Cheapest Rent Insurance

When it comes to protecting your rental property and belongings, finding the cheapest rent insurance can be a sensible financial decision. Rent insurance, also known as renter's insurance or tenant insurance, provides coverage for your personal property and offers liability protection. In this comprehensive guide, we will explore the world of rent insurance, delving into the factors that influence its cost, uncovering the cheapest options available, and providing valuable insights to help you make an informed decision.

Understanding Rent Insurance and Its Benefits

Rent insurance is a specialized type of insurance policy designed to safeguard renters and their belongings. It offers coverage for a range of situations, providing peace of mind and financial protection. Let’s take a closer look at the key benefits of rent insurance:

Protecting Your Personal Belongings

One of the primary advantages of rent insurance is the coverage it provides for your personal property. This includes furniture, electronics, clothing, and other valuables. In the unfortunate event of theft, fire, or other covered perils, rent insurance will reimburse you for the cost of replacing your belongings, ensuring you’re not left financially burdened.

| Covered Perils | Examples |

|---|---|

| Fire | Damage caused by fire, including smoke damage. |

| Theft | Burglary, robbery, or theft of your belongings. |

| Vandalism | Intentional damage to your property. |

| Water Damage | Damage from plumbing issues, roof leaks, or natural disasters. |

Liability Protection

Rent insurance also provides liability coverage, which is essential for protecting yourself against potential legal claims. If someone is injured on your rental property or if your actions result in property damage, rent insurance can help cover the associated costs, including medical expenses and legal fees.

Additional Living Expenses

In the event that your rental unit becomes uninhabitable due to a covered loss, rent insurance often includes coverage for additional living expenses. This means that your insurance policy may cover the cost of temporary accommodation and other necessary expenses until you can return to your home.

Factors Influencing the Cost of Rent Insurance

The cost of rent insurance can vary significantly based on several factors. Understanding these factors is crucial when searching for the cheapest option. Here are the key elements that influence the price of rent insurance:

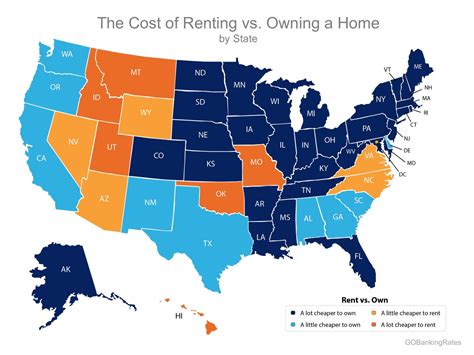

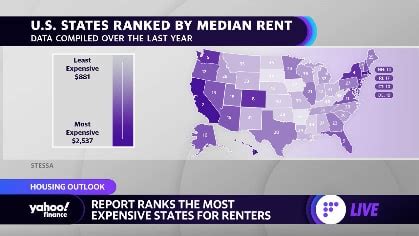

Location

The location of your rental property plays a significant role in determining the cost of insurance. Insurance providers consider factors such as crime rates, the prevalence of natural disasters, and the overall cost of living in your area. For instance, rent insurance in urban areas with high crime rates may be more expensive than in suburban or rural regions.

Coverage Amount

The amount of coverage you choose directly impacts the cost of your rent insurance policy. Higher coverage limits for personal property will result in a higher premium. It’s essential to find a balance between adequate coverage and a reasonable cost.

Deductibles

Similar to other insurance policies, rent insurance comes with deductibles. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your insurance premium, making it an effective way to reduce costs.

Policy Add-Ons

Rent insurance policies often offer optional add-ons or endorsements that can enhance your coverage. These add-ons may include coverage for specific items, such as jewelry or fine art, or additional liability protection. While these add-ons can be beneficial, they also increase the overall cost of your policy.

Discounts and Bundling

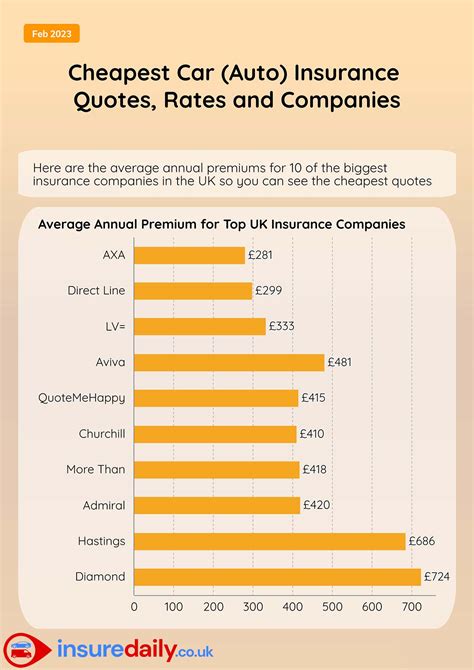

Insurance providers frequently offer discounts to attract customers. These discounts can be based on various factors, such as loyalty, good credit, or bundling multiple insurance policies. Bundling your rent insurance with other policies, like auto insurance, can result in significant savings.

Finding the Cheapest Rent Insurance

Now that we understand the factors influencing the cost of rent insurance, let’s explore some strategies to find the cheapest options available:

Shop Around

The insurance market is competitive, and rates can vary significantly between providers. It’s essential to shop around and compare quotes from multiple insurance companies. Online comparison tools and insurance brokers can simplify this process, allowing you to quickly assess different options.

Understand Your Needs

Before seeking rent insurance, take the time to understand your specific needs. Assess the value of your personal belongings and consider the risks associated with your rental property. By identifying your requirements, you can avoid overpaying for coverage you don’t need.

Consider Bundle Discounts

As mentioned earlier, bundling your rent insurance with other policies can lead to substantial savings. If you already have auto insurance or other policies with a particular provider, inquire about bundle discounts. Combining multiple policies can result in a more affordable overall insurance package.

Increase Your Deductible

Opting for a higher deductible can significantly reduce your insurance premium. While it means you’ll pay more out of pocket in the event of a claim, it’s a cost-effective way to lower your monthly insurance costs. Ensure you choose a deductible amount that you’re comfortable paying.

Review Your Coverage Regularly

Rent insurance policies and costs can change over time. Regularly reviewing your coverage and comparing it with other options can help you identify opportunities for cost savings. Stay informed about market rates and take advantage of any available discounts or promotions.

Expert Tips for Maximizing Savings

In addition to finding the cheapest rent insurance, there are several expert tips and strategies you can employ to maximize your savings and ensure you’re getting the best value for your money:

Maintain a Good Credit Score

Insurance providers often consider your credit score when determining your insurance premium. Maintaining a good credit score can lead to lower rates, as it indicates a lower risk profile. Work on improving your credit score by paying bills on time, reducing debt, and regularly monitoring your credit report.

Enhance Home Security

Insurance companies may offer discounts if your rental property has enhanced security features. Installing a monitored security system, smoke detectors, and fire extinguishers can reduce the risk of theft and fire-related incidents. These safety measures not only protect your belongings but also qualify you for potential insurance discounts.

Choose the Right Coverage Limits

While it’s important to have adequate coverage for your personal belongings, overinsuring can lead to unnecessary expenses. Assess the true value of your possessions and choose coverage limits that align with your needs. Avoid paying for coverage you don’t require, as it will only increase your insurance premium.

Review Your Policy Annually

Insurance policies and rates can change annually. Make it a habit to review your rent insurance policy each year. Compare your current policy with other available options to ensure you’re still getting the best deal. This annual review can help you identify any changes in your coverage needs or discover new discounts.

Negotiate with Your Insurance Provider

Don’t be afraid to negotiate with your insurance provider. If you’ve been a loyal customer or have a good claims history, you may be able to secure a better rate. Reach out to your insurance company and discuss your options. They may be willing to offer a discount or work with you to find a more affordable plan.

Common Misconceptions About Rent Insurance

Before we conclude, it’s essential to address some common misconceptions surrounding rent insurance. Understanding these misconceptions can help you make more informed decisions:

Misconception: Rent Insurance is Expensive

Many renters believe that rent insurance is prohibitively expensive, but this is often not the case. Rent insurance policies can be surprisingly affordable, especially when you consider the peace of mind and financial protection they provide. By following the tips outlined in this guide, you can find cheap rent insurance options that fit your budget.

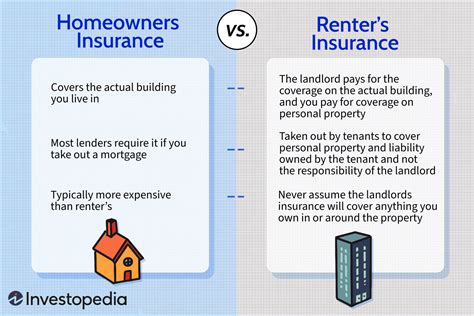

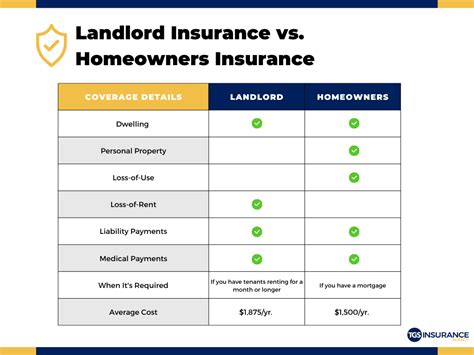

Misconception: Rent Insurance is Unnecessary

Some renters mistakenly believe that rent insurance is an unnecessary expense, assuming that their landlord’s insurance will cover any losses. However, landlord insurance typically only covers the structure of the building, not your personal belongings. Rent insurance is essential to protect your valuables and provide liability coverage.

Misconception: Rent Insurance is Complicated

Rent insurance policies can sometimes appear complex, with various coverage options and exclusions. However, with the right guidance and resources, understanding rent insurance is straightforward. Online resources, insurance brokers, and insurance providers themselves can help demystify the process and ensure you choose the right policy for your needs.

Conclusion

Finding the cheapest rent insurance is a wise financial decision that provides valuable protection for your rental property and belongings. By understanding the factors that influence insurance costs, shopping around, and implementing expert tips, you can secure affordable rent insurance coverage. Remember, rent insurance is not just about cost; it’s about ensuring you’re adequately protected in the event of unforeseen circumstances. Take the time to research and choose a policy that aligns with your needs and budget, providing you with the peace of mind you deserve.

How much does rent insurance typically cost?

+The cost of rent insurance can vary depending on several factors, including location, coverage amount, and deductibles. On average, rent insurance policies range from 15 to 30 per month, providing basic coverage for personal belongings and liability protection. However, prices can be higher or lower based on individual circumstances.

Can I get rent insurance if I have a low credit score?

+Yes, it is possible to obtain rent insurance even with a low credit score. While a good credit score may result in lower premiums, insurance providers consider other factors as well. By shopping around and comparing quotes, you can find affordable rent insurance options regardless of your credit score.

What is the difference between rent insurance and landlord insurance?

+Rent insurance, or renter’s insurance, is specifically designed to protect renters and their personal belongings. It covers losses due to theft, fire, and other perils, as well as providing liability protection. Landlord insurance, on the other hand, covers the structure of the building and any fixtures or fittings owned by the landlord. It does not provide coverage for the renter’s personal property.

Are there any exclusions in rent insurance policies?

+Yes, rent insurance policies typically have exclusions and limitations. Common exclusions include damage caused by floods, earthquakes, and intentional acts. It’s important to carefully review the policy document to understand what is and isn’t covered. If you have specific concerns or high-value items, consider adding additional coverage or endorsements to your policy.