Auto Insurance For Older Cars Quotes

As vehicles age, their value depreciates, but that doesn't mean they become less important to their owners. Many car enthusiasts and practical drivers alike hold onto their older vehicles, often for sentimental reasons or because they are reliable and well-maintained. However, insuring an older car can present unique challenges and considerations. Understanding the factors that affect insurance rates for older vehicles is crucial for anyone looking to protect their cherished ride.

In this comprehensive guide, we'll delve into the world of auto insurance for older cars, exploring the quotes, coverage options, and strategies to ensure you get the best protection for your vintage or classic vehicle. Whether you're a collector, a long-term car owner, or simply driving a reliable older model, this article will provide you with the insights and tips to navigate the insurance landscape successfully.

Understanding Insurance for Older Cars

Insuring an older car differs from typical auto insurance in several key ways. The age and condition of the vehicle, its make and model, and its usage all play significant roles in determining the cost and scope of coverage.

Factors Influencing Quotes

When requesting quotes for older cars, several factors come into play. Insurance providers consider the vehicle’s age, make, and model, as well as its current condition and mileage. Additionally, your personal driving history, including any previous claims or violations, will impact the quote. Here’s a breakdown of these factors and their influence:

- Vehicle Age and Value: Older cars, especially those over 10 years old, are typically valued lower than newer models. Insurance companies may offer reduced rates as the car's value depreciates over time. However, this also means that comprehensive and collision coverage may not be as cost-effective for older vehicles, as the payout in the event of a total loss might not cover the cost of repairs or replacement.

- Make and Model: Some car makes and models are statistically more prone to accidents or theft, which can affect insurance rates. Classic or vintage vehicles may have specialized parts that are harder to source, driving up repair costs and influencing insurance premiums.

- Vehicle Condition: Well-maintained older cars are often viewed more favorably by insurers. Regular servicing, proper maintenance, and a clean bill of health can lead to more competitive quotes. On the other hand, vehicles with significant mechanical issues or body damage may face higher premiums or even be declined coverage.

- Mileage: The number of miles on an older car's odometer can impact insurance rates. Higher mileage generally suggests increased wear and tear, which may lead to more frequent mechanical issues and higher repair costs.

- Driver's Profile: Your personal driving history is a critical factor. Insurers consider your age, gender, driving record, and claims history when calculating quotes. A clean driving record with no accidents or violations can result in more favorable rates.

Coverage Options for Older Cars

When insuring an older car, it’s essential to understand the various coverage options available and how they might apply to your vehicle. Here’s a closer look at the common types of coverage and their relevance to older cars:

- Liability Coverage: This is the most basic form of auto insurance, covering damages or injuries you cause to others in an accident. It's required by law in most states and is a crucial aspect of any insurance policy. For older cars, liability coverage is often the primary focus, as the cost of repairing or replacing the vehicle may not be worth comprehensive or collision coverage.

- Comprehensive and Collision Coverage: These coverages protect your vehicle against damage from accidents, vandalism, natural disasters, or theft. For older cars, comprehensive and collision coverage may be less necessary or cost-effective, especially if the vehicle's value has significantly depreciated. However, if your older car is a classic or collectible, these coverages might be essential to ensure proper protection.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages. It's a valuable addition to any policy, especially for older cars, as it provides an extra layer of protection against financial losses.

- Medical Payments Coverage: Also known as "MedPay," this coverage helps pay for medical expenses for you and your passengers after an accident, regardless of fault. It's a useful addition for older cars, as it can cover expenses not covered by health insurance, such as co-pays and deductibles.

- Personal Injury Protection (PIP): PIP coverage, available in some states, provides compensation for medical expenses, lost wages, and other related costs after an accident, regardless of fault. It's an essential coverage for older cars, as it ensures you're protected even if the other driver is uninsured or underinsured.

Strategies for Affordable Insurance Quotes

Insuring an older car doesn’t have to break the bank. By employing a few strategic approaches, you can secure more affordable quotes and ensure your older vehicle is properly protected. Here are some tips to consider:

Compare Quotes from Multiple Insurers

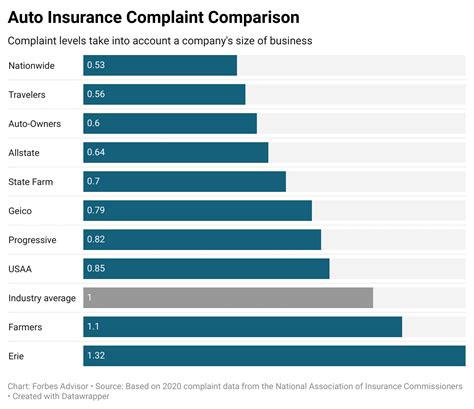

Insurance rates can vary significantly between providers, even for the same vehicle and driver profile. By obtaining quotes from multiple insurers, you can compare prices and coverage options to find the best deal. Online comparison tools and insurance brokers can make this process easier, providing a wide range of quotes in one place.

Choose the Right Coverage Levels

As mentioned earlier, the coverage you choose can significantly impact your insurance costs. For older cars, it’s essential to strike a balance between adequate protection and cost-effectiveness. Consider your vehicle’s value, usage, and your personal financial situation when deciding on coverage levels.

Maintain a Clean Driving Record

Your driving history is a major factor in determining insurance rates. A clean record with no accidents or violations can lead to lower premiums. Focus on safe driving practices, obey traffic laws, and avoid distractions to maintain a positive driving history.

Consider Usage and Storage

The way you use your older car can influence insurance rates. If your vehicle is primarily for pleasure driving or is a classic car used only occasionally, you may be eligible for lower rates or specialized coverage options. Additionally, proper storage and security measures can also impact your insurance costs. Storing your car in a garage or a secure location can reduce the risk of theft or damage, leading to more favorable quotes.

Explore Discounts and Bundles

Many insurance providers offer discounts for various reasons, such as safe driving records, loyalty, or bundling multiple policies (e.g., auto and home insurance). Take advantage of these discounts to lower your insurance costs. Additionally, consider using telematics devices or apps that track your driving behavior. Some insurers offer discounts based on safe driving habits monitored through these devices.

Specialized Insurance for Classics and Collectibles

If your older car is a classic or collectible, you may want to consider specialized insurance providers that cater specifically to these types of vehicles. These insurers often offer more comprehensive coverage options, such as agreed-value policies, which ensure you receive the full value of your vehicle in the event of a total loss. They may also provide additional benefits like event coverage, spare parts coverage, and specialized repair networks.

The Future of Auto Insurance for Older Cars

The insurance landscape for older cars is evolving, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of auto insurance for vintage and classic vehicles:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance (UBI) are becoming increasingly popular, offering drivers the opportunity to lower their insurance costs by demonstrating safe driving habits. These technologies track driving behavior, including speed, braking, and mileage, and provide discounts based on responsible driving. For older cars, UBI can be a great way to save on insurance costs while also encouraging safer driving practices.

Customized Coverage Options

As the insurance industry becomes more data-driven, insurers are better equipped to offer customized coverage options tailored to individual needs. This means that older car owners can expect more personalized insurance plans that take into account the unique characteristics and value of their vehicles. Customized coverage can provide more comprehensive protection while also being cost-effective, ensuring older cars are properly insured without unnecessary expenses.

Online Comparison Tools and Digital Insurance

The rise of digital insurance and online comparison platforms is making it easier and more convenient for consumers to shop for insurance. These tools provide a transparent view of the market, allowing older car owners to compare quotes and coverage options from multiple insurers in one place. Additionally, digital insurance platforms often offer faster claims processing and more efficient customer service, ensuring a smoother overall experience.

Alternative Risk Transfer (ART) Solutions

ART solutions, such as parametric insurance and microinsurance, are gaining traction in the insurance industry. These innovative approaches offer more flexible and customizable coverage options, often at a lower cost. For older car owners, ART solutions can provide an alternative to traditional insurance, offering protection against specific risks or perils while being more affordable and accessible.

Insuring Older Electric Vehicles (EVs)

With the rise of electric vehicles, the insurance industry is also adapting to cover these unique vehicles. Older EVs may present specific challenges, such as the availability and cost of replacement parts or specialized repair facilities. Insurance providers are developing coverage options tailored to older EVs, ensuring these vehicles are properly protected while also considering their unique characteristics and maintenance needs.

FAQs

How do I determine the value of my older car for insurance purposes?

+Determining the value of an older car for insurance can be complex. You can start by researching comparable sales of similar vehicles in your area. Online resources and vehicle valuation guides can provide a good starting point. Additionally, consider getting a professional appraisal from a classic car expert or consulting with an insurance agent who specializes in older vehicles. They can help you assess the fair market value and ensure you’re properly insured.

Are there any special considerations for insuring classic or vintage cars?

+Absolutely! Classic and vintage cars often require specialized coverage due to their unique value and maintenance needs. Consider seeking out insurers who specialize in classic car insurance. They can offer agreed-value policies, which ensure you receive the full value of your vehicle in the event of a total loss. Additionally, these insurers may provide access to specialized repair networks and spare parts coverage, ensuring your classic car is properly cared for.

What if my older car is a daily driver, but I also use it for pleasure trips or car shows?

+If your older car serves a dual purpose, it’s important to inform your insurance provider about its usage. Many insurers offer specific coverage options for vehicles used for pleasure driving or car shows. These policies may provide additional protection for events or exhibitions, ensuring your car is covered while participating in these activities. Make sure to discuss your usage with your insurer to ensure you have the right coverage.

Can I get discounts on insurance for my older car if I have multiple vehicles or other policies with the same insurer?

+Yes, bundling multiple policies with the same insurer is a great way to save on insurance costs. Many insurers offer multi-policy discounts, which can provide significant savings on your auto insurance premiums. Additionally, if you have other types of insurance, such as home or life insurance, with the same provider, you may be eligible for even more discounts. It’s always worth exploring these options to lower your overall insurance expenses.

What should I do if my older car is involved in an accident, and I need to file a claim?

+If your older car is involved in an accident, the first step is to ensure your safety and the safety of others involved. Then, contact your insurance provider as soon as possible to report the accident. They will guide you through the claims process, which typically involves providing details of the incident, obtaining estimates for repairs, and potentially arranging for a rental car if necessary. It’s important to cooperate fully with your insurer and provide all the required documentation to ensure a smooth claims process.