Insure A Car

Insuring a car is a crucial aspect of vehicle ownership, providing financial protection and peace of mind for drivers. With a wide range of insurance options available, it's essential to understand the process and considerations to make an informed decision. This comprehensive guide will delve into the intricacies of insuring a car, covering various factors and providing valuable insights to ensure a smooth and secure journey on the road.

Understanding Car Insurance Policies

Car insurance policies serve as a financial safety net, protecting drivers and their vehicles from potential losses and liabilities. These policies typically cover a range of scenarios, including accidents, theft, and damage caused by natural disasters. Understanding the different types of coverage available is key to tailoring an insurance plan to your specific needs.

Liability Coverage

Liability coverage is a fundamental component of any car insurance policy. It protects the policyholder against claims arising from bodily injury or property damage caused to others in an accident for which the insured is held responsible. This coverage is mandatory in most states and ensures financial protection against lawsuits and medical expenses incurred by third parties.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injuries sustained by others in an accident. |

| Property Damage Liability | Pays for repairs or replacements for damages caused to another person's property, such as their vehicle or personal belongings. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage offer additional protection for the insured vehicle. Collision coverage pays for repairs or replacements if the insured vehicle collides with another vehicle or object, regardless of fault. Comprehensive coverage, on the other hand, covers damages caused by non-collision events, such as theft, vandalism, natural disasters, or hitting an animal.

Personal Injury Protection (PIP)

Personal Injury Protection, often known as PIP, provides coverage for medical expenses and lost wages for the policyholder and their passengers, regardless of who is at fault in an accident. This coverage is particularly beneficial as it ensures prompt access to medical care and financial support during recovery.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage protects the policyholder when involved in an accident with a driver who either lacks insurance or has inadequate coverage to pay for the damages caused. This coverage ensures that the insured is not left with out-of-pocket expenses when faced with an uninsured or underinsured driver.

Factors Influencing Car Insurance Rates

Car insurance rates can vary significantly depending on various factors. Understanding these influences can help drivers make informed decisions and potentially negotiate better rates.

Driver's Profile

The driver's profile is a critical factor in determining insurance rates. Insurers consider age, gender, driving history, and credit score when assessing risk. Young drivers, especially males, are often considered higher risk and may face higher premiums. Conversely, experienced drivers with clean records and good credit scores may enjoy more favorable rates.

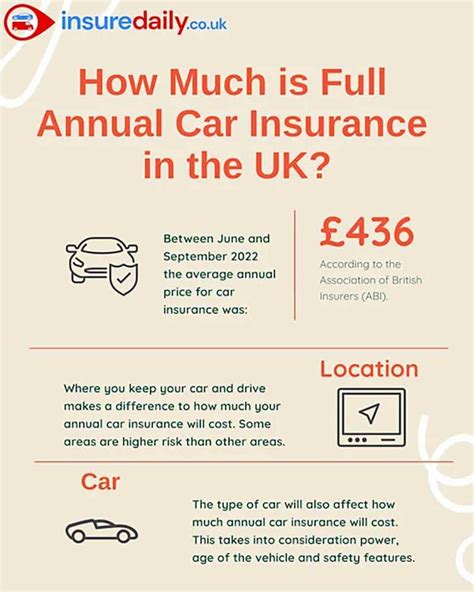

Vehicle Type and Usage

The type of vehicle and its intended usage also play a significant role in insurance rates. High-performance sports cars and luxury vehicles generally carry higher premiums due to their increased repair costs and higher risk of theft. Additionally, vehicles used for business purposes or frequent long-distance travel may also attract higher rates.

Location and Mileage

The location where the vehicle is primarily driven and the annual mileage are important considerations. Urban areas with higher populations and increased traffic tend to have higher insurance rates due to the higher likelihood of accidents. Similarly, vehicles with higher mileage are often associated with increased wear and tear, leading to potentially higher premiums.

Insurance Provider and Coverage Options

Different insurance providers offer varying coverage options and rates. It's essential to shop around and compare quotes from multiple insurers to find the best fit. Additionally, the chosen coverage levels and deductibles significantly impact the overall premium. Higher deductibles may result in lower premiums, but they also mean the policyholder will pay more out of pocket in the event of a claim.

The Process of Insuring a Car

Insuring a car involves several steps, from gathering necessary information to finalizing the policy. Here's a breakdown of the process:

Research and Comparison

Start by researching different insurance providers and the coverage options they offer. Compare quotes and policy details to identify the best fit for your needs and budget. Online comparison tools and insurance broker services can be valuable resources during this stage.

Gathering Required Information

To obtain an accurate quote, insurers will require specific information, including the driver's personal details, vehicle make and model, intended usage, and driving history. Having this information readily available will streamline the application process.

Applying for Insurance

Once you've selected an insurance provider, the next step is to apply for coverage. This typically involves filling out an application form, either online or with the assistance of an insurance agent. Ensure all information provided is accurate and up-to-date to avoid potential issues down the line.

Reviewing and Finalizing the Policy

After submitting the application, the insurance provider will review the details and provide a quote. Carefully review the policy, including the coverage limits, deductibles, and any exclusions or limitations. If satisfied, you can finalize the policy by paying the initial premium and receiving your insurance certificate.

Tips for Obtaining the Best Car Insurance Rates

Obtaining the best car insurance rates involves a combination of factors, including smart shopping, maintaining a good driving record, and exploring discounts. Here are some strategies to consider:

Shop Around and Negotiate

Don't settle for the first quote you receive. Shop around and compare rates from multiple insurers. Many providers offer discounts for bundling policies (e.g., combining car and home insurance) or for being a loyal customer. Negotiating with your insurer and highlighting these potential savings can lead to better rates.

Maintain a Good Driving Record

A clean driving record is a significant factor in determining insurance rates. Avoid traffic violations and accidents to keep your record clean. Insurers view drivers with a history of safe driving as lower risk, which can result in more favorable rates.

Explore Discounts

Insurance providers offer a variety of discounts to attract and retain customers. Common discounts include safe driver discounts, good student discounts, multi-policy discounts, and loyalty discounts. Additionally, some insurers provide discounts for vehicles equipped with safety features or for drivers who complete defensive driving courses.

Consider Higher Deductibles

Opting for higher deductibles can result in lower premiums. However, it's important to choose a deductible amount that you can comfortably afford in the event of a claim. This strategy can be particularly beneficial for drivers with a clean record and a lower risk of frequent claims.

FAQs

How much does car insurance typically cost?

+The cost of car insurance can vary widely depending on factors such as the driver's profile, vehicle type, location, and coverage options. On average, drivers can expect to pay anywhere from $500 to $1,500 annually for basic liability coverage. However, the cost can be significantly higher for comprehensive coverage and additional features.

Can I get car insurance if I have a poor driving record?

+Yes, it is still possible to obtain car insurance with a poor driving record. However, insurers may view you as a higher risk, leading to increased premiums. It's essential to shop around and compare quotes from different providers to find the most competitive rates. Additionally, maintaining a clean driving record going forward can help improve your insurance options over time.

What happens if I fail to maintain car insurance coverage?

+Failing to maintain car insurance coverage can result in significant legal consequences. In most states, it is mandatory to have at least the minimum level of liability insurance. If caught driving without insurance, you may face fines, license suspension, or even criminal charges. Additionally, you would be financially responsible for any damages or injuries caused in an accident.

How often should I review and update my car insurance policy?

+It is advisable to review your car insurance policy annually or whenever significant changes occur in your life or driving situation. This includes changes in your driving record, vehicle usage, or personal circumstances. Regular reviews ensure that your coverage remains adequate and that you're not overpaying for unnecessary features.

Can I switch car insurance providers mid-policy term?

+Yes, you can switch car insurance providers at any time. However, it's essential to ensure that you have continuous coverage to avoid gaps in protection. When switching, make sure to provide the new insurer with proof of prior coverage and compare the new policy's coverage limits and deductibles to ensure a seamless transition.