Cheap Auto Insurance After Accident

Finding cheap auto insurance after an accident can be a challenging task, especially when you consider the potential impact on your premiums. An accident, regardless of fault, often leads to an increase in insurance costs. However, there are strategies and considerations that can help you navigate this situation and potentially secure more affordable coverage. This comprehensive guide will delve into the factors that influence insurance rates post-accident, explore options for securing cheaper premiums, and provide valuable insights to help you make informed decisions about your auto insurance.

Understanding the Impact of an Accident on Insurance Rates

An accident, even a minor one, can have a significant impact on your insurance premiums. Insurance companies use various factors to assess risk and determine premiums, and accidents are a key indicator of potential future claims. Here’s a breakdown of how accidents can affect your insurance rates:

At-Fault Accidents

If you are deemed at fault for an accident, your insurance company will likely consider you a higher risk. At-fault accidents can result in increased premiums due to the potential for future claims. The severity of the accident and the number of claims filed can further impact the extent of the rate increase.

| Accident Severity | Impact on Premiums |

|---|---|

| Minor fender benders | Mild to moderate rate increase |

| Major accidents with significant damage and injuries | Substantial rate increase |

Non-Fault Accidents

Even if you are not at fault, an accident can still affect your insurance rates. While the impact may be less severe than an at-fault accident, it can still result in increased premiums. This is because insurance companies consider the overall risk profile of the driver, including their involvement in accidents, regardless of fault.

Claims History

Your claims history is a critical factor in determining insurance rates. If you have a history of multiple accidents and claims, insurance companies may view you as a higher risk and charge higher premiums. It’s important to note that the impact of an accident on your rates can depend on the number of claims you’ve made in the past and the time elapsed since the accident.

Strategies for Securing Cheaper Auto Insurance After an Accident

While an accident can lead to increased insurance costs, there are strategies you can employ to potentially mitigate the impact on your premiums. Here are some effective approaches to consider:

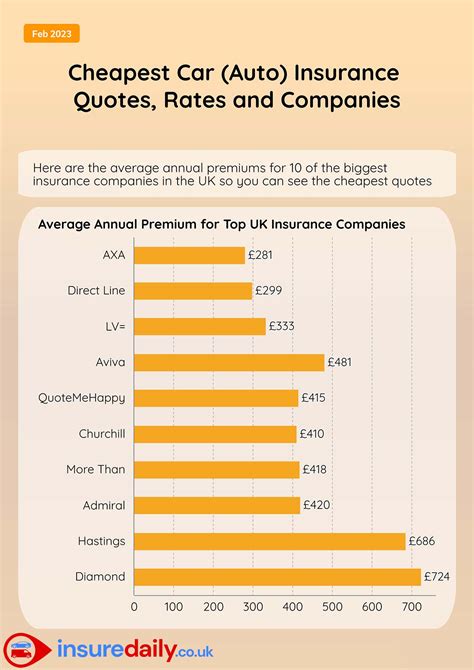

Shop Around and Compare Rates

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare rates from multiple insurance providers. Insurance companies use different methodologies to assess risk and determine premiums, so you may find variations in rates for similar coverage. Use online comparison tools and reach out to different insurers to get a range of quotes.

Review Your Coverage

Assess your current insurance coverage and consider making adjustments to reduce your premiums. Review the various components of your policy, such as liability limits, comprehensive and collision coverage, and any optional add-ons. You may find that adjusting these aspects can result in cost savings without compromising essential coverage.

Increase Your Deductible

Consider increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you assume more financial responsibility in the event of a claim, which can lead to lower premiums. However, it’s important to choose a deductible amount that you can comfortably afford in the event of an accident.

Maintain a Clean Driving Record

A clean driving record is a powerful tool in securing affordable insurance rates. Focus on safe driving practices and avoid any further accidents or violations. Insurance companies often reward drivers with clean records by offering lower premiums. Additionally, consider enrolling in defensive driving courses, as some insurers provide discounts for completing such programs.

Explore Discounts and Special Programs

Insurance companies offer a variety of discounts and special programs that can help reduce your premiums. Common discounts include safe driver discounts, multi-policy discounts (bundling auto insurance with other policies), and loyalty discounts for long-term customers. Additionally, some insurers offer accident forgiveness programs, which can prevent an at-fault accident from impacting your rates.

Consider Telematics or Usage-Based Insurance

Telematics or usage-based insurance programs use technology to monitor your driving behavior and habits. These programs can provide personalized rates based on your actual driving patterns. If you’re a safe and cautious driver, these programs may offer lower premiums. However, it’s important to carefully review the terms and conditions of such programs to ensure they align with your privacy preferences.

Seek Professional Guidance

If you’re unsure about the best course of action or need assistance navigating the insurance landscape post-accident, consider seeking guidance from an insurance professional or broker. They can provide expert advice tailored to your specific situation and help you explore all available options for securing cheaper auto insurance.

The Long-Term Impact of an Accident on Insurance Rates

While the immediate impact of an accident on insurance rates can be significant, the long-term effects can vary. Here’s what you need to know about the potential long-term implications:

Time Elapsed Since the Accident

The amount of time that has passed since the accident can play a role in determining your insurance rates. Insurance companies often consider the recency of an accident when assessing risk. Over time, as you maintain a clean driving record and avoid further accidents, the impact of the initial accident may diminish.

Insurance Companies and Rate Changes

Insurance companies have different policies and practices when it comes to rate adjustments post-accident. Some insurers may choose to increase rates significantly after an accident, while others may adopt a more gradual approach. It’s important to understand the specific practices of your insurance company and how they handle rate changes.

Renewal and Shopping for New Insurance

When it’s time to renew your insurance policy or if you’re shopping for new insurance after an accident, it’s crucial to carefully review your options. Compare quotes from multiple insurers and assess the potential long-term costs. Some insurance companies may offer more favorable rates for drivers with a history of accidents, while others may have more stringent pricing policies.

Tips for Navigating the Insurance Process Post-Accident

Here are some additional tips to help you navigate the insurance process and potentially secure cheaper auto insurance after an accident:

- File claims promptly and provide all necessary information to your insurance company.

- Cooperate with the claims process and respond to any requests for additional documentation or inspections.

- Consider using a reputable auto body shop for repairs, as some insurers have preferred partnerships that can impact claim settlements.

- Keep a detailed record of all communication and interactions with your insurance company, including dates, times, and names of representatives.

- Review your insurance policy regularly to ensure you understand the coverage and any potential exclusions.

- Stay informed about changes in insurance regulations and market trends that may impact your premiums.

Frequently Asked Questions

Will my insurance rates go up after an accident, even if I’m not at fault?

+Yes, even if you’re not at fault, an accident can still impact your insurance rates. While the increase may be less severe than an at-fault accident, it’s important to understand that insurance companies assess the overall risk profile of the driver. However, the extent of the rate increase can depend on various factors, including the severity of the accident and your claims history.

How long will an accident stay on my insurance record and affect my rates?

+The duration that an accident stays on your insurance record can vary depending on the insurance company and your state’s regulations. Generally, accidents remain on your record for a minimum of three years, but some insurers may consider them for a longer period. It’s important to review your insurance policy and understand the specific practices of your insurer regarding accident reporting and rate adjustments.

Can I negotiate my insurance rates after an accident to avoid a significant increase?

+While negotiating insurance rates can be challenging, it’s not impossible. Some insurance companies may be open to discussing rate adjustments, especially if you have a long-standing relationship with them or have a strong track record of safe driving. It’s worth reaching out to your insurer and explaining your situation to see if there’s room for negotiation.

Are there any alternative insurance options for drivers with a history of accidents?

+Yes, there are alternative insurance options available for drivers with a history of accidents. Some insurers specialize in providing coverage for high-risk drivers or those with a less-than-perfect driving record. These insurers may offer more competitive rates and flexible coverage options. It’s worth exploring these alternatives, especially if you’ve struggled to find affordable insurance through traditional providers.

Can I lower my insurance rates by switching companies after an accident?

+Switching insurance companies can sometimes result in lower rates, especially if you’ve had a recent accident. However, it’s important to carefully consider the overall value and coverage provided by the new insurer. While a lower rate may be appealing, ensure that the new policy meets your needs and provides adequate coverage. Additionally, some insurers may have specific policies regarding accidents and rate adjustments, so it’s crucial to thoroughly research and compare options.