New Jersey Insurance Companies

The insurance landscape in New Jersey is a diverse and competitive one, offering a range of options for residents and businesses alike. With a rich history dating back to the early 19th century, the Garden State has witnessed the evolution of insurance practices and the emergence of prominent insurance companies. This article delves into the world of New Jersey insurance, exploring the key players, the unique challenges, and the innovative solutions that shape the industry.

A Historical Perspective on New Jersey’s Insurance Industry

New Jersey’s insurance sector has its roots firmly planted in the 1800s, with the establishment of early mutual insurance companies. These companies, founded by local communities, provided a crucial safety net against unforeseen events such as fires and storms. One notable example is the Mutual Fire Insurance Company of New Jersey, founded in 1851, which later merged with several other companies to become the current-day Progressive Insurance Company, a prominent name in the state’s insurance market.

As the state's economy flourished and urbanized, the demand for various types of insurance grew. The early 20th century saw the rise of large commercial insurance companies, catering to the needs of the expanding industrial sector. The Hartford Insurance Company, with its strong presence in New Jersey, played a significant role in insuring factories and businesses during this period.

The post-World War II era brought about a shift in focus, with a growing emphasis on personal insurance. State Farm, a well-known name across the United States, established its presence in New Jersey during this time, offering auto and home insurance policies to meet the needs of the burgeoning suburban population.

The late 20th century and early 21st century have been marked by consolidation and innovation. Many of New Jersey's insurance companies have merged or been acquired by larger national or international entities, allowing for greater financial stability and a broader range of services. Simultaneously, the rise of digital technologies has transformed the industry, with online platforms and mobile apps offering convenience and efficiency to policyholders.

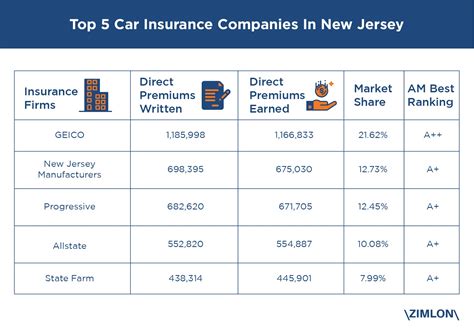

The Leading Insurance Companies in New Jersey Today

New Jersey boasts a robust insurance market with a mix of national, regional, and local carriers. Here’s an overview of some of the key players:

Progressive Insurance Company

With its roots firmly planted in New Jersey’s mutual insurance history, Progressive has evolved into a leading provider of auto, home, and business insurance. Known for its innovative approach, Progressive offers policyholders the convenience of online and mobile services, making it a preferred choice for tech-savvy residents.

State Farm Insurance

State Farm has been a stalwart in New Jersey’s insurance market for decades. Specializing in auto, home, life, and health insurance, State Farm’s local agents provide personalized service to policyholders. The company’s strong financial standing and commitment to customer satisfaction make it a trusted name across the state.

The Hartford Insurance Company

The Hartford has a long-standing relationship with New Jersey’s businesses. Offering a comprehensive range of commercial insurance products, from property and casualty to workers’ compensation, The Hartford caters to the diverse needs of the state’s industrial and commercial sectors. Its expertise in risk management and loss control makes it a preferred partner for many New Jersey enterprises.

Allstate Insurance Company

Allstate is another national insurance giant with a significant presence in New Jersey. Known for its slogan, “You’re in good hands with Allstate,” the company provides a full spectrum of insurance products, including auto, home, life, and commercial insurance. Allstate’s innovative products, such as its Drivewise program that rewards safe driving habits, have made it a popular choice among New Jersey residents.

NJM Insurance Group

NJM Insurance Group is a unique player in the New Jersey market. As a mutual company, NJM is owned by its policyholders, not shareholders. This structure allows NJM to prioritize policyholder needs and maintain a strong focus on customer satisfaction. NJM offers auto, homeowners, and business insurance, with a reputation for excellent customer service and competitive rates.

| Insurance Company | Specialization |

|---|---|

| Progressive Insurance Company | Auto, Home, Business Insurance |

| State Farm Insurance | Auto, Home, Life, Health Insurance |

| The Hartford Insurance Company | Commercial Insurance, Property & Casualty |

| Allstate Insurance Company | Auto, Home, Life, Commercial Insurance |

| NJM Insurance Group | Auto, Homeowners, Business Insurance |

Unique Challenges and Opportunities in New Jersey’s Insurance Market

New Jersey’s insurance landscape presents a unique set of challenges and opportunities due to its diverse population, geographical features, and economic dynamics.

High Population Density and Urban Risks

New Jersey’s high population density, particularly in urban areas like Newark, Jersey City, and Camden, poses unique risks. These areas are more susceptible to natural disasters such as hurricanes and flooding, as well as man-made risks like arson and property crimes. Insurance companies must develop strategies to mitigate these risks and offer tailored insurance solutions to urban residents.

Diverse Business Landscape

New Jersey’s economy is diverse, with a mix of large corporations, small businesses, and startups. Insurance companies must cater to the varying needs of these businesses, offering specialized coverage for industries such as pharmaceuticals, finance, and technology. The challenge lies in developing innovative products that meet the unique risks faced by these diverse sectors.

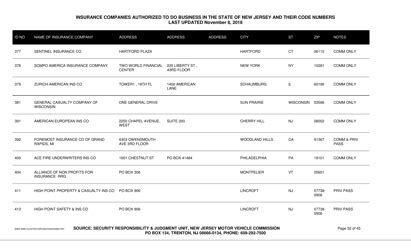

Regulatory Environment

New Jersey’s insurance industry is regulated by the New Jersey Department of Banking and Insurance (DOBI). The DOBI ensures that insurance companies operate fairly and provide adequate coverage to policyholders. While this regulatory environment provides stability and consumer protection, it also presents challenges for insurance companies in terms of compliance and regulatory changes.

Opportunities for Growth

Despite the challenges, New Jersey’s insurance market presents numerous opportunities for growth. The state’s diverse population and economy create a demand for a wide range of insurance products. Furthermore, the state’s focus on innovation and technology provides opportunities for insurance companies to leverage digital solutions and enhance customer experience.

Innovations and Future Trends in New Jersey’s Insurance Sector

The future of New Jersey’s insurance industry is poised for significant growth and transformation, driven by technological advancements and changing consumer preferences. Here are some key trends and innovations to watch out for:

Digital Transformation

Insurance companies in New Jersey are increasingly embracing digital technologies to enhance customer experience and streamline operations. This includes the development of user-friendly mobile apps, online portals for policy management, and the use of advanced analytics to personalize insurance offerings. For instance, Progressive Insurance has pioneered the use of digital tools, allowing customers to compare insurance rates and manage their policies entirely online.

Telematics and Usage-Based Insurance

The use of telematics devices and usage-based insurance (UBI) is gaining traction in New Jersey. UBI policies offer customized rates based on an individual’s driving behavior, encouraging safer driving practices. Companies like Allstate and State Farm have introduced programs that reward drivers for safe habits, such as avoiding sudden accelerations and maintaining a steady speed.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the insurance industry, from underwriting to claims processing. These technologies enable insurance companies to analyze vast amounts of data, identify patterns, and make more accurate predictions. For example, The Hartford is utilizing AI to enhance its risk assessment processes, helping businesses better understand and mitigate potential risks.

Enhanced Risk Management

New Jersey’s insurance companies are investing in advanced risk management strategies to better protect policyholders. This includes the use of drones for property inspections, especially in hard-to-reach areas, and the integration of weather data to predict and mitigate natural disasters. NJM Insurance Group, for instance, leverages cutting-edge technology to provide comprehensive risk assessments for its commercial clients.

Partnerships and Collaborations

Insurance companies in New Jersey are forming strategic partnerships and collaborations to enhance their offerings. This includes alliances with tech startups, universities, and other industry players. These partnerships enable insurance companies to access cutting-edge technologies and expertise, driving innovation and growth.

How do I choose the right insurance company in New Jersey?

+When selecting an insurance company in New Jersey, consider factors such as the company’s financial stability, the range of insurance products offered, and customer reviews. Look for companies that specialize in the type of insurance you need and have a strong reputation for customer service. Additionally, compare rates and coverage options to find the best value for your needs.

What are the key regulations that impact insurance companies in New Jersey?

+Insurance companies in New Jersey are subject to various regulations set by the New Jersey Department of Banking and Insurance (DOBI). These regulations cover aspects such as premium rates, coverage requirements, claims handling, and financial solvency. DOBI ensures that insurance companies operate ethically and provide adequate protection to policyholders.

How has the COVID-19 pandemic impacted the insurance industry in New Jersey?

+The COVID-19 pandemic has had a significant impact on the insurance industry in New Jersey. Many insurance companies have seen a surge in claims related to business interruptions and liability issues. On the other hand, the shift to remote work and reduced travel has led to a decrease in certain types of claims, such as auto accidents. The pandemic has also accelerated the adoption of digital technologies in the insurance sector, with companies moving towards online and mobile services to better serve customers.