Insurance Quote For Homeowners

Protecting your home and family is a top priority for any homeowner, and finding the right insurance coverage is crucial. With a wide range of options and variables to consider, navigating the insurance landscape can be daunting. In this comprehensive guide, we will delve into the world of homeowners' insurance, exploring the factors that influence quotes, the coverage options available, and strategies to secure the best possible rates.

Understanding Homeowners’ Insurance Quotes

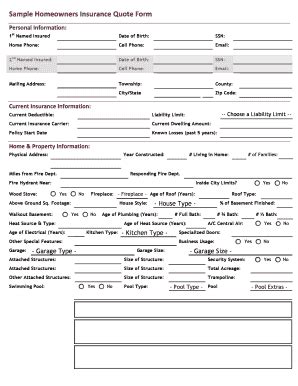

A homeowners’ insurance quote is an estimate of the cost to insure your home and its contents. It takes into account various factors to assess the potential risks and determine the level of coverage required. Here’s a breakdown of the key elements that influence insurance quotes.

Location and Property Characteristics

The location of your home plays a significant role in insurance quotes. Factors such as crime rates, natural disaster risks (e.g., hurricanes, floods, earthquakes), and proximity to fire stations can impact your rates. Additionally, the age, size, and construction materials of your home are considered. For instance, a newer home with fire-resistant materials may qualify for lower rates.

| Location Risk Factors | Impact on Quote |

|---|---|

| High Crime Areas | Increased rates due to potential theft or vandalism. |

| Natural Disaster Zones | Elevated rates to cover potential damages. |

| Proximity to Fire Stations | Lower rates as response times are quicker. |

Coverage Types and Limits

Homeowners’ insurance typically offers various coverage types to protect different aspects of your home and possessions. The coverage limits you choose will directly impact your quote. Here are some common coverage types and their purposes:

- Dwelling Coverage: Protects the physical structure of your home.

- Personal Property Coverage: Covers your belongings inside the home.

- Liability Coverage: Provides protection against lawsuits and medical expenses for injuries on your property.

- Additional Living Expenses (ALE): Covers temporary living costs if your home becomes uninhabitable due to a covered event.

When determining your coverage limits, it's essential to strike a balance between adequate protection and affordability. Insurers use tools like the Replacement Cost Value (RCV) to estimate the cost of rebuilding your home and determining the appropriate coverage limits.

Deductibles and Policy Terms

Deductibles are the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Opting for a higher deductible can lead to lower premiums, as you’re assuming a greater financial responsibility in the event of a claim. Additionally, the policy term, typically one year, influences the overall cost of your insurance.

Factors Influencing Insurance Quotes

Apart from the basic coverage types, several other factors can impact your homeowners’ insurance quote. Understanding these factors can help you make informed decisions when shopping for insurance.

Credit Score and Insurance History

Your credit score is often used as an indicator of financial responsibility. Insurers may review your credit history to assess your risk profile. A higher credit score can lead to more favorable insurance quotes, as it suggests a lower likelihood of filing claims.

Similarly, your insurance history, including any past claims, can impact your quote. Multiple claims, especially those related to negligence or frequent incidents, may result in higher premiums or even policy cancellations.

Home Security Features

Implementing security measures in your home can lead to reduced insurance quotes. Features like burglar alarms, smoke detectors, fire sprinklers, and reinforced doors can lower the risk of theft and damage, making your home a more attractive insurance prospect.

Personal Profile and Lifestyle

Your personal profile, including age, marital status, and occupation, can influence your insurance quote. For instance, younger individuals or those with high-risk occupations may face higher premiums due to perceived increased risk.

Additionally, your lifestyle choices, such as owning a swimming pool or engaging in high-risk hobbies, can impact your insurance rates. These activities may increase the likelihood of accidents or injuries, leading to higher premiums.

Strategies for Securing the Best Insurance Quote

Navigating the insurance market and securing the best quote requires a strategic approach. Here are some tips to help you find the right coverage at the most competitive rates.

Compare Multiple Quotes

Obtain quotes from several insurance providers to compare rates and coverage options. Online insurance marketplaces or insurance brokers can streamline this process, allowing you to easily compare multiple quotes side by side.

Bundle Your Policies

Consider bundling your homeowners’ insurance with other policies, such as auto insurance or life insurance. Many insurers offer discounts for customers who bundle multiple policies, making it a cost-effective way to save on insurance costs.

Review and Update Your Coverage Regularly

Insurance needs can change over time, so it’s essential to review your coverage annually. Assess any changes in your home, personal circumstances, or lifestyle that may impact your insurance requirements. Regularly updating your coverage ensures you’re not overpaying for unnecessary coverage or leaving yourself exposed to potential risks.

Negotiate and Shop Around

Don’t be afraid to negotiate with insurance providers. If you’ve been a loyal customer for years or have a clean claims history, you may be able to secure a better rate by discussing your situation with your insurer. Additionally, shopping around and obtaining quotes from various providers can help you identify the most competitive rates.

Improve Your Home’s Safety Features

Investing in home safety features, such as smoke detectors, fire extinguishers, and security systems, can lead to significant insurance discounts. These improvements not only enhance your home’s safety but also demonstrate your commitment to risk mitigation, which is appealing to insurers.

Choose the Right Deductible

Opting for a higher deductible can lower your insurance premiums. However, it’s essential to choose a deductible that aligns with your financial capabilities. A deductible that’s too high may leave you struggling to cover the out-of-pocket expenses in the event of a claim.

The Future of Homeowners’ Insurance

The insurance industry is constantly evolving, and homeowners’ insurance is no exception. As technology advances, insurers are leveraging data analytics and artificial intelligence to more accurately assess risks and offer personalized insurance solutions. This trend, known as usage-based insurance or pay-as-you-go insurance, could revolutionize the way insurance is priced, offering more affordable and tailored coverage options.

Additionally, the rise of smart home technology is expected to impact homeowners' insurance. Insurers are exploring ways to integrate smart home devices into their risk assessment processes, potentially leading to discounts for homeowners who adopt these technologies. For instance, smart water leak detectors or fire-resistant materials could reduce the risk of water damage or fire-related claims, resulting in lower insurance rates.

Conclusion

Obtaining a homeowners’ insurance quote is a critical step in protecting your home and family. By understanding the factors that influence quotes, exploring coverage options, and adopting strategic approaches, you can secure the best possible insurance rates. Remember, your home is one of your most valuable assets, and proper insurance coverage is essential to safeguard it against unforeseen events.

How often should I review my homeowners’ insurance policy?

+It is recommended to review your homeowners’ insurance policy annually or whenever there are significant changes to your home, personal circumstances, or insurance needs. Regular reviews ensure that your coverage remains up-to-date and aligned with your requirements.

Can I get insurance for a rental property I own?

+Yes, you can obtain insurance for rental properties. This type of insurance, known as landlord insurance, provides coverage for the building and its contents, as well as liability protection for tenants and their guests. It’s essential to have the right coverage to protect your investment.

What should I do if my home is damaged and I need to file a claim?

+In the event of damage to your home, contact your insurance provider immediately to report the claim. They will guide you through the claims process, which typically involves providing documentation and evidence of the damage. It’s important to act promptly to ensure a smooth and efficient claims process.