Different Car Insurance Companies

The world of car insurance is vast and diverse, with numerous companies vying for your attention. Choosing the right insurer can be a daunting task, especially with the myriad of options available. This comprehensive guide aims to demystify the process and provide you with the tools to make an informed decision. We'll explore the unique offerings, policies, and features of various car insurance companies, helping you understand the key differences and find the best fit for your needs.

Understanding Car Insurance Companies: A Diverse Landscape

The car insurance market is a bustling ecosystem, comprising a wide range of providers, each with its own distinct approach and offerings. From established industry giants to innovative startups, these companies cater to diverse consumer needs, offering tailored policies and services. Understanding the unique attributes of each insurer is crucial in making an informed choice.

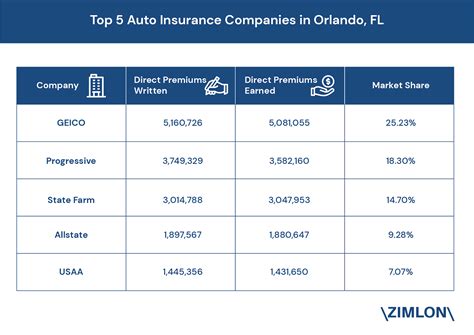

Industry Leaders: Established Brands with a Proven Track Record

The car insurance industry boasts several long-standing, well-known brands. These companies, often with decades of experience, have built a reputation for reliable service and comprehensive coverage. Their policies often encompass a wide range of options, catering to various vehicle types and driver profiles. While their services may be more traditional, their extensive experience can be a reassuring factor for many drivers.

For instance, State Farm, one of the largest insurers in the U.S., offers a comprehensive range of auto insurance policies, including coverage for liability, collision, comprehensive, and medical payments. Their policies often include additional perks like roadside assistance and rental car reimbursement. With a focus on customer service, State Farm provides agents who can guide policyholders through the claims process, offering a personalized touch.

| Company | Key Offerings |

|---|---|

| State Farm | Comprehensive coverage, roadside assistance, rental car reimbursement |

| Geico | Discounts for safe driving, accident forgiveness, digital tools for policy management |

| Progressive | Snapshot program for personalized rates, 24/7 customer support, flexible payment options |

Innovative Startups: Disrupting the Industry with Technology

The car insurance landscape is also witnessing the emergence of innovative startups, leveraging technology to offer unique, often more affordable, insurance solutions. These companies often focus on digital platforms, providing an efficient, streamlined experience for customers. Their policies may be more tailored, with personalized rates based on individual driving habits and behaviors.

Consider Metromile, a company that specializes in pay-per-mile insurance. Their policies are designed for low-mileage drivers, offering significant savings for those who don't drive frequently. With a focus on sustainability, Metromile promotes eco-friendly driving habits and rewards drivers for reducing their carbon footprint. Their app-based platform provides real-time tracking and feedback, offering a unique, personalized insurance experience.

Regional Insurers: Specialized Coverage for Local Needs

Beyond the national players, there are also regional car insurance companies that specialize in serving specific geographic areas. These insurers often have a deep understanding of the unique needs and challenges of drivers in their region, offering tailored policies and local support. While their coverage may be more limited in scope, they can provide specialized solutions that larger, national insurers might overlook.

Take North Eastern Mutual as an example, a company that caters exclusively to drivers in the northeastern U.S. states. They offer policies that take into account the unique weather conditions and road challenges of the region, providing comprehensive coverage for snowstorms, icy roads, and other seasonal hazards. With a focus on local service, North Eastern Mutual provides a dedicated team of claims adjusters and customer support staff who are familiar with the region's specific needs.

Key Considerations When Choosing a Car Insurance Company

With a vast array of car insurance companies to choose from, it’s important to consider several key factors to ensure you select the right provider for your needs. These considerations can help you narrow down your options and find an insurer that offers the coverage, service, and value you’re looking for.

Coverage Options: Tailoring Your Policy to Your Needs

One of the most critical aspects of car insurance is the range and depth of coverage offered. Different insurers provide various coverage options, from the standard liability and collision insurance to more specialized policies like gap insurance, rental car coverage, and roadside assistance. It’s essential to assess your specific needs and choose an insurer that offers the right mix of coverage to protect you and your vehicle adequately.

For instance, if you own a classic car, you might need an insurer that offers specialized classic car insurance. This type of policy often provides agreed-value coverage, ensuring you receive the full value of your vehicle in the event of a total loss. It also typically includes coverage for unique needs like transportation to shows and events, providing the specialized protection classic car owners require.

Pricing and Discounts: Finding the Best Value

Car insurance premiums can vary significantly between insurers, even for the same level of coverage. It’s essential to compare prices and understand the factors that influence them. Many insurers offer discounts for various reasons, such as safe driving records, vehicle safety features, and multiple policy bundles. Understanding these discounts can help you save money on your insurance premiums.

Consider Geico, which offers a range of discounts to its policyholders. These include a good student discount for young drivers with a GPA of 3.0 or higher, a federal employee discount for government workers, and a military discount for active-duty and retired military personnel. Additionally, Geico provides a safe driver discount for policyholders who maintain a clean driving record for a certain period. These discounts can significantly reduce your insurance premiums, making Geico a cost-effective choice for many drivers.

Claims Process and Customer Service: Ensuring a Smooth Experience

In the event of an accident or other insured incident, the claims process can be a critical aspect of your car insurance experience. It’s important to choose an insurer with a straightforward, efficient claims process, ensuring you receive the compensation you’re entitled to without unnecessary delays or complications. Customer service is also key, as you’ll want an insurer that provides prompt, helpful assistance when you need it.

Take Progressive, for example, which offers a highly rated claims process. With a dedicated claims team, Progressive provides 24/7 customer support, ensuring you can report a claim at any time. Their process is designed to be quick and efficient, with many claims settled within a few days. Progressive also provides a range of resources to guide policyholders through the claims process, ensuring a smooth, stress-free experience.

Comparing Car Insurance Companies: A Comprehensive Analysis

To help you make an informed decision, we’ve conducted a comprehensive analysis of several leading car insurance companies, evaluating their policies, coverage options, pricing, and customer service. This analysis provides a detailed overview of each insurer, highlighting their unique strengths and areas of improvement, to assist you in choosing the best fit for your needs.

State Farm: Comprehensive Coverage and Personalized Service

State Farm is a leading provider of auto insurance, offering a wide range of coverage options and personalized service. Their policies are designed to cater to various driver needs, providing comprehensive protection for a range of vehicles and driving situations. With a focus on customer satisfaction, State Farm provides a network of knowledgeable agents who can guide policyholders through the insurance process, offering a tailored, personalized experience.

One of State Farm's key strengths is its extensive range of coverage options. Beyond the standard liability and collision coverage, they offer additional policies like rental car coverage, roadside assistance, and gap insurance. This ensures policyholders can tailor their coverage to their specific needs, providing comprehensive protection for their vehicles. Additionally, State Farm provides a range of discounts for safe driving, multiple policy bundles, and vehicle safety features, making their policies more affordable for many drivers.

Geico: Affordable Premiums and Innovative Tools

Geico is known for its affordable car insurance premiums and innovative digital tools. Their policies are designed to be straightforward and easy to understand, providing a simple, efficient insurance experience. With a focus on value, Geico offers a range of discounts to make their policies more affordable, while their digital platform provides convenient, efficient policy management and claims reporting.

One of Geico's standout features is its Mobile App, which provides policyholders with a range of convenient services. The app allows users to view and manage their policies, report and track claims, and access digital ID cards. It also provides a range of tools, like the Digital Accident Guide, which offers step-by-step guidance in the event of an accident. Additionally, Geico's Accident Forgiveness program can be a valuable feature, offering policyholders protection against rate increases after their first at-fault accident.

Progressive: Customized Rates and 24⁄7 Support

Progressive is a leading insurer known for its innovative Snapshot program, which provides personalized insurance rates based on individual driving habits. Their policies are designed to be flexible and customizable, catering to a wide range of driver needs. With a focus on customer service, Progressive provides 24⁄7 support, ensuring policyholders can access assistance whenever they need it.

The Snapshot program is a unique feature that sets Progressive apart. By installing a small device in your vehicle, Snapshot tracks your driving habits, including mileage, time of day, and braking habits. This data is used to calculate a personalized insurance rate, which can lead to significant savings for safe drivers. Additionally, Progressive offers a range of additional services, like roadside assistance and rental car coverage, which can be added to your policy to enhance your protection.

Future Trends and Innovations in Car Insurance

The car insurance industry is continually evolving, with new technologies and innovations shaping the future of insurance. From the rise of usage-based insurance to the integration of telematics and AI, these advancements are set to revolutionize the way we insure our vehicles, offering more personalized, efficient, and cost-effective coverage.

Usage-Based Insurance: Personalized Rates Based on Driving Habits

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that calculates insurance rates based on individual driving habits. By tracking factors like mileage, time of day, and driving behavior, insurers can offer personalized rates that reward safe driving and discourage risky behavior. This approach can lead to significant savings for safe drivers and provide a more fair, accurate reflection of individual risk.

Companies like Root Insurance are leading the way in usage-based insurance. Their app-based platform uses advanced telematics technology to track driving behavior in real-time. Based on this data, Root calculates a personalized insurance rate, which can be significantly lower for safe drivers. This approach not only rewards safe driving but also encourages it, promoting safer roads and reducing the overall cost of insurance.

Telematics and AI: Enhancing Safety and Efficiency

Telematics and AI are transforming the car insurance industry, offering a range of benefits from improved safety to more efficient claims processing. Telematics technology, which includes GPS tracking and advanced sensors, can provide real-time data on vehicle location, driving behavior, and even vehicle health. This data can be used to enhance safety features, provide early warning of potential issues, and improve the accuracy of insurance claims.

AI, on the other hand, is being used to automate various insurance processes, from policy administration to claims handling. By leveraging machine learning algorithms, insurers can analyze vast amounts of data to identify patterns and make more accurate predictions. This can lead to more efficient, streamlined processes, reducing costs and improving customer service. Additionally, AI can be used to personalize insurance policies, offering tailored coverage and rates based on individual needs and behaviors.

Conclusion: Navigating the Car Insurance Landscape

The world of car insurance is diverse and dynamic, offering a wide range of options to suit different needs and preferences. From established industry leaders to innovative startups, each insurer has its own unique offerings and approach. By understanding your specific needs and the key considerations in choosing an insurer, you can navigate this landscape with confidence, finding the right provider to protect your vehicle and provide peace of mind.

Whether you're looking for comprehensive coverage, affordable premiums, or innovative, personalized insurance, there's an insurer out there that can meet your needs. With a clear understanding of your priorities and the landscape of car insurance, you can make an informed decision, ensuring you get the best value and protection for your money.

How do I choose the right car insurance company for me?

+Choosing the right car insurance company involves considering several factors, including your specific needs, the range of coverage options, pricing, and the insurer’s reputation for customer service and claims handling. It’s important to research and compare multiple insurers to find the best fit for your situation.

What are some key coverage options to look for in a car insurance policy?

+Key coverage options to consider include liability coverage, collision coverage, comprehensive coverage, medical payments coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP). Depending on your needs and state requirements, you may also want to look for additional coverages like rental car reimbursement, gap insurance, and roadside assistance.

How can I save money on my car insurance premiums?

+To save money on your car insurance premiums, you can shop around for quotes from multiple insurers, consider bundling your policies (e.g., auto and home insurance), maintain a good driving record, take advantage of any applicable discounts (e.g., safe driver discounts, student discounts), and increase your deductible (though this may impact your out-of-pocket costs if you need to make a claim).