Look Up An Insurance License

When it comes to navigating the world of insurance, having access to reliable information is crucial. One essential step in this process is looking up an insurance license, which provides valuable insights into the qualifications and credibility of insurance professionals. This article will delve into the importance of license lookups, the steps involved, and the resources available to empower you with the knowledge to make informed decisions regarding your insurance needs.

The Significance of Insurance License Lookups

In the insurance industry, trust and expertise are paramount. By verifying an insurance professional’s license, you can ensure that you are engaging with a qualified individual who possesses the necessary knowledge and skills to guide you through the complex world of insurance coverage. License lookups offer a transparent window into an agent’s credentials, allowing you to assess their experience, educational background, and any specialties they may hold.

Moreover, license lookups serve as a safeguard against potential fraud and unscrupulous practices. With the rise of online interactions, it has become increasingly important to verify the legitimacy of insurance providers. A simple license search can reveal whether an individual is authorized to sell insurance products in your state and whether they have any disciplinary actions or complaints filed against them.

Steps to Conduct an Insurance License Lookup

Conducting an insurance license lookup is a straightforward process that can be completed online. Here’s a step-by-step guide to help you navigate the procedure:

Step 1: Identify the Insurance Professional’s Name and State

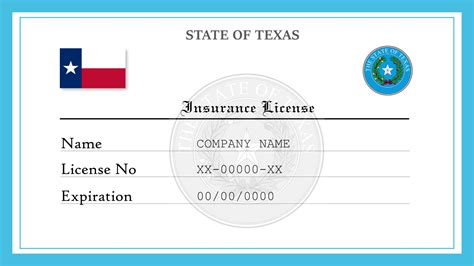

Begin by gathering the full name of the insurance professional you wish to verify. Additionally, note the state in which they are licensed to practice. This information is crucial as license databases are typically organized by state, making it easier to locate the specific agent you are interested in.

Step 2: Access the State’s Insurance Department Website

Each state maintains its own insurance department or regulatory body that oversees the licensing and supervision of insurance professionals. Visit the official website of your state’s insurance department. These websites are publicly accessible and provide valuable resources for consumers.

Step 3: Locate the License Lookup Tool

On the state insurance department’s website, navigate to the section dedicated to license lookups or agent searches. These tools are designed to be user-friendly and often feature a search bar where you can enter the name of the insurance professional.

Step 4: Enter the Required Information

Provide the necessary details, including the insurance professional’s name and, if available, their license number. Some license lookup tools may also require additional information, such as the last four digits of their social security number or their date of birth. This added layer of security helps ensure that you are accessing accurate and up-to-date information.

Step 5: Review the License Details

Once you have submitted the required information, the license lookup tool will generate a detailed report on the insurance professional’s license status. This report typically includes the agent’s name, license number, the type of insurance they are authorized to sell, and their licensing date. It may also provide information on any specialties or endorsements they hold, indicating their expertise in specific areas of insurance.

Step 6: Verify Additional Details (Optional)

If you require further verification, many state insurance department websites offer additional resources. These may include complaint histories, disciplinary actions, or details on any legal proceedings involving the insurance professional. By exploring these additional resources, you can gain a more comprehensive understanding of the individual’s track record and ensure they meet your standards of professionalism and integrity.

Resources for Insurance License Lookups

In addition to state insurance department websites, several online platforms provide insurance license lookup tools. These resources can be particularly useful when conducting cross-state license searches or when you are unsure of the specific state in which an insurance professional is licensed.

National Association of Insurance Commissioners (NAIC)

The NAIC maintains a national insurance producer database that allows users to search for insurance professionals across all 50 states and Washington, D.C. This comprehensive database provides information on an agent’s license status, the type of insurance they are licensed to sell, and any disciplinary actions taken against them. It serves as a valuable resource for individuals seeking to verify an insurance professional’s credentials on a national level.

State-Specific Insurance License Lookup Websites

Many states have their own dedicated insurance license lookup websites or platforms. These state-specific resources often provide more detailed information, including an agent’s complete license history, educational background, and any additional certifications they may hold. By accessing these state-specific platforms, you can gain a deeper understanding of an insurance professional’s qualifications and track record within a particular state.

Insurance Company Websites

Insurance companies often maintain directories or search tools on their websites, allowing customers to verify the credentials of their agents. These directories typically provide information on the agents’ licenses, specialties, and years of experience working with the company. While these resources may be limited to agents associated with a specific insurance company, they can still offer valuable insights into an individual’s expertise and track record within that organization.

Benefits of Conducting Insurance License Lookups

Conducting insurance license lookups offers a multitude of benefits for consumers. By verifying an insurance professional’s license, you can:

- Ensure Legitimacy: Confirm that the insurance professional you are considering is properly licensed and authorized to sell insurance products in your state.

- Evaluate Expertise: Assess the agent's educational background, specialties, and years of experience, helping you choose an expert who aligns with your specific insurance needs.

- Identify Potential Risks: Discover any disciplinary actions, complaints, or legal proceedings against the insurance professional, allowing you to make informed decisions and avoid potential pitfalls.

- Build Trust and Confidence: Verifying an agent's license fosters trust and confidence in their ability to provide accurate and reliable insurance advice and services.

The Role of Insurance License Lookups in Consumer Protection

Insurance license lookups play a vital role in consumer protection. By empowering individuals with the ability to verify the credentials and track record of insurance professionals, license lookups contribute to a safer and more transparent insurance market. Consumers can make informed choices, ensuring they receive guidance and services from qualified and reputable individuals.

Additionally, license lookups serve as a deterrent against fraudulent activities and unethical practices. When consumers have easy access to license verification tools, insurance professionals are held accountable for their actions and are less likely to engage in deceptive or unscrupulous behavior. This enhances the overall integrity of the insurance industry and strengthens consumer trust.

Conclusion

In today’s dynamic insurance landscape, being an informed consumer is crucial. Conducting insurance license lookups is a simple yet powerful tool that empowers individuals to make well-informed decisions regarding their insurance coverage. By following the steps outlined in this article and utilizing the available resources, you can easily verify the credentials of insurance professionals, ensuring a more secure and satisfying insurance experience.

FAQs

What information do I need to conduct an insurance license lookup?

+To conduct an insurance license lookup, you will typically need the full name of the insurance professional and the state in which they are licensed. Some license lookup tools may also require additional details, such as the agent’s license number, last four digits of their social security number, or date of birth.

Are insurance license lookups free of charge?

+Yes, insurance license lookups provided by state insurance departments and other reputable sources are generally free. These resources are designed to empower consumers and promote transparency in the insurance industry.

Can I verify the license of an insurance professional who works for a specific company?

+Yes, many insurance companies maintain directories or search tools on their websites that allow customers to verify the credentials of their agents. These resources provide information on the agents’ licenses, specialties, and experience with the company.

What if I cannot find any information on the insurance professional I am searching for?

+If you are unable to find any information on an insurance professional through state or national databases, it is advisable to contact the state insurance department directly. They may have additional resources or be able to guide you toward the appropriate channels to verify the individual’s license status.

Are insurance license lookups only necessary for new insurance policies?

+Insurance license lookups are beneficial for both new and existing insurance policies. Even if you have worked with an insurance professional for an extended period, verifying their license status periodically ensures they remain active and in good standing. It also allows you to stay informed about any changes or updates to their credentials.