Cancel Health Insurance

Canceling health insurance is a significant decision that requires careful consideration. With the rise in healthcare costs and changing personal circumstances, many individuals find themselves in a situation where they need to reassess their insurance coverage. This comprehensive guide aims to provide an in-depth analysis of the process, the implications, and the alternatives to ensure a smooth transition when canceling health insurance.

Understanding the Reasons for Cancellation

There are various reasons why someone might choose to cancel their health insurance policy. Some common factors include:

- Change in Employment: When an individual changes jobs or leaves employment, they may lose their employer-provided health insurance coverage. This often prompts the need to evaluate and potentially cancel the existing policy.

- Cost Considerations: Rising healthcare costs and premium rates can make health insurance unaffordable for some individuals. In such cases, canceling the policy and exploring more cost-effective alternatives becomes a priority.

- Medicare Eligibility: As individuals reach the age of 65, they become eligible for Medicare, the federal health insurance program for seniors. This transition often involves canceling existing health insurance policies and enrolling in Medicare plans.

- Alternative Coverage Options: With the advancement of healthcare options, there are now various alternatives to traditional health insurance plans. These may include short-term health insurance, limited benefit plans, or high-deductible health plans with Health Savings Accounts (HSAs). Exploring these options can lead to more tailored and cost-effective coverage.

The Process of Canceling Health Insurance

Canceling health insurance involves a series of steps to ensure a seamless transition and avoid any potential penalties or complications. Here’s a detailed guide to the process:

Step 1: Review Your Policy and Contract

Start by carefully reviewing your health insurance policy and the contract you signed when enrolling. Look for any specific provisions or clauses related to cancellation, including notice periods and potential penalties. Understanding the terms and conditions is crucial to ensure a smooth cancellation process.

Step 2: Contact Your Insurance Provider

Reach out to your insurance provider to discuss your intention to cancel the policy. Most insurance companies have dedicated customer service representatives who can guide you through the cancellation process. Provide them with the necessary details, such as your policy number and the effective date of cancellation.

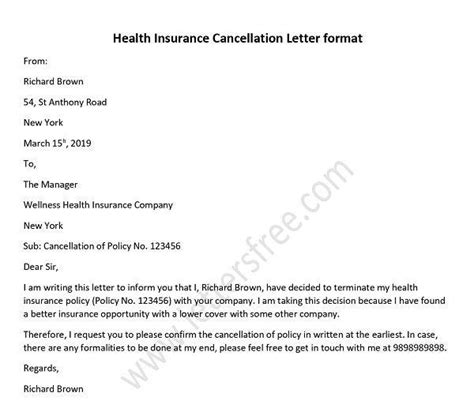

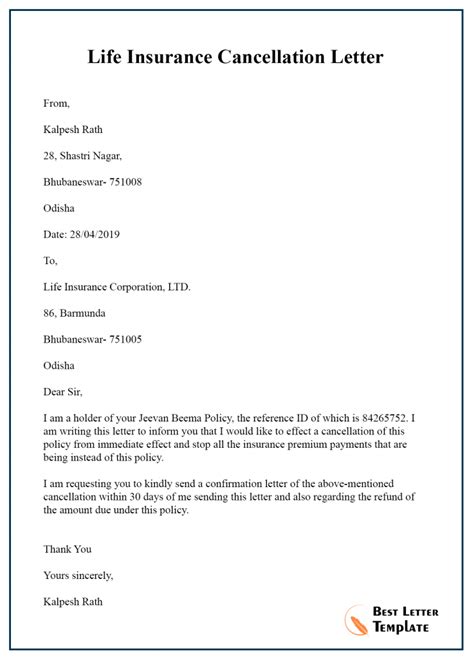

Step 3: Provide a Written Notice

It is generally recommended to provide a written notice of cancellation to your insurance provider. This can be done via email, online form, or traditional mail. The notice should include your policy number, the effective date of cancellation, and a clear statement of your intention to cancel the policy. Keep a copy of this notice for your records.

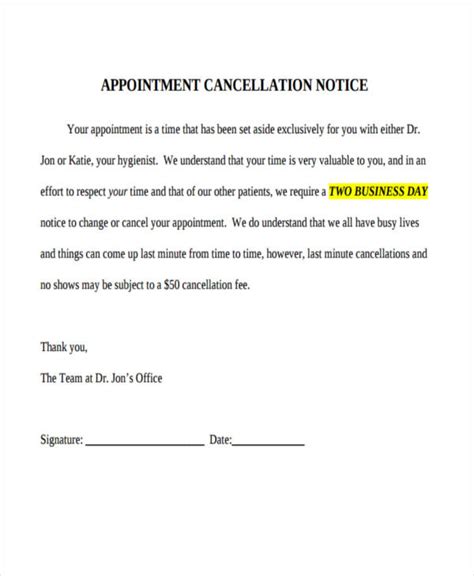

Step 4: Confirm Cancellation and Receive Documentation

Once you’ve provided the written notice, follow up with your insurance provider to confirm that the cancellation process is underway. Request a confirmation letter or email detailing the cancellation date and any relevant information. This documentation will be useful for future reference and to avoid any potential disputes.

Step 5: Explore Alternative Coverage Options

As you cancel your health insurance, it’s essential to explore alternative coverage options to ensure continuous protection. Depending on your circumstances, you may consider the following:

- Short-Term Health Insurance: Short-term health insurance plans offer temporary coverage for a specified period, typically ranging from a few months to a year. These plans are ideal for individuals in transition or those who are between jobs.

- Limited Benefit Plans: Limited benefit plans provide coverage for specific health services or conditions. These plans are often more affordable but may have limited coverage compared to traditional health insurance.

- High-Deductible Health Plans with HSAs: High-deductible health plans (HDHPs) have lower premiums but higher deductibles. Combining an HDHP with a Health Savings Account (HSA) allows you to save money tax-free for future medical expenses.

- Medicare Enrollment: If you're eligible for Medicare, it's crucial to understand the enrollment process and the different Medicare plans available. Transitioning to Medicare ensures continuous healthcare coverage for seniors.

Implications and Considerations

Canceling health insurance comes with certain implications and considerations that individuals should be aware of. These include:

Penalty Fees and Tax Implications

Depending on your situation and the reason for cancellation, you may incur penalty fees or face tax implications. For instance, canceling a policy before the end of the contract term may result in early termination fees. Additionally, if you’re subject to the individual mandate under the Affordable Care Act (ACA), canceling your health insurance could lead to tax penalties.

Gap in Coverage

When canceling health insurance, it’s important to ensure a seamless transition to avoid any gaps in coverage. Gaps in coverage can leave you vulnerable to unexpected medical expenses, so it’s crucial to have alternative coverage in place before canceling your existing policy.

Pre-Existing Condition Coverage

If you have a pre-existing medical condition, canceling your health insurance and transitioning to a new plan may impact your coverage for that condition. Some alternative plans may have waiting periods or exclusions for pre-existing conditions, so it’s essential to understand the implications and choose a plan that provides adequate coverage.

Cost-Effectiveness and Value

When evaluating alternative coverage options, it’s crucial to consider both the cost and the value of the plan. While cost is an important factor, it’s equally important to assess the plan’s benefits, coverage limits, and out-of-pocket expenses. Choosing a plan that provides comprehensive coverage at a reasonable cost is essential to ensure you receive the healthcare you need without financial strain.

Real-Life Scenarios and Expert Insights

Let’s explore a few real-life scenarios and gain insights from industry experts to better understand the process and implications of canceling health insurance.

Scenario 1: Changing Jobs and Losing Employer-Provided Insurance

John, a 35-year-old software engineer, recently received a job offer from a new company. His current employer provides comprehensive health insurance coverage, but the new company does not offer the same benefits. John decides to accept the new position but needs to cancel his existing health insurance.

Expert Insight: In this scenario, John should carefully review his new job offer and understand the healthcare benefits provided by the new company. He can then assess whether the new coverage meets his needs or if he needs to explore alternative options. It’s important to ensure a smooth transition and avoid any gaps in coverage during the job change.

Scenario 2: Rising Premium Costs and Affordable Alternatives

Sarah, a 40-year-old freelance writer, has been paying increasingly high premiums for her health insurance plan. With rising costs, she finds it challenging to afford her current coverage. She decides to explore more affordable alternatives to meet her healthcare needs.

Expert Tip: In Sarah’s case, evaluating alternative coverage options, such as short-term health insurance or limited benefit plans, can provide cost-effective solutions. It’s crucial to compare the benefits and coverage limits of these plans to ensure they meet her specific healthcare requirements. Additionally, Sarah should consider the potential tax implications of canceling her current plan and explore options to minimize any financial penalties.

Scenario 3: Transitioning to Medicare

Robert, a 67-year-old retiree, is eligible for Medicare. He currently has a private health insurance plan but wants to understand the process of transitioning to Medicare and canceling his existing policy.

Industry Advice: Transitioning to Medicare involves a specific enrollment process. Robert should research the different Medicare plans available and understand the coverage they provide. It’s important to consider the timing of his enrollment to avoid any gaps in coverage. Additionally, Robert should carefully review the benefits and limitations of his existing plan to ensure a smooth transition and maintain continuity of care.

Frequently Asked Questions

Can I cancel my health insurance at any time?

+The timing of canceling your health insurance depends on your specific circumstances and the terms of your policy. Some policies may allow cancellation at any time, while others may have specific notice periods or renewal dates. It’s important to review your policy and contract to understand the cancellation provisions.

What happens if I cancel my health insurance during a medical emergency?

+Canceling your health insurance during a medical emergency can leave you vulnerable to significant out-of-pocket expenses. It’s crucial to have alternative coverage in place before canceling your existing policy to ensure continuous protection. Consider exploring temporary coverage options, such as short-term health insurance, to bridge the gap during emergencies.

Are there any penalties for canceling health insurance?

+The presence of penalties for canceling health insurance depends on various factors, including the reason for cancellation and the terms of your policy. Early termination fees or tax penalties under the Affordable Care Act (ACA) are potential consequences. It’s essential to review your policy and understand the potential implications before canceling.

How do I choose the right alternative coverage option?

+Choosing the right alternative coverage option involves careful consideration of your healthcare needs, budget, and the benefits provided by different plans. Evaluate short-term health insurance, limited benefit plans, and high-deductible health plans with HSAs. Compare the coverage limits, out-of-pocket expenses, and any waiting periods or exclusions to ensure you find a plan that meets your specific requirements.

Can I cancel my health insurance and enroll in a new plan immediately?

+The timing of canceling your health insurance and enrolling in a new plan depends on the specific circumstances and the terms of your policies. Some plans may have waiting periods or enrollment restrictions. It’s crucial to ensure a seamless transition and avoid any gaps in coverage. Plan your cancellation and enrollment dates carefully to maintain continuous protection.

Canceling health insurance is a significant decision that requires careful planning and consideration. By understanding the reasons for cancellation, following a structured process, and exploring alternative coverage options, individuals can ensure a smooth transition and maintain continuous healthcare protection. Remember to review your policy, contact your insurance provider, and explore the various alternatives available to make an informed decision.