Quote For Renters Insurance

Renters insurance is an essential yet often overlooked aspect of financial planning for those who live in rental properties. This type of insurance provides coverage for personal belongings, liability, and additional living expenses in the event of various incidents. With the right policy, renters can protect themselves and their possessions, ensuring peace of mind and financial security. In this article, we will delve into the world of renters insurance, exploring its benefits, key coverage areas, and the factors that influence its cost. By understanding the ins and outs of renters insurance, you can make informed decisions and secure the best quote for your specific needs.

Understanding Renters Insurance

Renters insurance is a specialized form of property insurance designed to cater to the unique needs of individuals who rent their living spaces. Unlike homeowners insurance, which covers the structure and its contents, renters insurance primarily focuses on protecting the personal belongings and providing liability coverage for renters. It offers a comprehensive solution to safeguard against unexpected losses and potential liabilities that may arise during tenancy.

Benefits of Renters Insurance

Renters insurance provides a wide range of benefits, offering protection and peace of mind to individuals living in rental properties. Here are some key advantages:

- Personal Property Coverage: Renters insurance typically covers personal belongings such as furniture, electronics, clothing, and jewelry. In the event of a covered loss, like a fire or theft, the policy will reimburse you for the value of your damaged or stolen items.

- Liability Protection: This coverage is crucial as it safeguards renters against potential lawsuits and legal expenses. If a guest is injured in your rental unit or if your actions result in property damage to others, renters insurance can provide financial protection.

- Additional Living Expenses: In the unfortunate event that your rental unit becomes uninhabitable due to a covered incident, renters insurance can cover the costs of temporary housing and other additional living expenses until you can return to your home.

- Personal Injury Protection: Some renters insurance policies offer personal injury protection, which covers legal expenses if you are sued for libel, slander, or other personal injury claims.

- Loss of Use Coverage: This coverage reimburses you for the additional expenses incurred when you cannot use your rental unit due to a covered loss. It can include costs for hotel stays, restaurant meals, and other temporary living expenses.

Coverage Options and Customization

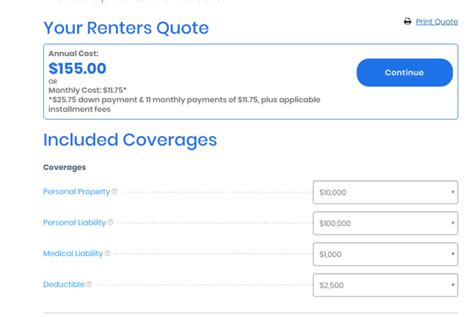

Renters insurance policies can be customized to meet the specific needs of each individual. Here are some key coverage options to consider:

- Actual Cash Value vs. Replacement Cost Coverage: Actual cash value coverage reimburses you for the current value of your belongings, taking depreciation into account. Replacement cost coverage, on the other hand, provides reimbursement for the full cost of replacing your items without deducting for depreciation.

- Personal Property Coverage Limits: You can choose the amount of coverage you need for your personal belongings. It’s essential to assess the value of your possessions and select a limit that adequately covers your items.

- Liability Coverage Limits: Liability coverage limits vary, and it’s crucial to select an amount that provides sufficient protection against potential lawsuits. Consider your assets and the potential risks associated with your rental unit.

- Additional Coverages: Depending on your needs, you can add optional coverages to your policy. This may include coverage for high-value items like jewelry or fine art, rental unit upgrades, or coverage for specific risks such as identity theft or water backup.

Factors Influencing Renters Insurance Quotes

The cost of renters insurance quotes can vary based on several factors. Understanding these influences can help you make informed decisions when choosing a policy. Here are some key factors that impact renters insurance quotes:

Location

The geographical location of your rental property plays a significant role in determining insurance rates. Areas with a higher risk of natural disasters, crime rates, or property damage claims tend to have higher insurance premiums. For instance, if you live in an area prone to hurricanes or earthquakes, your insurance quote may reflect the increased risk.

Coverage Limits

The coverage limits you select for your policy directly impact the cost of your insurance quote. Higher coverage limits provide more protection but also result in higher premiums. It’s essential to find a balance between adequate coverage and a manageable insurance cost.

Deductibles

Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your insurance premiums, as it reduces the financial burden on the insurance provider. However, it’s important to choose a deductible that you can afford in the event of a claim.

Discounts and Bundling

Many insurance companies offer discounts to renters who bundle their policies. By combining renters insurance with other types of insurance, such as auto or homeowners insurance, you may be eligible for significant savings. Additionally, certain safety features or security systems in your rental unit can also qualify you for discounts.

Credit Score

Believe it or not, your credit score can influence your renters insurance quote. Insurance providers often use credit-based insurance scores to assess the risk associated with insuring you. A higher credit score may result in lower insurance premiums, as it indicates a lower risk of claims.

Rental Unit Type

The type of rental unit you occupy can also impact your insurance quote. Apartments, condominiums, and single-family homes may have different insurance considerations. For instance, apartments may have lower premiums due to shared security measures and building maintenance, while single-family homes may have higher premiums due to increased liability risks.

Claims History

Your past insurance claims history can influence your current renters insurance quote. A history of frequent or costly claims may result in higher premiums, as it indicates a higher risk to the insurance provider. Maintaining a clean claims record can help keep your insurance costs down.

Securing the Best Renters Insurance Quote

To secure the best renters insurance quote, it’s important to shop around and compare policies from multiple providers. Consider the following tips:

Research and Compare

Take the time to research and compare renters insurance policies from different providers. Online comparison tools and insurance marketplaces can make this process easier and more efficient. Look for policies that offer the coverage you need at a competitive price.

Bundle Your Policies

If you have other insurance policies, such as auto or homeowners insurance, consider bundling them with your renters insurance. Bundling can result in significant savings and streamline your insurance management.

Understand Your Coverage Needs

Assess your specific coverage needs and prioritize the areas that are most important to you. Consider the value of your personal belongings, your liability risks, and any additional coverages you may require. By understanding your needs, you can choose a policy that provides the right level of protection.

Consider Deductibles

Evaluate the impact of deductibles on your insurance premiums. While higher deductibles can lower your monthly payments, they also mean you’ll have to pay more out of pocket in the event of a claim. Choose a deductible that aligns with your financial situation and risk tolerance.

Explore Discounts

Inquire about potential discounts when obtaining quotes. Many insurance companies offer discounts for various reasons, such as loyalty, safety features, or good credit scores. Don’t hesitate to ask about available discounts and see if you qualify.

Seek Professional Advice

If you’re unsure about the best renters insurance policy for your needs, consider seeking advice from an insurance professional. They can provide guidance based on your specific circumstances and help you navigate the various coverage options and quotes.

The Importance of Regular Reviews

Renters insurance policies should be reviewed periodically to ensure they remain up-to-date and adequately cover your needs. Here are some reasons why regular reviews are essential:

Changing Circumstances

Your life circumstances and possessions may change over time. Regular reviews allow you to assess if your current policy still aligns with your needs. For instance, if you acquire new and valuable items, you may need to increase your coverage limits.

Policy Updates

Insurance providers may introduce new policy options or update existing ones. By reviewing your policy regularly, you can stay informed about any changes and take advantage of improved coverage or discounts.

Competitive Pricing

Insurance rates can fluctuate, and by shopping around and comparing quotes regularly, you can ensure you’re getting the most competitive price for your renters insurance. This is especially important if you’ve been with the same provider for a long time.

Conclusion

Renters insurance is an invaluable tool for protecting your personal belongings and providing financial security in the event of unexpected incidents. By understanding the benefits, coverage options, and factors influencing quotes, you can make informed decisions and secure a policy that suits your needs. Regular reviews and staying informed about the latest insurance offerings will ensure you maintain adequate coverage at a competitive price. Remember, renters insurance is an investment in your peace of mind and financial well-being.

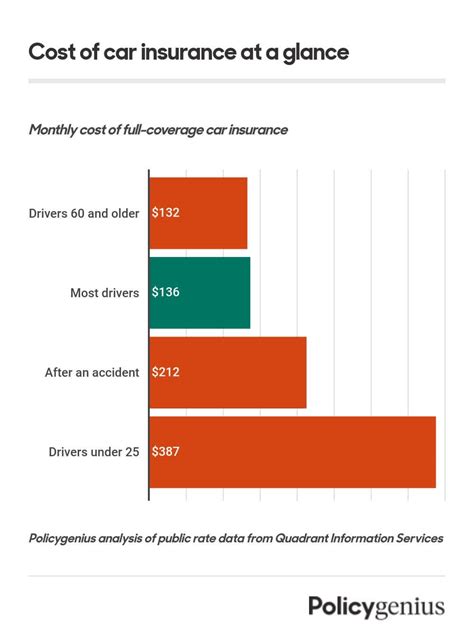

What is the average cost of renters insurance?

+The average cost of renters insurance varies depending on factors such as location, coverage limits, and deductibles. According to industry statistics, the average annual premium for renters insurance is around 180, with monthly premiums ranging from 10 to $30. However, it’s important to note that rates can differ significantly based on individual circumstances.

Can I customize my renters insurance policy?

+Yes, renters insurance policies can be customized to meet your specific needs. You can choose coverage limits for personal property, select liability coverage limits, and opt for additional coverages such as rental unit upgrades or high-value item protection. Customization allows you to tailor your policy to your unique circumstances.

How do I file a claim with renters insurance?

+To file a claim with renters insurance, you should contact your insurance provider as soon as possible after a covered incident occurs. Provide them with details about the loss or damage, and they will guide you through the claims process. It’s important to document the incident and any relevant information, as it may be required for the claim.

Does renters insurance cover natural disasters?

+Renters insurance typically provides coverage for certain natural disasters, such as fires, windstorms, and vandalism. However, it’s important to review your policy carefully, as some natural disasters may require additional coverage or specific endorsements. Flood coverage, for example, is often not included in standard renters insurance policies and may require a separate policy.

Can I save money on renters insurance?

+Yes, there are several ways to save money on renters insurance. Bundling your policies with other insurance types, such as auto or homeowners insurance, can result in significant discounts. Additionally, maintaining a good credit score, installing security systems or smoke detectors, and opting for higher deductibles can also lower your insurance premiums.