Purchase Workers Compensation Insurance

Understanding Workers' Compensation Insurance: A Comprehensive Guide

Workers' compensation insurance is a vital component of any business's risk management strategy. It provides financial protection to employers and ensures that employees injured on the job receive the necessary medical care and compensation. In this comprehensive guide, we will delve into the intricacies of workers' compensation insurance, offering a deep understanding of its purpose, benefits, and the process of acquiring this essential coverage.

With workers' compensation, employers can safeguard their businesses from potential financial burdens arising from workplace injuries or illnesses. This type of insurance is designed to provide a safety net for employees, ensuring they receive prompt and adequate medical treatment, as well as wage replacement during their recovery period. By purchasing workers' compensation insurance, employers demonstrate their commitment to employee well-being and compliance with legal requirements.

As we navigate through this guide, we will explore the key aspects of workers' compensation insurance, including its historical context, the specific coverage it provides, and the factors that influence premium rates. We will also guide you through the process of obtaining this insurance, highlighting the importance of accurate risk assessment and the role of insurance brokers in tailoring policies to your business's unique needs.

The History and Evolution of Workers' Compensation

The concept of workers' compensation has its roots in ancient civilizations, where various forms of compensation were provided to injured workers. However, it was during the Industrial Revolution that the need for a structured system became apparent. As industries expanded and workplace accidents became more frequent, the issue of worker protection gained prominence.

The late 19th and early 20th centuries witnessed significant developments in workers' compensation laws. Countries like Germany, England, and the United States began enacting legislation to address the rising concerns over workplace injuries. These laws aimed to establish a no-fault system, where injured workers would receive benefits regardless of who was at fault for the accident.

Over time, workers' compensation programs have evolved to include not only physical injuries but also occupational illnesses and mental health conditions. Today, these programs are an integral part of workplace safety and employee rights, offering a comprehensive approach to protecting workers and their families.

Key Components of Workers' Compensation Coverage

Workers' compensation insurance offers a wide range of benefits, tailored to meet the diverse needs of employees and their families. Here are some of the critical components of this coverage:

Medical Benefits

One of the primary purposes of workers' compensation is to provide medical care to injured workers. This includes coverage for emergency room visits, hospital stays, surgeries, prescription medications, and rehabilitative services. The insurance ensures that employees receive the necessary treatment without incurring significant out-of-pocket expenses.

Wage Replacement

In the event of a work-related injury or illness, workers' compensation provides wage replacement benefits. These benefits aim to compensate employees for the wages they lose while they are unable to work due to their condition. The amount and duration of wage replacement depend on various factors, including the severity of the injury and state regulations.

Vocational Rehabilitation

For employees who suffer severe injuries or illnesses, workers' compensation can provide vocational rehabilitation services. These services assist employees in returning to work by offering job training, skill development, and job placement assistance. Vocational rehabilitation aims to help employees regain their independence and productivity.

Death Benefits

In the unfortunate event of a workplace fatality, workers' compensation provides death benefits to the surviving family members of the deceased worker. These benefits can include funeral expenses, burial costs, and ongoing financial support for the worker's dependents.

Factors Influencing Workers' Compensation Premiums

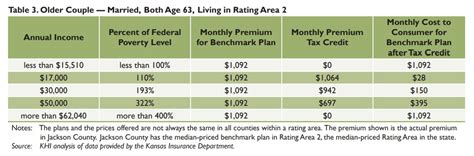

The cost of workers' compensation insurance, or the premium, is determined by a variety of factors. Understanding these factors can help employers make informed decisions when purchasing this coverage. Here are some key considerations:

Industry and Occupational Risks

Different industries and occupations carry varying levels of risk. For instance, construction work is generally considered more hazardous than office work. Insurance companies take into account the nature of your business and the associated risks when calculating premiums. Higher-risk industries typically pay higher premiums.

Claim History

Your company's claim history is a significant factor in determining workers' compensation premiums. If your business has a history of frequent or severe claims, it may lead to higher premiums. Conversely, a low claim rate can result in more affordable rates. Maintaining a safe work environment and implementing effective safety measures can positively impact your claim history.

Employee Wages

The wages paid to your employees also play a role in determining premiums. Higher-paid employees may result in higher premiums, as the wage replacement benefits are calculated based on their income. It's important to accurately report employee wages to ensure fair and accurate premium calculations.

State Regulations

Workers' compensation is regulated at the state level, and each state has its own set of rules and regulations. These regulations can influence premium rates, as they determine the benefits and coverage provided. It's essential to understand your state's specific requirements to ensure compliance and accurate premium assessments.

The Process of Purchasing Workers' Compensation Insurance

Acquiring workers' compensation insurance involves several steps to ensure a comprehensive and tailored coverage plan. Here's a step-by-step guide to help you through the process:

Conduct a Risk Assessment

Begin by conducting a thorough risk assessment of your business. Identify the potential hazards and risks associated with your industry and operations. This assessment will help you understand the specific coverage needs of your business and guide you in choosing the right policy.

Choose an Insurance Provider

Research and select a reputable insurance provider that specializes in workers' compensation insurance. Look for providers with a strong track record, excellent customer service, and a comprehensive understanding of your industry. Consider seeking recommendations from industry peers or consulting with an insurance broker.

Collaborate with an Insurance Broker

Engaging an insurance broker can be highly beneficial when purchasing workers' compensation insurance. Brokers have extensive knowledge of the insurance market and can guide you through the process, ensuring you obtain the best coverage at a competitive price. They can also assist in negotiating terms and conditions with insurance providers.

Provide Accurate Information

When applying for workers' compensation insurance, it's crucial to provide accurate and detailed information about your business. This includes employee wages, claim history, and any safety measures or training programs in place. Accurate information ensures that your policy is tailored to your specific needs and that premiums are calculated fairly.

Review and Understand the Policy

Once you receive a workers' compensation insurance policy, take the time to review and understand its terms and conditions. Ensure that the coverage meets your business's needs and that you are aware of any exclusions or limitations. If you have any questions or concerns, consult with your insurance broker or provider.

Tips for Managing Workers' Compensation Costs

While workers' compensation insurance is essential, it's also important to manage costs effectively. Here are some tips to help you keep premiums under control:

- Implement a robust safety program: A comprehensive safety program can reduce the number and severity of workplace accidents, leading to lower claim rates and, consequently, lower premiums.

- Encourage employee wellness: Promoting a healthy workforce can prevent injuries and illnesses, reducing the need for medical treatment and wage replacement benefits.

- Stay informed about regulatory changes: Keep abreast of any changes in state regulations that may impact your workers' compensation coverage and premiums. Being aware of these changes allows you to adjust your risk management strategies accordingly.

- Regularly review your policy: Periodically review your workers' compensation policy to ensure it aligns with your business's evolving needs. This may involve adjusting coverage limits or exploring alternative policies that offer better value.

By implementing these strategies, you can maintain a safe workplace, reduce claim rates, and ultimately lower your workers' compensation insurance costs.

Future Trends in Workers' Compensation

The landscape of workers' compensation is continually evolving, driven by technological advancements, changing workplace dynamics, and shifting societal attitudes. Here are some key trends to watch in the future:

Telemedicine and Digital Health Solutions

The integration of telemedicine and digital health solutions is expected to play a significant role in workers' compensation. These technologies offer convenient and efficient access to medical care, allowing injured workers to receive timely treatment without the need for physical visits to healthcare providers. This can lead to faster recovery times and reduced medical costs.

Focus on Mental Health

There is a growing recognition of the importance of mental health in the workplace. As a result, workers' compensation programs are expanding their coverage to include mental health conditions resulting from work-related stress or trauma. This shift aims to provide comprehensive support to employees facing mental health challenges.

Data-Driven Risk Management

Advanced analytics and data-driven insights are transforming risk management in workers' compensation. By leveraging data, employers can identify trends, anticipate potential risks, and implement targeted interventions to prevent injuries and illnesses. This proactive approach can lead to more effective risk mitigation strategies.

Collaboration Between Employers and Insurers

The relationship between employers and insurance providers is expected to become more collaborative. Insurance companies are increasingly offering value-added services, such as safety training and risk assessment tools, to help employers improve workplace safety. This partnership approach can lead to enhanced risk management practices and more affordable insurance coverage.

Conclusion

Workers' compensation insurance is a critical component of any business's risk management strategy. By understanding the history, coverage, and purchasing process of this insurance, employers can ensure the well-being of their employees and comply with legal requirements. With a proactive approach to risk management and a focus on workplace safety, businesses can not only protect their bottom line but also foster a culture of care and support for their workforce.

As the landscape of workers' compensation continues to evolve, staying informed about emerging trends and technologies is essential. By embracing innovation and collaboration, employers can navigate the changing landscape of workers' compensation and create a safer, more supportive work environment.

How much does workers’ compensation insurance cost?

+The cost of workers’ compensation insurance, or the premium, varies depending on several factors. These include the industry and occupational risks, claim history, employee wages, and state regulations. Higher-risk industries and businesses with a history of frequent claims may pay higher premiums. It’s important to conduct a risk assessment and work with an insurance broker to obtain a fair and accurate premium assessment.

What happens if I don’t have workers’ compensation insurance?

+Failing to carry workers’ compensation insurance can have severe consequences for employers. In most states, it is a legal requirement for businesses to provide this coverage. Without it, employers may face significant fines, penalties, and even criminal charges. Additionally, injured workers may pursue legal action against the employer, leading to costly litigation and damage to the business’s reputation.

Can I tailor my workers’ compensation policy to my business’s needs?

+Absolutely! Workers’ compensation policies can be customized to meet the specific needs of your business. By working closely with an insurance broker, you can assess your unique risks and coverage requirements. This may involve adjusting coverage limits, adding endorsements for specific risks, or exploring alternative policies that offer a better fit for your business.

How can I reduce my workers’ compensation premiums?

+There are several strategies to manage workers’ compensation costs effectively. Implementing a robust safety program, encouraging employee wellness, staying informed about regulatory changes, and regularly reviewing your policy can all contribute to lower premiums. Additionally, collaborating with your insurance provider to explore alternative coverage options or negotiate terms may result in more affordable rates.