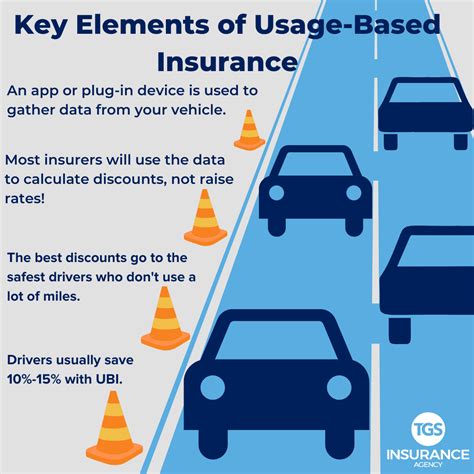

Usagebased Insurance

Usage-based insurance (UBI) is a revolutionary concept in the automotive insurance industry that is transforming the way drivers are insured. It is an innovative approach that shifts the focus from traditional static factors like age, gender, and location to a more dynamic and personalized assessment of individual driving behavior. This concept has gained significant traction in recent years, with many insurers adopting UBI programs to offer customized policies based on how, when, and where their customers drive.

In this article, we will delve into the intricacies of usage-based insurance, exploring its origins, the technology that powers it, and the benefits it brings to both insurers and policyholders. We will also analyze the potential future of this insurance model and its impact on the industry as a whole.

The Evolution of Usage-Based Insurance

Usage-based insurance is not a new concept; its roots can be traced back to the early 2000s when the idea of pay-as-you-drive (PAYD) insurance first emerged. This early model proposed charging insurance premiums based on the distance driven by the policyholder. However, it was limited in its ability to accurately assess risk due to the lack of advanced telematics technology.

The true evolution of UBI began with the development of sophisticated telematics devices and smartphone apps. These technologies enabled insurers to collect detailed data on driving behavior, including speed, acceleration, braking, and even the time of day and geographical location of trips. With this wealth of information, insurers could create a more comprehensive picture of an individual's driving habits and, consequently, their risk profile.

How Does Usage-Based Insurance Work?

Usage-based insurance operates on the principle of data-driven risk assessment. Insurers offer policyholders the option to install a telematics device in their vehicles or use a smartphone app to track their driving behavior. These devices or apps record and transmit data on various driving parameters, which is then analyzed to determine the policyholder’s premium.

Telematics Devices

Telematics devices are small, discrete gadgets that are typically installed under the dashboard of a vehicle. These devices use a combination of GPS, accelerometers, and gyroscopes to gather data on the vehicle’s location, speed, and movement. Some advanced devices can also detect harsh braking, rapid acceleration, and even the driver’s phone usage while driving.

| Device Type | Data Collected |

|---|---|

| GPS-based | Location, speed, distance traveled |

| Accelerometer-based | Acceleration, braking, cornering |

| Advanced Telematics | All of the above, plus phone usage, driver behavior |

The data collected by these devices is transmitted to the insurer's servers, where it is analyzed using sophisticated algorithms. These algorithms assess the risk associated with the driver's behavior and calculate the premium accordingly. Some insurers offer real-time feedback to policyholders, providing them with insights into their driving habits and suggestions for improvement.

Smartphone Apps

For those who prefer a less intrusive option or do not drive a vehicle equipped with a telematics device, smartphone apps offer a convenient alternative. These apps use the phone’s GPS, accelerometer, and gyroscope to collect data on driving behavior. While smartphone apps may not provide as much detail as dedicated telematics devices, they still offer a wealth of information for insurers to assess risk.

The Benefits of Usage-Based Insurance

Usage-based insurance brings a host of benefits to both insurers and policyholders. For insurers, UBI offers a more accurate assessment of risk, leading to improved underwriting and pricing. By analyzing real-time driving data, insurers can identify high-risk drivers and price their policies accordingly, reducing the burden on low-risk drivers who previously had to subsidize the costs of high-risk individuals.

Advantages for Insurers

- Improved Risk Assessment: Insurers can make more informed decisions about pricing and policy offerings based on real-time driving data.

- Reduced Claims Costs: By identifying high-risk drivers, insurers can take proactive measures to reduce the likelihood of accidents and claims.

- Increased Customer Engagement: UBI programs often include driver feedback and rewards, encouraging policyholders to engage with their insurance provider.

Benefits for Policyholders

- Customized Premiums: Policyholders who exhibit safe driving behaviors can enjoy lower premiums, providing an incentive to drive safely.

- Real-Time Feedback: Many UBI programs offer instant feedback on driving habits, helping drivers identify areas for improvement.

- Discounts and Rewards: Some insurers offer discounts or rewards for safe driving, further incentivizing policyholders to maintain good driving habits.

Performance Analysis and Case Studies

Several insurance companies have already implemented usage-based insurance programs with notable success. These case studies provide valuable insights into the effectiveness of UBI and its potential to revolutionize the insurance industry.

Case Study: Progressive Snapshot

Progressive Insurance’s Snapshot program is one of the most well-known UBI initiatives. Since its launch in 2008, Snapshot has been installed in over 4 million vehicles, providing a wealth of data for Progressive to analyze. The program has led to a 20% reduction in accidents among policyholders, resulting in significant savings for both the insurer and its customers.

Case Study: Allstate Drivewise

Allstate’s Drivewise program offers policyholders a discount of up to 30% for safe driving. The program uses a small device plugged into the vehicle’s OBD-II port to collect data on driving behavior. This data is then used to calculate a personalized discount for each policyholder. Drivewise has been instrumental in encouraging safe driving habits among Allstate’s customers, leading to a reduction in claims and improved customer satisfaction.

The Future of Usage-Based Insurance

As technology continues to advance, the future of usage-based insurance looks promising. The integration of artificial intelligence and machine learning will further enhance the accuracy of risk assessment, allowing insurers to offer even more precise pricing and coverage options.

Additionally, the rise of autonomous vehicles and connected car technologies will likely lead to a shift in the focus of UBI programs. Insurers may begin to assess risk based on vehicle performance and autonomous driving capabilities rather than solely on human driving behavior. This could result in a new era of insurance, where the vehicle itself becomes the primary risk indicator.

Conclusion

Usage-based insurance represents a significant shift in the automotive insurance landscape, moving away from traditional static factors and towards a dynamic, data-driven approach. With its ability to accurately assess risk based on real-time driving behavior, UBI offers a more fair and personalized insurance experience for policyholders. As the technology continues to advance, we can expect to see even more innovative UBI programs and a continued evolution of the insurance industry.

How does usage-based insurance benefit high-risk drivers?

+Usage-based insurance provides an opportunity for high-risk drivers to improve their driving habits and potentially reduce their premiums. By receiving real-time feedback on their driving behavior, they can identify areas of improvement and make changes to reduce their risk profile.

Are there any privacy concerns with usage-based insurance programs?

+Insurers take privacy very seriously and use robust security measures to protect the data collected by telematics devices and smartphone apps. Additionally, policyholders have control over their data and can choose to opt out of the program at any time.

Can usage-based insurance programs be used for commercial vehicles?

+Absolutely! Usage-based insurance programs can be tailored to commercial vehicles, offering fleet managers and business owners insights into their drivers’ behavior and providing opportunities for cost savings through safer driving practices.