Private Health Insurance Options

In today's dynamic healthcare landscape, understanding the intricacies of private health insurance is paramount for making informed decisions about your healthcare coverage. With a plethora of options available, from comprehensive plans to specialized policies, navigating the private health insurance market can be a daunting task. This comprehensive guide aims to demystify the process, offering an in-depth analysis of various private health insurance options, their benefits, and how they can cater to diverse individual needs.

Understanding Private Health Insurance

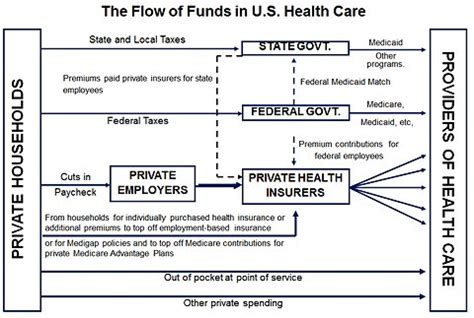

Private health insurance, distinct from public healthcare systems, provides individuals and families with access to a range of healthcare services and benefits. These policies are tailored to offer flexibility and choice, allowing policyholders to select the coverage that best aligns with their health needs and financial capabilities.

Key Features of Private Health Insurance Plans

Private health insurance plans are characterized by their coverage of a wide array of medical services, including but not limited to:

- Hospitalization: Covering expenses for hospital stays, surgeries, and specialized treatments.

- Outpatient Services: Providing access to medical professionals and treatments without requiring hospitalization.

- Prescription Drugs: Offering coverage for medications, often with preferred pharmacy networks.

- Specialist Care: Allowing access to specialists and their associated services.

- Preventive Care: Encouraging regular check-ups and screenings to maintain health and detect potential issues early.

The Advantages of Private Health Insurance

Choosing private health insurance comes with several notable advantages. Firstly, these plans often provide broader coverage options, allowing individuals to customize their policies to suit their unique needs. Secondly, shorter waiting periods are common, enabling faster access to healthcare services. Additionally, private health insurance often offers a wider choice of healthcare providers, ensuring policyholders can receive care from their preferred doctors and facilities.

Types of Private Health Insurance Plans

The private health insurance market is diverse, offering a range of plan types to cater to different demographics and needs. Here’s an overview of some common types:

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, provide the most flexibility. Under these plans, policyholders can choose their healthcare providers and services, and the insurance company reimburses a percentage of the cost.

Managed Care Plans

Managed care plans focus on cost control and coordination of care. These plans include:

- Health Maintenance Organizations (HMOs): Requiring policyholders to select a primary care physician and obtain referrals for specialist care. HMOs often have lower out-of-pocket costs but may limit provider choices.

- Preferred Provider Organizations (PPOs): Offering more flexibility than HMOs, PPOs provide a network of preferred providers. Policyholders can choose providers inside or outside the network, with cost variations.

- Point-of-Service (POS) Plans: Combining features of HMOs and PPOs, POS plans offer primary care physicians and a network of preferred providers. Policyholders can choose between in-network and out-of-network providers, with varying cost implications.

Specialty Plans

Specialty plans focus on specific health needs or demographics. These include:

- Dental Plans: Covering dental care, including cleanings, fillings, and more extensive procedures.

- Vision Plans: Providing coverage for eye exams, glasses, and contact lenses.

- Senior Health Plans: Tailored to the unique healthcare needs of older adults, often including Medicare Advantage plans.

Choosing the Right Private Health Insurance Plan

Selecting the right private health insurance plan involves careful consideration of various factors. Here’s a comprehensive guide to help you make an informed decision:

Assessing Your Healthcare Needs

Start by evaluating your current and potential future healthcare needs. Consider factors such as:

- Existing health conditions and their associated treatment costs.

- The likelihood of needing specialized medical care or surgery.

- Prescription drug requirements and the cost of medications.

- The need for regular check-ups and preventive care.

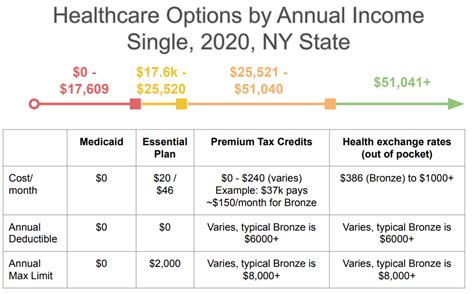

Understanding Your Budget

Private health insurance plans come with varying premium costs, deductibles, and out-of-pocket expenses. It’s crucial to assess your financial situation and determine the level of coverage you can comfortably afford. Remember, while higher premiums may offer more comprehensive coverage, they can also strain your budget.

Researching Insurance Companies

Different insurance companies offer varying levels of service, financial stability, and coverage options. Take the time to research and compare companies based on their reputation, customer satisfaction ratings, and the range of plans they offer. Online reviews and industry ratings can provide valuable insights.

Comparing Plan Benefits and Costs

Once you’ve narrowed down your options to a few insurance companies, it’s time to compare their plans. Consider the following:

- Coverage: Ensure the plan covers your specific healthcare needs, including any pre-existing conditions.

- Premiums: Compare monthly premiums, keeping in mind that lower premiums often come with higher deductibles or limited coverage.

- Deductibles and Co-pays: Understand the out-of-pocket costs, including deductibles (the amount you pay before insurance kicks in) and co-pays (the fixed amount you pay for certain services).

- Network of Providers: Verify if your preferred doctors and hospitals are in the plan’s network. Out-of-network care can be significantly more expensive.

- Prescription Drug Coverage: Review the plan’s formulary (list of covered drugs) and any restrictions or tiers that may affect your medication costs.

Seeking Professional Advice

If you’re unsure about the best private health insurance plan for your needs, consider consulting an insurance broker or financial advisor. These professionals can provide expert guidance, explain the nuances of different plans, and help you make a well-informed decision.

Maximizing Your Private Health Insurance Benefits

Once you’ve selected your private health insurance plan, it’s important to understand how to make the most of your coverage. Here are some tips to ensure you’re getting the best value from your policy:

Stay Informed

Keep yourself updated on any changes to your plan, such as modifications to the network of providers, coverage limits, or prescription drug formularies. Regularly review your plan’s summary of benefits and coverage, and reach out to your insurance company or broker with any questions or concerns.

Utilize Preventive Care

Most private health insurance plans offer coverage for preventive care services, such as annual check-ups, vaccinations, and screenings. Taking advantage of these services can help detect potential health issues early, when they’re often more treatable and less costly.

Understand Your Plan’s Limitations

While private health insurance offers a wide range of benefits, it’s important to be aware of any limitations or exclusions in your plan. These may include specific procedures, treatments, or medications that aren’t covered. Understanding these limitations can help you plan for potential out-of-pocket expenses.

Manage Your Out-of-Pocket Costs

Consider setting aside funds specifically for healthcare expenses, especially if you have a high-deductible plan. This can help ensure you have the necessary funds available when you need them. Additionally, many insurance companies offer flexible spending accounts (FSAs) or health savings accounts (HSAs) that can help you save for healthcare costs tax-free.

Stay Healthy

Maintaining a healthy lifestyle can help reduce your need for medical care and keep your insurance costs down. This includes regular exercise, a balanced diet, and avoiding risky behaviors like smoking or excessive alcohol consumption. Many insurance companies now offer wellness programs or discounts for healthy lifestyle choices.

Future Trends in Private Health Insurance

The private health insurance industry is constantly evolving, driven by technological advancements, changing healthcare needs, and shifts in regulatory environments. Here’s a glimpse into some potential future trends:

Telehealth and Digital Health

The COVID-19 pandemic has accelerated the adoption of telehealth services, allowing patients to access healthcare remotely. This trend is expected to continue, with insurance companies increasingly covering virtual doctor visits and remote monitoring services. Digital health technologies, including wearable devices and health apps, are also gaining traction, offering new opportunities for preventive care and chronic disease management.

Value-Based Care

Value-based care models, which focus on providing high-quality care while controlling costs, are gaining popularity. These models incentivize healthcare providers to deliver efficient, effective care, often through bundled payments or other performance-based compensation structures. As these models become more prevalent, insurance companies may adjust their plans to better align with value-based care.

Personalized Medicine

Advancements in genomics and personalized medicine are revolutionizing healthcare. Insurance companies may start offering plans that incorporate genetic testing and personalized treatment plans. This could lead to more targeted and effective healthcare interventions, potentially reducing overall healthcare costs.

Focus on Mental Health

With growing awareness around mental health issues, insurance companies are increasingly recognizing the importance of covering mental health services. Expect to see private health insurance plans expanding their coverage for mental health treatments, including therapy, counseling, and medication management.

Frequently Asked Questions

What is the difference between private and public health insurance?

+Private health insurance is purchased through insurance companies and offers a wide range of coverage options, often with more flexibility and choice. Public health insurance, on the other hand, is typically provided by government programs and may have more limited coverage but often comes with lower out-of-pocket costs.

How do I choose the right private health insurance plan for my family?

+Consider your family’s current and potential future healthcare needs, including any pre-existing conditions. Assess your budget and determine the level of coverage you can afford. Research and compare insurance companies and their plans, focusing on coverage, premiums, deductibles, and network of providers. It’s also beneficial to seek advice from insurance brokers or financial advisors.

Can I switch private health insurance plans if I’m not satisfied with my current one?

+Yes, you have the right to switch private health insurance plans at any time. However, it’s important to note that pre-existing conditions may not be covered immediately under a new plan. There are often waiting periods for certain conditions, so it’s crucial to understand these restrictions before making a switch.

What are some common exclusions in private health insurance plans?

+Common exclusions in private health insurance plans may include cosmetic procedures, experimental treatments, and certain types of mental health services. It’s essential to carefully review the summary of benefits and coverage document provided by your insurance company to understand what’s included and what’s not.