How Do You Get Health Insurance

Accessing health insurance is a crucial step towards ensuring your well-being and financial security. With the right coverage, you can navigate the complexities of the healthcare system with confidence and peace of mind. In this comprehensive guide, we will explore the various avenues through which you can obtain health insurance, understanding the different options, and making informed decisions to protect your health and financial interests.

Understanding Health Insurance Options

Health insurance serves as a vital safeguard, providing financial protection and access to essential healthcare services. When it comes to securing health insurance, individuals have a range of options to consider, each with its own set of advantages and considerations.

Employer-Sponsored Health Insurance

One of the most common ways to obtain health insurance is through your employer. Many companies offer health insurance plans as part of their employee benefits package. These plans are often comprehensive and may include coverage for medical, dental, and vision care, as well as prescription drugs and other essential services.

Employer-sponsored health insurance plans are typically more cost-effective than individual plans, as the employer contributes a significant portion of the premium. Additionally, these plans often provide access to a network of healthcare providers, ensuring convenient and affordable care for employees and their families.

| Pros of Employer-Sponsored Insurance | Cons of Employer-Sponsored Insurance |

|---|---|

| Cost-effective premiums | Limited plan choices |

| Network of providers | Dependence on employment |

| Comprehensive coverage | May not cover pre-existing conditions |

Individual Health Insurance Plans

For individuals who are self-employed, unemployed, or whose employers do not offer health insurance, there are individual health insurance plans available. These plans can be purchased directly from insurance companies or through the government-run Marketplace, also known as the Health Insurance Marketplace or Exchange.

Individual health insurance plans offer a wide range of options, allowing individuals to choose coverage that best suits their needs and budget. These plans can include various levels of coverage, from basic plans with lower premiums to more comprehensive plans with higher premiums and additional benefits.

| Pros of Individual Health Insurance | Cons of Individual Health Insurance |

|---|---|

| Flexibility in plan choice | Higher premiums compared to employer-sponsored plans |

| Covers pre-existing conditions | May have limited provider networks |

| Accessible for self-employed individuals | Possible tax implications |

Government-Sponsored Health Insurance Programs

Various government-sponsored health insurance programs are available to provide coverage for specific populations. These programs aim to ensure that individuals who may not have access to traditional insurance can still receive the necessary healthcare services.

- Medicaid: A joint federal and state program that provides health coverage for eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Medicaid offers comprehensive coverage, including hospital stays, doctor visits, prescription drugs, and more.

- Medicare: A federal program primarily for individuals aged 65 and older, as well as those with certain disabilities. Medicare covers a range of healthcare services, including hospital care, doctor visits, and prescription drugs. There are different parts to Medicare, each covering specific aspects of healthcare.

- Children's Health Insurance Program (CHIP): A program designed to provide low-cost health coverage for children in families who earn too much to qualify for Medicaid but cannot afford private health insurance. CHIP covers a wide range of medical services, including doctor visits, immunizations, dental care, and vision care.

Navigating the Health Insurance Marketplace

The Health Insurance Marketplace, also known as the Affordable Care Act (ACA) Marketplace, is an online platform that allows individuals and families to compare and enroll in health insurance plans. It was established as part of the ACA to make health insurance more accessible and affordable.

Key Features of the Marketplace

- Plan Comparison: The Marketplace offers a user-friendly platform where you can compare different health insurance plans based on factors such as premiums, deductibles, co-pays, and covered services. This helps you make an informed decision that aligns with your healthcare needs and budget.

- Income-Based Subsidies: One of the significant advantages of the Marketplace is the availability of income-based subsidies. If your income falls within a certain range, you may be eligible for premium tax credits, reducing the cost of your monthly premiums. Additionally, cost-sharing reductions may be available to lower out-of-pocket expenses for certain individuals.

- Open Enrollment Period: The Marketplace operates within specific enrollment periods. The Open Enrollment Period typically occurs once a year, allowing individuals to enroll in a new plan or make changes to their existing coverage. Outside of this period, you may still be able to enroll if you experience a qualifying life event, such as losing your job, getting married, or having a baby.

Steps to Enroll in the Marketplace

- Visit the official Health Insurance Marketplace website. Ensure you are on the government-run site to avoid potential scams.

- Create an account and provide basic information, including your name, date of birth, and social security number.

- Determine your eligibility for income-based subsidies by providing income and household information. This will help you understand the available financial assistance.

- Browse and compare the available health insurance plans. Consider factors such as premiums, deductibles, and covered services to find the plan that best suits your needs.

- Choose your preferred plan and complete the enrollment process. You may need to provide additional documentation to verify your eligibility.

- Once enrolled, review your coverage details and understand your rights and responsibilities as a policyholder.

Understanding Health Insurance Terminology

When navigating the world of health insurance, it's essential to understand the terminology commonly used. Here are some key terms to familiarize yourself with:

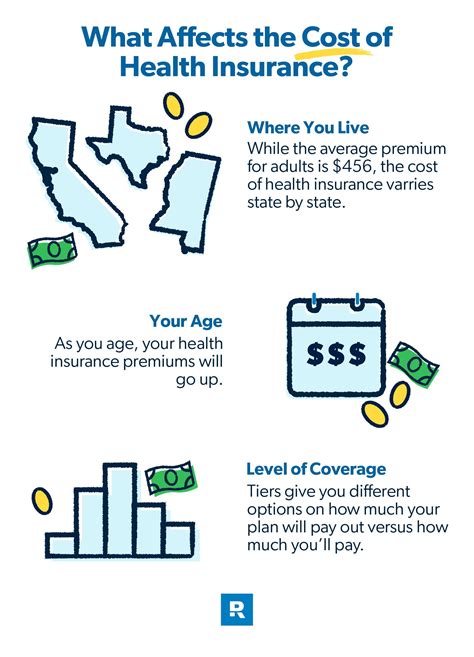

- Premium: The amount you pay for your health insurance plan, typically on a monthly basis. Premiums can vary based on factors such as age, location, and the level of coverage chosen.

- Deductible: The amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, while lower deductibles may have higher premiums.

- Co-payment (Co-pay): A fixed amount you pay for a covered healthcare service, such as a doctor's visit or prescription medication. Co-pays are typically due at the time of service.

- Co-insurance: The percentage of covered medical expenses you are responsible for paying after meeting your deductible. For example, if your co-insurance is 20%, you pay 20% of the cost, while your insurance covers the remaining 80%.

- Out-of-Pocket Maximum: The maximum amount you will pay for covered services in a given year. Once you reach this limit, your insurance covers 100% of eligible expenses.

- Network: A group of healthcare providers, such as doctors, hospitals, and pharmacies, that have a contract with your insurance company. Using in-network providers typically results in lower costs and more straightforward claims processing.

- Pre-existing Condition: A health condition that you had before enrolling in a new health insurance plan. Under the ACA, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions.

Maximizing Your Health Insurance Benefits

Once you have secured health insurance, it's essential to understand how to make the most of your coverage to ensure you receive the necessary healthcare services without unnecessary financial strain.

Understanding Your Plan's Coverage

Take the time to thoroughly review your health insurance plan's benefits and limitations. This includes understanding what services are covered, any applicable deductibles or co-pays, and any restrictions or exclusions. By familiarizing yourself with your plan, you can make informed decisions about your healthcare and avoid unexpected costs.

Utilizing In-Network Providers

Whenever possible, use healthcare providers that are in your insurance plan's network. In-network providers have negotiated rates with your insurance company, resulting in lower costs for you. Out-of-network providers may charge higher fees, and you may be responsible for a larger portion of the cost.

Additionally, using in-network providers often simplifies the claims process, as your insurance company has pre-established relationships with these providers, making it easier to process and reimburse claims.

Taking Advantage of Preventive Care

Many health insurance plans offer preventive care services at little to no cost to the policyholder. Preventive care includes screenings, immunizations, and wellness visits aimed at identifying and addressing health issues early on. By taking advantage of these services, you can catch potential health problems before they become more serious and costly to treat.

Additionally, some preventive care services, such as annual check-ups and certain screenings, are fully covered by insurance under the ACA, ensuring you can access these services without paying out of pocket.

Understanding Your Rights and Responsibilities

As a policyholder, it's important to understand your rights and responsibilities under your health insurance plan. This includes knowing your rights to appeal claims decisions, dispute denials, and access an independent review if necessary. Additionally, be aware of any required co-pays, deductibles, or co-insurance amounts, as well as any limitations or exclusions in your coverage.

Frequently Asked Questions (FAQ)

Can I have multiple health insurance policies at once?

+It is possible to have multiple health insurance policies, but it's important to understand how they interact with each other. In some cases, having multiple policies can provide more comprehensive coverage. However, it's essential to review the terms and conditions of each policy to ensure there are no conflicts or duplications of coverage. Additionally, be aware of any coordination of benefits clauses, which determine how multiple policies interact.

What happens if I need emergency medical care while traveling internationally?

+If you require emergency medical care while traveling internationally, your health insurance plan may or may not cover the expenses. It's crucial to check your policy's terms and conditions, as some plans may have limited or no coverage for international emergencies. In such cases, you may need to rely on travel insurance or out-of-pocket payments. It's recommended to purchase travel insurance that includes medical coverage for peace of mind during your travels.

How can I reduce my health insurance costs?

+There are several strategies to reduce your health insurance costs. One option is to enroll in a high-deductible health plan (HDHP) paired with a Health Savings Account (HSA). HDHPs typically have lower premiums, and HSAs allow you to save pre-tax dollars for qualified medical expenses. Additionally, consider choosing a plan with a higher deductible or a narrower provider network, as these options often have lower premiums. It's important to find a balance between cost and coverage that aligns with your healthcare needs.

What should I do if I have a dispute with my insurance company regarding a claim?

+If you have a dispute with your insurance company regarding a claim, it's important to first review your policy documents and understand the terms and conditions. Contact your insurance company's customer service department to discuss the issue and attempt to resolve it. If the dispute remains unresolved, you may have the right to appeal the decision. Many insurance companies have an internal appeals process, and if that fails, you may be able to seek an independent review or legal assistance.

Obtaining health insurance is a critical step towards safeguarding your well-being and financial stability. By understanding the various options available, navigating the Health Insurance Marketplace, and maximizing your benefits, you can ensure that you have the coverage you need to access quality healthcare. Remember to review your plan’s coverage, utilize in-network providers, and take advantage of preventive care services to make the most of your health insurance.