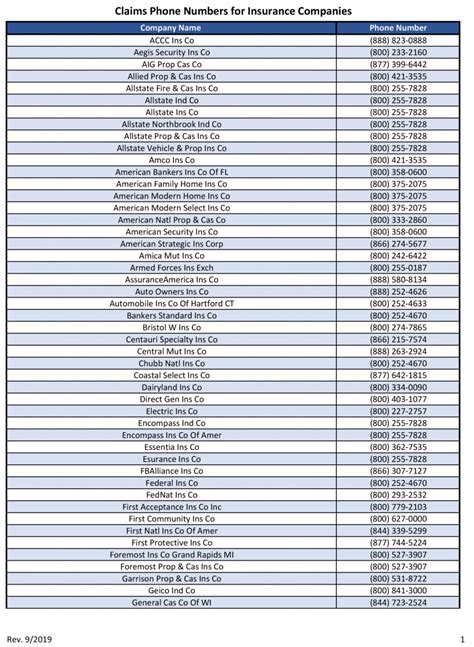

The General Insurance Claims Phone Number

When it comes to insurance claims, having easy access to the right phone number is crucial for policyholders. In today's fast-paced world, the ability to quickly reach out and connect with your insurance provider can make all the difference, especially during unexpected situations or emergencies. In this comprehensive guide, we will delve into the world of general insurance claims, providing you with the essential phone number you need to know and exploring the process of making a successful claim.

Understanding the Importance of the General Insurance Claims Phone Number

The general insurance claims phone number serves as a direct line of communication between policyholders and their insurance providers. It is a critical contact point, especially when it comes to reporting claims, seeking assistance, or obtaining guidance during the claims process. Having this number readily available can streamline the entire experience, ensuring a faster and more efficient resolution to your insurance-related queries and concerns.

Imagine this scenario: you've been involved in a car accident, and your vehicle has sustained significant damage. In such a situation, having the general insurance claims phone number at your fingertips can be a lifeline. By reaching out to your insurance provider promptly, you can initiate the claims process, receive guidance on the necessary steps, and potentially expedite the repair or replacement of your vehicle. This timely action can minimize the impact of the accident and help you get back on the road sooner.

The Role of the General Insurance Claims Department

The general insurance claims department is the dedicated team within insurance companies that handles and processes claims made by policyholders. These professionals are trained to assess and evaluate various types of insurance claims, ranging from auto accidents to property damage, health-related incidents, and more. Their expertise lies in ensuring a fair and efficient claims process, providing policyholders with the support and compensation they deserve.

Within the claims department, you'll find a range of specialized roles. Adjusters, for instance, are responsible for investigating and evaluating the extent of the loss or damage. They collect evidence, review relevant documentation, and assess the validity of the claim. Once the claim is approved, the adjuster works closely with the policyholder to ensure a smooth and timely resolution. Other roles within the claims department include claims examiners, who review and approve smaller claims, and claims managers, who oversee the entire process and ensure compliance with company policies and regulations.

Step-by-Step Guide: Making a Successful General Insurance Claim

Now that we understand the significance of the general insurance claims phone number and the role of the claims department, let’s explore the step-by-step process of making a successful insurance claim.

Step 1: Report the Claim

The first step in the claims process is to report the incident to your insurance provider. This can be done by calling the general insurance claims phone number or by using the online claims reporting system, if available. When reporting the claim, provide as much detail as possible about the incident, including the date, time, location, and any relevant circumstances. Be prepared to answer questions and provide supporting documentation, such as photographs or police reports, to assist in the claims assessment.

For example, let's say you've experienced a break-in at your home, resulting in property damage and the theft of valuable items. In this case, you would contact your insurance provider's claims department and provide them with the necessary details. The claims adjuster will guide you through the process, explaining the documentation required and any specific steps you need to take to ensure a smooth claims resolution.

Step 2: Claims Assessment and Investigation

Once you’ve reported the claim, the insurance company’s claims department will initiate the assessment and investigation process. This step is crucial as it helps determine the validity and extent of the claim. The adjuster will review the information provided, assess the damage or loss, and gather any additional evidence needed to support the claim. They may request further documentation, such as repair estimates or medical reports, to ensure a comprehensive understanding of the situation.

During the investigation, the adjuster may visit the site of the incident, inspect the damaged property, and interview witnesses or relevant parties. This thorough process ensures that the insurance company has all the necessary information to make an informed decision regarding the claim. It also allows them to identify any potential fraud or discrepancies, safeguarding both the policyholder and the insurance provider.

Step 3: Approval and Settlement

After a thorough assessment and investigation, the insurance company will make a decision regarding your claim. If the claim is approved, the adjuster will work with you to determine the appropriate settlement amount. This may involve reviewing repair estimates, replacement costs, or calculating the actual cash value of the damaged or stolen items.

The settlement process can vary depending on the type of insurance and the specific circumstances of your claim. For instance, in the case of an auto accident, the adjuster may negotiate with the other party's insurance provider to reach a fair settlement. In property insurance claims, the adjuster will work with you to ensure that the repairs or replacements are completed satisfactorily, and any additional costs are covered as per the terms of your policy.

Step 4: Payment and Closure

Once the settlement amount is agreed upon, the insurance company will proceed with the payment process. This typically involves issuing a check or transferring the funds to your designated bank account. It’s important to review the payment details carefully to ensure accuracy and promptly deposit the funds.

After the payment is made, the claims process is considered closed. However, it's essential to retain all relevant documentation, including the settlement agreement, repair receipts, and any correspondence with the insurance company. These records can be valuable for future reference or in case of any disputes that may arise.

Tips for a Smooth Claims Process

To ensure a seamless and efficient claims process, consider the following tips:

- Document Everything: Take detailed notes and keep a record of all conversations, emails, and correspondence with the insurance company. This documentation will be invaluable during the claims process and can help resolve any potential disputes.

- Be Prompt: Report your claim as soon as possible after the incident. Prompt reporting can help expedite the claims process and ensure a quicker resolution.

- Provide Accurate Information: When reporting your claim, be as detailed and accurate as possible. Provide all relevant information and supporting documentation to assist the claims adjuster in their assessment.

- Understand Your Policy: Familiarize yourself with the terms and conditions of your insurance policy. This knowledge will help you navigate the claims process more effectively and ensure that you receive the coverage you are entitled to.

- Stay in Touch: Maintain open lines of communication with your insurance provider throughout the claims process. Keep them updated on any developments or changes, and respond promptly to any requests for additional information.

The Impact of Technology on Insurance Claims

In recent years, technology has revolutionized the insurance industry, and its impact on the claims process is significant. Many insurance companies now offer digital platforms and mobile apps that allow policyholders to report claims, upload supporting documentation, and track the progress of their claims in real-time. These technological advancements have streamlined the claims process, making it more efficient and convenient for policyholders.

For instance, imagine you've experienced a water leak in your home, resulting in water damage to your property. With a mobile app provided by your insurance company, you can easily report the claim, upload photographs of the damage, and even receive real-time updates on the status of your claim. This level of accessibility and transparency can significantly reduce the stress and anxiety associated with making an insurance claim.

Future Trends in Insurance Claims

As technology continues to advance, the future of insurance claims looks promising. Here are some trends to watch out for:

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms are being increasingly utilized in the insurance industry to automate claims processing. These technologies can analyze large amounts of data, detect patterns, and streamline the claims assessment process, resulting in faster and more accurate decisions.

- Blockchain Technology: Blockchain, a distributed ledger technology, has the potential to revolutionize insurance claims. By creating a secure and transparent digital record of transactions, blockchain can enhance claim verification, reduce fraud, and improve the overall efficiency of the claims process.

- Telematics and Connected Devices: Telematics and connected devices, such as smart home systems and vehicle tracking devices, are providing insurance companies with real-time data. This data can be used to enhance risk assessment, improve claims accuracy, and even offer personalized insurance rates based on individual behavior.

Conclusion

The general insurance claims phone number is a vital contact point for policyholders, providing a direct line of communication with their insurance providers. Understanding the claims process, the role of the claims department, and the importance of timely reporting can empower policyholders to navigate the claims journey with confidence. As technology continues to shape the insurance industry, we can expect even more innovative solutions that further streamline and enhance the claims experience.

How long does it typically take for an insurance claim to be processed and approved?

+The processing time for insurance claims can vary depending on the complexity of the claim and the insurance provider. Simple claims with minimal damage or loss may be processed and approved within a few days to a week. However, more complex claims, such as those involving extensive property damage or personal injuries, can take several weeks or even months to be fully assessed and approved.

Can I make a claim if I have a basic insurance policy?

+Yes, you can make a claim regardless of the type of insurance policy you have. However, it’s important to understand the coverage limits and exclusions of your specific policy. Some basic policies may have lower coverage limits or certain restrictions, so it’s essential to review your policy documentation thoroughly to ensure you are aware of any limitations.

What should I do if my claim is denied by the insurance company?

+If your claim is denied, it’s important to carefully review the denial letter and understand the reasons provided by the insurance company. You may have the option to appeal the decision by providing additional evidence or documentation to support your claim. It’s recommended to seek legal advice or consult an insurance professional to guide you through the appeals process.