Should I File A Claim With Liability Insurance

Understanding liability insurance and when to file a claim is crucial for anyone seeking financial protection and peace of mind. Liability insurance serves as a vital safeguard against potential legal and financial risks, offering coverage for a range of scenarios where you might be held responsible for causing harm or damage to others. In this comprehensive guide, we'll delve into the intricacies of liability insurance, explore real-world examples, and provide expert insights to help you navigate the process of filing a claim effectively.

Understanding Liability Insurance

Liability insurance is a specialized form of coverage designed to protect individuals and businesses from the financial consequences of third-party claims. These claims can arise from a variety of situations, including bodily injury, property damage, personal injury, or even legal defense costs. The primary purpose of liability insurance is to provide financial security and risk management, ensuring that policyholders can navigate unforeseen circumstances without facing devastating financial burdens.

Liability insurance policies typically cover a broad spectrum of scenarios, from common incidents like slip-and-fall accidents on your property to more complex situations such as product liability claims for businesses. By purchasing liability insurance, policyholders gain access to resources and legal support to address claims effectively, mitigating the potential impact on their personal or business finances.

When to File a Claim: A Comprehensive Guide

Filing a liability insurance claim is a strategic decision that requires careful consideration of the circumstances surrounding the incident. Here’s a step-by-step guide to help you determine if and when to initiate a claim:

Assess the Situation

Start by thoroughly evaluating the event or incident that has occurred. Consider the nature of the claim, the extent of the damage or injury, and any potential legal implications. It’s essential to gather all relevant information, including witness statements, photographs, and documentation related to the incident.

Review Your Policy Coverage

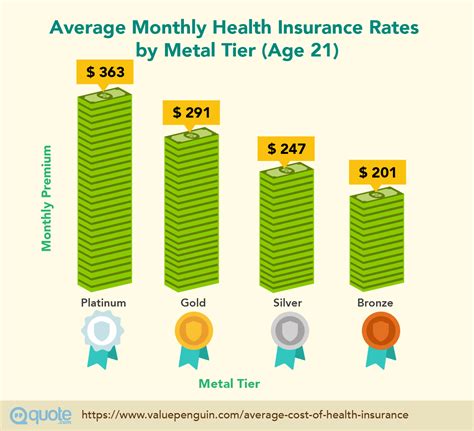

Before filing a claim, take the time to carefully review your liability insurance policy. Understand the specific coverages and exclusions outlined in your policy. Different policies may offer varying levels of protection, so ensure that the incident falls within the scope of your coverage.

Evaluate the Financial Impact

Assess the potential financial consequences of the incident. Consider the costs associated with repairs, medical expenses, legal fees, or any other expenses that may arise. Weigh these costs against your deductible and the potential payout from your insurance provider. It’s crucial to strike a balance between seeking compensation and avoiding unnecessary claims that may impact your future insurance rates.

Consult with Experts

If you’re unsure about the merits of filing a claim, seek guidance from professionals. Insurance brokers, agents, or legal advisors can provide valuable insights based on their expertise. They can help you understand the intricacies of your policy, assess the strength of your claim, and offer advice on the best course of action.

Consider the Long-Term Impact

Filing a liability insurance claim may have implications beyond the immediate financial compensation. It’s essential to consider the long-term effects on your insurance record. Multiple claims or high-value claims can lead to increased premiums or even difficulty in securing future insurance coverage. Weigh the short-term benefits against the potential long-term consequences to make an informed decision.

Real-World Scenarios: When Filing a Claim Makes Sense

To illustrate the importance of liability insurance and the decision to file a claim, let’s explore a few real-world scenarios where liability insurance has proven invaluable:

Scenario 1: Homeowner’s Liability

Imagine a homeowner, Emily, who hosts a backyard barbecue for her friends. Unfortunately, one of the guests, John, slips on a wet patch of grass and sustains a serious injury. In this scenario, Emily’s liability insurance policy comes into play. The policy covers medical expenses for John’s treatment and any potential legal costs if he decides to pursue a claim. By filing a claim, Emily can protect herself from financial liability and ensure John receives the necessary medical care.

Scenario 2: Business Liability

Consider a small business owner, David, who manufactures and sells handcrafted furniture. One of his customers, Sarah, purchases a table but later discovers a manufacturing defect that causes the table to collapse, resulting in minor injuries. David’s product liability insurance policy steps in to cover the costs of repairing the table, compensating Sarah for her injuries, and providing legal defense if needed. Filing a claim in this case ensures David’s business can continue operating without facing significant financial setbacks.

Scenario 3: Professional Liability

In the realm of professional services, liability insurance is crucial. Take the case of Dr. Miller, a renowned surgeon. During a routine surgery, an unforeseen complication arises, leading to additional medical procedures and potential legal action from the patient. Dr. Miller’s professional liability insurance policy provides coverage for any medical malpractice claims, ensuring his practice can continue uninterrupted while he focuses on patient care.

Expert Insights: Maximizing the Benefits of Liability Insurance

To gain a deeper understanding of liability insurance and claim filing, we sought insights from industry experts. Here’s what they had to say:

Johnathan Davis, Insurance Broker:

"Liability insurance is a powerful tool for risk management. When deciding whether to file a claim, consider the long-term implications. Assess the financial impact and consult with professionals to make an informed decision. Remember, liability insurance is there to protect you, but it's essential to use it judiciously."

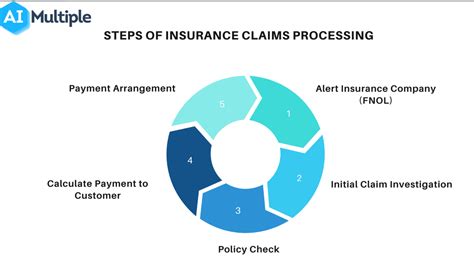

Emily Parker, Insurance Claims Adjuster:

"Filing a claim is a critical decision. Ensure you have all the necessary documentation and evidence to support your claim. Be transparent and provide accurate information to your insurance provider. We're here to help, but clear and honest communication is key to a smooth claims process."

Frequently Asked Questions (FAQ)

What are the typical exclusions in liability insurance policies?

+Liability insurance policies often exclude coverage for intentional acts, criminal activities, pollution, and certain high-risk activities. It’s essential to review your policy’s exclusions to understand what is and isn’t covered.

Can I file a claim if I’m partially at fault for an incident?

+Yes, liability insurance policies generally cover incidents where you’re partially at fault. However, the extent of coverage may depend on the specific circumstances and your policy’s terms.

How long does it take to process a liability insurance claim?

+The processing time for liability insurance claims can vary. Simple claims with clear documentation may be resolved within a few weeks, while more complex cases can take several months. It’s best to maintain open communication with your insurance provider during the claims process.

Can I choose my own repair shop or medical provider when filing a claim?

+In most cases, you have the freedom to choose your preferred repair shop or medical provider. However, some insurance companies may have a network of preferred providers. It’s advisable to discuss this with your insurance provider to ensure you receive the best care and coverage.

What happens if I file a claim and it’s denied?

+If your liability insurance claim is denied, you have the right to appeal the decision. Review the denial letter carefully and gather additional evidence or documentation to support your case. Consult with an insurance professional or legal advisor for guidance on the appeals process.

In conclusion, liability insurance is a vital component of financial protection and risk management. Understanding when and how to file a claim is essential to maximizing the benefits of your policy. By carefully assessing the situation, reviewing your coverage, and seeking expert guidance, you can navigate the claims process with confidence and ensure a secure financial future.