Cheap Car Insurances

Finding cheap car insurance can be a daunting task, especially with the numerous options and factors to consider. However, with the right approach and knowledge, it is possible to secure affordable coverage for your vehicle without compromising on quality. In this comprehensive guide, we will delve into the world of car insurance, exploring the various strategies and considerations to help you find the best and most cost-effective policy for your needs.

Understanding the Basics of Car Insurance

Car insurance is a legal requirement for vehicle owners, providing financial protection in case of accidents, theft, or other unexpected events. It is designed to cover the costs of repairs, medical expenses, and liability claims. Understanding the different types of coverage and how they work is crucial to making an informed decision.

Types of Car Insurance Coverage

There are several key types of car insurance coverage, each serving a specific purpose:

- Liability Coverage: This covers the costs of damages and injuries you cause to others in an accident. It is typically divided into bodily injury liability and property damage liability.

- Collision Coverage: Collision insurance pays for repairs to your vehicle after an accident, regardless of who is at fault. It provides protection against costly repair bills.

- Comprehensive Coverage: Comprehensive coverage protects against non-collision incidents such as theft, vandalism, natural disasters, and animal collisions. It offers peace of mind for unexpected events.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers medical expenses and lost wages for you and your passengers, regardless of who is at fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has little or no insurance. It ensures you’re not left with the financial burden.

Factors Influencing Car Insurance Rates

Insurance companies use various factors to determine the cost of your car insurance policy. Understanding these factors can help you make choices that lead to lower premiums. Some of the key considerations include:

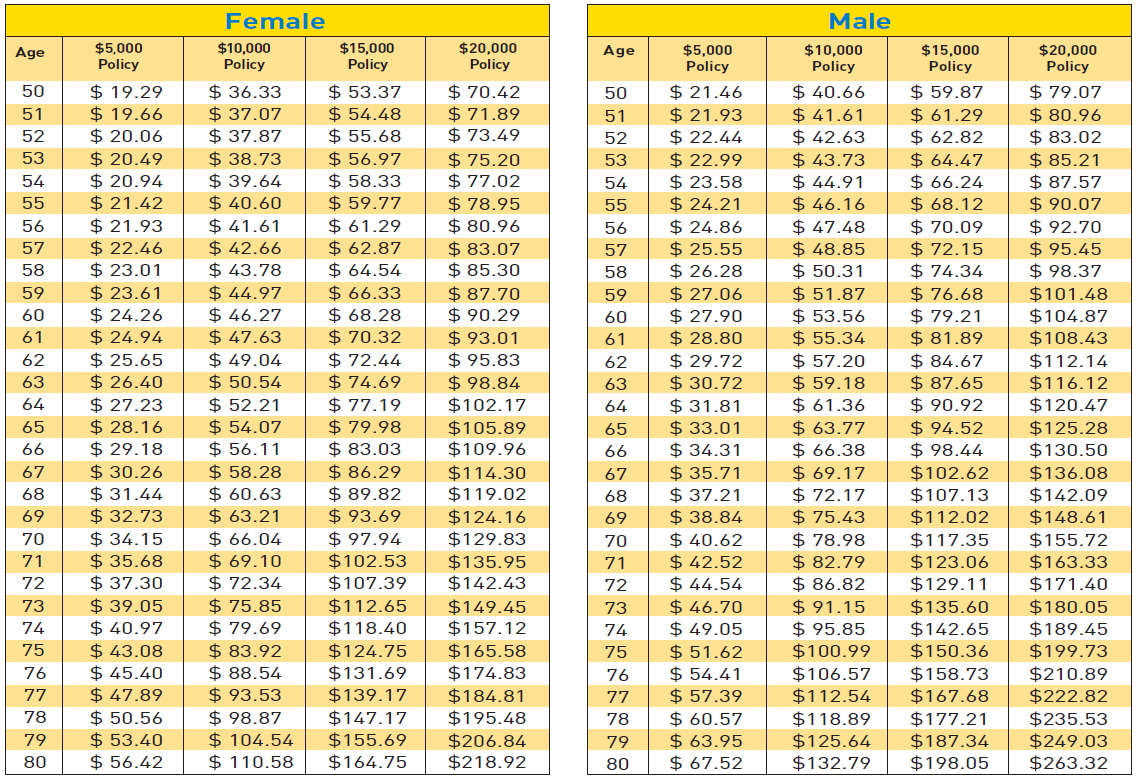

- Age and Gender: Younger drivers and males often face higher insurance rates due to statistical risk factors.

- Driving Record: A clean driving record with no accidents or violations can lead to significant discounts.

- Vehicle Type and Usage: The make, model, and purpose of your vehicle (e.g., personal use, business, or pleasure) can impact insurance costs.

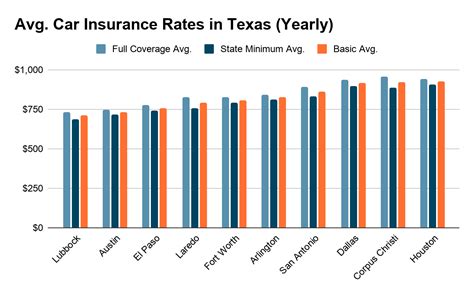

- Location: Where you live and park your car plays a role in insurance rates. Urban areas may have higher premiums due to increased traffic and crime.

- Credit History: Surprisingly, your credit score can influence insurance rates. A good credit history may result in lower premiums.

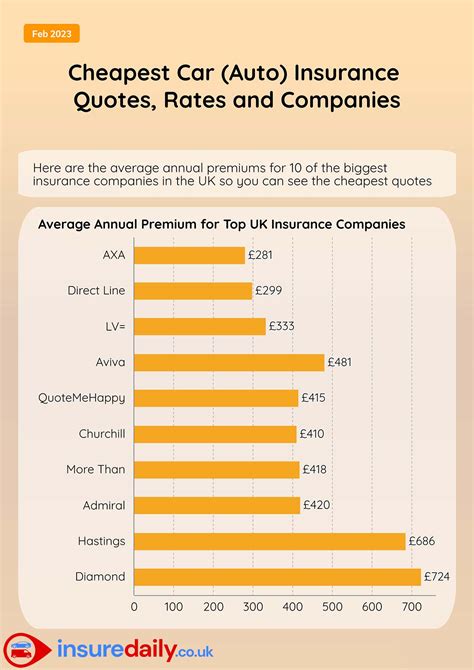

- Insurance Company and Policy Type: Different insurers offer various policy types and pricing structures. Comparing options is essential.

Strategies for Finding Cheap Car Insurance

Now that we have a solid understanding of the basics, let’s explore some effective strategies to find affordable car insurance:

Shop Around and Compare Quotes

One of the most powerful tools in your search for cheap car insurance is comparison shopping. Insurance rates can vary significantly between providers, so obtaining multiple quotes is crucial. Online insurance marketplaces and broker websites can streamline this process by providing quotes from various insurers.

Consider using an insurance comparison tool to input your details once and receive quotes from multiple companies. This saves time and effort, allowing you to quickly identify the most competitive rates.

| Insurance Provider | Average Annual Premium |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,350 |

| Provider C | $980 |

| Provider D | $1,420 |

Note: The table above provides a hypothetical example of insurance premiums from different providers. Actual rates may vary based on individual circumstances.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies together. For instance, if you have home insurance and car insurance, combining them with the same provider can result in significant savings. This is known as a “multi-policy discount.”

Consider contacting your current insurance provider to inquire about potential discounts for bundling. It's a simple way to reduce your overall insurance costs.

Utilize Discounts

Insurance companies offer a wide range of discounts to attract and retain customers. Some common discounts include:

- Safe Driver Discount: This is often the most significant discount available. Insurers reward drivers with clean records, so maintaining a good driving history is crucial.

- Loyalty Discount: Staying with the same insurer for an extended period may result in loyalty discounts.

- Student Discount: Many insurers offer discounts to students who maintain good grades or attend specific educational institutions.

- Defensive Driving Course Discount: Completing an approved defensive driving course can lead to reduced premiums.

- Anti-Theft Devices Discount: Installing approved anti-theft devices in your vehicle may qualify you for a discount.

Increase Your Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your insurance premiums. However, it’s essential to choose a deductible amount that you can comfortably afford in case of an accident.

Consider a higher deductible if you're a safe driver with a clean record and have sufficient savings to cover potential repairs. This strategy can result in substantial savings on your insurance policy.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses technology to monitor your driving habits and reward safe driving behaviors. Insurers install a device in your vehicle or use an app to track factors like mileage, braking habits, and time of day you drive.

If you're a cautious driver and don't log many miles, usage-based insurance can be a cost-effective option. It provides a more accurate assessment of your driving risk and may result in lower premiums.

Improve Your Credit Score

As mentioned earlier, your credit score can impact your insurance rates. Maintaining a good credit history is not only beneficial for financial stability but can also lead to lower insurance premiums.

Review your credit report regularly and take steps to improve your score if needed. Simple actions like paying bills on time, reducing credit card balances, and correcting errors on your report can positively impact your credit score and, consequently, your insurance rates.

Choose a Safer Vehicle

The type of vehicle you drive can significantly influence your insurance rates. Insurers consider factors like the make, model, and safety features when determining premiums. Vehicles with advanced safety technologies, such as collision avoidance systems and lane departure warnings, may be eligible for lower insurance rates.

Research and consider vehicles with strong safety ratings and innovative safety features. This not only enhances your protection but can also lead to more affordable insurance costs.

The Importance of Quality Coverage

While finding cheap car insurance is important, it’s equally crucial to ensure you have adequate coverage. Striking a balance between affordability and comprehensive protection is essential.

Consider your specific needs and circumstances when selecting coverage limits. For instance, if you have a new or expensive vehicle, comprehensive and collision coverage may be a wise investment. On the other hand, if you drive an older vehicle with low resale value, you might opt for liability-only coverage to keep costs down.

Additionally, review your policy annually to ensure it aligns with your current needs. Life circumstances, such as marriage, having children, or purchasing a new home, can impact your insurance requirements. Regular policy reviews allow you to adjust coverage and make necessary changes to maintain cost-effectiveness.

Conclusion

Finding cheap car insurance requires a strategic approach and an understanding of the various factors that influence rates. By shopping around, utilizing discounts, and making informed choices, you can secure affordable coverage without compromising on quality. Remember, a well-researched and tailored insurance policy is an investment in your financial well-being and peace of mind.

Frequently Asked Questions

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the U.S. varies based on numerous factors, including the state you reside in, your driving record, and the type of coverage you select. As of 2022, the national average for annual car insurance premiums is around 1,674. However, this can range from as low as 1,000 to over $2,500, depending on individual circumstances.

Can I get car insurance if I have a poor driving record or multiple violations?

+

Yes, it is possible to obtain car insurance even with a less-than-perfect driving record. However, insurers may charge higher premiums or require you to enroll in a high-risk insurance program. It’s essential to shop around and compare quotes from multiple providers to find the most affordable option.

How can I save money on car insurance if I’m a young driver?

+

Young drivers often face higher insurance premiums due to their statistical risk factors. To save money, consider maintaining a clean driving record, taking defensive driving courses, and inquiring about student discounts. Additionally, staying on a parent’s insurance policy, if possible, can help keep costs down.

What are some common mistakes to avoid when purchasing car insurance?

+

Some common mistakes to avoid include underestimating the value of your vehicle, not comparing quotes from multiple insurers, and neglecting to review your policy annually. Additionally, failing to ask about available discounts and not understanding the coverage limits of your policy can lead to financial pitfalls.