Average Health Insurance Cost For Family Of 4

The average health insurance cost for a family of four is a topic of great importance, as it directly impacts the financial well-being and healthcare access of millions of families across the nation. With the rising costs of healthcare and varying insurance plans, understanding the average expenses can provide valuable insights for families planning their budgets and seeking adequate coverage.

Breaking Down the Average Health Insurance Costs for a Family of Four

The average health insurance premium for a family of four in the United States can vary significantly based on numerous factors, including the state of residence, the chosen healthcare plan, and the age and health status of family members. According to recent studies, the average monthly premium for family coverage ranges from approximately $1,000 to $2,000. However, it is crucial to delve deeper into the specifics to comprehend the true financial implications.

State-by-State Variations

Health insurance costs can differ considerably from one state to another due to variations in healthcare infrastructure, regulations, and population demographics. For instance, states like New York and California, known for their high living costs, often have higher insurance premiums compared to states like Idaho or Nebraska. In New York, the average monthly premium for a family of four can exceed $2,500, while in Idaho, it may be closer to $1,500.

| State | Average Monthly Premium (Family of 4) |

|---|---|

| New York | $2,800 |

| California | $2,650 |

| Texas | $2,100 |

| Florida | $1,950 |

| Idaho | $1,480 |

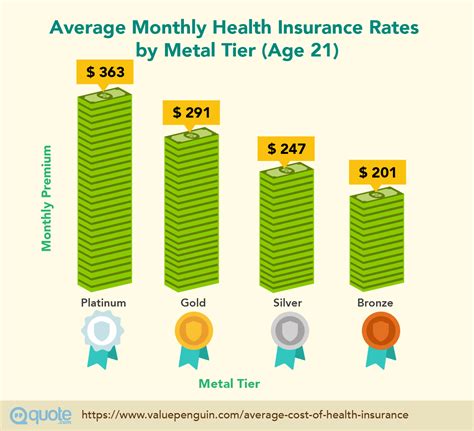

The Impact of Plan Selection

The type of health insurance plan chosen can significantly influence the overall cost. Plans are typically categorized into bronze, silver, gold, and platinum, each with varying levels of coverage and cost-sharing. Bronze plans, while offering the lowest premiums, often come with higher deductibles and out-of-pocket expenses. On the other hand, platinum plans provide extensive coverage but carry the highest premiums.

| Plan Type | Average Monthly Premium (Family of 4) | Deductible |

|---|---|---|

| Bronze | $1,200 | $8,000 |

| Silver | $1,500 | $4,000 |

| Gold | $1,800 | $2,000 |

| Platinum | $2,200 | $1,000 |

The Role of Age and Health Status

The age and health status of family members play a crucial role in determining insurance costs. Generally, younger families tend to have lower premiums, as they are considered less risky from an insurance perspective. However, as family members age and face potential health issues, premiums can increase significantly. Pre-existing conditions can also lead to higher premiums or even denial of coverage in some cases.

Strategies to Reduce Health Insurance Costs for Families

Given the substantial financial burden that health insurance can impose on families, it is essential to explore strategies to reduce costs without compromising essential coverage. Here are some effective approaches:

- Employer-Sponsored Plans: Many employers offer group health insurance plans, which can provide significant cost savings compared to individual plans. These plans often have negotiated rates and may include additional benefits.

- Government Programs: Explore government-sponsored programs like Medicaid or the Children's Health Insurance Program (CHIP) if your family's income meets the eligibility criteria. These programs can offer comprehensive coverage at little to no cost.

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, consider opening an HSA. HSAs allow you to save money tax-free to cover medical expenses, providing a strategic way to manage out-of-pocket costs.

- Shop Around: Compare different insurance plans and providers to find the best fit for your family's needs. Online marketplaces like healthcare.gov can be a great resource for researching and selecting plans.

- Wellness Programs: Some insurance providers offer discounts or incentives for participating in wellness programs. These programs can promote healthier lifestyles and potentially reduce future healthcare costs.

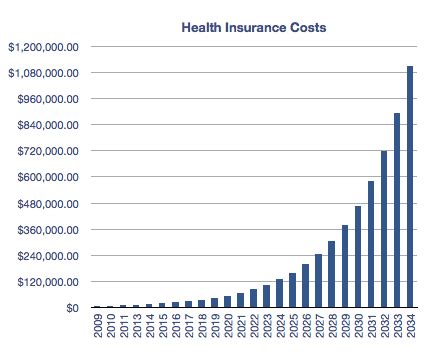

The Future of Family Health Insurance Costs

Looking ahead, the landscape of family health insurance costs is likely to continue evolving, influenced by various factors, including legislative changes, technological advancements, and shifts in healthcare delivery models. One significant trend is the increasing focus on value-based care, which aims to provide higher-quality care at a lower cost. This approach could potentially reduce the financial burden on families by improving the efficiency of healthcare services.

Additionally, the growing adoption of telemedicine and digital health solutions offers new opportunities for cost savings. Telemedicine, for instance, allows families to access healthcare services remotely, reducing travel expenses and potentially lowering insurance premiums. As these technologies become more integrated into healthcare systems, they may play a pivotal role in making healthcare more affordable and accessible.

In conclusion, while the average health insurance cost for a family of four can be substantial, there are numerous strategies and emerging trends that offer hope for more affordable and accessible healthcare. By staying informed, comparing plans, and taking advantage of available resources and programs, families can navigate the complex world of health insurance with greater financial confidence and security.

How can I find the best health insurance plan for my family’s needs?

+Researching and comparing different plans is crucial. Consider factors like coverage limits, deductibles, and out-of-pocket expenses. Online marketplaces and insurance brokers can provide valuable insights and help you find the right fit.

Are there any tax benefits associated with health insurance premiums for families?

+Yes, families may be eligible for tax credits or deductions based on their income and insurance premiums. It’s advisable to consult a tax professional to understand the specific benefits available to your family.

What if I can’t afford the health insurance premiums for my family?

+If you’re struggling to afford insurance, explore government-sponsored programs like Medicaid or CHIP. These programs are designed to provide coverage for families with limited financial means. Additionally, check if your state offers any financial assistance programs.