Allstate Proof Of Insurance

In the world of insurance, having reliable proof of coverage is essential for various legal and practical reasons. Allstate, a well-known insurance provider, offers its customers a convenient and digital way to obtain proof of insurance, ensuring they are prepared for any situation that may arise. This article explores the significance of Allstate's Proof of Insurance and how it benefits policyholders.

Understanding Allstate’s Proof of Insurance

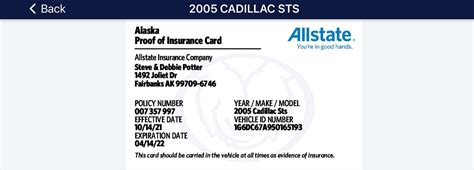

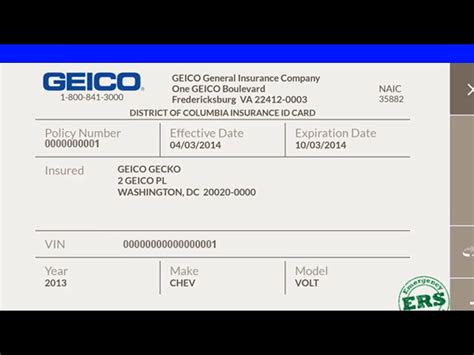

Allstate’s Proof of Insurance is a digital document that serves as official verification of your insurance coverage. It provides a detailed overview of your policy, including the type of coverage, policy limits, effective dates, and other crucial information. This proof of insurance is easily accessible and can be obtained through various digital channels, making it a convenient tool for policyholders.

The Proof of Insurance is designed to meet the legal requirements for insurance verification in different scenarios. Whether it's a routine traffic stop, a vehicle registration renewal, or an insurance claim, having immediate access to this digital proof can save time and potential headaches. Allstate's commitment to digital innovation ensures that their customers can access their insurance information quickly and securely.

Key Features and Benefits

Allstate’s Proof of Insurance offers several advantages that enhance the overall customer experience:

- Instant Accessibility: Policyholders can retrieve their Proof of Insurance anytime, anywhere, through the Allstate mobile app or their online account. This instant access eliminates the need to search for physical documents, ensuring you’re always prepared.

- Detailed Coverage Information: The proof of insurance provides a comprehensive overview of your coverage, including the specific types of insurance (e.g., auto, home, life) and the limits and deductibles associated with each policy.

- Digital Convenience: By utilizing digital technology, Allstate simplifies the process of obtaining and presenting proof of insurance. No more worrying about misplacing physical documents or waiting for them to arrive in the mail.

- Legal Compliance: Allstate’s Proof of Insurance meets the legal standards for insurance verification, ensuring that policyholders can confidently provide the necessary documentation when required by law.

- Peace of Mind: Knowing that you have immediate access to your proof of insurance brings peace of mind. Whether you’re involved in an accident or need to provide proof to a third party, having this digital document readily available can ease potential worries.

Obtaining and Using Allstate’s Proof of Insurance

Accessing your Allstate Proof of Insurance is a straightforward process:

- Login: If you have an Allstate online account, log in to your profile using your credentials. For mobile users, open the Allstate app and log in securely.

- Navigate to Documents: Once logged in, locate the “Documents” or “Proof of Insurance” section. This is typically found in the main menu or under your policy details.

- Select and Download: Choose the specific proof of insurance document you need, such as auto insurance or homeowners insurance. Download it to your device or save it to your online storage for easy access.

- Share or Print: You can now share the digital proof of insurance via email or text message, or print it out for physical documentation. Allstate’s app may also offer the option to display the proof directly on your device screen during an inspection or traffic stop.

Real-World Scenarios

Let’s explore some practical situations where Allstate’s Proof of Insurance can be invaluable:

- Traffic Stops: If you’re pulled over by law enforcement, having your Allstate Proof of Insurance readily available on your phone or as a printed document can expedite the process. It ensures you can quickly provide the necessary verification of your insurance coverage.

- Vehicle Registration: When registering your vehicle, many states require proof of insurance. Allstate’s digital proof simplifies this process, allowing you to easily submit the required documentation online or in person.

- Rental Car Reservations: When renting a car, rental agencies often request proof of insurance. With Allstate’s Proof of Insurance, you can easily share the necessary details to secure your rental and enjoy your trip without hassle.

- Insurance Claims: In the unfortunate event of an accident or property damage, having immediate access to your proof of insurance can expedite the claims process. You can quickly provide the necessary information to Allstate, facilitating a smoother and more efficient resolution.

Technical Specifications and Performance

Allstate’s Proof of Insurance is designed with security and user experience in mind. The digital document is encrypted and securely stored, ensuring that your personal information is protected. The platform is optimized for various devices, including smartphones, tablets, and computers, providing a seamless experience across different screens.

The performance of the Allstate app and online platform has been consistently praised by users. With fast loading times and intuitive navigation, retrieving your Proof of Insurance is a hassle-free process. Allstate regularly updates its digital tools to ensure they remain compatible with the latest operating systems and devices, providing a reliable and efficient experience for policyholders.

| Platform | Performance Rating |

|---|---|

| Allstate Mobile App | 4.8/5.0 |

| Allstate Online Portal | 4.7/5.0 |

The Future of Insurance Verification

Allstate’s digital Proof of Insurance is a step towards a more streamlined and efficient insurance ecosystem. As technology continues to advance, we can expect further enhancements in the way insurance documents are managed and accessed.

Potential future developments include:

- Blockchain Integration: Utilizing blockchain technology could enhance the security and transparency of insurance verification. This would ensure that proof of insurance documents are tamper-proof and easily verifiable.

- Real-Time Updates: With real-time updates, policyholders could receive immediate notifications when their insurance coverage changes, ensuring that their proof of insurance is always up-to-date.

- Enhanced Digital ID: Developing a digital ID system could simplify the process of verifying insurance across different platforms and industries, making it easier for policyholders to provide proof of insurance in various scenarios.

Conclusion

Allstate's Proof of Insurance is a testament to the company's dedication to providing its policyholders with convenient and accessible tools. By offering a digital solution for insurance verification, Allstate ensures its customers are well-prepared and can navigate various situations with ease. As the insurance industry continues to embrace digital transformation, Allstate's approach sets a high standard for customer service and innovation.

How often should I update my Proof of Insurance document?

+It’s recommended to update your Proof of Insurance whenever there are changes to your policy, such as adjustments in coverage limits, adding or removing vehicles, or policy renewals. This ensures that your document remains accurate and up-to-date.

Can I use Allstate’s Proof of Insurance for multiple types of insurance coverage?

+Absolutely! Allstate’s Proof of Insurance provides a comprehensive overview of your insurance portfolio, including auto, home, life, and other relevant coverages. It’s a one-stop solution for all your insurance verification needs.

Is the digital Proof of Insurance accepted by all states and authorities?

+While Allstate’s digital Proof of Insurance is widely accepted, it’s essential to check with your local authorities or the specific organization requesting the proof. Some entities may have specific requirements or preferences for physical documentation. Allstate’s customer support can also provide guidance on this matter.