State Farm Renters Insurance Phone Number

State Farm is a renowned insurance provider in the United States, offering a comprehensive range of insurance products, including renters insurance. Renters insurance is an essential coverage for individuals who rent their living spaces, as it protects their personal belongings and provides liability coverage. This article will delve into the world of State Farm renters insurance, providing an in-depth analysis of its features, benefits, and the steps to obtain coverage.

Understanding State Farm Renters Insurance

State Farm’s renters insurance policy is designed to safeguard the possessions and personal liability of renters. Unlike homeowners insurance, which primarily covers the structure and its contents, renters insurance focuses on the belongings and liabilities of individuals residing in rental properties. It is an affordable and comprehensive solution for renters, offering peace of mind and financial protection in the event of unexpected losses or liabilities.

Key Coverage Elements of State Farm Renters Insurance

State Farm’s renters insurance policy includes several crucial coverage components:

- Personal Property Coverage: This coverage protects your personal belongings, such as furniture, electronics, clothing, and other valuables, against damage or loss due to perils like fire, theft, or vandalism. State Farm offers customizable coverage limits to ensure your belongings are adequately insured.

- Liability Protection: Renters insurance provides liability coverage, which is crucial for protecting you against claims or lawsuits arising from accidents or injuries that occur within your rental unit. It covers medical expenses and legal defense costs if you are found liable.

- Additional Living Expenses: In the event that your rental home becomes uninhabitable due to a covered loss, this coverage reimburses you for additional living expenses, such as temporary housing and meals, until your residence is restored.

- Personal Injury Protection: This coverage offers protection against non-bodily injury claims, such as libel, slander, or invasion of privacy, providing legal defense and coverage for settlement costs.

- Loss of Use: If a covered loss prevents you from using your rental property, this coverage reimburses you for any necessary additional expenses incurred, such as hotel stays or restaurant meals.

The Importance of Renters Insurance

Renters insurance is an essential financial safeguard for individuals who rent their homes. It provides protection against unforeseen events, such as theft, fire, or water damage, which can result in significant financial losses. Moreover, liability coverage ensures that you are protected if someone is injured in your rental unit, preventing potential legal and financial repercussions.

How to Obtain State Farm Renters Insurance

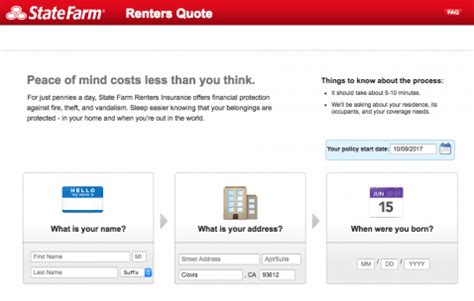

To obtain State Farm renters insurance, you can follow these simple steps:

- Contact State Farm: Reach out to State Farm’s customer service team via their official website or by calling their toll-free number: 1-800-STATE-FARM (1-800-782-8332). Their knowledgeable representatives will guide you through the process and provide personalized assistance.

- Provide Rental Information: During the application process, you will be required to provide details about your rental property, including the location, type of dwelling, and any unique features or amenities. Accurate information is essential for obtaining an accurate quote.

- Select Coverage Options: State Farm offers customizable coverage options to meet your specific needs. You can choose coverage limits for personal property, liability, and additional living expenses, ensuring you have adequate protection.

- Review and Purchase: After selecting your coverage options, carefully review the policy details and premium costs. If you are satisfied, proceed with the purchase and payment process. State Farm offers various payment options for your convenience.

Benefits of Choosing State Farm

State Farm is a trusted insurance provider with a strong reputation for customer satisfaction. Here are some key benefits of choosing State Farm for your renters insurance needs:

- Personalized Service: State Farm offers a personalized approach, ensuring that you receive tailored advice and guidance to meet your specific insurance needs.

- Competitive Pricing: State Farm provides competitive rates for renters insurance, offering affordable coverage options without compromising on quality.

- Claims Support: In the event of a claim, State Farm’s experienced claims team is available to guide you through the process, ensuring a smooth and efficient resolution.

- Discounts and Savings: State Farm offers various discounts, such as multi-policy discounts, good student discounts, and loyalty rewards, which can help reduce your insurance costs.

- Additional Services: State Farm provides valuable resources and tools, including online account management, mobile apps, and educational materials, to enhance your insurance experience.

State Farm Renters Insurance: Real-Life Case Study

To illustrate the benefits of State Farm renters insurance, let’s consider a real-life scenario:

Sarah, a recent college graduate, moved into her first apartment. She was mindful of the importance of renters insurance and decided to explore her options. After researching, she chose State Farm for its reputation and personalized approach.

During the application process, Sarah received guidance from a State Farm agent who helped her select the right coverage limits for her personal belongings and liability. With State Farm’s competitive pricing, Sarah was able to obtain comprehensive coverage at an affordable rate.

A few months later, Sarah’s apartment building suffered a fire due to a faulty electrical wiring issue. Fortunately, Sarah’s personal belongings were protected by her renters insurance policy. State Farm’s claims team promptly assisted her, providing guidance and support throughout the claims process. Sarah received a fair settlement, allowing her to replace her damaged belongings and get her life back on track.

State Farm Renters Insurance: A Smart Choice

State Farm renters insurance is a wise choice for individuals seeking comprehensive and affordable coverage for their rental properties. With its personalized service, competitive pricing, and exceptional claims support, State Farm offers a reliable and trusted insurance solution.

Key Takeaways

- State Farm renters insurance provides essential coverage for personal belongings and liability protection.

- The policy includes coverage for personal property, liability, additional living expenses, personal injury protection, and loss of use.

- Renters insurance is crucial for financial protection against unforeseen events and liability claims.

- State Farm offers a seamless application process, customizable coverage options, and competitive pricing.

- Real-life case studies demonstrate the benefits and effectiveness of State Farm renters insurance.

Frequently Asked Questions

How much does State Farm renters insurance cost?

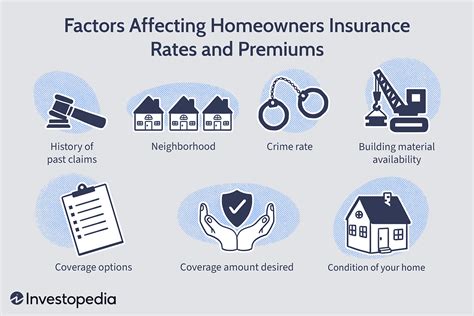

+The cost of State Farm renters insurance varies based on several factors, including the location of your rental property, the coverage limits you select, and any applicable discounts. On average, renters insurance policies from State Farm range from 15 to 30 per month. However, it’s best to obtain a personalized quote to determine the exact cost for your specific situation.

What is the coverage limit for personal property in State Farm renters insurance?

+State Farm allows you to customize your coverage limits for personal property. You can choose coverage amounts ranging from 10,000 to 100,000 or more, depending on the value of your belongings. It’s important to accurately assess the value of your possessions to ensure adequate coverage.

Does State Farm renters insurance cover damages caused by natural disasters?

+State Farm renters insurance provides coverage for damages caused by perils such as fire, theft, and vandalism. However, it typically does not cover damages resulting from natural disasters like floods or earthquakes. To obtain coverage for natural disasters, you may need to purchase separate policies or additional coverage options.

Can I add additional coverage options to my State Farm renters insurance policy?

+Yes, State Farm offers various optional coverage enhancements to customize your renters insurance policy. These may include coverage for high-value items, identity restoration coverage, rental car coverage, and more. Consult with a State Farm agent to explore the available options and determine the best fit for your needs.

How do I file a claim with State Farm renters insurance?

+To file a claim with State Farm renters insurance, you can contact their 24⁄7 claims service hotline at 1-800-STATE-FARM (1-800-782-8332). Their dedicated claims team will guide you through the process, providing assistance and support. You can also file a claim online through their website or mobile app.