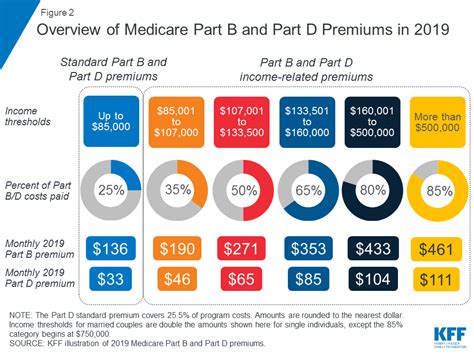

Additionally, a study by the Kaiser Family Foundation revealed that a significant proportion of enrollees on health insurance marketplaces qualify for premium subsidies. This highlights the critical role of marketplaces in making healthcare coverage accessible to those with lower incomes. The study also found that a majority of enrollees expressed satisfaction with their chosen plans, indicating a positive user experience.

From a broader perspective, health insurance marketplaces have contributed to a more stable and competitive healthcare insurance market. By providing a platform for multiple insurers to offer their plans, marketplaces foster competition, leading to improved plan quality and potentially lower costs for consumers. This market competition also incentivizes insurers to innovate and offer more comprehensive and tailored coverage options.

Future Implications and Potential Innovations

As health insurance marketplaces continue to evolve, there are several exciting possibilities for the future. One area of focus is the integration of advanced technology to further enhance the user experience. This could include the development of personalized recommendation engines that consider an individual’s specific healthcare needs and preferences, guiding them towards the most suitable plans.

Furthermore, the potential for data-driven insights and analytics on marketplaces offers immense value. By analyzing enrollment patterns, plan utilization, and consumer feedback, policymakers and insurers can identify trends and gaps in the market. This data-driven approach can inform policy decisions and lead to more effective healthcare reforms, ultimately benefiting consumers.

Another avenue for exploration is the expansion of health insurance marketplaces to include additional services and benefits. For instance, integrating dental, vision, and even wellness programs into these platforms could provide a more holistic approach to healthcare coverage. This comprehensive offering would not only improve the overall health of individuals but also attract a wider range of consumers.

Conclusion: A Transformative Tool for Healthcare Access

Health insurance marketplaces have emerged as a transformative force in the healthcare landscape, empowering individuals to take control of their healthcare decisions. Through their user-friendly platforms, transparent plan comparisons, and income-based subsidies, these marketplaces have made healthcare coverage more accessible and affordable. As they continue to evolve and innovate, health insurance marketplaces are poised to play an even more critical role in shaping a healthier and more equitable future for all.

How do I know if I qualify for premium subsidies on a health insurance marketplace?

+

Eligibility for premium subsidies on health insurance marketplaces is primarily determined by your income level. Generally, if your household income falls within a certain range, you may qualify for financial assistance. This range varies by state and family size. During the enrollment process, the marketplace platform will calculate your estimated premium subsidies based on your reported income.

Can I switch health plans during the year on a marketplace?

+

In most cases, health insurance plans on marketplaces are selected during the annual open enrollment period. However, there are special enrollment periods that allow you to switch plans outside of this window if you experience certain qualifying life events, such as losing other health coverage, getting married, or having a baby. It’s important to check the specific guidelines and deadlines for special enrollment periods in your state.

What happens if I don’t enroll in a health plan during the open enrollment period?

+

If you miss the open enrollment period and do not qualify for a special enrollment period, you may face a coverage gap and potentially incur a penalty fee. It’s important to stay informed about the enrollment deadlines and take advantage of the available opportunities to ensure you have continuous health coverage.