Insurance Usa

The insurance industry in the United States is a complex and vital sector, playing a crucial role in protecting individuals, businesses, and communities from financial risks. With a long history and a diverse range of products and services, insurance in the US has evolved significantly to meet the changing needs of its population. This article aims to delve into the depths of the American insurance landscape, exploring its key aspects, challenges, and future prospects.

Understanding the Insurance Landscape in the US

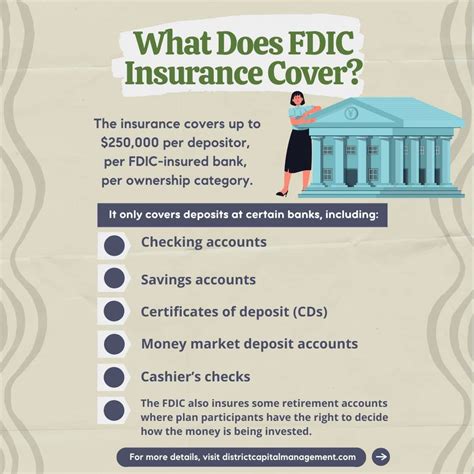

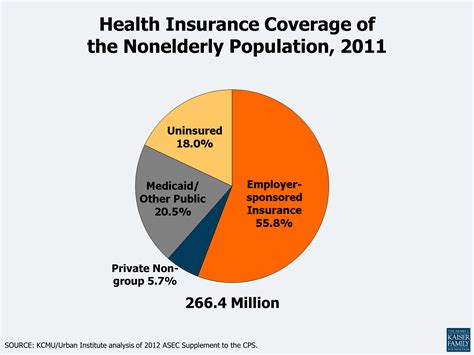

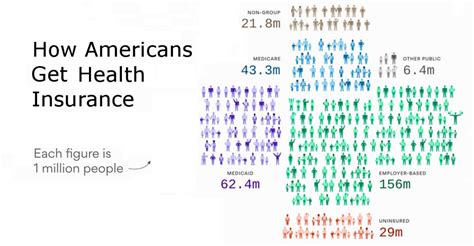

Insurance in the United States is a multifaceted industry, offering a wide array of coverage options to cater to the diverse needs of its citizens. From life insurance policies that provide financial security to families, to health insurance plans that ensure access to essential medical care, and property insurance that safeguards homes and businesses, the American insurance market is comprehensive and robust.

The industry's reach extends beyond these traditional forms of coverage. It also includes auto insurance, which is mandatory in most states, protecting drivers from financial liabilities in the event of accidents. Furthermore, the rise of digital technologies has led to the emergence of new insurance types, such as cyber insurance, which addresses the growing risks associated with data breaches and cyberattacks.

The US insurance market is characterized by a high degree of competition, with numerous insurance companies, both domestic and international, vying for market share. This competitive environment has driven innovation, with insurers constantly developing new products and services to stay ahead of the curve and meet the evolving needs of their customers.

Key Players and Market Share

The American insurance industry is dominated by a handful of large, well-established companies. These include household names like State Farm, Allstate, and Progressive, which have built their reputation on providing reliable and comprehensive insurance coverage. These companies have a significant market share, particularly in the auto and home insurance sectors.

However, the industry is not limited to these major players. There are numerous smaller insurance providers, often specializing in specific types of coverage or catering to niche markets. These smaller insurers bring diversity and innovation to the market, offering unique products and personalized services.

| Insurance Company | Market Share (%) |

|---|---|

| State Farm | 14.6 |

| Allstate | 9.8 |

| Berkshire Hathaway | 7.6 |

| Progressive | 6.6 |

| Liberty Mutual | 5.4 |

| Travelers | 5.2 |

| USAA | 4.2 |

| Farmers | 3.8 |

| Nationwide | 3.4 |

| MetLife | 2.6 |

It's important to note that market share can vary significantly depending on the type of insurance and the specific region. For instance, while State Farm might dominate the auto insurance market in certain states, other insurers may have a stronger presence in different regions or for specific insurance types.

Insurance Regulation and Oversight

The US insurance industry is subject to a complex regulatory framework aimed at protecting consumers and ensuring the stability of the market. Insurance regulation in the US is primarily a state-level affair, with each state having its own department or office responsible for overseeing the industry within its borders.

While state-level regulation is the norm, there are also federal agencies that play a role in overseeing certain aspects of the insurance industry. For instance, the Federal Insurance Office (FIO) is responsible for monitoring the insurance industry and making recommendations to the federal government on regulatory and legislative matters.

State-Level Regulation

Each state has its own set of insurance laws and regulations, which can vary significantly from one state to another. These regulations cover a wide range of aspects, including licensing requirements for insurance agents and companies, solvency standards for insurers, and consumer protection measures.

State insurance departments are responsible for enforcing these regulations and ensuring that insurers operating within their jurisdiction comply with the law. They also play a crucial role in consumer protection, investigating and addressing complaints against insurance companies, and ensuring that policyholders receive the benefits they are entitled to.

Despite the state-level focus, there are certain aspects of insurance regulation that are uniform across the country. For instance, all states require auto insurance to include liability coverage, which protects the policyholder against claims arising from bodily injury or property damage caused to others in an accident for which the policyholder is at fault.

Federal Oversight

While state insurance departments have primary responsibility for regulating the industry, there are several federal agencies that play a role in overseeing specific aspects of the insurance market.

- Federal Insurance Office (FIO): As mentioned earlier, the FIO is responsible for monitoring the insurance industry and making recommendations to the federal government on regulatory and legislative matters. It also coordinates with state insurance regulators to ensure a consistent approach to insurance regulation across the country.

- Federal Trade Commission (FTC): The FTC plays a role in ensuring fair competition in the insurance industry, particularly in the area of marketing and advertising. It investigates and takes action against insurers that engage in deceptive or unfair practices.

- Department of Labor (DOL): The DOL's Employee Benefits Security Administration (EBSA) oversees employee benefit plans, including health insurance plans provided by employers. It enforces the Employee Retirement Income Security Act (ERISA), which sets minimum standards for such plans.

The involvement of federal agencies in insurance regulation ensures a certain level of consistency and uniformity across the country, complementing the primary role played by state insurance departments.

Challenges and Future Prospects

The insurance industry in the US faces a number of challenges, both immediate and long-term. These challenges include rising costs, changing consumer expectations, and the impact of technological advancements.

Rising Costs and Premium Prices

One of the most significant challenges facing the insurance industry is the rising cost of insurance coverage. This is driven by a variety of factors, including increasing medical costs, the rising frequency and severity of natural disasters, and the impact of inflation on claim payouts.

As a result, insurance premiums have been on the rise, making coverage less affordable for many individuals and businesses. This has led to a growing demand for more affordable insurance options, particularly in the health and property insurance sectors.

In response, insurers are exploring various strategies to control costs. This includes the adoption of more efficient claims management processes, the use of predictive analytics to identify and mitigate potential risks, and the development of innovative products that offer more affordable coverage options.

Changing Consumer Expectations

The digital age has transformed consumer expectations across all industries, and insurance is no exception. Today's consumers, particularly the younger generations, expect a seamless, personalized, and tech-driven insurance experience.

They want insurance policies that are easy to understand and purchase, with clear and transparent terms. They also expect quick and efficient claims processing, often preferring digital channels for communication and interaction with their insurers.

Insurers are rising to this challenge by investing in digital transformation. They are developing user-friendly online platforms and mobile apps, offering a range of digital services such as policy management, claims reporting, and real-time assistance. They are also leveraging data analytics to personalize insurance products and services, meeting the unique needs of individual consumers.

Impact of Technological Advancements

Technological advancements are reshaping the insurance industry in profound ways. The adoption of artificial intelligence (AI), machine learning, and data analytics is enabling insurers to make more accurate risk assessments, leading to more efficient underwriting and pricing.

Additionally, the use of Internet of Things (IoT) devices, such as connected car technologies and home security systems, is providing insurers with real-time data that can be used to offer more personalized and targeted insurance products. For instance, usage-based insurance policies for cars can offer discounts to safe drivers, while home insurance policies can provide incentives for the adoption of smart home technologies that reduce the risk of theft or damage.

However, technological advancements also bring new risks and challenges. The increasing reliance on digital technologies and data raises concerns about cybersecurity and data privacy. Insurers must invest in robust cybersecurity measures to protect their systems and the sensitive data they hold, while also ensuring they comply with evolving data privacy regulations.

Conclusion

The insurance industry in the United States is a complex and dynamic sector, offering a wide range of coverage options to meet the diverse needs of its population. It is characterized by a high degree of competition and innovation, with insurers constantly developing new products and services to stay ahead of the curve.

Despite the challenges it faces, including rising costs, changing consumer expectations, and the impact of technological advancements, the US insurance industry is well-positioned for the future. By embracing digital transformation, investing in technology, and adapting to changing market conditions, insurers can continue to provide essential protection and peace of mind to individuals, businesses, and communities across the country.

Frequently Asked Questions

What are the different types of insurance available in the US?

+The US insurance market offers a wide range of coverage types, including life insurance, health insurance, property insurance (covering homes and businesses), auto insurance, and more specialized forms such as cyber insurance and liability insurance.

How is the insurance industry regulated in the US?

+Insurance regulation in the US is primarily a state-level affair, with each state having its own department or office responsible for overseeing the industry within its jurisdiction. However, there are also federal agencies that play a role in overseeing certain aspects of the insurance market, such as the Federal Insurance Office and the Federal Trade Commission.

What are the main challenges facing the US insurance industry?

+The insurance industry in the US faces several challenges, including rising costs and premium prices, changing consumer expectations, and the impact of technological advancements. Insurers are addressing these challenges through digital transformation, the adoption of new technologies, and the development of innovative products and services.

How can I choose the right insurance provider for my needs?

+When choosing an insurance provider, it’s important to consider your specific needs and preferences. Research different insurers, compare their products and services, and read reviews from other customers. Look for an insurer that offers comprehensive coverage, transparent terms, and efficient claims processing. Consider factors such as financial stability, customer service reputation, and any additional benefits or perks they offer.

What is the future outlook for the US insurance industry?

+The US insurance industry is well-positioned for the future, with a focus on digital transformation and technological innovation. Insurers are adapting to changing consumer expectations and market conditions, offering more affordable and personalized insurance products. However, challenges such as rising costs and the need for robust cybersecurity measures will continue to shape the industry’s development.