Free Online Car Insurance Quote

Welcome to our comprehensive guide on understanding and navigating the process of obtaining a free online car insurance quote. In today's digital age, insurance providers have embraced the convenience of online platforms, making it easier than ever to compare policies and find the best coverage for your vehicle. This article will delve into the ins and outs of online car insurance quotes, exploring the benefits, the steps involved, and the key factors to consider to ensure you make an informed decision.

The Rise of Online Car Insurance Quotes: A Game-Changer for Drivers

The traditional method of seeking car insurance quotes involved visiting local insurance agents or making phone calls, often resulting in a time-consuming and cumbersome process. However, with the advent of online insurance platforms, drivers now have the power to compare multiple quotes within minutes, empowering them to make more informed choices and potentially save significant sums on their insurance premiums.

Online car insurance quotes have revolutionized the industry, offering unparalleled convenience and transparency. Drivers can now access a wealth of information and compare various policy options from the comfort of their homes, eliminating the need for tedious paperwork and physical visits. This shift towards digital insurance services has not only streamlined the process but has also fostered a more competitive environment, driving down costs and enhancing overall customer satisfaction.

Understanding the Online Car Insurance Quote Process

The online car insurance quote process is designed to be straightforward and user-friendly. Here’s a step-by-step breakdown to guide you through the journey:

Step 1: Research and Select Reputable Insurance Providers

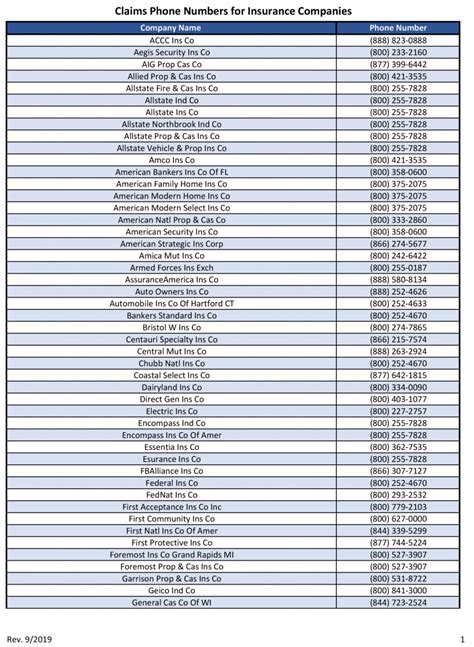

Begin by identifying a list of reputable insurance companies that offer online quote services. Look for established brands with a solid track record and positive customer reviews. Consider factors such as financial stability, customer service ratings, and the range of coverage options they provide.

Researching multiple providers allows you to compare their offerings and choose the ones that align best with your specific needs. Online review platforms and industry rankings can be valuable resources to assess the reputation and reliability of different insurance companies.

Step 2: Gather Essential Information

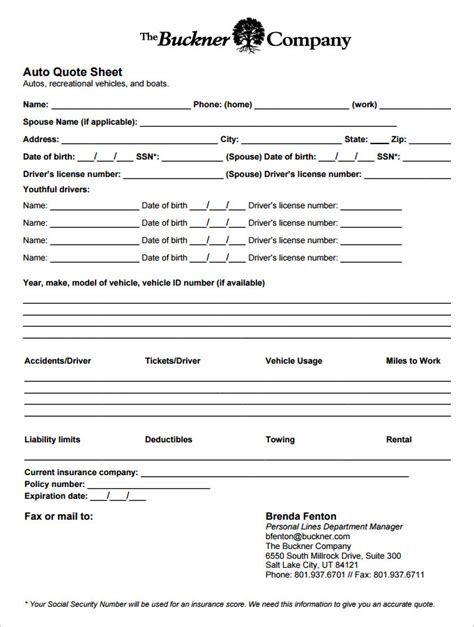

To obtain an accurate quote, you’ll need to gather some essential information about yourself, your vehicle, and your driving history. Here’s a checklist of details you’ll typically require:

- Personal Information: Your full name, date of birth, and contact details.

- Vehicle Details: Make, model, year, and VIN (Vehicle Identification Number) of your car.

- Driving History: Information on any previous accidents, traffic violations, and claims.

- Coverage Preferences: Decide on the types and levels of coverage you require, such as liability, collision, comprehensive, and additional perks like rental car coverage or roadside assistance.

- Usage Patterns: Estimate the annual mileage you drive and the primary purpose of your vehicle (e.g., commuting, business, pleasure)

Step 3: Visit Insurance Provider Websites

Navigate to the websites of the insurance providers you’ve shortlisted. Look for dedicated pages or sections where you can request a quote. These pages are often designed with user-friendly interfaces, making it simple to input your details and receive a quote.

Step 4: Provide Accurate Information

When filling out the online quote form, ensure that you provide accurate and truthful information. Insurance companies rely on the data you provide to assess your risk profile and determine your premium. Any discrepancies or misrepresentations could lead to issues later on, such as policy cancellations or denied claims.

Step 5: Compare Quotes and Choose the Best Option

After obtaining quotes from multiple providers, it’s time to compare and analyze. Consider not just the premium amount but also the coverage limits, deductibles, and any additional perks or discounts offered. Assess the financial stability and customer service reputation of each provider to ensure you’re choosing a reliable company.

Remember, the cheapest quote may not always be the best option. It's crucial to strike a balance between cost and comprehensive coverage that suits your needs. Online comparison tools and insurance calculators can be handy resources to assist you in this evaluation process.

Key Factors to Consider When Choosing an Online Car Insurance Quote

While obtaining multiple quotes is a great starting point, there are several other factors to contemplate to ensure you select the right car insurance policy. Here are some crucial considerations:

Coverage Options and Customization

Different drivers have unique needs, and a one-size-fits-all policy might not cater to everyone. Look for insurance providers that offer customizable coverage options. This allows you to tailor your policy to your specific requirements, whether it’s higher liability limits, additional coverage for specific scenarios, or perks like gap insurance or rental car coverage.

Discounts and Savings Opportunities

Insurance companies often provide various discounts to attract and retain customers. These discounts can significantly reduce your premium. Some common discounts include:

- Multi-Policy Discounts: Insuring multiple vehicles or combining car insurance with other policies (like home or life insurance) often results in savings.

- Safe Driver Discounts: If you have a clean driving record, many insurers offer discounts for safe and accident-free driving.

- Good Student Discounts: Some providers offer reduced premiums for young drivers who maintain good grades in school.

- Loyalty Discounts: Staying with the same insurer for an extended period may lead to loyalty rewards and reduced rates.

- Usage-Based Insurance (UBI) Discounts: Certain insurers offer discounts based on your actual driving behavior, monitored through telematics devices or apps.

Customer Service and Claims Handling

While premiums and coverage are crucial, don’t overlook the importance of excellent customer service and efficient claims handling. Research the insurer’s reputation for customer satisfaction and claims resolution. Look for providers with a track record of prompt and fair claim settlements, as this can be critical in times of need.

Financial Stability and Reputation

Choosing a financially stable insurance company is essential to ensure they can honor their commitments and pay out claims promptly. Look for providers with strong financial ratings from reputable agencies like Standard & Poor’s or AM Best. Additionally, consider their market reputation and customer reviews to gauge their overall reliability and trustworthiness.

Online Car Insurance Quotes: Benefits and Considerations

Obtaining free online car insurance quotes offers a multitude of advantages, but it’s important to be aware of certain considerations as well. Let’s explore the pros and cons of this digital insurance landscape:

Advantages of Online Car Insurance Quotes

- Convenience: The ability to obtain quotes from the comfort of your home or office, at any time, is a significant advantage. It saves time and effort compared to traditional methods.

- Transparency: Online platforms provide a clear and detailed breakdown of coverage options, premiums, and policy terms, allowing you to make informed choices.

- Comparison Shopping: With multiple quotes at your fingertips, you can easily compare different policies and insurers, ensuring you get the best value for your money.

- Competitive Pricing: The online market fosters competition among insurers, often resulting in more competitive pricing and better deals for consumers.

- Flexibility: Online quotes allow you to customize your coverage, choosing the options that suit your specific needs and budget.

Considerations for Online Car Insurance Quotes

- Data Privacy: When providing personal information online, ensure the website is secure and has robust data protection measures in place to safeguard your privacy.

- Accuracy of Information: It’s crucial to provide accurate details when requesting quotes. Inaccurate information could lead to issues later on and potentially affect your coverage.

- Hidden Costs: Always read the fine print to understand any potential hidden costs or additional fees that may not be immediately apparent in the initial quote.

- Policy Exclusions: Be aware of policy exclusions and limitations. Some insurers may have specific restrictions or conditions that could impact your coverage in certain scenarios.

- Customer Service Availability: While online quotes are convenient, some drivers may prefer the personal touch of a local agent. Consider your preferences and whether you need in-person assistance for certain aspects of your insurance needs.

Maximizing Your Savings with Online Car Insurance Quotes

Online car insurance quotes are a powerful tool for drivers seeking the best value for their insurance premiums. By following these tips, you can optimize your savings and ensure you’re getting the most out of your policy:

Shop Around and Compare

Don’t settle for the first quote you receive. Obtain multiple quotes from different providers to get a comprehensive view of the market. Online comparison tools can streamline this process, allowing you to see various options side by side.

Consider Bundling Policies

If you have multiple insurance needs, such as home, life, or health insurance, consider bundling your policies with the same provider. Many insurers offer discounts when you combine multiple policies, resulting in significant savings.

Review Your Coverage Regularly

Insurance needs can change over time. Regularly review your coverage to ensure it still aligns with your current circumstances and requirements. As your life evolves, you may need to adjust your policy to reflect new vehicles, drivers, or changes in your usage patterns.

Explore Discounts and Promotions

Insurance companies often run promotions or offer special discounts to attract new customers. Stay informed about these opportunities and take advantage of them when applicable. Some providers may offer discounts for early renewal or for referring friends and family.

Maintain a Clean Driving Record

Insurance companies reward safe driving habits. Strive to maintain a clean driving record by avoiding accidents and traffic violations. A spotless driving history can lead to significant savings on your premiums over time.

The Future of Online Car Insurance Quotes

The landscape of online car insurance quotes is constantly evolving, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of this industry:

Artificial Intelligence and Personalized Quotes

Artificial Intelligence (AI) is poised to play a significant role in the insurance industry. AI-powered algorithms can analyze vast amounts of data, including driving behavior, to provide highly personalized quotes. This technology can offer more accurate risk assessments and tailored coverage options, benefiting both insurers and consumers.

Telematics and Usage-Based Insurance

Usage-Based Insurance (UBI) is gaining traction, with insurers leveraging telematics devices or smartphone apps to monitor driving behavior. This real-time data collection allows insurers to offer discounts or incentives based on safe driving habits. UBI can encourage safer driving practices and provide a more accurate assessment of individual risk profiles.

Blockchain Technology for Secure Transactions

Blockchain technology has the potential to revolutionize the insurance industry by enhancing security and transparency. It can be used to securely store and verify insurance policies, claims, and other critical data, reducing the risk of fraud and streamlining the claims process.

Digital Assistant Integration

The integration of digital assistants, such as Amazon Alexa or Google Assistant, into the insurance process is on the horizon. Drivers may soon be able to request quotes, manage policies, and even file claims using voice commands, further simplifying the insurance experience.

Conclusion: Empowering Drivers with Knowledge

Obtaining a free online car insurance quote is a powerful tool for drivers seeking the best coverage at the most competitive prices. By understanding the process, considering key factors, and leveraging the advantages of online quotes, you can make informed decisions and maximize your savings. Remember, insurance is a critical aspect of vehicle ownership, and choosing the right policy can provide peace of mind and financial protection in the event of an accident or unforeseen circumstances.

As the insurance industry continues to evolve, staying informed about the latest trends and technologies can help you stay ahead of the curve and make the most of your insurance choices. Whether you're a seasoned driver or a first-time car owner, the knowledge and insights gained from exploring online car insurance quotes can empower you to take control of your insurance journey and ensure you're adequately protected on the road.

How accurate are online car insurance quotes?

+Online car insurance quotes are typically quite accurate, as they are generated based on the information you provide. However, it’s important to note that the final premium may vary slightly once the insurer verifies your details and assesses your specific risk profile. Always review the quote carefully and clarify any discrepancies with the insurer.

Can I customize my car insurance policy online?

+Yes, many online insurance platforms allow you to customize your policy by choosing different coverage levels, deductibles, and additional perks. This flexibility ensures you can tailor your policy to your specific needs and budget.

What if I have a less-than-perfect driving record?

+If you have a history of accidents or traffic violations, it’s still beneficial to obtain online quotes. While your premiums may be higher, you can compare options to find the most affordable coverage for your situation. Additionally, some insurers offer programs or discounts to help drivers with less-than-perfect records improve their insurance profiles over time.

How often should I review and update my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever there are significant changes in your life or driving circumstances. This ensures your coverage remains adequate and aligned with your needs. Regular reviews can also help you take advantage of any new discounts or promotions offered by your insurer.

Are there any downsides to online car insurance quotes?

+While online car insurance quotes offer many advantages, there are a few considerations. It’s important to ensure the website is secure and your data is protected. Additionally, providing accurate information is crucial to avoid potential issues later on. Always read the fine print to understand any exclusions or limitations, and consider your preferences for customer service and claims handling, as some drivers may prefer the personal touch of a local agent.