Whole Life Insurance Definition

Whole life insurance, also known as permanent life insurance, is a type of financial protection policy that provides coverage for an individual's entire life. Unlike term life insurance, which offers coverage for a specific period, whole life insurance remains in force as long as the policyholder continues to pay the premiums. It is a popular choice for individuals seeking long-term security and peace of mind, as it offers a guaranteed death benefit and accumulates cash value over time.

Understanding Whole Life Insurance

Whole life insurance policies are designed to provide a comprehensive financial safety net for individuals and their families. They offer a combination of death benefit protection and a savings component, making them an attractive option for those seeking both financial security and an investment vehicle.

The key characteristics of whole life insurance include:

- Lifetime Coverage: As the name suggests, whole life insurance policies provide coverage for the policyholder's entire life. There is no expiration date or renewal period, ensuring continuous protection.

- Guaranteed Death Benefit: The policy guarantees a specified amount, known as the death benefit, which is paid to the beneficiary upon the insured's death. This benefit remains constant throughout the policy's term.

- Cash Value Accumulation: Whole life insurance policies accumulate cash value over time. A portion of the premiums paid goes towards building this cash value, which can be accessed through policy loans or withdrawals.

- Fixed Premiums: Policyholders pay a fixed premium amount throughout the policy's term. These premiums are typically higher than term life insurance premiums but remain consistent, providing financial predictability.

- Investment Component: The cash value within the policy is invested by the insurance company, typically in a conservative manner. The policyholder may have limited investment options or the ability to direct the investment strategy in some cases.

How Whole Life Insurance Works

Whole life insurance operates through a combination of premiums, death benefit, and cash value accumulation. Here’s a simplified breakdown of its workings:

Premiums

Policyholders pay regular premiums, typically on a monthly, quarterly, or annual basis. These premiums are determined based on factors such as age, health, and lifestyle. The premium amount remains fixed throughout the policy’s term.

Death Benefit

The death benefit is the core protection provided by the whole life insurance policy. It is a guaranteed amount that the insurance company pays to the beneficiary upon the insured’s death. The beneficiary can use this money to cover funeral expenses, pay off debts, or provide financial support to dependents.

Cash Value Accumulation

A portion of the premiums paid is allocated towards building the policy’s cash value. This cash value grows over time due to the policy’s guaranteed interest rate and any additional investment returns. The cash value serves as a savings component and can be accessed by the policyholder through various means.

| Whole Life Insurance Key Features | Description |

|---|---|

| Lifetime Coverage | Provides coverage until the policyholder's death, ensuring long-term protection. |

| Guaranteed Death Benefit | Offers a fixed death benefit amount, providing financial security to beneficiaries. |

| Cash Value Accumulation | Builds cash value over time, acting as a savings component and investment vehicle. |

| Fixed Premiums | Requires consistent premium payments, offering financial predictability. |

| Investment Component | Allows for conservative investment of cash value, providing potential growth. |

Benefits and Considerations

Whole life insurance offers several advantages and considerations, which can make it an appealing choice for certain individuals:

Advantages

- Guaranteed Protection: Whole life insurance provides lifetime coverage, ensuring peace of mind and financial security for policyholders and their families.

- Cash Value Growth: The policy’s cash value accumulates over time, offering a potential source of savings and investment.

- Fixed Premiums: Policyholders benefit from consistent premium payments, making financial planning easier.

- Tax Advantages: The cash value within the policy grows tax-deferred, providing potential tax benefits.

- Flexible Options: Some policies offer flexibility in premium payments or the ability to customize investment strategies.

Considerations

- Higher Premiums: Whole life insurance policies typically have higher premiums compared to term life insurance, which may be a financial consideration for some individuals.

- Limited Investment Control: Policyholders may have limited control over the investment strategy of the cash value, as insurance companies manage it.

- Slower Cash Value Growth: While the cash value accumulates, it may grow more slowly compared to other investment options.

- Early Withdrawals: Withdrawing cash value prematurely may result in penalties and reduce the policy’s overall value.

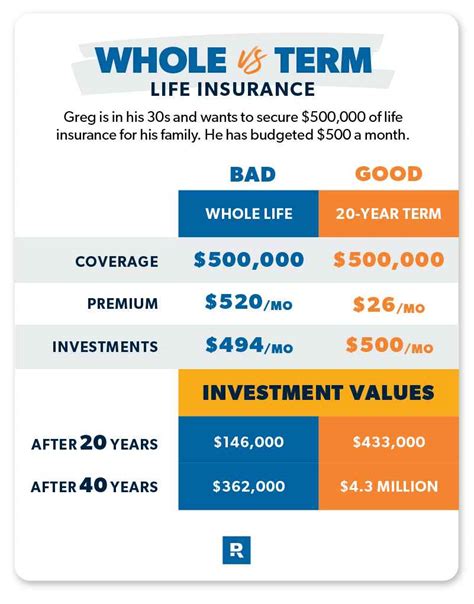

Comparing Whole Life and Term Life Insurance

When considering life insurance options, it’s essential to understand the differences between whole life and term life insurance. While both provide financial protection, they serve distinct purposes and cater to different needs.

Whole Life vs. Term Life: Key Differences

Here’s a comparison of the key differences between whole life and term life insurance:

| Whole Life Insurance | Term Life Insurance |

|---|---|

| Provides coverage for the policyholder's entire life | Offers coverage for a specified term, typically 10, 20, or 30 years |

| Guaranteed death benefit remains constant | Death benefit decreases over time or remains level, depending on the policy |

| Accumulates cash value over time | Does not accumulate cash value |

| Fixed premiums throughout the policy term | Premiums may increase over time or remain level |

| Offers investment potential through cash value | Primarily focuses on providing pure protection |

Choosing the Right Option

Selecting between whole life and term life insurance depends on individual needs, financial goals, and circumstances. Here are some factors to consider when making a choice:

Whole Life Insurance

Consider whole life insurance if you are looking for:

- Lifetime coverage and protection

- A guaranteed death benefit for your beneficiaries

- The potential for tax-advantaged savings and investment

- Financial predictability with fixed premiums

- A long-term financial planning tool

Term Life Insurance

Term life insurance may be more suitable if you are:

- Seeking coverage for a specific period, such as until your children become independent

- On a budget and need affordable premiums

- Primarily focused on providing financial protection for a defined period

- Open to exploring other investment options

Whole Life Insurance in Practice

Whole life insurance is a versatile financial tool that can be utilized in various ways to meet specific needs. Here are some practical applications of whole life insurance:

Estate Planning

Whole life insurance can be a valuable component of estate planning. The death benefit can provide liquidity to pay for estate taxes, outstanding debts, and other expenses, ensuring a smooth transition for beneficiaries.

Business Protection

Business owners can use whole life insurance to protect their businesses in the event of their untimely death. It can provide funds to buy out a partner’s share, cover business expenses, or ensure the continuity of the business.

Supplementary Retirement Income

The cash value within a whole life insurance policy can be used to supplement retirement income. Policyholders can borrow against the cash value or withdraw it to boost their retirement funds, providing additional financial flexibility.

Educational Funding

Whole life insurance can be a tool for funding a child’s education. The policy’s cash value can be utilized to pay for college expenses, providing a financial cushion for parents.

Long-Term Care

In some cases, the cash value of a whole life insurance policy can be used to cover long-term care expenses. This can be a strategic way to address the financial burden of long-term care needs.

What is the main advantage of whole life insurance over term life insurance?

+Whole life insurance provides lifetime coverage and a guaranteed death benefit, offering long-term financial protection. It also accumulates cash value, providing a savings component and potential investment growth. Term life insurance, on the other hand, offers coverage for a specific term and does not accumulate cash value.

Can I access the cash value in my whole life insurance policy?

+Yes, you can access the cash value in your whole life insurance policy through policy loans or withdrawals. However, it’s important to note that withdrawals may reduce the policy’s overall value, and loans must be repaid with interest.

Are whole life insurance premiums tax-deductible?

+No, whole life insurance premiums are generally not tax-deductible. However, the growth of the cash value within the policy is tax-deferred, which can provide potential tax advantages.